The recent crash of LUNA and UST is one of the biggest events in crypto history. This has sent much shockwaves to the market and investors may be questioning the legitimacy of crypto as a whole.

We invited 3 prominent speakers to address the reasons why LUNA collapsed, their opinions on LUNA and other stablecoins, as well as the future for crypto going forward.

Today we will feature a summarized version of our recent Twitter Spaces discussion featuring an all-star panel — Tascha Che from Tascha Labs, Darius Sit from QCP Capital, and Wangarian, Prev Principal of Defiance Capital.

The actual full recording and discussion can be found below:

And that's a wrap! We would like to thank @TaschaLabs, @0xWangarian, @dariussitzl and @mercurial_air for making our very first Twitter Space possible! 🎉

— Chain Debrief (@ChainDebrief) May 16, 2022

Listen to the full recording below for insights, outlooks and updates on the recent crash https://t.co/Hi4qyKLCh5

Reasons for collapse: A perspective

To kick off the conversation, the speakers provided some insights as to the reasons behind the UST and Luna crash.

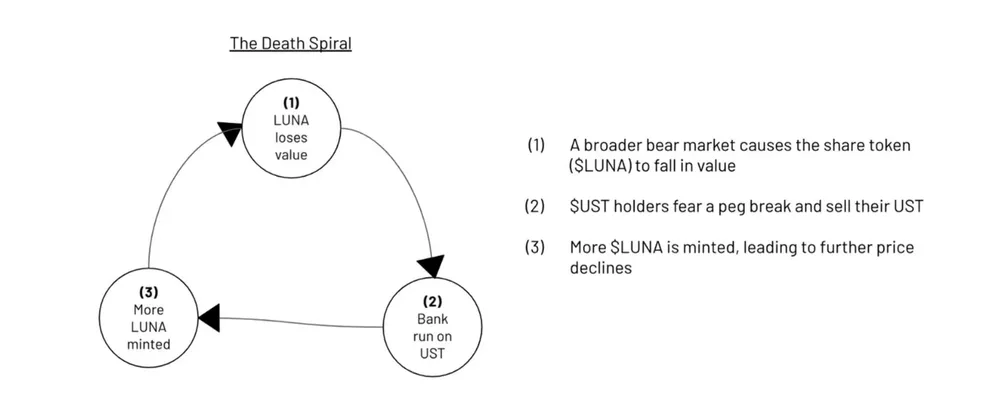

Darius: There were three main weaknesses for the ecosystem — liquidity weaknesses, a fragile mechanism that led to inflation of LUNA, and a fragile reserve that relied on a volatile asset (BTC). These three fundamental weaknesses triggered a crisis of confidence and eventually collapse.

Wangarian: There was no mechanism to backstop the “death spiral” phenomenon. In May, Jump Crypto stepped in to defend the peg and rescue LUNA when it should have failed at that point. Eventually, once UST supply had grown massively to 20 billion, no single market maker or group could defend the peg.

Tascha: Regardless of who triggered the “attack”, there was little use case for LUNA beyond collateral or backing for the stablecoin. What else is the collateral used for? We need to keep in mind these questions when designing an algorithmic stablecoin.

Similar attacks on fiat currency have actually happened. In the case of Soros’ attack on the British pound in 1992, while British pound was shorted heavily and devalued about 25% in four years, there was some level of fundamental demand for the pound as it had its own individual use-case for trade/commerce and daily transactions in the economy. This was not the case for UST.

Algostables: Are they sustainable?

Tascha: These mechanisms are fragile and depegs are bound to happen sooner or later. Especially once the depeg happens to a big extent there will be no equilibrium. Size was also a factor. It is easier for external capital to rescue a stablecoin if its is smaller.

A more resilient system would be 10-15 smaller stablecoins pegged to different collaterals/assets rather than 3-5 really big ones.

Darius: We can look at the EuroSwiss depeg in the FX markets during 2015. The Swiss National Bank tried to defend the peg but ultimately stepped back. If even a sovereign fiat can depeg under pressure, what more for one like LUNA/UST that is created independently and only backed by a few VCs and trading firms?

The amount of leverage also got out of hand. While UST was initially designed for e-commerce and based off KRT, it ended being used more for leverage and yield farming once DeFi took off. The system became more fragile as it grew bigger. Ironically, LUNA was a victim of its own success.

Ultimately, a small algostable is possible, and has to be collateralized with hard assets to some degree.

Wangarian: Algostables market will be winner-takes-all. The Luna model might not work, but perhaps the Frax model can. The usecase of Frax as a stable is not overly reliant on one yield farm (UST and Anchor).

I believe that decentralized money is needed for a decentralized ecosystem. An alternative will come, eventually.

What’s next? Proposals to save the ecosystem

Strongly support this. Coordinated sympathy and relief for the average UST smallholder who got told something dumb about "20% interest rates on the US dollar" by an influencer, personal responsibility and SFYL for the wealthy. https://t.co/YfNlpvAizg

— vitalik.eth (@VitalikButerin) May 14, 2022

Wangarian: There is only US$80 million worth of reserves left — almost impossible to compensate all affected.

A revival plan involves holders of UST and LUNA to be involved but at this point, strong leadership needs to take hold. There is also a leadership vacuum in the ecosystem. We are skeptical as to the recovery of LUNA/UST.

Darius: UST in whatever form is a done deal. Algorithmic stables ultimately rely on confidence in the peg and all of that is lost.

The best case would be some type of compensation. While the LUNA community is strong, much is unclear and the stablecoin system definitely needs a revamp.

Is this cycle like the 2018 crash?

Darius: In 2018, there was a lack of key infrastructure and liquidity. There was also immense leverage and hype, but little avenue for institution to step in. In 2021, the infrastructure in the space is a lot stronger, and there are more avenues and inflow of institutional players.

I see this as a sign of a more mature market, and surprisingly BTC and ETH have been quite resilient, despite the systemic fallout of LUNA and a hawkish FED.

Tascha: While much of the TVL of UST and LUNA was in Anchor and is not extensively used outside of Terra ecosystem, the spillover will likely be on the balance sheets of funds in the ecosystem. It is possible there will be rebalancing of portfolios especially for other alts, and the effect will be bigger than we have foreseen.

Wangarian: Not everyone was hard-hit by LUNA’s collapse. There were some investors in the ecosystem that had no exposure to the LUNA/UST death spiral.

Systemic damage will be constrained to certain ecosystems, such as IBC. dApps on Terra will also be devastated due to the loss of treasury funds and a lack of a chain to work on.

However, due to net inflow of talent in the space, long term wise things will work out, even if I am short term bearish.

Darius: In March 2020 there was a liquidity vacuum. In this case despite BTC being sold from LFG Treasury there were still good bids on ETH and BTC in general.

The biggest threat would be if bigger lending platforms like Celcius start to default. If this does not happen then the damage to LUNA will be contained.

My FengShui master says the bull will only be back in January 2023, so let’s see…

Also Read: Is This Time Really Different? Lessons And Warnings From Previous Crypto Bear Markets

LUNA: A doorway for regulation?

Tascha: Banks are regulated based on capital, leverage, liquidity ratios etc. If there was a capital liability ratio requirement for stablecoins, then perhaps a LUNA 2.0 will not happen. A mature industry will have industry standards by regulators or the government.

This will ultimately boost survival and be a good thing eventually. The Federal Reserve will need to do the right thing and others will follow.

Darius: Mostly concerned with regulator over-reach and impose too harshly on stablecoins like USDT/USDC. We have quarterly consults with the Federal Reserve and they are aware if they over-reach it might introduce systemic risk.

They are well-informed but there is some slight concern if uninformed regulators over step their boundaries and create liquidity problems.

Wangarian: We need regulation. It is there to protect the end-user, and those who suffered the worst losses in the LUNA collapse.

We can sacrifice some decentralization for quick-moving efficiency. In the case of LUNA, governance with TFL needed 7 days, which was too slow in times of duress.

On investment plans/portfolios

Darius: At QCP, we deal with options and yield. The fall out does not affect our investment per se, and as some shy away from DeFi they might even move on to the options and futures market.

We believe that it is a good time for folks to build in the space and that this collapse has been a good lesson on the need to build a robust ecosystem and manage treasury risks.

Wangarian: As a degen, my goal is to survive for the next 3-6 months. We also need to navigate the bearish macro outlook. We could enter a bear market that lasts for a few months to even a few years.

Ultimately it is better to work on capital preservation and have the firepower to make it back in the next bull market.

People that lost a lot recently might also try to make it back with one successful trade – don’t do it! There is no rush and there will be opportunities in the future.

Darius: For the audience, we should note that it is not LUNA per se that caused the bear. We have been in a bear market with recession being priced in alongside rising interest rates.

Tascha: I have some commodities and crypto, but expect to see more drops in next 3-6 months and will be eyeing better buying opportunities. It is better to be prudent and prepare for a longer bear market Take care of your life and cash flows and DCA in projects you really believe in.

Restoring retail faith

Wangarian: It is up to the products to innovate and attract the wider retail market. We saw 2 examples of this, such as Axie Infinity (GameFi), and StepN (walk-to-earn). These are retail centric activities which people already do (games and walking), which can be attractive to them.

Darius: Excesses in crypto eventually get corrected, but this is not an issue. Crypto will creep into all parts of life, with the base layer being a decentralized ecosystem and layer run on blockchains. Crypto has already captured the mindshare of the youth. Would they prefer to put their money in the bank or into crypto? The world is moving in the direction of decentralization, and ultimately the crypto and DeFi wave is unstoppable.

Tascha: I don’t think we should attract more retail into crypto. We need more maturity for mainstream adoption and better guard rails for retail.

On macro bearishness

Darius: There is strong correlation of crypto with macro at the moment. I’m unsure of the catalyst but something has to happen to break this correlation. The disruptive and innovative aspect of crypto has to come back.

Wangarian: As crypto grows bigger, correlation as an asset class with other assets is only to grow stronger. We can’t deny that crypto is the fastest growing tech sector in the word today.

We will see that reflected in prices in one way or another. Just as tech and growth equity took off from 2010-2020 with a 10 year bull run, eventually we will see that happening in crypto. However, there will not be a complete decoupling from the wider market.

Sim Jian-Hong, Board Director of Zipmex and Angel Investor joins the conversation

JH: This will only happen if crypto really starts to see real cash flow, and show crypto can stand on its own as an asset class.

Tascha: The FED will continue to be hawkish if inflation continues to be out of hand. Even if inflation goes down to say, less than 5%, there will be some policy lag – similar to how the FED acted late with rising inflation. We are likely to have continued hawkishness even when headline inflation comes down.

Darius: From a trading perspective, the leverage in space must be reduced. In 2018-2019, the futures curve were in backwardation.

Currently we have futures at premium to spot. In the past bear market, futures were actually discounted to spot. If that happens, then the market is net short. It might be a signal to go in despite longer term macro fears.

Is holding Luna still a good idea?

Darius: We were Luna seed investors and cashed out quite long ago. We still had some exposure to UST and LUNA from market making desks. We also had a direct line with TFL that allowed us to swap USDC and UST at par. In January when there was a slight depeg, TFL cut the line with us.

To me, it was a signal that TFL might not have full confidence in their peg, and we cut our exposure to LUNA and UST.

The interesting thing was that if you were short LUNA by being long puts in LUNA/UST, you would still be screwed anyway as this time, both assets went to zero.

For that reason we got lucky, and it is something to be cautious about – crypto is a space where even if you were correct, you could get screwed due to the risks with other associated assets.

Wangarian: I participated in the LFG round that closed not long ago. The funds are locked for 4 years — I have written it off a loss basically.

I am not going to double down on a new LUNA ecosystem because I do not see the necessary signs in cultivate proper developers and talent there. However, I am still an angel advisor to some of the Terra ecosystem portfolio companies and am supporting them wherever I can.

Tascha: I had very small exposure to the ecosystem – only some liquidity parked in Anchor a few months ago. I had about $2000 in Anchor and I removed it immediately.

I do have exposure to the Cosmos ecosystem and that got hit hard – am still optimistic about Cosmos as a whole. Terra was a huge part of the TVL of the Cosmos ecosystem. It is a big setback and in the bear market, things are not going to look up any time soon and it will take time to heal.

Final advice for investors

Darius: Crypto winter is the best time to make money — our best investments were made in the winter. We can find these in teams that can build well and inspire confidence.

Trading based on structure, as well as carry trades are good alternatives. Exploring non-Defi opportunities in crypto and alternative yield structures in the space is of value.

Wangarian: Do not anchor yourself to your all time high net worth. Reframe your mindset and start afresh — focus on survival first. The mental tax from slow draw-downs in the bear market takes a toll. You should review your portfolio and take a look at how much exposure you really want.

Assume that you had to rebuild your portfolio right now and restart today. Would you be as exposed as you are right now?

Tascha: Now’s a good time to come in the space as a builder/creator. It is a great opportunity right now, and much easier to get in the bear than the top of the bull market. Projects are patient and more careful in how they operate in the bear market. It is a good time if you are thinking seriously about a career in crypto.

JH: A lot of us get excited at “price goes up”. When the numbers go down or we go through chop we lose interest. If you are interested, please continue reading and learning in the space. Don’t lose hope and take this as a chance to build up knowledge for the next cycle.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Also Read: No Coin Is Too Big To Fail: How To Survive The Crypto Bear Market In 2022