The answer to the above is No.

So what has conspired over the past few days are rumours of wETH de-pegging, which are entirely false. I’ll go into the details in a bit.

These conversations mainly happened on crypto Twitter, where many accounts with influential following played along with the idea that wETH is insolvent but so in a sarcastic manner.

There's a joke going around about #WETH depending from #ETH. All the big names are playing with it including vitalik. I am not because I don't think joking about things that could get the silliest of users rekt is funny. Thus my jokes suck a bit more, but save more lives.

— Richard Heart (@RichardHeartWin) November 28, 2022

If you know what wETH is, you will also understand that the comments made do not tally, but the group of non-crypto natives might think otherwise and take things at face value.

The jokes play on the fact that wETH, as an ERC-20 token, is impossible to go insolvent (besides a very, very unlikely event of a contract flaw in the code) and will always be backed 1 to 1 by Ether deposited by the user.

In a space where meme coins occupy the top TVL rankings, many investors are banging on moonshot opportunities, not one with real utility and value. These investors may fall victim to believing what key opinion leaders say and quickly act on it.

Martin summarized this entire unnecessary FUD in 3 sentences, along with evidence on top of the wETH transaction from Nansen.

Broke: Write factual explainers on WETH which everyone ignores

— Martin Lee | Nansen 🧭 (@themlpx) November 28, 2022

Woke: Write jokes about WETH depeg which everyone believes

Bespoke: Create and use arb bot to arb WETH depeg and make free money

*SS shows top WETH Txs from @nansen_ai* pic.twitter.com/dWSQ5PQoWE

What is wETH?

Also known as wrapped ETH because it is essentially a “wrapped” version of Ether with ERC-20 token standards. Wrapped coins and tokens virtually have the same value as their underlying assets.

So is wETH safe to trade and invest in? Yes.

As far as Ethereum is concerned, wETH is pegged to the price of ETH at a 1:1 ratio. To a certain extent, wrapped assets are like the stablecoins we know of. USDC and USDT could be considered to be “wrapped USD.”

Wrapped Ethereum tokens can be unwrapped after they’ve been wrapped, and the process is simple: Users have to send their wETH tokens to a smart contract on the Ethereum network, which will then return an equal amount of ETH.

How does wETH actually work?

The “wrapping” process involves sending ETH to a smart contract to generate wETH in return. Meanwhile, ETH is locked to ensure that wETH is backed by a reserve.

When an investor wants to convert their wETH back to ETH, the exchanged wETH is burned or removed from circulation. This is done to ensure that wETH remains pegged to the value of ETH at all times.

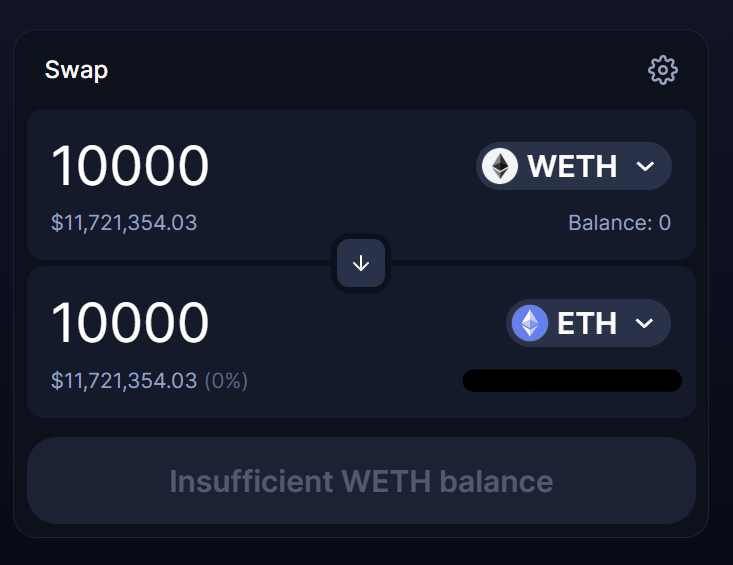

On exchanges like Uniswap, users can acquire wETH by swapping other tokens for it.

As mentioned, you can see the 1:1 value pegged between the two assets.

Fun fact: WETH cannot ever go insolvent. Your WETH will always be swappable 1:1 with ETH.

— cygaar (@0xCygaar) November 25, 2022

The code and logic is quite simple. In fact, it only takes 60 lines of code to implement.

Here's a simple primer on how WETH works 🧵: pic.twitter.com/kUsfreCrT8

So why do we need to complicate things with a wrapped token? Interoperability.

Wrapped tokens solve the interoperability issue that most blockchains face by allowing easy exchange of one token for another. Through wrapping, underlying coins are tokenized and wrapped with a specific blockchain token standard, allowing their use on other networks.

While wETH cannot be used to pay gas fees, it could provide more investment and staking opportunities on dApps.

According to WETH.IO, “the ultimate goal is to update Ethereum’s codebase and make it ERC-20 compliant in itself, eventually eliminating the need to wrap Ether for the purpose of interoperability.”

Until then, it remains valuable in providing liquidity on LPs and crypto lending.

Here is a list you can use to stake your wETH.

How to wrap your ETH?

While there are many ways you can wrap your ETH, we’ll go through the two most popular methods you can do so. Both are straightforward if you have dabbled in crypto for some time.

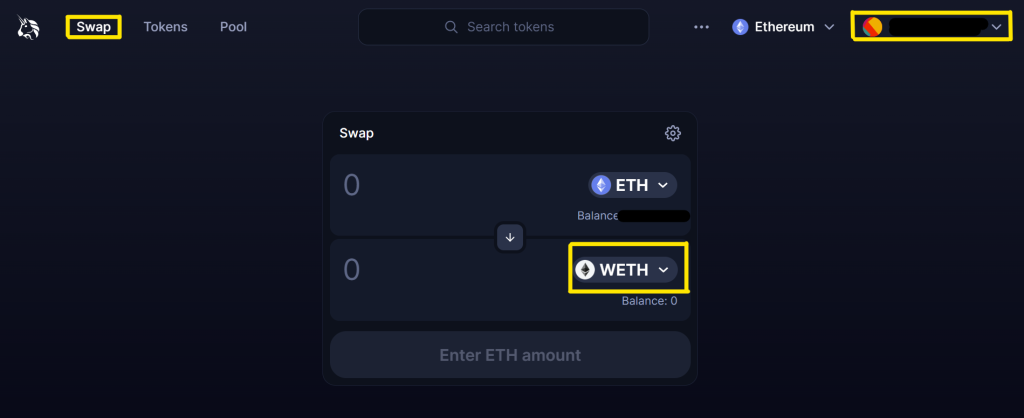

1. Uniswap

Head over to Uniswap.

Connect your Metamask wallet, and navigate under the swap tab.

From there, select the amount of ETH / any other asset available to convert to wETH.

Approve the transaction, and you’re ready with wETH, which will be reflected on your Metamask Wallet.

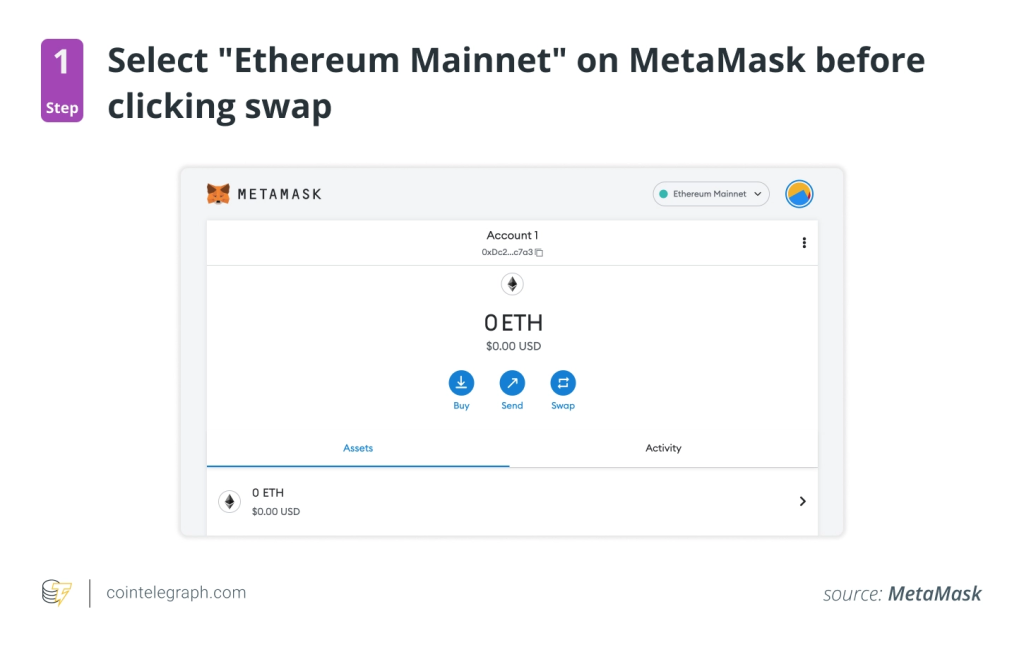

2. Metamask

Swapping ETH to wETH on Metamask is even simpler.

Open your Metamask wallet, and ensure the selected network is the Ethereum Mainnet.

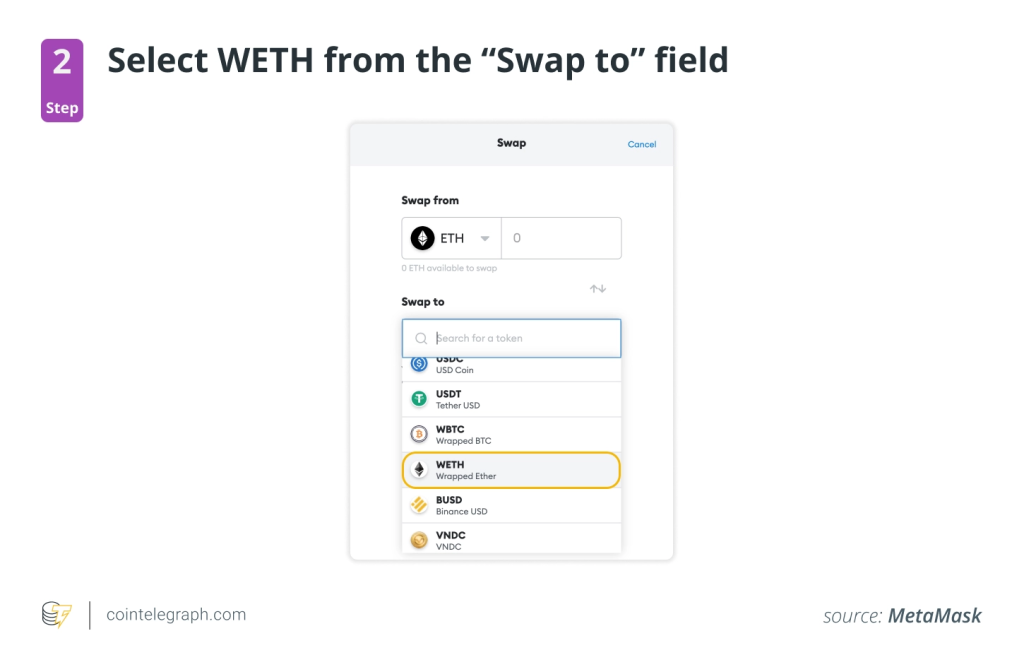

Click on “swap.”

Select wETH to swap and input the amount you plan to swap.

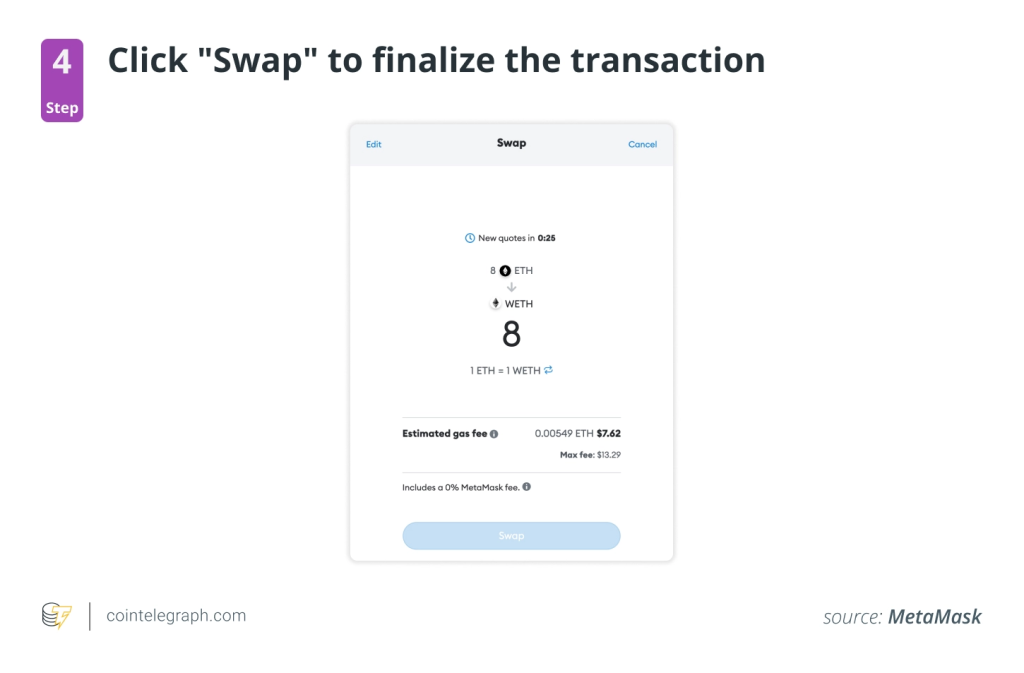

Once you review your swap, a window displaying a quote of the conversion rate will appear. Since it involves the conversion of ETH to wETH, the rate should be 1:1. To finalize the transaction, click “Swap.”

Unwrapping can be done reversely, basically swapping your wETH back to ETH.

Risks involved with wrapped assets

There are risks involved. The creator of Ethereum, Vitalik, raised one main disadvantage of wrapped assets about centralization.

As wrapping is usually only carried out using central programs, thus a concern for possible manipulation and abuse.

They depend on third-party platforms that issue them, which may raise concerns about the possibility of such mechanisms undermining the core principles of decentralization and transparency the blockchain industry currently stands for.

I'm worried about the trust models of some of these tokens. It would be sad if there ends up being $5b of BTC on ethereum and the keys are held by a single institution.

— vitalik.eth (@VitalikButerin) May 21, 2020

Closing thoughts

The WETH depeg jokes stopped being funny 24 hours ago.

— Arthur (@Arthur_0x) November 28, 2022

To demystify any doubts, wETH is not de-pegging from ETH; if it ever does, it would include a complete malfunction of the wrapped ether contract (in code), which is extremely hard to do due to the simple nature of wETH contracts just being 62 lines of code.

However, if you are HODL-ing your ETH, Vitalik and most ETH holders choose to HODL in idle ETH rather than wETH. This is due to the slightly less risk and more DeFi cost in swapping the two assets.

wETH is not to be confused with other assets like wBTC and wLUNA or any wrapped assets that may not work the same way. Some “wrapped” assets on non-Ethereum chains have centralized components that may be more susceptible to failing or losing value.

While the crypto community takes on a “meme-ish” culture, a passing joke, especially from someone with an influential following, has its implications. This is one flaw the crypto space faces, especially when people follow blindly. We have a long road coming before we see real adoption; instead of adoption purely for monetary gains.

Also Read: How Manipulation On AAVE And CURVE Went Wrong, Attacker Got Rekted Instead

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief