Key Takeaways:

- Liz Truss resigns 6 weeks after taking the position as Prime Minister

- Her 6-week reign took many disastrous turns, including crashing the pound

- New Finance Minister Jeremy Hunt is a self-proclaimed “Digital Entrepreneur”, could pass more crypto-friendly regulations

___________________________________________

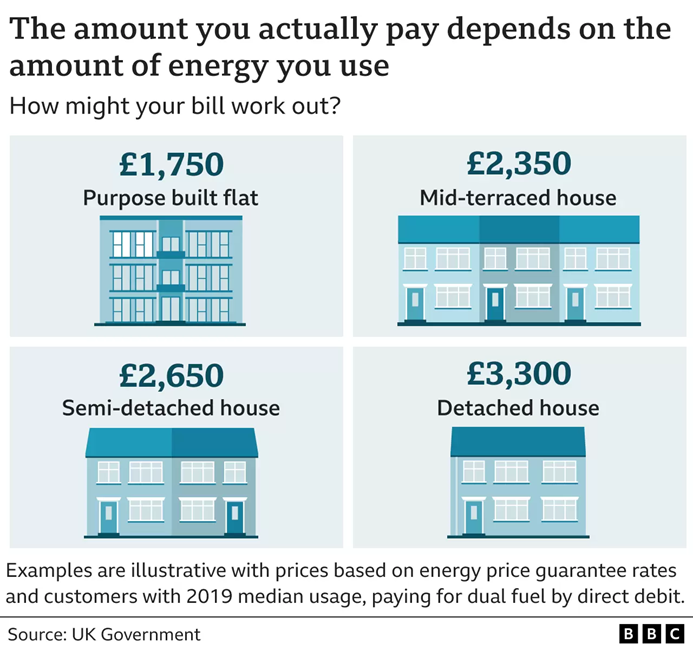

Mary Elizabeth Truss, or Liz Truss, took the office as Prime Minister of the United Kingdom on 6 September 2022 following the reign of former PM Boris Johnson. Over her short 6-week reign as the Prime Minister, she seemingly overpromised on a lot of things – from tax cuts to reducing energy prices.

And because of her short 6-week reign, here’s a simple breakdown on the timeline of her time in office and what led up to her resignation as well as my thoughts on the potential impacts to the crypto markets

Also Read: Could The New UK Prime Minister Usher In The Next Wave Of Crypto Adoption?

The Complete Timeline

The 6th September Energy Policy

How does the government get this money? By borrowing money from international markets, which adds to national debt. Windfall taxes were also used to fund the new measure.

Windfall taxes are one-off taxes levied on companies that experienced significantly large profits from a certain, often unexpected economic condition. In the case of UK Energy firms, they are profiting more from their oil and gas due to supply constraints from Russia’s end.

As described on UK’s policy paper, the Energy Profits Levy would be a 25% tax on profits that the oil and gas sector is making, expecting to raise around £5 billion over the next year.

19th September – Kami-Kwasi

Kwasi Kwarteng, the Secretary of State for Business, Energy and Industrial Strategy, detailed the cost of the energy scheme to be around a whopping £60 billion over the next 6 months without any additional fundraising measures introduced.

Instead, Kwarteng announced a new controversial borrowing plan after removing the top rate of income tax and scrapping the banker’s bonus cap. These caps were originally in place to limit the size of an employee’s bonus to no larger than 100% of their fixed annual pay (or 200% with shareholder approval).

Abolishing this would encourage a 2008-like banking crash as bankers are now incentivized heavily for profitable risky behavior. The budget was subsequently dubbed “Kami-Kwasi” (like Kamikaze) which caused the GBP to fall against USD.

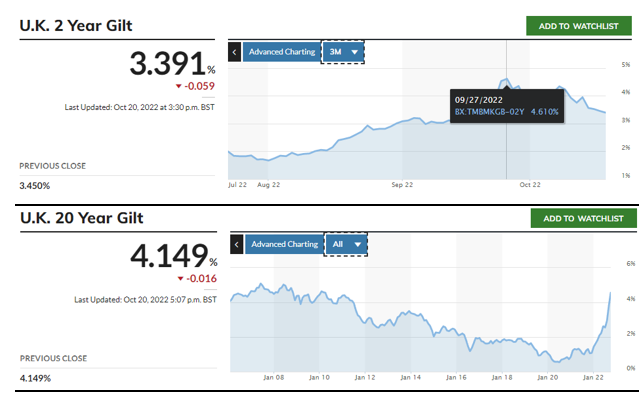

26th September – Bond Buybacks

As inflation hits all-time highs, you would think raising rates and taxes would be ideal in an inflationary environment. But, Truss’ support for tax cuts introduced by Kwarteng sent GBP to all-time lows, causing a mass sell-off and collapsing bond prices and skyrocketing yields to 4.6% for 2-year bonds, and 4.9% for 20-year bonds, the highest since 2008.

LDIs (Liability-driven investments) held by British pension funds incurred big losses and many had to liquidate assets such as bonds to pay them off. This ultimately led to the mass sell-off.

The central bank had to step in as a result of Kwarteng’s controversial plan and introduced a 13-day bond buyback programmed with funds primarily allocated to buying long-term 20- or 30-year gilts.

3rd October – Chaos in the markets

Due to chaos in the financial markets and faced with opposition within Truss’ party, she brought up a reversal of the tax cut plan. The government’s incompetency was seen not just within the country but also from investors internationally.

A proposal to abolish the 45% top rate of income tax crashed the GBP, which didn’t even go through because it was reversed, simply made the government look incompetent.

10th October – The Climax

On October 12, Truss then mentioned the government would not reverse the tax cuts or reduce public spending. Public perceptions were that the government was in chaos. This means £45 billion worth of tax cuts without a clear plan on where exactly the money is coming from since they also ruled out cuts on public spending, sending financial markets into further turmoil.

With pressure piling onto the government, Kwarteng was fired on 14 October, making him the second shortest-serving Chancellor, over his handling of the economic crisis which crashed bond markets. And just 2 days after saying the government wouldn’t reverse tax cuts, Truss scrapped the tax cut plan.

Truss resigned on 20 October after 45 days in office, making her the shortest-serving PM as she “could not deliver her promise which she was elected for in the first place”, her promise being a low-tax, high-growth economy.

Potential Implications on The Crypto Market

Truss has been widely viewed as being pro-crypto, but hasn’t revealed much about any plans during her time in office. In a 2018 tweet from Truss, “We should welcome #cryptocurrencies in a way that doesn’t constrain their potential”. She also mentioned that “the country could create great opportunities in areas such as blockchain” back in 2020 when she was the trade minister.

We should welcome #cryptocurrencies in a way that doesn't constrain their potential. Liberate free enterprise areas by removing regulations that restrict prosperity. #PolicyExchange #futureoffreedom #shakeup

— Liz Truss (@trussliz) January 30, 2018

Kwasi Kwarteng, the Secretary of State for Business, Energy and Industrial Strategy, identified in a UK Innovation Strategy report that Blockchain is one of the “seven technology families of UK strength and opportunity” back in 2021.

Earlier in April, a plan to regulate stablecoins was also brought up by the treasury back when Rishi Sunak was chancellor as he planned to make UK the “global crypto hub”. The treasury aimed to make stablecoins a recognized form of payment and introduced this regulation to provide a safe space for consumer funds to interact with stablecoins.

The Post-Resignation Effects

As Truss dismissed Kwarteng as the finance minister, the crypto regulation again change hands to newly elected finance minister Jeremy Hunt who is much more favorable and experienced in the eyes of citizens.

If we focus our attention on the UK stablecoin regulation, here’s what happens if its passed (this list is non-exhaustive):

- HM Treasury would recognise certain stablecoins

- Wallet providers and entities providing stablecoin payments must be authorised by the FCA and subject to the central bank’s supervision

- HMT would extend the applicability of Part 5 of the Banking Act2009 to include stablecoin activities. Meaning, the central bank will supervise systemic stablecoins

- HMT would develop an FMI (Financial market infrastructure) sandbox to support firms wanting to innate and ensure regulations can accommodate tokenisation and DLT.

With the stablecoin scene in crypto not being very “stable” at the moment, with obvious reasons such as the Luna crash which caused widespread FUD, having regulation on stablecoins in place and central banks backing stablecoins will definitely help with widespread adoption of crypto in daily lives.

Are Crypto Regulations Good?

Again, regulations may also cause FUD and panic in the short-term because various existing projects may be affected, but in the long-term, regulations are in my opinion needed for sustainable growth for the industry.

Imagine developing a DeFi product or project, knowing that regulations are looming but not knowing exactly what the regulation is. And only after launching the product, the regulation directly affects your project. Ultimately, I believe regulations provide a clearer idea on how projects can and should be built, without the impending timebomb of uncertainty that may completely invalidate a project.

In the case of the UK, Liz Truss’ time in office may not directly influence the crypto scene in the UK. But, with the new finance minister, Jeremy Hunt who is a self-proclaimed digital entrepreneur, could see the stablecoin regulation being passed and provide a more stable climate for crypto companies to operate in the UK

Also Read: Bitcoin is More Energy Efficient Than You Think

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief