Key Takeaways:

- Leverage free research reports to find hot new projects

- Evaluate key metrics and compare them with similar projects

- For new projects, focus on their tokenomics and potential value capture

___________________________________________

Let’s face it – it’s hard to be excited about crypto during a bear market.

From depressed prices to confirmation bias, most crypto participants already know what they “should” be buying, if they are even buying at all.

However, not all cryptocurrencies are made equal. Regardless of whether a project may have the “fundamentals” now, it may very well go to zero the next bull market.

Here, we give you a free and easy five step process to help you with your due diligence.

1. WHERE To Find Promising Projects

We all have biases towards the projects we already accumulate.

Despite this, there are many low-to-mid market capitalization gems out there to capitalize on, even in the bear market.

For most of us, however, screening through millions of high-volatility, low liquidity projects is not in our best interest.

Instead, we can leverage FREE research reports from key opinion leaders in the space on potential gems.

Good places to start are Messari and Nansen’s research pages, which are host to a multitude of reports on anything from DeFi to NFTs.

Even for paywalled reports, being able to see the name/logo of the project being covered means you can then do your own due diligence.

Also Read: Slaying The Bear Market: 5 Skills You Need To Excel In a Crypto Downturn

2. HOW To Know If A Project is Good

Most crypto projects in the bull market relied on “ponzinomics” to pump prices higher and higher.

However, the bear market has caused a revival of good old TradFi valuation metrics. Current investors have mostly begun to look at profits to choose where to park their money.

As such, the ability for a project to make money in the long run is now of the utmost importance.

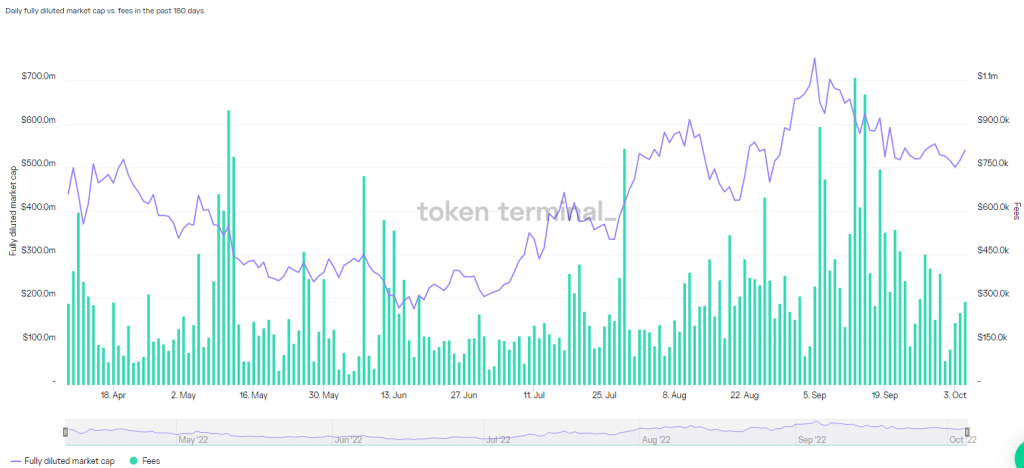

Token Terminal is an easy, yet effective way to view whether a project has been performing well in that regard.

Here, we see that $GMX has been producing steady fees for users, a positive sign for the protocol.

We can also see that fees have been steadily increasing across the last 180 days, and should continue with more users entering the protocol.

But will there be more users?

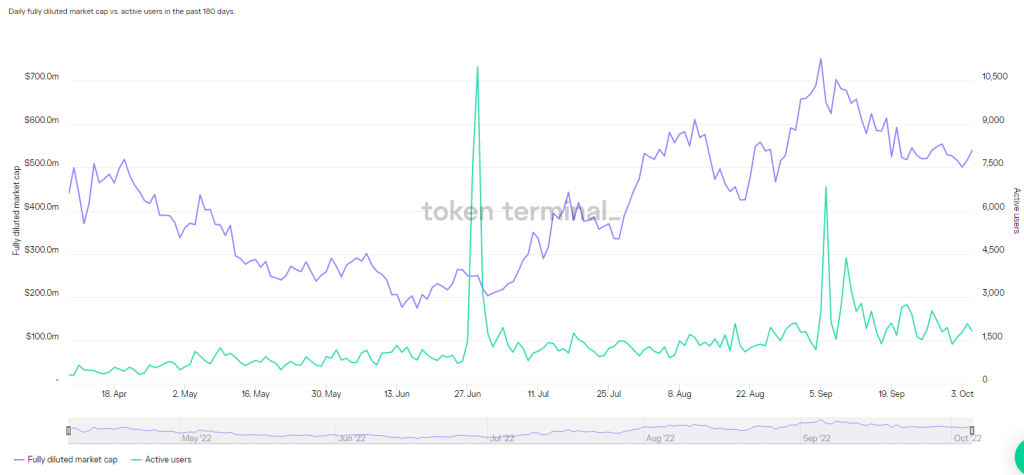

Switching to their “Active Users” tab shows that there has also been a steady influx of participants trying out the protocol.

Of course, those are not the only metrics – and token terminal offers a slew of other graphs, including trading volume, TVL, revenue, and more.

Also Read: No More Ponzis: Solving The DeFi Recapture Problem For Mainstream Adoption

3. WHEN Should I Start Investing?

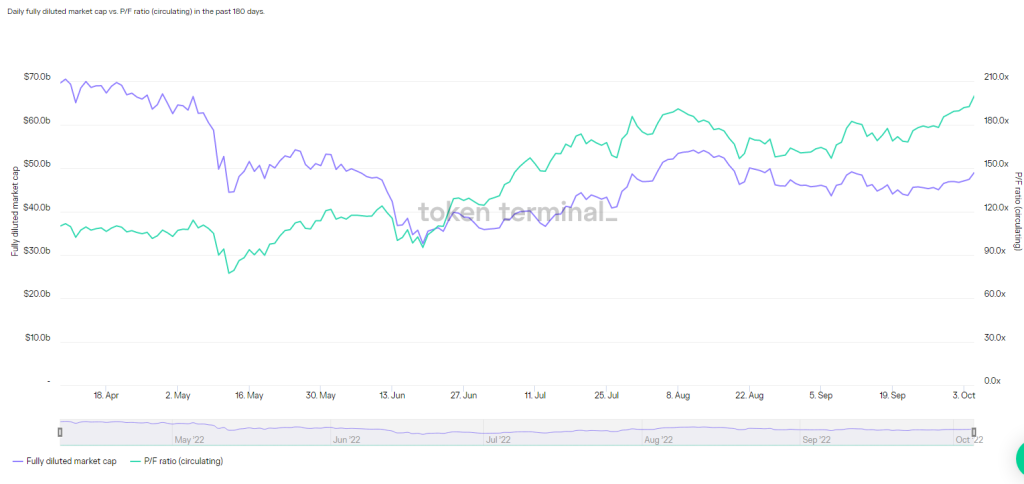

Despite the bear market, most cryptocurrencies are still trading at massive multiples of what their “fair value” should be.

While we can perform some form of technical analysis on what price we should start investing at – an arguably better metric would be to contrast their valuations with similar projects.

Here, we can see that $BNB has a ratio of approximately 180x price-to-annualized fees.

While that may seem overbought, $ETH is trading at approximately the same ratio. By comparing the ratios of different protocols and networks, we can see which is currently under or over valued relative to their peers.

Also Read: Technical Analysis Basics – How to Identify Support and Resistance

4. WHAT Else Should I Be Considering?

Prices are a function of demand and supply – even in cryptocurrency.

As such, we should look at a series of metrics, including tokenomics, transactions, user activity, and the ecosystem surrounding a project.

While all of them are extremely important, focusing on tokenomics is important, especially for new projects.

This includes:

- Use case

- Supply Unlocks

- Buy backs/Profit Sharing

- Notable holders

and more.

While most of these can be found by simply googling “Token name docs” and scrolling to the tokenomics section, having accurate inflation rates and vesting schedules on hand is imperative to evaluating projects.

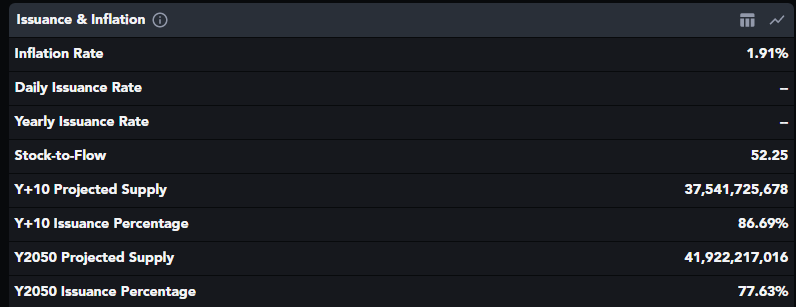

Messari does a good job of indexing such metrics, such as projected supply, inflation rate and issuance percentage.

The platform also has data on supply unlocks, active addresses, liquid market cap, sharpe ratio, and historical volatility.

By leveraging the available data, it becomes easier to start investigating the tokenomics relevant to a project.

Also Read: Yield Farming Tokenomics: Why Do DeFi Yield Farms Dump At First?

5. WHO Can I Follow To Stay Up To Date?

While individually researching a project is important, tapping on the community can lead to even more alpha and insights into a project.

Key people to be following with respect to a project would include: founders, other protocols in its ecosystem, partners, and those researching it.

However, finding them is the hard part.

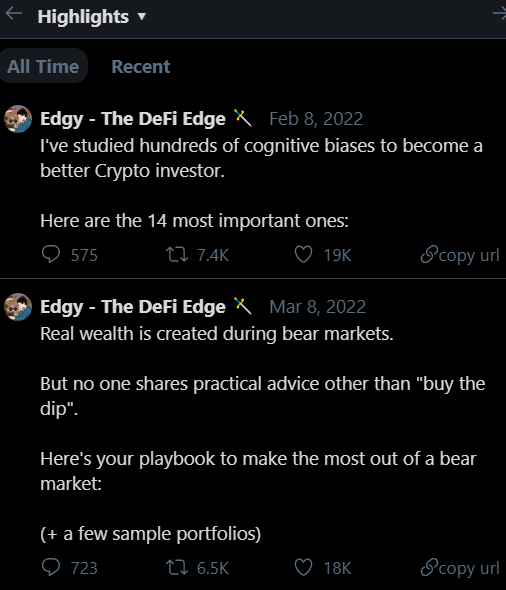

With most crypto-natives taking to Twitter as their de-facto town hall, scraping it for threads has proven an essential tool for anyone in the space.

Using Twitter’s advanced search function is one way to get an edge in that aspect – looking for users who have done dedicated research to specific projects.

You can also make the process easier by downloaded a browser extension such as twemex, which highlights the top performing tweets of any user.

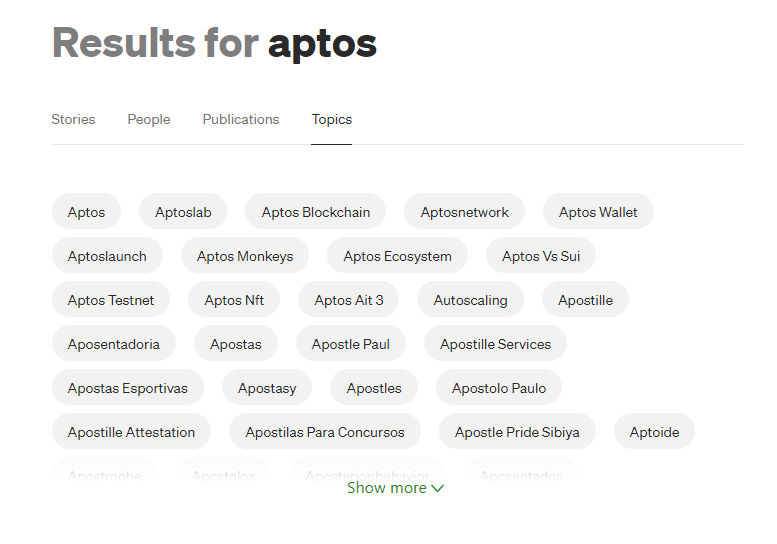

Going through Medium and Substack and searching by project tags is another good way to search for insights.

Closing Thoughts

While the above-mentioned methods are good ways to do your own research – there can never be enough due diligence done.

From smart contract risk to centralization of wallets to wash trading, a lot of metrics are hidden below the surface-layer insight offered by many platforms.

However, that does not mean the data is useless. In fact, they are often the base layer that many crypto natives build upon.

Furthermore, the provide invaluable key metrics to start your journey of due diligence – especially if you have limited time and resources to scrape all the data yourself.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief