The Current State of DeFi

An ominous gloom surrounds the DeFi Space, almost like a barren wasteland you see in the movies. This aspect of crypto suffered greatly to the point where loud chatter in the summer has turned into cold whispers of winter.

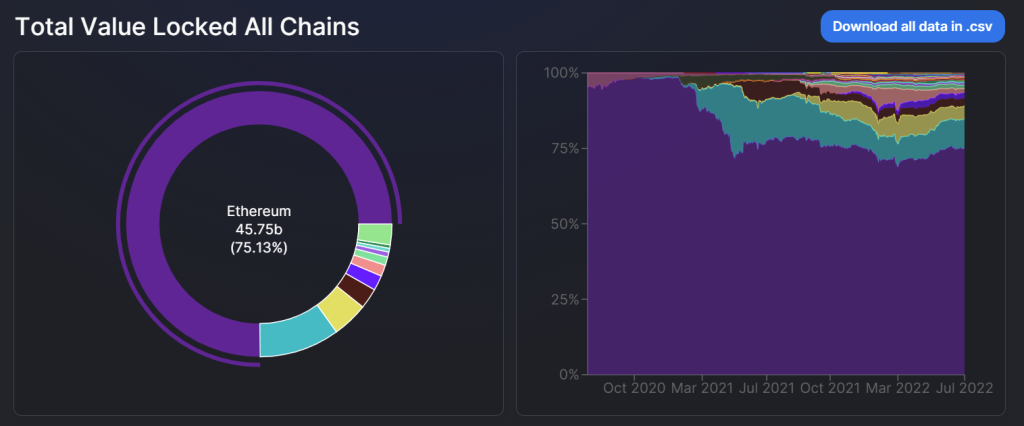

Total Value Locked (TVL)

At its peak, the DeFi space amounted to a high of US$252B in total value locked. According to DeFiLlama, the current TVL of DeFi is at US$75B, a 70.3% decrease from the all-time high.

As crypto continues its descent, the DeFi space is no longer safe; something investors easily overlooked during DeFi summer last year.

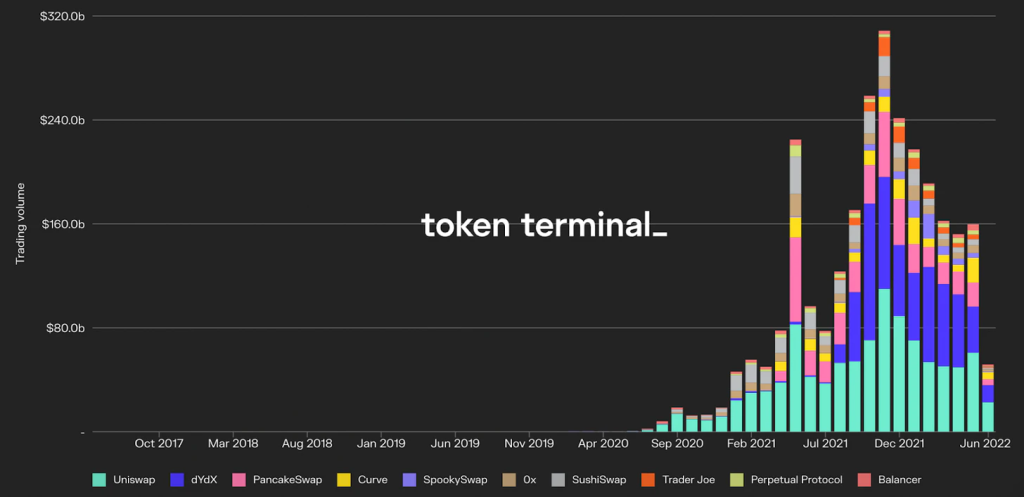

Volume On DEX

Monthly DEX volume sits well below its November 21, 2021 peak at $308.6B. Books for June 2022 are currently on pace to clock in at $103.3B. This represented a 66.2% decline across the ten platforms.

Why would this statistic matter? Trading activity. As trading activity and price appreciation are highly correlated, the decline in trading volume is associated with the market’s decline.

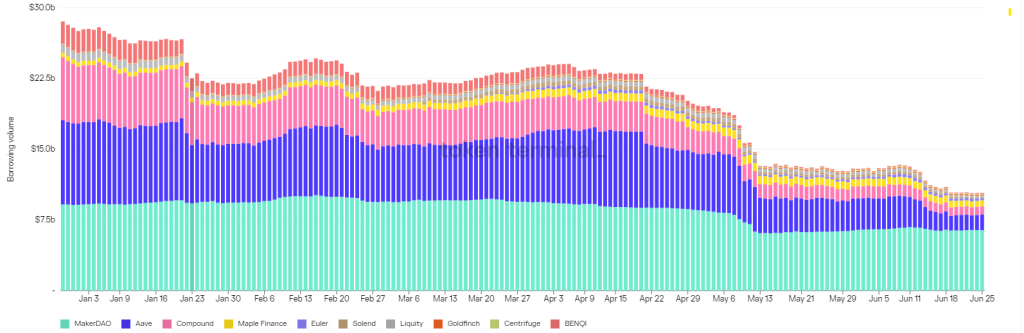

Borrowing and lending

The borrowing volume is also crucial in determining if DeFi is dead; why? It measures the value of outstanding debt on lending protocols which currently sits at $5.1B, a 75.3% decrease from its peak of $21.1B in December 2021.

Borrowing and lending are the heart of DeFi, the engine which attracts adoption and interest. Decreased demand for loan leverage is a direct indicator of a bearish climate we are abiding in.

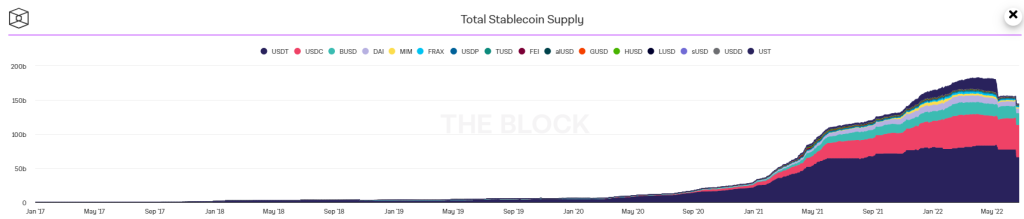

Stablecoin supply

The market capitalization of stablecoins is currently $156.7 billion, a 17.1% decrease from its peak of $188.9 billion in May 2021. This decline coincides with the collapse of UST, which at its peak had a market cap of more than $18.7B.

This led to contractions in the supply of other stablecoins — such as USDT, BUSD, and DAI — as holders redeemed assets amidst the panic. Stablecoins minimize typical cryptocurrency volatility by maintaining collateral in the form of reserves, often of U.S. dollars, this way.

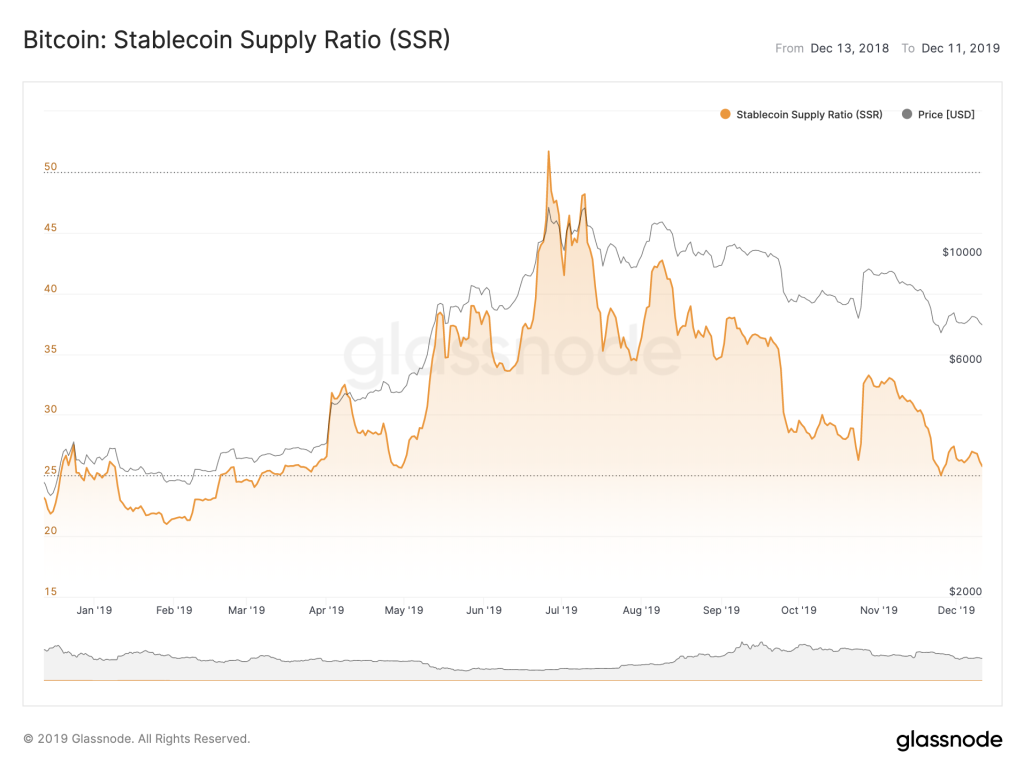

The importance of stablecoin supply in the market may be critical for investors to see the inflow of capital into alts. For example, The Stablecoin Supply Ratio (SSR) is the ratio between Bitcoin supply and the supply of stablecoins, denominated in BTC.

When the SSR is low, the current stablecoin supply has more “buying power” to purchase BTC. It serves as a proxy for the supply/demand mechanics between BTC and USD.

Struggles of DeFi

The statistics above show signs of weakness in DeFi, and let’s admit, it’s not as exciting as before. With those aside, let’s dive into the correlation between the decline of prices and the slowdown of on-chain activity.

1. Yields not the same as before

The correlation between price action and on-chain activity makes DeFi yields highly reflexive.

Reflexivity generally refers to the examination of one’s own beliefs, judgments and practices during the research process and how these may have influenced the research.

DeFi summer was an example where protocols, liquidity and leverages rode the wave. The increase in usage led to higher yields as LP earned more swap fees, deposit rates on lending and borrowing markets soared, and so did the incentivization of the value of token accrual.

These led to the inflow of capital into DeFi. I remember this vividly everyone chasing the APYs, those who got in early and capitalized on DeFi’s money-making benefits were the winners, some of them able to retire on their earnings.

So was DeFi summer a financial revolutionary, or was it our friendly neighbour, Greed knocking on our doors?

The current DeFi space isn’t as hot as before. Prices have fallen, and so has the on-chain activity. The yields and returns you get from DeFi become less enticing and attractive by the day. Naturally, it drives the outflow of liquidity away from the space.

2. Liquidity Mining

From one farm to another, I realized myself subconsciously moving my funds to projects with better APYs, I was chasing. Liquidity Mining powered the first wave of DeFi adoption by providing protocols which was also an incredibly effective tool to garner usage and growth.

This new system seemed to be a big win in DeFi but arose sustainability issues which needed to be improved.

Despite the effectiveness of liquidity mining in the short-term growth hack, it has several important drawbacks. Firstly, Liquidity flows out of a protocol or DEX pool as soon as rewards begin to subside or yield compress which may reveal the unsustainable nature of LM.

The second is also downward pressure on the price of the reward token, as farmers realize their yield through the sale of assets. Furthermore, it accelerated the draining of treasuries as protocols often allocate a portion of their native supply to these rewards programs.

The resiliency of the LM infrastructure is also tested during macroeconomic conditions of the current day and we see the remains of DeFi as it is right now.

3. Blowups and DeFi exploits

As the bear market looms, numerous events have highlighted key risks apparent to DeFi.

The fall of Terra. LUNA collapsed, UST depegged and the token was hyper-inflated which resulted in a 99% fall in the value of the token. Literally 100 to zero.

The UST death spiral was also brought to the doorstep of Terra Native protocols, Anchor – a money market that paid a 20% rate on UST deposits for users as a “savings account”.

Along with other implosions, DeFi was susceptible to hacks even before the bear market. More than $1.44B of user funds have been lost across 20 exploits in 2022 alone, which already exceeds all of the value lost in 2021.

Also Read: How Celsius Single-Handedly Crashed Crypto And What It Means For You

The frequency and magnitude of these attacks have likely contributed to the sharp decrease in on-chain activity, as the prospect of losing funds, coupled with the compression in yields, has made the risk-reward profile of deploying capital on-chain less attractive.

Catalysts for DeFi

1. Very very real-world adoption

Our dear friend “real world adoption” will always be a factor to revive DeFi.

The explosion of DeFi in the scene came along with a myriad of components and features which can be utilized by a more diverse group of market participants, fueling growth with new liquidity into the ecosystem. I believe this is the start where the inflow of trillions into the crypto space is getting carved.

Along with institutions’ adoption, we are also seeing early signs of real-world businesses leveraging DeFi. Goldfinch, a decentralized credit protocol, has originated more than $102.2 million in loans to businesses operating in markets like Nigeria, Southeast Asia, and Mexico.

This represents another avenue in which DeFi can grow its user base, bring in new capital and demonstrate its value proposition by actually providing financing in the real world, especially those underbanked and emerging markets.

2. Scalability unlocks for DeFi

A primary reason as to why DeFi adoption has been limited to a small pool of eager degens thus far comes down to scalability constraints.

Gas fees on Ethereum remain so high that they price out a large portion of potential users. This not only restricts the types of applications that can be built but also encourages poor risk and position management on those that are built.

By providing users with cheaper transaction fees and near-instant semi-confirmations, L2s not only dramatically improve user experience and unbound platforms but will enable the mass onboarding of a new wave of users into DeFi.

L2s also unlock a new design space for developers. Many of the most popular applications on these rollups today are ones that were impractical to build on L1.

Many would also flock to opposing layer 1s in the crypto space. Big names like Solana, Avalanche and NEAR have their respective DeFi ecosystem each with its very own unique selling feature. As the layer 1s in the space continues to build, they are slowly inching in TVL towards Ethereum.

Conclusion

The rapid and consecutive combustion of UST (a stablecoin), Terra (UST’s Layer 1), Celsius (a CeFi bank), and Three Arrows Capital (Terra’s VC) was by no means spontaneous. This series of events has easily burnt investors and carved the idea that whatever is left with DeFi is a barren wasteland.

There are plenty of external factors affecting the general state of DeFi. The ripple effects were clearly seen with the fall of Celsius and 3AC. Right now, in its infancy stages, it is still a very dependent verticle within the broader crypto market.

However, if one were to dissect the components of the domino fall, he will soon realize that none of the above are built on Ethereum, and none of them are DeFi platforms. In fact, the value proposition of the fully transparent and open financial system that DeFi provides has never been clearer.

So what’s next? Scalability solutions like L2s mean DeFi will soon have the bandwidth to onboard a new generation of users. The key success factor also lies in the developer’s space. Instead of forking quick wins in protocol copycats, consistent innovation in building prototypes will lay out the path for trillions in new capital to flush into the ecosystem and propel it forward.

These innovations may come from the merge of DeFi with existing real-world companies we know about. From the lights of Tesla, Google and Amazon, these companies might play a pivotal role in instigating crypto adoption with their real-world products. Gaming and DeFi might be another one to look out for.

Yes, on the charts DeFi may be down bad. But what is to emerge from this barren wasteland may invoke a new wave

Also Read

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief