You might still be hesitant in crypto and I really don’t blame you. Amidst the current market conditions, it may be best to hold out in deploying your cash and instead, maximizing the downturn with expanding your knowledge in the space.

@a16z a venture capital firm that backs bold entrepreneurs who published a 2022 state of crypto report which highlights how far crypto has journeyed, how we might still be early and how the space is building the next generation of the internet.

Find out more on their crypto portfolio here.

1. Price-Innovation Cycle

According to the report, we are currently in the middle of the fourth price-innovation cycle.

Just like the 4 seasons we go through in the world, the crypto markets are similar in being seasonal. In the summer, when projects are “hot” will likely see high user adoption in the space — euphoria. While the chills of winter is a period of flat trading after a market crash.

Whereas prices are often a lagging indicator of performance in some industries, in crypto they are a leading indicator. Prices are a hook which drives interest, followed with new ideas and activity, which in turn drives innovation.

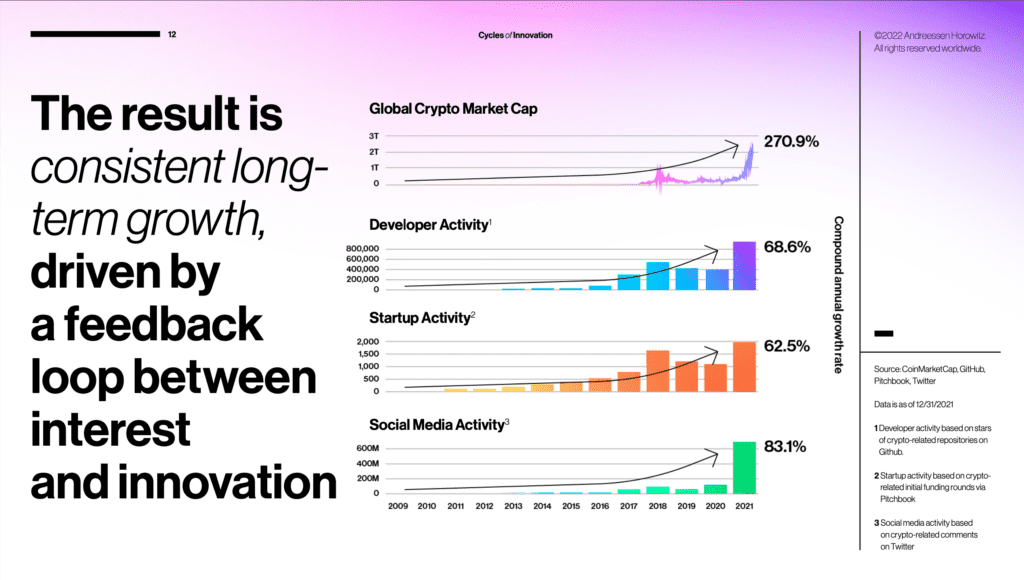

The result of this cycle is a consistent long-term growth despite periods of volatility. In my opinion, this is an underrated metric, where non crypto natives tend to overlook, but the inevitability of those innovation will one day shows its light to the masses. IMO, this space is an unstoppable force.

Find out more on the Crypto Price Innovation Cycle.

“It is better to build”

Benjamin Graham

The first man who landed on the moon was in 1969 and 5 decades later we only have a space shuttle which takes people into the lower space orbit. Funny thing is this very space shuttle is now retired and we are almost back to square 1 in space development (correct me if I am wrong I am no astronaut guy).

We are mistaken to think technology automatically improves but it only improves when people continuously build. Instead of just focusing on the volatile price action, eyes should be turned towards the developers in the crypto space.

Those who swore off tech after the dot-com bubble are ones who missed the best opportunity in the past decade. Is it now time to consider equivalent success in web3?

2. Creators to choose Web3.0 > Web2.0

This point is for the creators and how they are able to garner a fairer, more deserving economic terms compared to what traditional web2 companies provide.

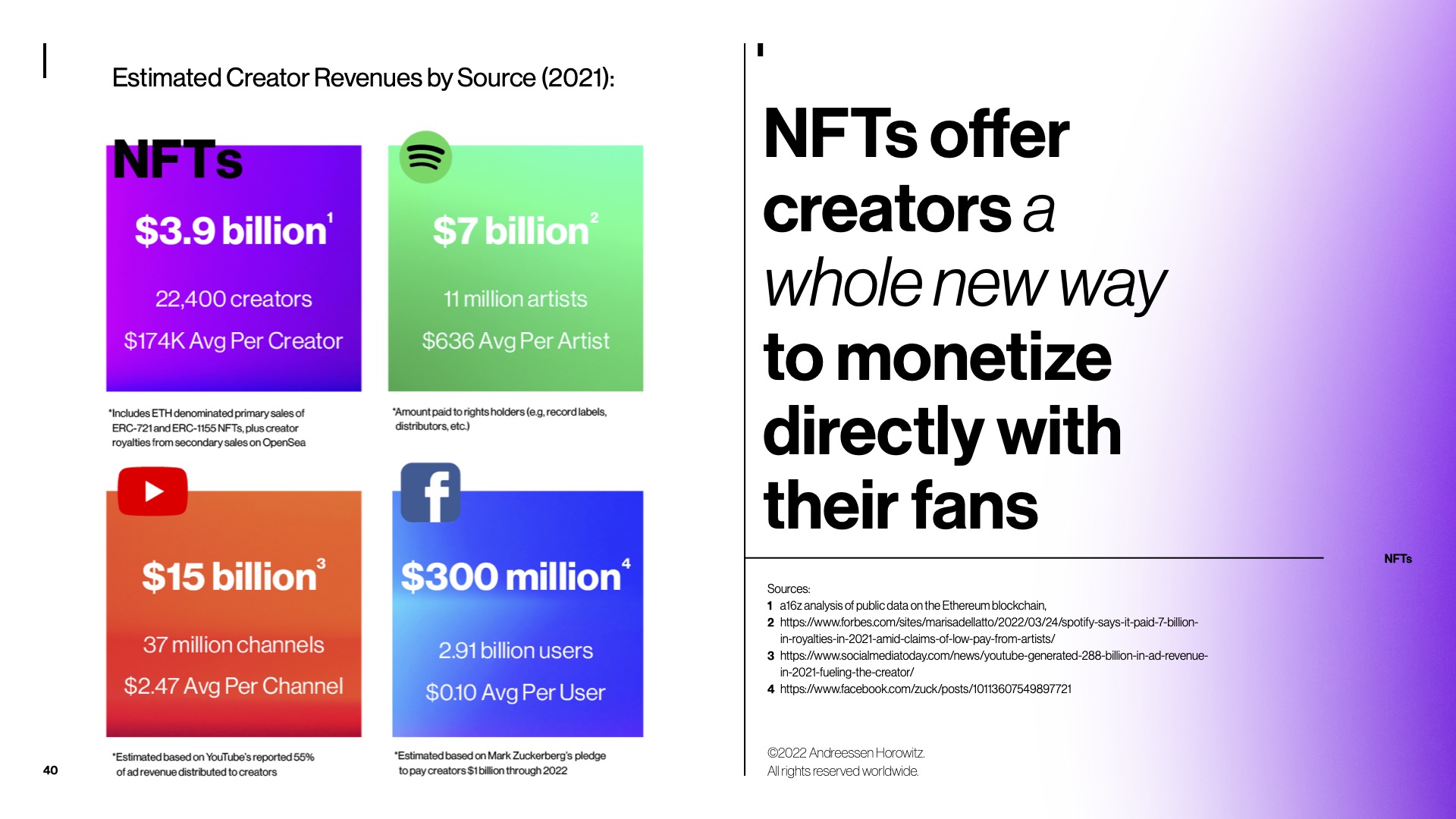

Web3 paid $174,000 per creator vs $0.10 at Meta or $2.47 at Youtube. This is just a small sample size, but the earnings potential are evident. This is before innovative concepts like music NFTs, web3 social platforms, and creator tokens gain mass adoption.

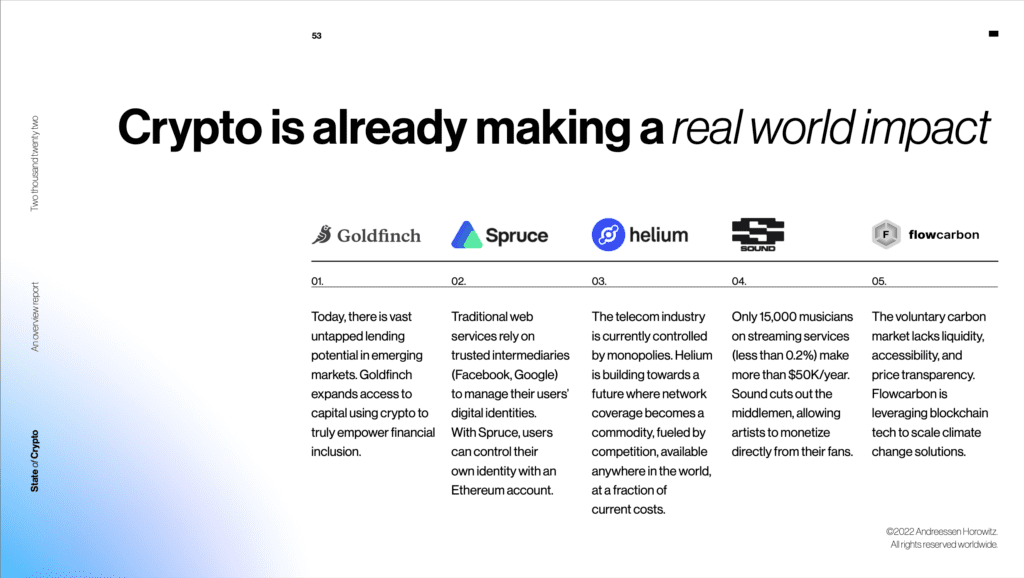

Today there are over 8 million musicians on streaming services, yet less than 15,000 musicians (less that 0.2%) make more than $50K/year. That’s because the vast majority of the revenue is kept by the streaming services and music labels.

With NFTs, musicians keep over 90% of sales. By cutting out layers of intermediaries, musicians can credibly support themselves with just a thousand true fans. You may read more on NFTs and A Thousand True Fans.

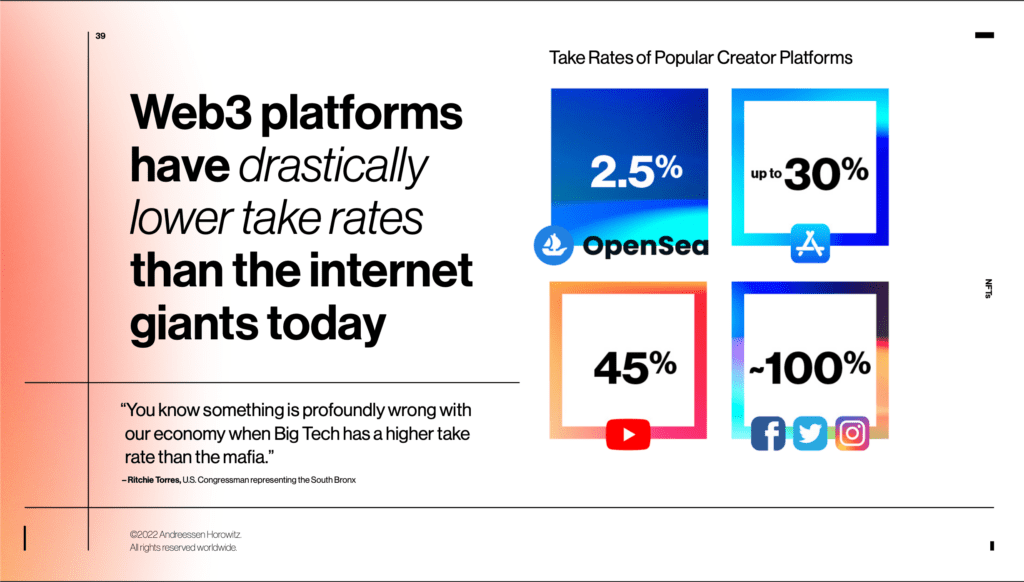

Social media platforms like Twitter, Instagram, and TikTok have take rates of 100% which they don’t share any revenue at all with creators. That’s great for the big web2 companies but bad for users.

A take rate is the fee charged by a marketplace on a transaction performed by a third-party seller or service provider.

So why should this matter to creators? Although the comparisons is not exact, removing costly intermediaries of giant web2 companies allows innovative experiments with new business models to play out in favour of the next generation of builders and creators.

In a space where creativity powers the industry to thrive, the removal of these conditions would enable creators to explore curation of their content with limitless boundaries, and thereafter letting the market decide on the price tag to peg for their success.

Web 2 platforms depend entirely on creators for content, yet give only scraps back. This is not sustainable and in fact if supresses innovation and creatively we are all meant to freely explore.

Web 2’s take rate is Web 3’s opportunity.

3. Real world impact

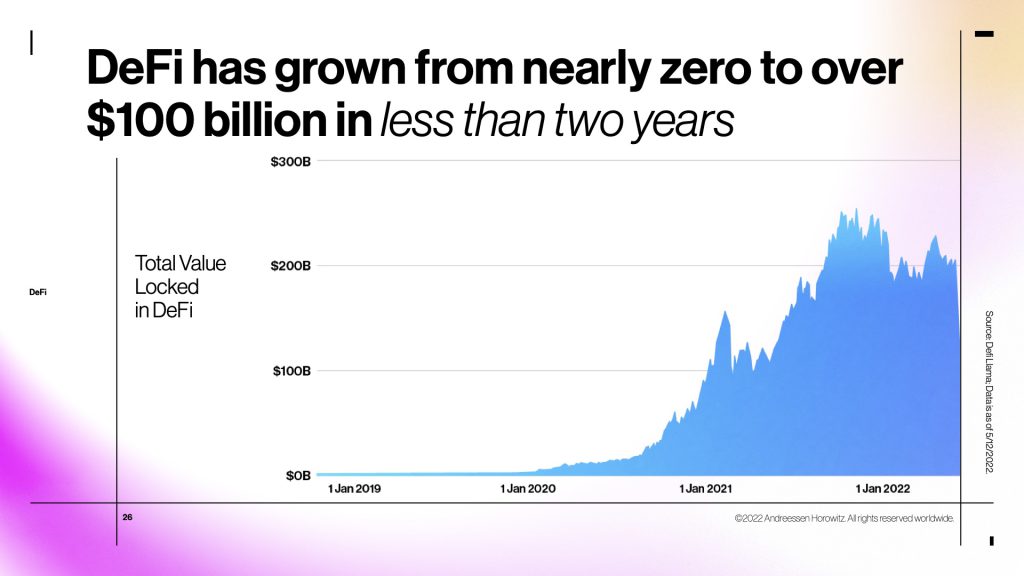

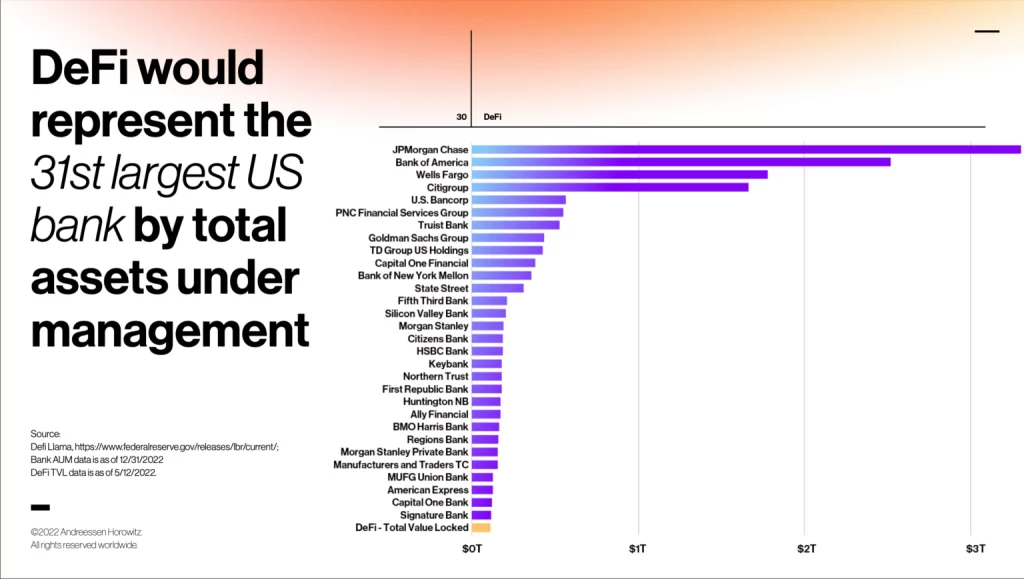

A major component in crypto is DeFi, which would represent the 31st largest US bank by total assets under management. With it’s rapid growth from zero to over US$100B in less than 2 years, there is so much more crypto has to offer beyond the incentives to creators.

This aspect of crypto reaches especially into 3rd world countries where traditional finance may not be accessible due to costs/demographic reasons.

Crypto offers a shot into financial inclusion to those who has a mobile smart phone especially in those countries where underserved and unbanked populations are prevalent. Projects like Goldfinch will be the missing piece which finally unlocks crypto lending for most people in the world, especially in emerging markets.

Here are other aspects of how crypto tackles real world problems. Some of these industries include, telecommunications, climate and impact on traditional web services.

Crypto is far more than just a financial innovation. It’s inclusive of social, cultural, and technological aspects. As this technology trickle into the industries of the world, I foresee use cases for crypto to be evident in all aspects of our lives, impacting the way we live in an immensely manner.

4. Will Ethereum continue to hold it’s crown?

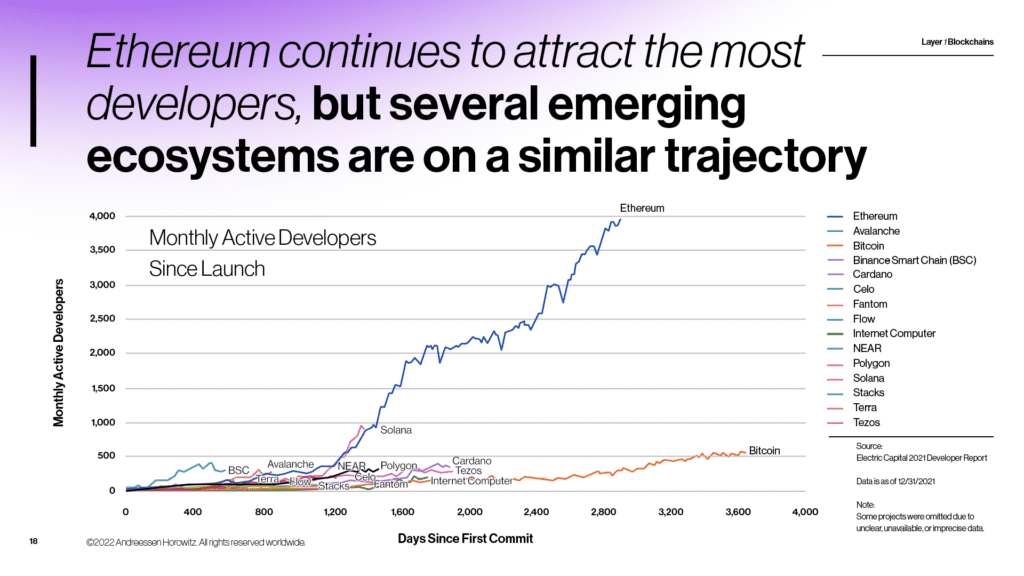

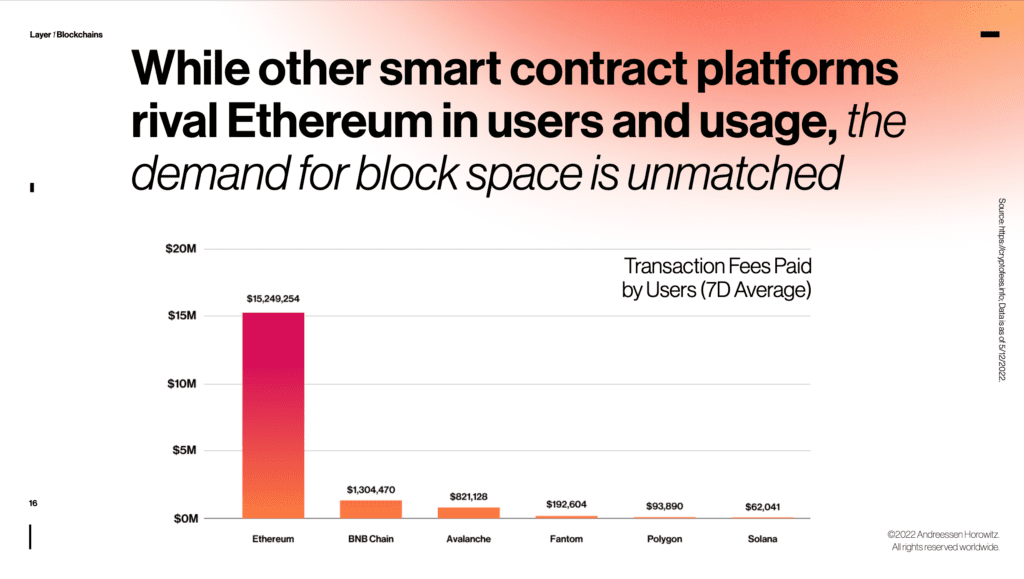

There are plenty of dubbed “Ethereum killers” out in the market which aim to capture market share in developers and user adoption. These projects include the lights of Solana, Polygon, BNB Chain, Avalanche, and Fantom who are angling for similar success.

You might have heard of all these other names but with its first mover advantage and strong community, ETH dominates the web3 space and currently holds the throne within the space. But for how long?

As far as developer interest goes, Ethereum is miles ahead with the most builders, with nearly 4,000 monthly active developers. Following that is the lightning fast Solana (with nearly 1,000) and Bitcoin (about 500).

Ethereum’s popularity is also a double-edged sword. Because Ethereum has historically prized decentralization over scaling, other blockchains have been able to swoop in and attract users with promises of better performance and lower fees.

Read more on the blockchain trilemma

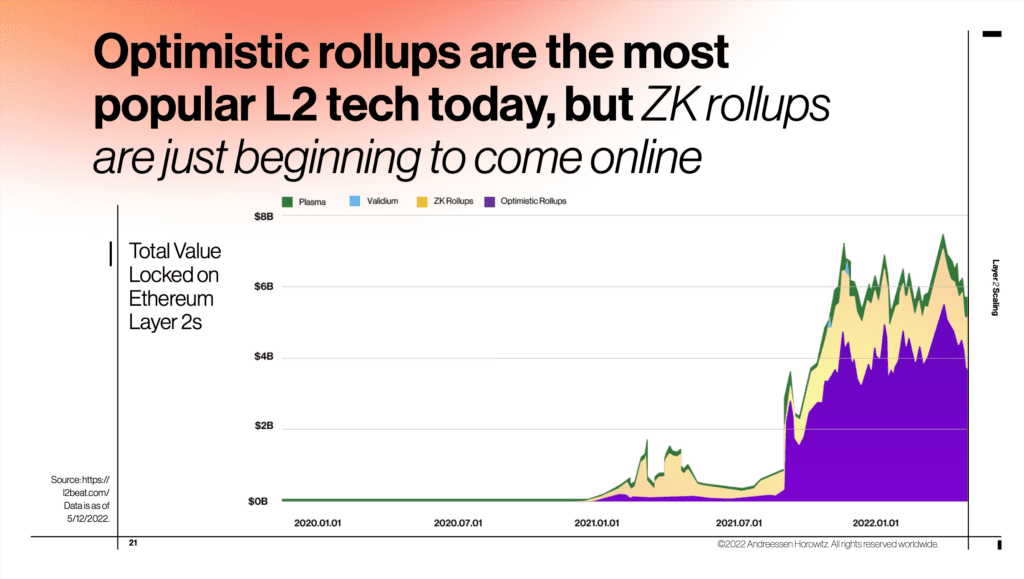

We also see the wave of interoperability, beyond the fight of the layer 1s, which allows people to bridge assets from one blockchain to another as well as layer 2 technologies such as optimistic rollups and zero-knowledge rollups, which aim to lower costs by expanding available blockspace.

Read more: Are Layer 2 Blockchain Scaling Solutions Better Than Layer 1s?

5. You are still early if you are reading this

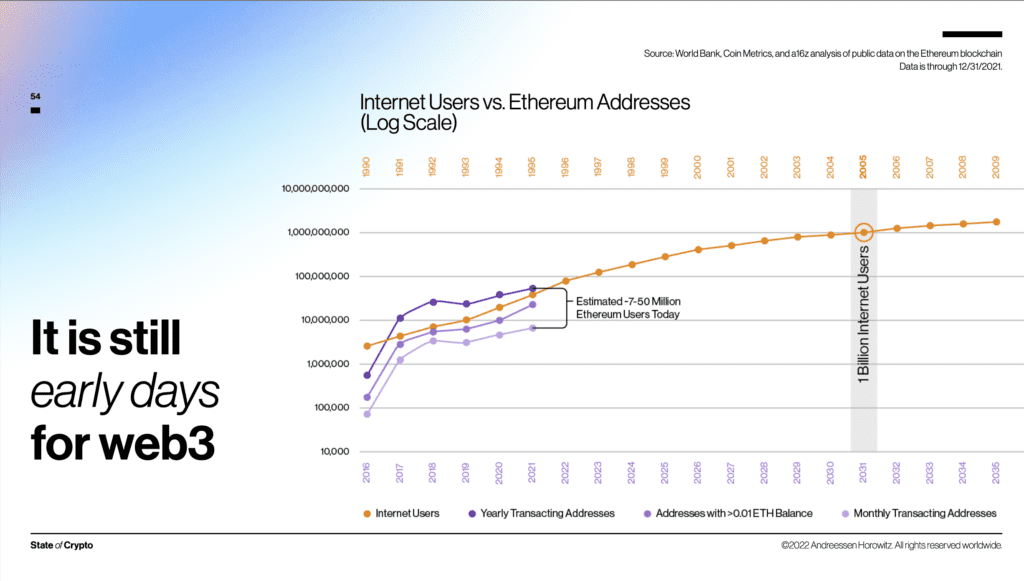

Comparing to early days of the internet development, we see user base of crypto drawing similar sentiment in present day. The estimated active Ethereum users is between 7M – 50M, which is comparable to the early days of the internet back in 1995.

This is also a ballpark figure which leaves out rapidly growing L1s and L2s like Polygon, Solana, BNB, AVAX which may bring the figure closer to 100M.

Every successful industry had to go through a phase before reaching maturity. This “trial” period will be greeted with ups and downs but keeping an open mind in understanding the process will be key in future web3 development.

In my opinion, it is a beautiful thing on how blockchain technology is slowly infiltrating into cervices of various industries where eventually, it is expected for the human race to be forced to live with.

Closing thoughts

If you look at prices, your first deduction of the crypto market would be a negative one. I do not blame you when you draw that conclusion but the flipside is an array of use cases on why crypto is here to stay.

We will expect further development in web3 infrastructure development in the layer1s and layer2s. Interoperability may also be a key role in connecting these projects in ensuring exponential growth within the crypto space.

The NFT space is a welcoming space for creators. As the space develops, so will the onboarding of creators to move from web2 to 3. Within NFT is another exciting vertical, gaming. The billion dollar gaming industry being infiltrated by crypto will see the merge of AAA grade games along with DeFi elements which I think will be a game changer.