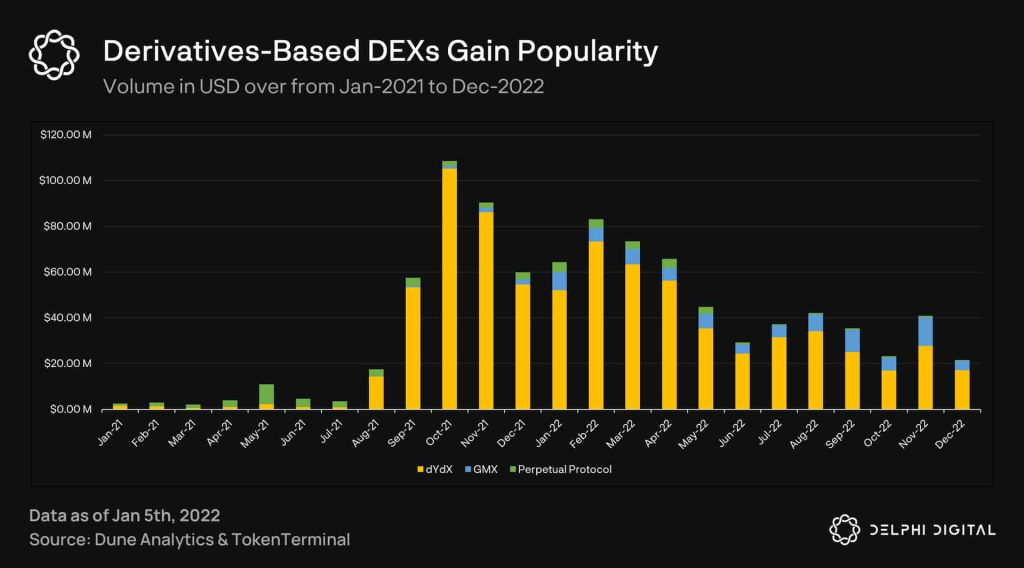

Decentralized exchanges (DEX) have seen explosive demand at the end of 2022. The FTX debacle turned investors to look at decentralized exchanges (DEX); according to Delphi Digital, derivatives-based DEXs have risen over the past two years, where crypto investors have more control over their coins.

While decentralized exchanges garner significant attention, one is “differentiating” itself from the rest.

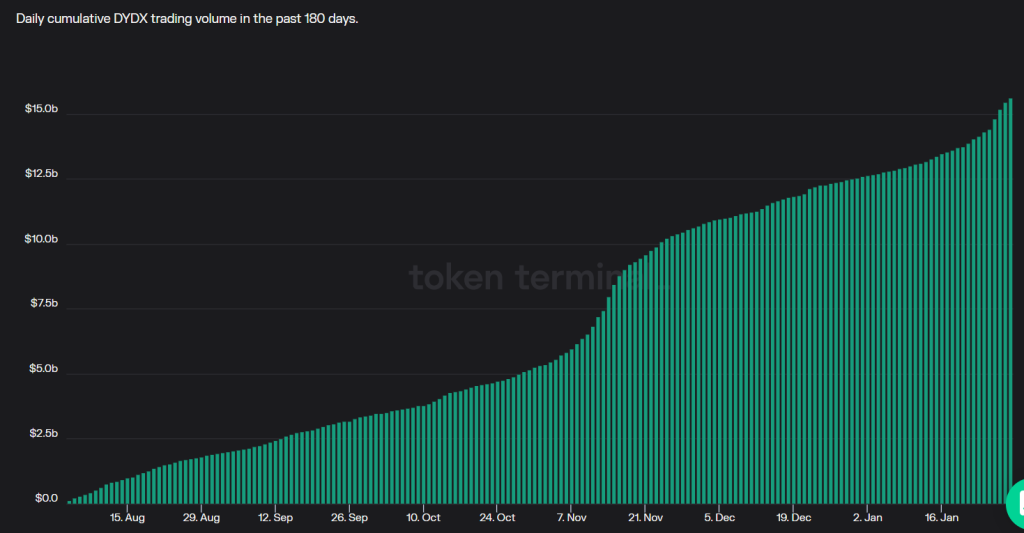

dYdX has achieved incredible product market fit since launching as an app-specific StarkEx rollup secured by Ethereum, surpassing the $80B mark for total cumulative trading volume at the beginning of January 2023.

To put things into perspective, competitors GMX and GNS only racked up a cumulative total trading volume of $4B and $786M, respectively.

In terms of the past 7d earnings, dYdX clinched 3rd place after Ethereum and Opensea based on Token Terminal.

Protocols ranked based on past 7d 'Earnings' ⤵️

— Token Terminal (@tokenterminal) January 25, 2023

🥇 Ethereum

🥈 OpenSea

🥉 dYdX

4⃣ Lido

5⃣ Gains Network

6⃣ ENS

7⃣ Maker

8⃣ Tokenlon

9⃣ SuperRare

🔟 Arbitrum

11. Convex

12. Aave

13. Foundation

14. LooksRare

15. SynFutures

16. MUX

17. Cap

🗒️ Earnings: revenue – token incentives pic.twitter.com/IIxyRJ1JtG

Ngl, they have one of the best merch out there too.

Yoooo if you ever get offered a swag bag of @dYdXmerch from @dYdX SAY YES PLEASE!

— Guy 🦇🔊 (@wholisticguy) January 27, 2023

Sorry @nuclearnerds, dYdX just overtook you for the best crypto merch I’ve seen. pic.twitter.com/RedVQhiSN5

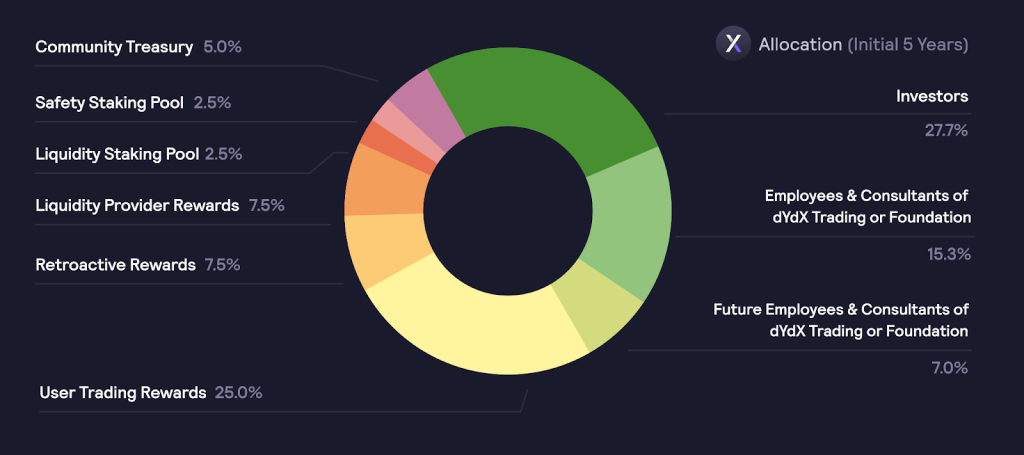

They do things differently with inflationary tokens

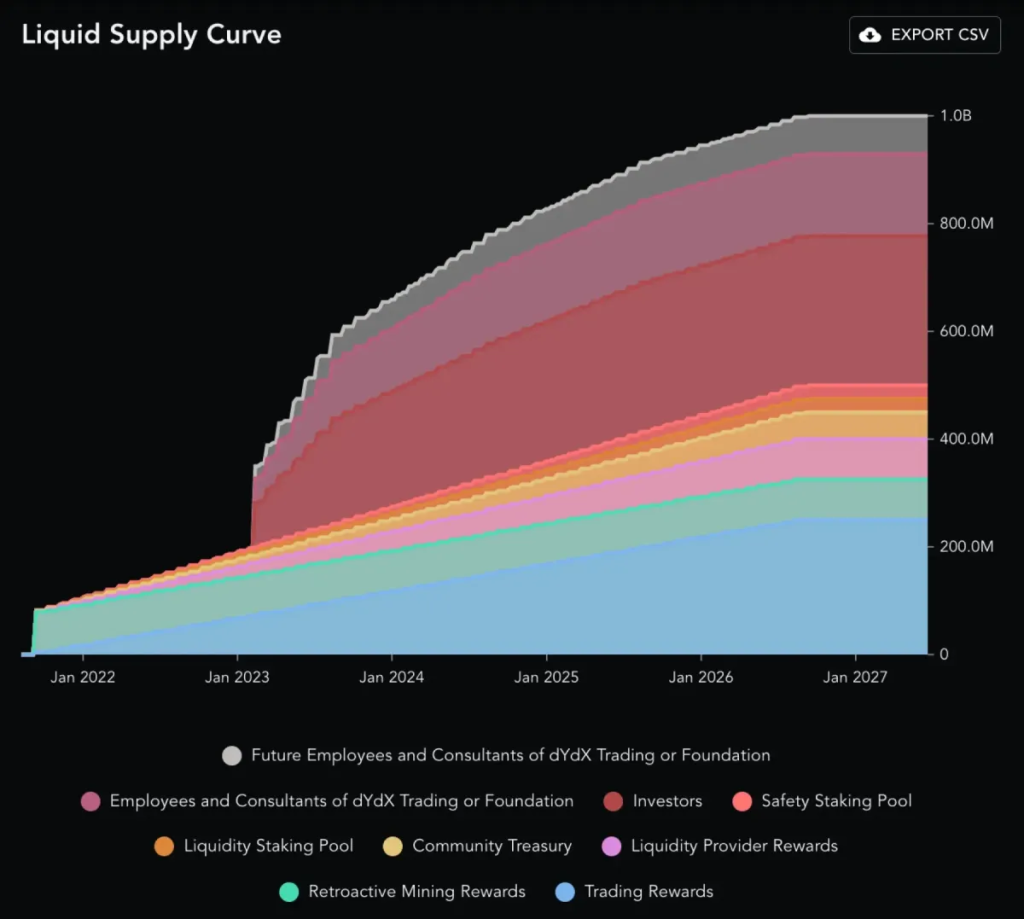

Even with the success of trading volume since its inception, there is no doubt that dYdX has an inflation problem. While rewards dished out by them may be lucrative, we all know, especially when a token is involved, looking into its tokenomics will give you an idea of how the project will fair in the long term.

When you hear inflationary tokens, sustainability should come to mind. I learnt this the hard way with STEPN’s hyperinflationary tokens, $GST and $GMT, which had their spell of run-ups and dumps after user interest faded.

But at what rate exactly doesn’t the dYdX token inflate?

Well, despite the strong fundamentals of the underlying protocol, dYdX does not share revenue with token holders and rewards traders with dYdX incentives based on trading volume.

According to @karl_0x token unlock list, dYdX takes the top spot in the most inflationary tokens list with a current inflation rate of 251%.

Imagine a particular token will double in circulating supply in the next six months, and supply will inflate again by 80%. Effectively, more tokens entering the market will create downward price pressure.

Even so, some projects on the list above have a decent product-market fit (I’d say CRV), even with higher-than-average inflation numbers. Those with little to zero inflation should also not be regarded as the gold standard, and it does not guarantee success. I would say it is all about the balance.

The most popular currency, the U.S. Dollar, has an annual inflation rate of 6.5% for the 12 months that ended in December 2022. I would take that inflation number as the average benchmark, but 251% is a little bit much…

So bad tokenomics but good product market fit = balance? Only time will tell.

They do things REALLY differently with announcements

So this, to me, is where it got sus.

For a long time coming, the migration to dYdX V4, first announced in Jan 2022, was planned to occur before the year’s end. This upgrade was long-anticipated, especially with the move to Cosmos to be a standalone blockchain.

dYdX began 2023 still operating on L2, but a recent announcement by the project team on January 17 postponed the release of V4 until the end of Q3 2023.

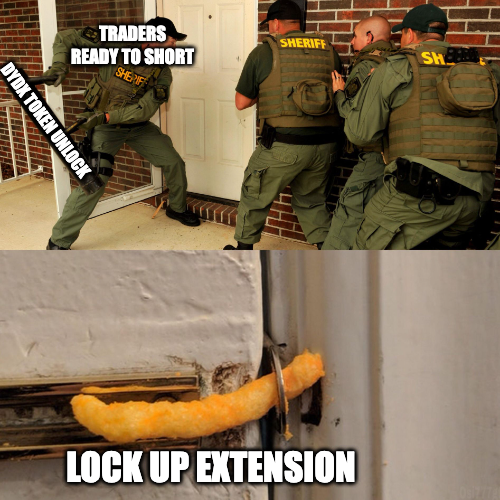

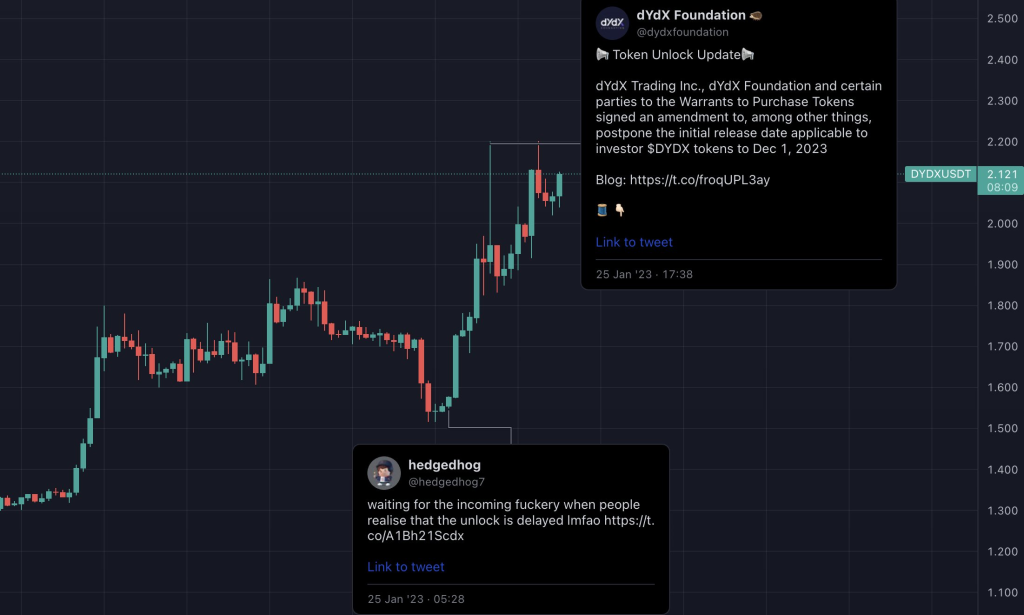

In addition, many investors were worried about the imminent $DYDX to unlock. Initially, 30% of insider tokens (150 million dYdX) were scheduled for release on February 3, doubling the current circulating supply of ~147 million tokens.

But after an announcement on the 25th of January in an agreement between dYdX trading and the dYdX foundation and private investors, it stated that “among other things,” the parties agreed to delay portions of a massive token unlock scheduled for this week.

📢Token Unlock Update📢

— dYdX Foundation 🦔 (@dydxfoundation) January 25, 2023

dYdX Trading Inc., dYdX Foundation and certain parties to the Warrants to Purchase Tokens signed an amendment to, among other things, postpone the initial release date applicable to investor $DYDX tokens to Dec 1, 2023

Blog: https://t.co/froqUPL3ay

🧵👇🏻

This unlock was moved to December 2023, and according to Blockworks Research, “a 200%+ increase in supply throughout 2023 is no longer.”

dYdX threw the boomerang, but it will come back swinging

dYdX insiders, including private investors, the project team, consultants, and advisors, have been allocated 500 million dYdX tokens, or 50% of the total token supply.

The entities agreed to postpone the release of 83.2 million tokens for private investors and an unknown amount for founders, employees, advisors, and consultants. The exact amount to be released in the near future is undisclosed due to the lack of clarity on the release and vesting schedules.

Simply put, some strings must have been pulled at the top because you can’t just delay an unlock of this size. There is a first for everything, but I never imagined this would be possible because what makes you think this can’t be done similarly in the future?

The ball is always in their court.

Whatever is sus, Twitter investigates

Imagine you knew the token unlock would be pushed back to later this year; what positions would you take to maximize this?

Regardless, you are now in a position to take a favourable one. If we paid attention last year, on the 26th of December, a now-deleted account and an apparent insider curiously claimed the unlock would be delayed until the V4 launch.

It might be impossible to confirm whether it was a genuine leak, but the timing raised eyebrows.

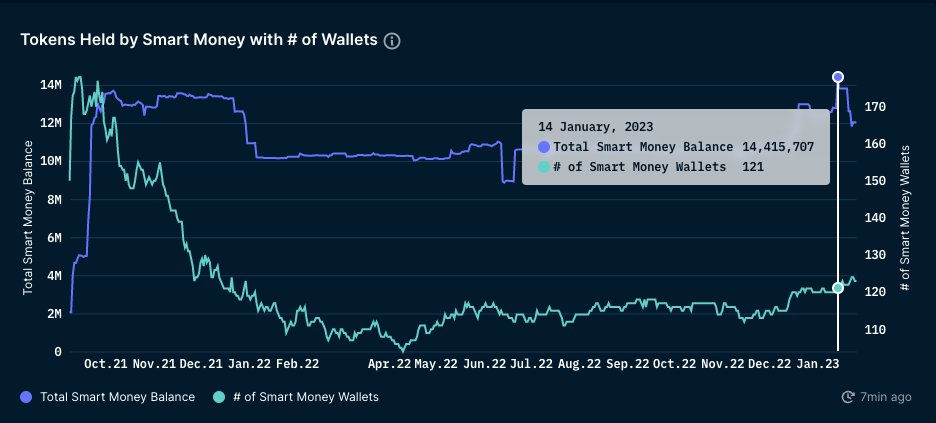

On-chain data also revealed an increase of 40% in dYdX tokens held by smart money, which peaked around January 14th.

Twelve hours before the announcement, there was a significant increase in open interest in leverage-enabled platforms such as Binance and Bybit.

This also coincided with another tweet suggesting the unlock was delayed.

With fears of the unlock, many took shorting positions to anticipate the double token supply for dYdX. If insider trading is true, it is easy knowing the news release will get those in short positions to potentially liquidate, pumping the token’s price.

Furthermore, some co-mingling might be involved with Wintermute, Brian Armstrong, and dYdX. Find out more in the investigative thread done by Spreek and LuigyGT below.

So after hearing the news about dYdX changing its vesting date, I and @luigyGT were curious about exactly how they handled vesting in the first place.

— Spreek (@spreekaway) January 26, 2023

What we found was not pretty 🧵

Closing thoughts

Retail investors are paying the price for bad tokenomics. Delaying an unlock does not sit well with me because it will likely happen again if it happens once. It does not solve any problems but instead, delays them. Furthermore, it probably raises even higher inflation numbers when the unlock happens. Cool, the token price pumps 240% in 30 days, but the long-term horizon to me looks bleak.

They might be banging on the fact that the Cosmos integration will bring more value to investors, but I highly double that would be sustainable too.

Even with many trading pairs and a dynamic product market fit, re-altering anticipated news would raise suspicion strong enough for me to steer away. When the short term is prioritised, the long time will be compromised.

Also Read: I Looked Into The Historical Cycles Of Crypto, Here’s What I Found

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief