Key Takeaways:

- Money is created through undercollateralized lending

- Stablecoins, other DeFi products not able to provide such functions yet

- More incentives need to be created for DeFi to break into mainstream adoption

Decentralized finance, in a nutshell, promises transparency and offers benign conditions for lenders and borrowers.

The goal of DeFi is to get rid of third parties that are involved in any kind of financial transactions. DeFi aims to democratize finance by replacing centralized intermediaries with peer-to-peer relationships. A wide product range of financial services from everyday banking, loans and mortgages, to complicated contractual relationships and asset trading, you name it all.

Thus, these DeFi platforms aim to construct an alternative robust financial system for offering and receiving loans, exchanging currencies, making payments, etc. with no banks, brokers or any form of third parties involved.

Just purely a secure and transparent software that improves with time.

Also Read: Web3Connect: A Quick Recap On How DeFi Will Change The Way You Earn

How is money created?

The vast majority of the American money supply is digitally debited and credited to commercial banks. Besides, real money creation takes place after the banks loan out the new balances to the broader economy.

Money is created through lending. Not through governance, algorithms or margin loans.

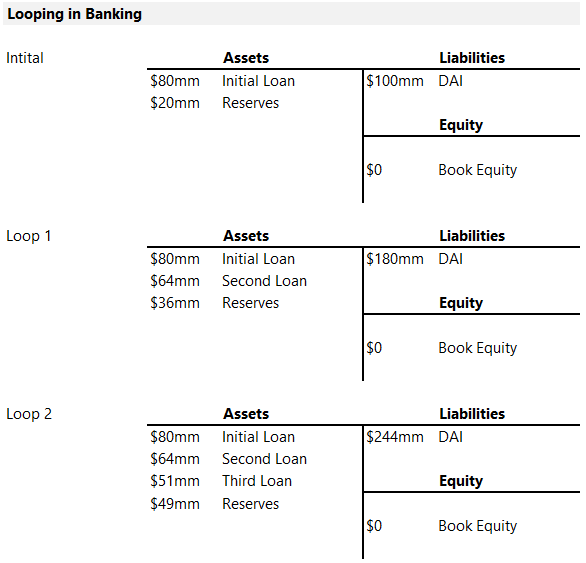

The loop of money

Let’s see an example: A new bank has $100M worth of deposit.

Due to the fractional reserve banking system, a bank is only required to keep on hand a certain amount of the cash that depositors give. This allows the bank to loan out as much as 80% of their deposit base. Assuming they did just that, that will be a loan of $80M.

So what do borrowers do with that $80M? Let’s say they chose to buy houses. So now the sellers of the houses have $80M which they will then deposit back in the bank.

This means that the bank has $180M ($100M + $80M) in deposits currently. Now the bank can make another loan subject to the 80% cap with the new deposits. They will then proceed to make a $64M (80% × $80M) loan. This is how money is created via looping.

In this system, every $1 of deposits creates $5 of money.

This is derived as the money multiplier which is = 1 ÷ (1 – Reserve requirement). So, 1 ÷ (1-80%) = 5x

This looping is the key to money creation in any financial system. It is this flow that is very profitable. $100M of deposits create $500M of money.

If you pay depositors 2% interest and loan the deposits out for 6%, you gain 4% multiplied by $500M which equates to $20M. $20M ÷ $100M of initial deposits = 20% return on equity.

Money is created by capturing deposits, making loans and then recapturing the deposits again. However, in crypto, we have deposits and loans but not material recapture.

Do stablecoins have a recapture?

There needs to be a reason to hold DAI against USD.

Crypto stablecoins banks create no looping because nobody transacts in them. There are limited reasons why someone should hold DAI over USD. If nobody is willing to hold DAI, all the more they would not consider transacting in it. If retail does not transact in DAI, there is no recapture.

But can DeFi ever sustain without the ability to recapture?

Real-world lending

Real-world lending is still one of the keys to mass adoption of crypto in my opinion.

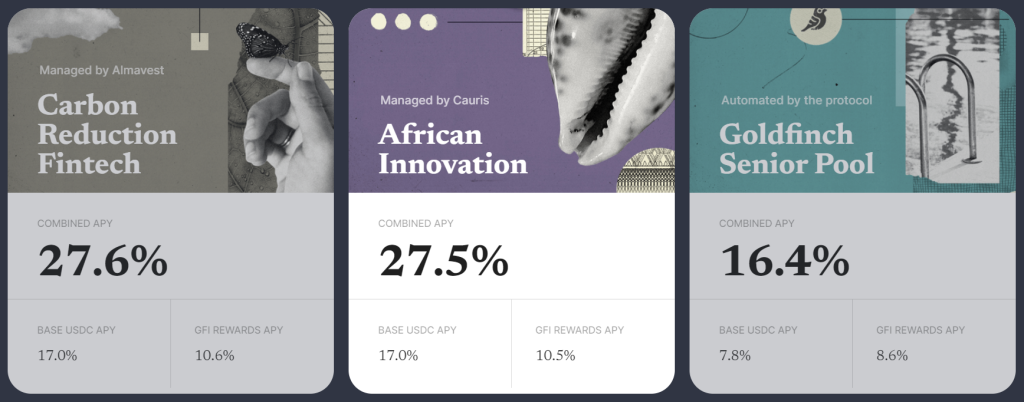

There are companies out there such as Goldfinch and Credix who lend your USDC to real businesses worldwide. All these at a better than average rate for current market conditions.

For example, Goldfinch offers a whopping combined APY of 27.5% for a project called African Innovation. It constitutes of 17% base USDC APY and 10.5% APY rewarded in their GFI token.

Conclusion

It is evident that stablecoins have a recapture problem and this is one of the stumbling blocks in driving real-world usage. In my opinion, incentives to hold stablecoins should be prioritized and worked on to encourage more users to hold them, transact in them, earn yield on them, and do anything you can do just like with fiat.

Majority of the topics discussed here were courtesy of the talented 0xHamZ. And with the aforementioned, qué será, será.

Read More: All You Need To Know About Cap Finance And How It Brings Real Yield In DeFi

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief