While there are many DEX aggregators to get you the best rates on swaps, the same cannot be said for bridging. Li Finance hopes to solve that, especially as Cross-Chain interoperability becomes a more prominent narrative in 2022.

A recap on why we need bridge aggregators

There are a variety of scaling solutions including Layer 2 and Layer 1s. L2 scaling solutions have a separate execution layer, leveraging the security and decentralization of Ethereum of the L1 blockchains they run on. This means that transactions from end-users taking place on the L2 have to be sent back to the L1 eventually.

Everyone that has interacted with an L1, L2, or even L0 will know the importance of DEX aggregators. Bridge aggregators, however, are lacking and urgently needed as users are currently unsure of which bridges offer the best rates.

Bridges also generally only support a small range of coins, and users may be left lost when trying to bridge small caps.

What is Li Finance?

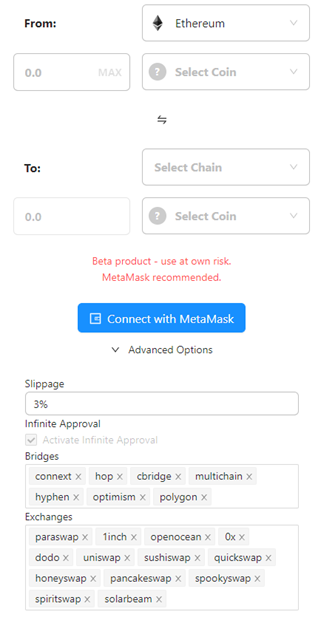

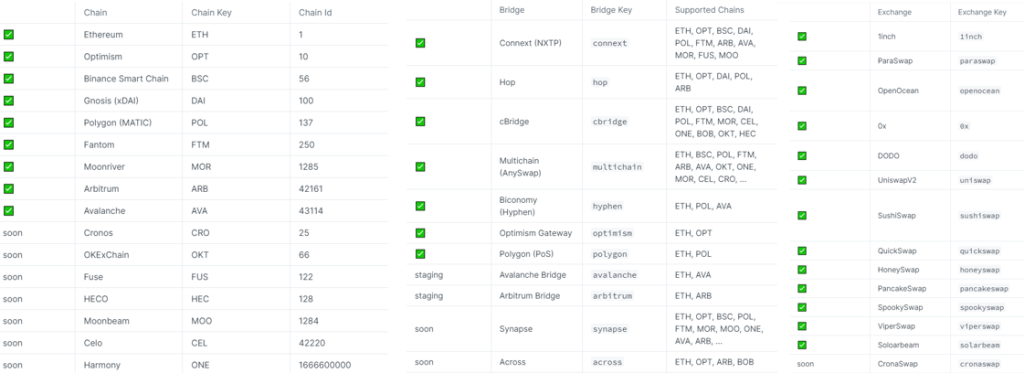

Li Finance is a cross-chain bridge aggregator that supports any-to-any swaps by aggregating bridges and at the same time, connecting them to DEX Aggregators through multiple partnerships. With DEXes on both sides of the bridge, they facilitate the bridging of most coins. This saves you the cumbersome need to convert some assets into stablecoins before bridging it to another chain.

One of the routes possible is AAVE on Polygon -> DAI on Polygon using Paraswap -> DAI on Avalanche using NXTP -> SPELL on Avalanche using Paraswap.

Li Finance closes the gap between chains, especially since most bridges only focus on EVM-compatible networks. Their smooth UX, made available as a Javascript SDK that collects to all wallets, also provides for a pleasant and customizable user experience.

Li Finance operates on a multitude of platforms such as:

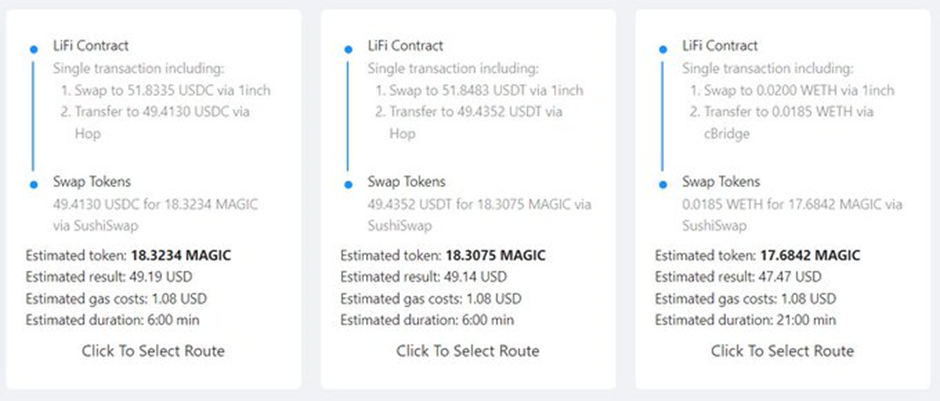

Smart Routing, Aggregation and Abstraction

Li Finance uses an algorithm to look for all available routes to maximize efficiency and gas costs. However, this smart routing happens off-chain. While this lack of decentralization may be an issue, they plan to eventually be fully on-chain and transparent with their process.

The bridge abstraction happens through an upgradable smart contract, which only has to be implemented once. This means that it can eventually be optimized as new developments emerge. The contract allows for complex any-to-any swaps, allowing for on, cross, and multi-chain swaps.

Use Cases for Li Finance

According to their Docs, the project currently provides 4 main use cases. These include:

- Seamless User on-ramps

- Cross-Chain Swaps

- Cross-Chain Yield Farming

- Multi-Chain Money Markets

With Li Finance, users can interact with their dApp interface in any way they like. They can also pick any asset on any chain or bridge, swap it and move it on the spot into an asset or desired vault. This saves inexperienced users from the hassle of bridging wrongly, which could result in a loss of funds.

In addition, it allows for seamless yield farming opportunities as vault contracts keep track of yield across multiple chains. Finding the best way to deposit and best bridge into the best yield generating protocols will help save on fees.

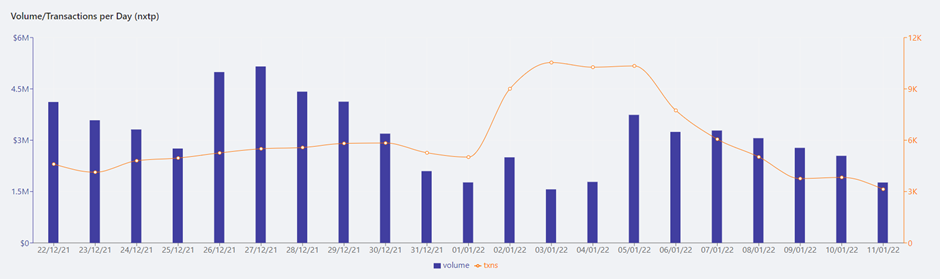

Lastly, one of the most attractive features is cross-chain loans. With Li Finance, dApps can communicate and let users collateralize, borrow and repay their loans on different networks. Analytics are also available for users on their website

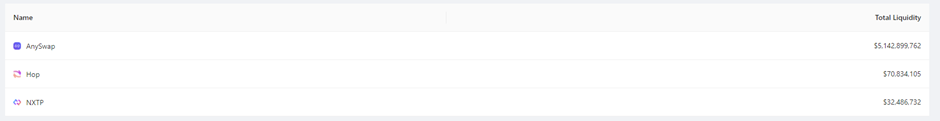

Statistics such as Usage per Route, Volume/Transactions per day, and Liquidity per chain and Token are all available here. Currently, their main sources of liquidity are from AnySwap, Hop, and NXTP.

Closing Thoughts

The biggest advantages of Li Finance are their user-friendly UX and a larger array of tokens available for bridging. They propose the best results and perform all transactions seamlessly, making bridging simple and intuitive for anyone.

This project has the potential to become one of the top aggregators as Decentralized Finance moves toward a multi-chain future. Even if you may not require it, swapping once on their bridge would probably be good, in case they decide to plan an airdrop in the future.

Featured Image Credit: Li Finance

Also Read: Nansen Data Journalist Tells Us How To Use Data To Predict The Future Of Crypto

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!