With salaries averaging $140K/year, Web3.0 has seen a massive spike in adoption and interest worldwide. While market prices are down, the industry itself has proven to be an invaluable, exciting, and lucrative space.

This means that it is a good time to consider looking at a crypto career! Here are some tips and tricks from myself and other professionals in the space.

Also Read: The Lazy (But Effective) 5 Step Process To Doing Your Own Research In The Bear Market

Popular Web 3.0 Jobs

Before we start, its good to know what possible career aspects there are in this amazing space. Let’s just cover a few popular ones.

We can mainly divide crypto into a few main categories:

- Developer & Design

- Community & Content Creation

- Marketing & Product

- Data Analysis & Economists

- Business Development, Strategy & Operations

Let’s just look at one category, blockchain development. This is currently the most sought after skillset which are in high demand currently.

This would range from Blockchain Core Developers, Blockchain Software developers, Front-end developers, Back-end developers, and more.

There are just so many opportunities available, and technically speaking, both non-technical and technical crypto-economy positions demand higher rates than “normie” jobs.

Because the space moves fast, there is a constant need to adopt top talent for the respective positions.

Know your Goals

What exactly are you trying to achieve in crypto? Are you trying to optimize your career? Looking for foundation-building experience or perhaps even $10 million by the age of 30.

Or maybe you may just be looking to delve into the space a bit, and you may be considering just looking for part-time gigs, bounties, contracts, handshakes, or airdrops.

A good start would be to write down exactly what you may be looking for. What exactly are you looking for. Work-life balance? Competitive pay?

Organize your Portfolio

If you come completely from Web 2.0, take a step back and look for what skills you can bring to the Web 3.0 space.

For example, you may be excellent at Procurement and Supply Chain Management. How can you apply this skill as a Founder or as an employee of a start-up?

Integrate a new proprietary software for supply chain management using the blockchain? There are many things you can do.

If you have a target, look for what skills you can use plus what skills you need to learn. Create a personal website to highlight what you can do.

Build Your Brand

Showcase your work in the space. What can you do for the broader crypto market. Apply your skills and learnings to create something to contribute for the broader community.

For example, it could be networking with individuals at events. Maybe even providing a fresh perspective on their products.

Crypto is about co-creation, not competition. Networking will tend to bring you more opportunities in the space. You never know who you may meet.

Fortune favors the brave.

Sahil Bloom’s Tips on Career Optimization

For those wondering, Sahil Bloom is the managing partner of SRB Ventures which writes $100-$250k checks into high-growth technology companies.

His advice is based on two principles:

- Build the foundation for experience

- Reach $10 million by the age of 30

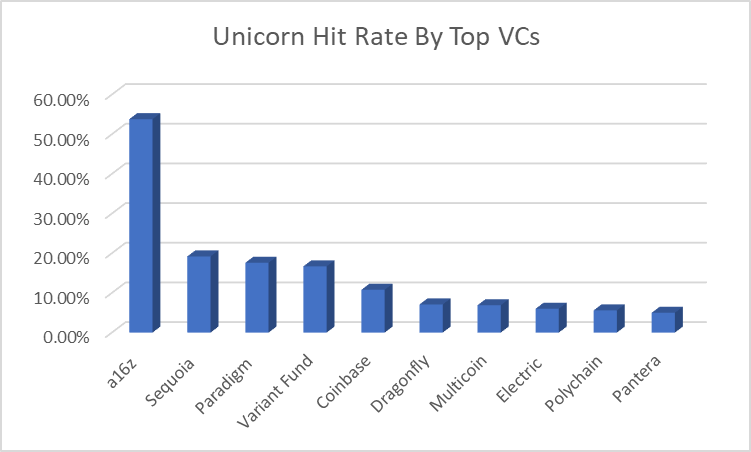

Going from a venture capital approach, he would compile the top 10 ventures funds investing in a market. In this case, I would recommend looking at venture funds with the highest unicorn hit rate.

Your entire life can change with one year of focused daily effort.

— Sahil Bloom (@SahilBloom) September 25, 2022

Use Twitter or LinkedIn (if you’re brave) to search for the individual and send a concise cold DM (similar to deal sourcing) to request for a 30 minute call to ask them a few questions about their portfolio.

Assuming you are able to reach just 1 or 2 of them, ask these two main questions.

- What early investment are you most excited about in crypto?

- What are the clear early winners

Straight away, you would have a list of information to quickly look into. Research them. Open roles, founders, and most importantly, their story.

Reach back to the VC that named this company and share your insights and excitement about this company. Most of them would be more than happy to give an intro into that company.

With just some luck, you would be able to get into a high-growth start-up with intelligent individuals.

To grow your equity as well, show that you are interested in the project, and prioritize equity instead of cash. This would give you a much larger stake especially when the company takes off.

This approach is an ingenious idea for those much younger in their career growth paths and incredibly insightful. This would give you a great opportunity to dive into Web 3.

More of his tips and tricks here: https://sahilbloom.substack.com/

Eda’s Observations on 100 Days in Web 3.0

How to get started in web3 ⚡️

— Eda (@edatweets_) January 17, 2022

I didn't know what web3 was 7 months ago. Recently I completed the #100daysofweb3 challenge!

🧵 Here you go, my web3 roadmap for anyone getting started:

Eda writes about Web 3.0 and recently shares her personal Web 3.0 journey. Her advice is to start by learning and using the tools in the space. Do anything related to crypto and do it.

For example, some basics:

- Setting up a wallet (MetaMask & Phantom)

- Interact with dApps

- Starting Farming

- Learn about Development

Read. Research. Repeat. Even for myself, I cannot stress enough on this point. I’m learning new things everyday in the Web3.0 space. Look into Web3.0 resources and development tools.

For example, just a few: Bankless, RabbitHole, Delphi Insights, Research Reports, Twitter Threads, Dune Analytics, DeepDAO, LobsterDAO

All of these provide awesome information at varying levels of information that are great.

Lastly, get involved. Build something, try something, and do something. The easiest way would be to participate in a DAO. You can find out more on @DAOCentral.

My Personal Advice

This is a common pattern that I see with most people. Get on Twitter, follow the right people, read, research etc. Ignore the noise. Yes, that’s great!

You “feel” like you know so much about the crypto space but actually its really different. The hard truth is you probably know less than 1% of the crypto space itself.

Seeing and Reading is different from DOING. Doing tells you so many more things as you explore unchartered territory. You may think you know what you are doing, but actually you don’t, because Web 3 is exploratory and that’s fine.

No twitter thread, book, podcast, or article is going to educate you on everything you need to know if something goes south. For example:

- How to deal with a poorly managed crypto team

- What happens if a deal falls apart last minute

- Your trust gets abused in a project you are building.

These are things no one is going to educate you on. You can only figure it out on your own.

It doesn’t just apply to these categories. Another example, Web 3.0 marketing. What makes it so different from Web 2.0 is that while Web 2.0 marketing lays the foundation, you simply can’t just copy and paste statistically backed marketing strategies for any Web 3.0 project.

Each project is different. They will have different requirements, different communities, and different products. The real deal is understanding when to use what and how do you keep in trend. This comes from my personal experience in business development & strategy.

The last things I would recommend is networking. Networking in Web 3.0 is so much fun and frankly, much easier than Web 2.0 networking. Web 3.0 has separated differences due to co-creation, and you can meet many great people in the space.

People who you think you may not even be able to meet in your lifetime, are now actually possible to meet. Take advantage of this, learn from them, ask them what they did that made them so prominent in the space.

Never stop learning and remember, reading and learning is useful, but the only way to actually win is to get into the game.

Listen to this podcast as well before you get into the game, they share pretty great insights that are useful to your career and personal growth

Also Read: Ex-MOE Teacher Takes The Unconventional Route Into Web3; Now Leads Research Team At Spartan Labs

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief