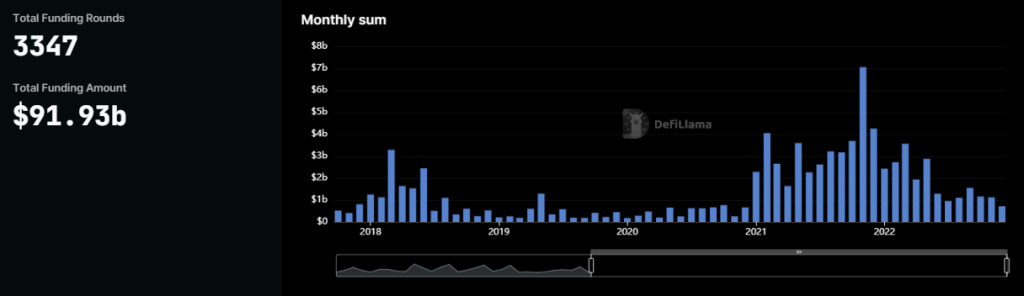

I was dabbling through DeFiLlama and found a new feature on one of its dashboards, “raises”, and thought this may be the most significant readily available alpha yet.

This DeFiLlama dashboard shows the amount raised for new or existing projects in pre-seed, seed, round, or private rounds. Here’s an overview of the dashboard, with the total funding rounds amounting to $91.93B.

While this metric shows you the amount raised for each project, it also reveals deeper insight into what VCs/Whales/Big players are looking at. Find the common denominator among the top 10 projects per se, and it might land you narratives/gems/alphas these big players believe in.

It is as clear as day, as simple as snow.

It is unlikely VCs cast a wide net in hopes one of the projects they invest in will bring them a 100x. Instead, they dive deep into a project before money comes to the table.

So we know it’s Quality over Quantity. But how do we ensure Quality? A simple answer is a solid team for analysis (there are many other factors). When millions of dollars are on the line, this department could be the differentiator in a loss or a 10x on return.

So the strategy is simple, follow those who did their diligence and have skin in the game. Let’s look at ten under-the-radar projects VCs invested in December 2022 on DeFiLlama.

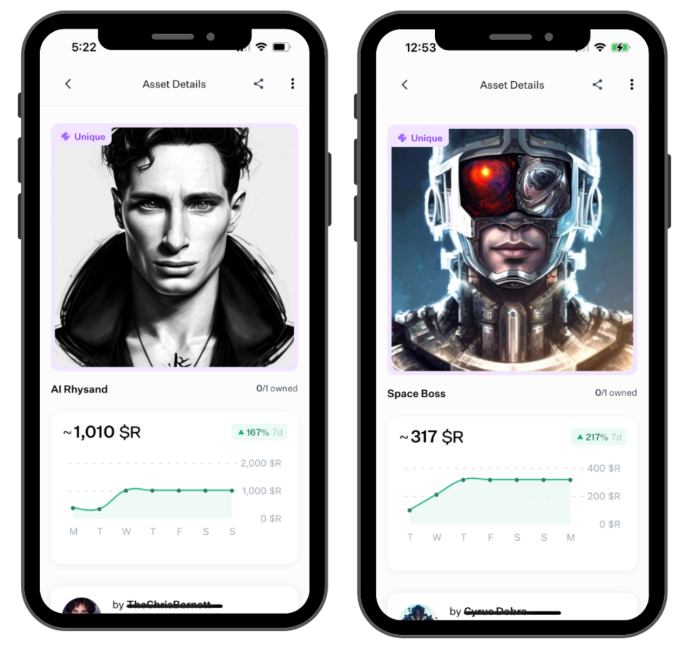

1. Revel raised $7.8M to be the next Instagram & Robinhood of the NFT platform

Being an NFT or social collectable platform, Revel’s seed round was led by renowned crypto VC dragonfly capital. Instagram is a social media platform, while Robinhood is an investing and trading platform; Revel aims to blend the two by allowing users to create NFTs for their followers, friends or community and will enable people to own editions of the media they like and follow.

Along with social game economics, the game design is built with simple economic concepts of supply, demand, and inflation, among others.

Imagine if a social network & a dex had a baby. Comments & likes are replaced with trading of visual assets & an in-game currency. Sprinkle in a #ProofOfDemand mechanism to prevent spam and…

— 𝖘𝖙𝖆𝖗𝐏𝐀𝐔𝐒𝐄.𝚗𝚎𝚊𝚛ᵏᵃʸ⁹ᵈ 🟣 (@starpause) December 8, 2022

You've got @RevelXyz!

Bonus: generate #AI #art in-app. Addictive! pic.twitter.com/eQfixS4wTj

The rise of an all-in-one NFT marketplace and finance platform.

2. ETH accumulation and structured crypto products with Pods Finance

We are thrilled to announce that Pods has raised $5.6MM in seed funding 🥳

— Pods (@PodsFinance) December 19, 2022

This round funds the team's mission to establish frictionless structured products for crypto assets.

Read more about it here 👇🏼https://t.co/tkquuyRL6e

1/

Pods raised $5.6M in Seed Funding to create structured products for crypto assets earlier this year. The financing had investors such as IOSG, Tomahawk, Republic, Framework Ventures, 4RC and more.

They are in the business of offering a platform that helps DeFi users be exposed to professional investment strategies. As a DeFi protocol, it provides an alternative to yield on crypto assets as opposed to CeFi lenders.

Currently residing in the Ethereum ecosystem, they tap on its scaling solutions, such as Arbitrum and Polygon, to provide the “highest upside and lowest risk.”

The first strategy for Pod’s yield is stETHvv. Yes, I know it is a mouthful.

stETHvv (Ethereum Volatility Vault) is a low-risk product focused on ETH accumulation. It combines Lido’s yield with weekly strangle to earn more every time the ETH price bounces up or down with volatility.

Strangle – an options strategy in which the investor holds a position in both a call and a put option with different strike prices but with the same expiration date and underlying asset.

ETH remains king; accumulate while you can.

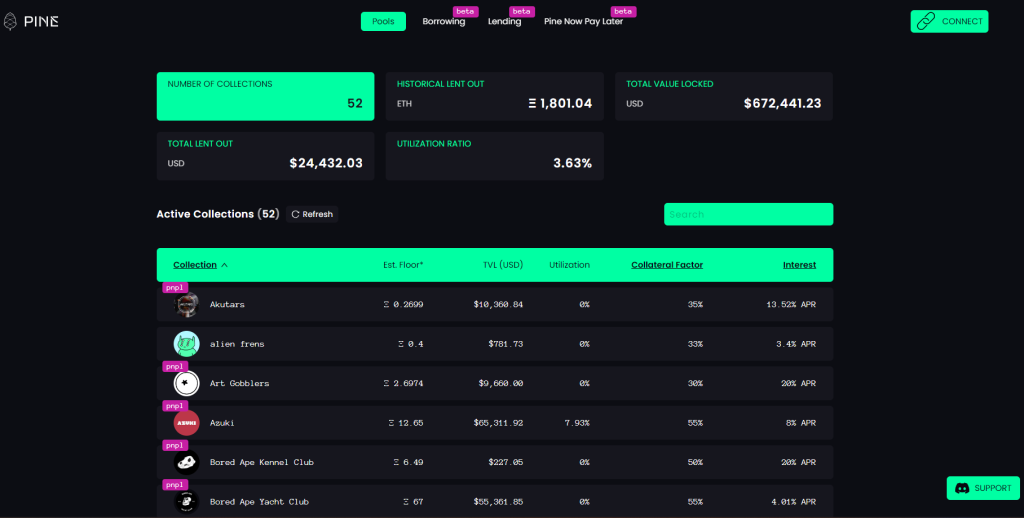

3. Need help financing your BAYC? Pine Protocol might help

PINE provides a permissionless NFT-backed loan and NFT financing. Amber group and Sparkle VC co-led their recent $3M private round. Along with Shima Capital, The LAO, Maple block and the spartan group to build innovative NFT-Fi features such as bid now and pay later, which allows users to bid on NFTs on OpenSea with 0 ETH in their wallet.

The $PINE token will release next year, but the core protocol is live. Users can stake NFTs for liquidity, and when you do, you can set your APY, which usually works out to be roughly 10% on average.

THIS!!

— Pine Protocol🌲 | NFT Financing (@PineProtocol) December 16, 2022

At Pine, our platform was built as NON-CUSTODIAL 🌲

This means that Pine NEVER holds/takes ownership of your NFTs!! This should be the standard of Web3 👊

Make sure you don't deposit your JPEGs in the wrong protocol anon! Protect your art 🖼🔐 https://t.co/vWnWCadNv7

NFT Finance may be the narrative to watch in 2023.

4. Betting big with a decentralized sports prediction market, Frontrunner

Still think there's huge vacuum/opening for exotic forms of sports betting + leveraged sports bets, enabled by frictionless nature of crypto exchanges

— GCR (@GCRClassic) October 1, 2022

Imagine CT shifting from being macro larps to sports larps if that was the only thing hot and liquid

Frontrunner raised $4.75 million in a seed round led by Susquehanna Private Equity Investments and SOMA Capital, Toy Ventures, Ledger Prime and WAGMI Ventures. Frontrunner is a non-custodial decentralized prediction market for sports betting built in the Cosmos ecosystem.

They are a prediction market that simplifies sports betting by removing the complexity of betting odds. Instead, individuals buy and sell shares in teams and players using crypto across sports markets such as the NBA, NFL and others.

1/ Time for a thread on prediction markets! One of the most fascinating yet poorly understood areas of DeFi, IMHO. Let's explore…

— AriannaSimpson.eth (@AriannaSimpson) May 23, 2019

The betting industry is a multi-billion dollar market, and crypto is getting a piece of the pie. As it continues to gain traction in 2023, it will be a close narrative to follow.

5. Zero-Knowledge Rollups + Privacy = Aztec

Aztec Network’s goal is to bring encryption to blockchains. Led by a16z, Aztec landed a $100M series B funding round to accomplish its vision.

Their goal is to take the original promise of Ethereum and expand its capability immensely by making it fully encrypted. This fundraiser enables them to build a next-generation blockchain with no compromises.

Why is encrypting Ethereum such a big deal? Transparency, after all, is why Ethereum is so powerful, auditable, and secure. It’s core to the transformational impact of Ethereum’s innovation: Transparency begets verifiability.

But in the current public blockchain paradigm, users and entities unknowingly broadcast data to the public, compromising privacy and security to get trustless. Aztec is building blockchain encryption without trade-offs.

OFAC pretty much crippled all the privacy projects in crypto in one day.

— Jason Choi (@mrjasonchoi) October 20, 2022

But @aztecnetwork *may* buck the trend.

Disclaimer: am (clearly) not a cryptographer, below is just commentary from a commercial/investment standpoint. Also not an investor, just a geek. pic.twitter.com/R1wv5kuSQ7

Privacy is still a big narrative to follow in 2023.

6. Did you know crypto has insurance too? Evertas raised $14M

Led by Polychain capital, the $14M Series A funding includes Sino Global Capital, CMT Digital Ventures, Foundation Capital, Matrixport, HashKey and many more.

Crypto Insurance is a policy that protects investors from losses caused by fraud and cyber threats. It is one of the major value propositions that can unlock the potential of institutional investment in cryptocurrency for an exchange, trading firm, or even a custody provider.

Crypto Insurance should be talked about more. If the user’s Funds/assets were insured, the losses that occurred this year through hacks, de-pegs, and other reasons would have been minimal.

Insurance in DeFi – a thread

— MIDΞ.eth (@theProcessXCII) September 1, 2022

now we all know how vulnerable this space is, according to Cointelegraph, since the beginning of 2022, more than $1.6 billion has been stolen from the DeFi space, exceeding the sums taken in both 2020 and 2021 combined. pic.twitter.com/3HTdoiYWBV

The insurance market might suit crypto, especially with its volatility; big players are even keeping their eyes peeled.

7. Building a decentralized hiring network with Outdefine

Outdefine raises $2.5 million in a seed round to build a decentralized hiring network on Solana. With backers including Jump Crypto, Big Brain Holdings and TCG Crypto, they help web3 talent find jobs when the industry is grappling with widespread layoffs.

Outdefine is a decentralized network that allows talent to find work through its hiring marketplace. The platform uses tokenomics to try and drive a more equitable and transparent relationship between hiring companies and talent.

Let's talk about web3 jobs.. what they are, how you can get them and where to find them

— 03:00am (@0300am_eth) December 19, 2022

🧵👇 pic.twitter.com/6FytmyQ4oO

Web3 will be inevitable, and there is a need for people to run the work. A cool idea.

8. Polkadot’s new interoperable smart contract hub with t3rn

T3rn recently raised $6.5M in a private token sale led by Polychain capital, Huobi ventures, Figment capital and others. They have their sights set on launching on Polkadot next year.

They are a platform hosting smart contracts that enable trustless multi-chain execution and composable collaboration.

In order to reach mass adoption, and onboard the next billion users, interoperability must be answered.

— t3rn – interoperable smart contract hub (@t3rn_io) August 4, 2022

Find out how t3rn addresses the issue in our following🧵

Interoperability has played a big narrative in the past year. Will t3rn take this concept to higher heights?

9. A game development platform with the Mirror

In a $2.3M round led by Founders Fund, a Silicon Valley firm that funded Facebook, Airbnb, Stripe and others.

The Mirror is a game development platform that lets indie developers build virtual worlds. They expedite the creation of 3D multiplayer games set in virtual worlds and include tools for real-time collaboration, one of the characteristics necessary for occupation in the metaverse.

We're extremely excited to announce that @themirrorspace has raised $2.3M led by @rabois at @foundersfund, joined by @konvoyventures, @AbstractVC, @FloridaFunders, & @palmtreecrew! https://t.co/knDQUNLzDK

— Jared McCluskey (@JaredDMcCluskey) December 7, 2022

Gaming has always been referred to as the catalyst for crypto adoption; an all-in-one gaming development platform might be a play for 2023.

10. Panoptic is in the business of Decentralized options

Panoptic raised $4.5 million to build a decentralized protocol for perpetual options with investors, including Uniswap Labs Ventures, Coinbase Ventures and Jane Street.

They are a Uniswap-based decentralized finance protocol for trading perpetual options; they recreate options like payoffs in a peer-to-pool model without relying on Black Scholes logic.

The core idea behind Perpetual Options is that Uni v3 LP positions can be seen as tokenized short puts. This result emerges from the observation that providing concentrated liquidity in Uni v3 generates a payoff mathematically identical to selling a put option.

As you might know i'm a big fan of on-chain options protocols so lets dig into @Panoptic_xyz

— slappjakke.eth 🤌 (@Slappjakke) December 8, 2022

✅ Oracle free Options based on UNI v3 LP pools

✅ On-chain Options with leverage

✅ Panoptic Options never expire and are perpetual

A thread 👇🧵

We all start with spot trading first, then taking long/short positions, and call/put options will come next. Decentralized options may see their breakthrough in 2023.

Closing thoughts

DeFiLlama is a powerful tool, especially those who are new to on-chain data. I always believe knowledge is power, especially evident in crypto. This list may not give you the next 100x gem, but rather, it points you in a direction for some possible narratives which will. Looking into what VCs are investing could also give you the upper hand in getting information early before it is too late.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief