My first crypto buy was 0.01 Bitcoin back in February 2018, and yes, it means I got it for under 10k (insane right?). I traded it in the following weeks for about 10% gain each trade but the crypto winter hit and I sold all my holdings and moved on.

It was fun while it lasted but I concluded that it was risky and was not worth my time. Spoiler alert, I was wrong.

Like every other 30-plus millennial under Covid-19 lockdown, I started paying attention to crypto out of FOMO, and when I discovered Decentralised Finance (DeFi) in March 2020, I started to see the real potential of cryptocurrency.

It is not a tool for drug lords or money laundering like what the mainstream media tries to paint — it is a game changer, disrupting incumbent financial institutions.

When it comes to Decentralised Finance, the concept of a middle man no longer exists. Users of DeFi operate in a trust-less, and permission-less manner. There is no need for KYC (Know-Your-Client) or declaring of your income because there are no middle man involved to verify your solvency.

Diving Deep into DeFi

So I got into the rabbit hole of the DeFi world, and then eventually went “all-in” on cryptocurrency, except this time, it was Ethereum, not Bitcoin.

I transferred money to my Coinhako account regularly and loaded it to my Metamask wallet. This unlocks every DeFi project out in the ecosystem and I can now freely deploy my ETH to make it work for me.

Setting up was really easy, all I had do was install the extension on my browser, create a password, and store the secret phase (I suggest printing it out and locking it in a safe).

Now the cute little fox follows you wherever you go on the Internet. The interactions were smooth, and it was quick on the blockchain especially when 5-15 gwei (gwei to ETH is the equivalent like cents to dollar) was the norm — transactions took maybe a few minutes to confirm.

But what I didn’t realize was gas fees (transaction fees in legacy finance term) racked up pretty quickly.

If I have to guess, I probably spent $2,000 on gas fees alone. It was almost 20% of the initial amount I transferred to Metamask. The earnings paid for it, but it still took out a sizeable chunk from my return.

Sushiswap was great but the gas fees made it less attractive so I figured there had to be a better way to do this. It was the great DeFi Summer afterall.

My non-existence social life was a bonus too – more time to research. I was reading up about 5-10 different strategies every month on getting higher yield. Before I knew it I was spending half a day shifting tokens around to chase those yields while still paying the exorbitant gas fees.

Apparently there’s a term for people like me: a Yield Farmer. I didn’t care about what I was called — all that mattered was the sweet, delicious Yams and Sushi accumulating in my wallet. Life was good and I felt like a part of history creating the new decentralized financial future.

Yield gets eroded

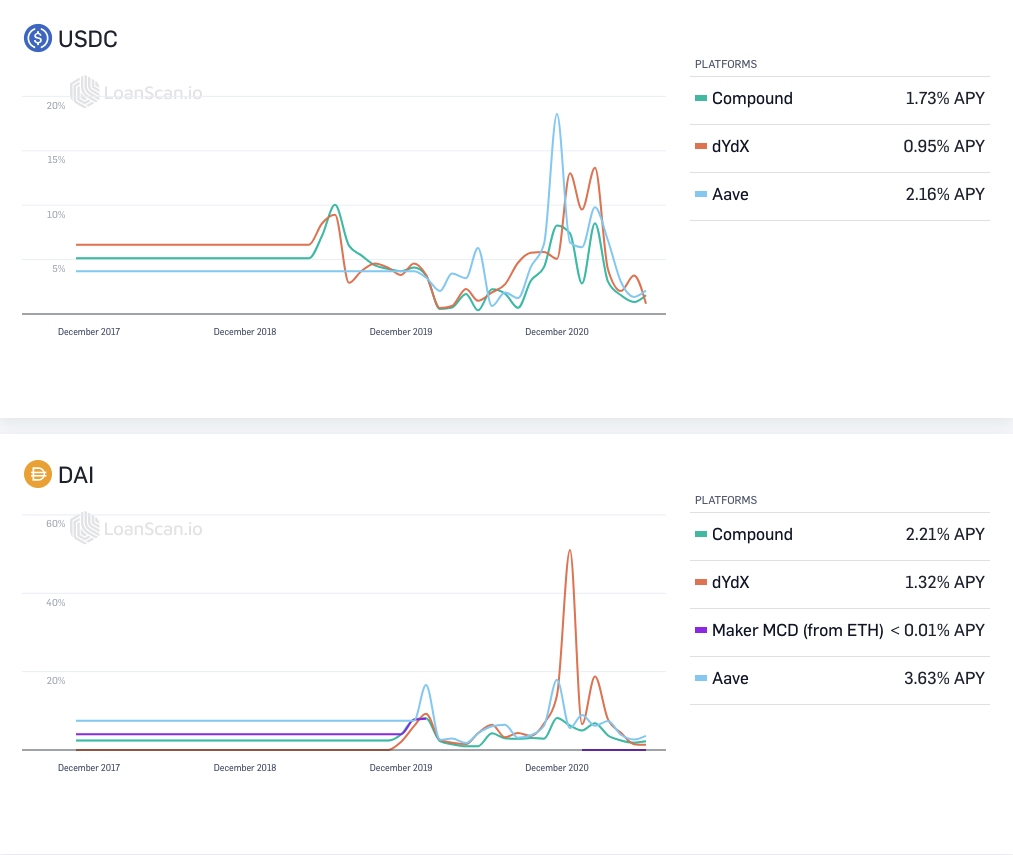

However, lately, it’s not going great with the yield getting lower and lower. Is the DeFi winter here already? I checked the yields I was earning and I couldn’t believe my eyes: USDC was earning 2% on AAVE and Compound.

2%? I don’t recall buying US Treasury bills. At this rate, I might as well be doing just that. I’m not entirely sure what the root cause is, but I know this was not what I was expecting in return for the risk of rug pull and price volatility.

I made my way over to LoanScan.io, a portal for loans and other financial instruments on both DeFi and CeFi. The lending and borrowing rates were a whopping 0.01% on Ether over at AAVE. What happened to the promise about getting a Lamborghini once you invest in crypto? At this rate, I can probably only get one in the next millennium.

Every single stablecoin showed the same trend and the indicates that yield will only continue trending downward.

This is a double whammy — new market entrants (especially institutional funds) and copycat yield farmers are driving down returns.

The abundance of liquidity (USDC alone has skyrocketed from 4B in circulation to over 25B (~625%) as of July 20, 2021) means there’s too many farmers chasing rapidly diminishing yields.

If I’m right, the collapse of yields is only getting started. If you’re an Ape, I’d recommend you to stay as far away as possible from yield farming. For the risk and the low yield, you might be better off buying ICP or other random shitcoins.

Also Read: How To Get Started With Decentralised Finance (DeFi) For Beginners