Loop Finance launched in early October last year to little fanfare and it certainly wasn’t as hyped as the projects that have hit the shores of the Terra ecosystem in recent times.

Similar to other farm tokens, the price fell from a high of US$1 to around $0.14 at the time of writing.

Loop Finance as an incentivised AMM DEX

At first glance, Loop Finance might seem like just another DEX on Terra, but it actually differs significantly from TerraSwap and Astroport.

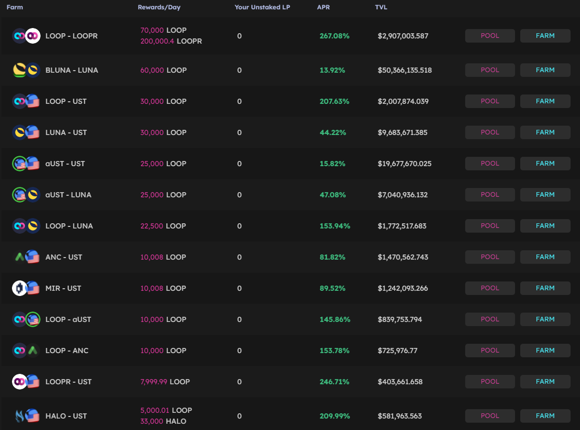

When compared with TerraSwap. Loop Finance stands out as it incentivizes all the pools on its dApp.

On top of the fees that liquidity providers earn from every trade made on Loop, each pool has a certain amount of LOOP that is allocated to that pool on a daily basis.

For example, 60,000 LOOP tokens are allocated to the bLUNA-LUNA pool daily, this provides an APR of 13.92% for users. Rewards earned in LOOP can then be pooled with your other assets to yield farm or be compounded back to your initial farm.

Furthermore, Loop stands out when we compare the fees that go to liquidity providers. All three DEXs impose a 0.3% fee on the standard xy=k pool. However, even though both Loop and Astroport have their own governance token to which a portion of fees is diverted to, Loop allocates 75% of the fees to LP (0.225%) while Astroport only allocates two-thirds of the fees to LP (0.2%). From the perspective of an LP, Loop is better..

Another difference when comparing both TerraSwap and Astroport is that Loop will support both ERC-20 and SPL (Solana) tokens on top of native Terra tokens.

To my understanding, both Astroport and TerraSwap only support CW20 (Terra) tokens currently. This means that Loop will effectively have the potential to be a multichain DEX in the future.

Loop as a content creation site

The idea here is similar to Medium where users are able to create an account to share their thoughts on any subject that they are passionate about. The difference here is that users are encouraged to share about matters related to the Terra ecosystem and they get rewarded at the same time!

This idea is not a new one — about 4 years back, co-founder Thomas Norwood founded Trybe which was a tokenised publishing platform and social network.

While this was launched on a different blockchain, the idea is similar to the content community at Loop. Although this project did not take off due to issues with that blockchain, it has since been given a new lease of life on Terra.

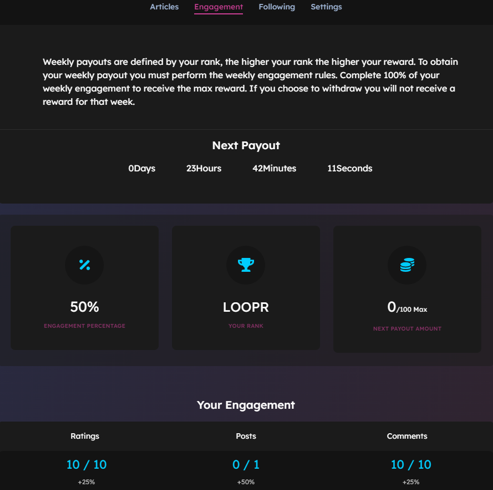

Anyone who is passionate about all things crypto, especially Terra, can simply sign up for an account here. You can then proceed to engage with the community by writing articles, commenting on other people’s work, and even rating their articles.

All these actions will help you to earn LOOPR on a weekly basis. LOOPR tokens are what you earn by participating in the community. On the other hand, LOOP tokens are earned through yield farming. Both these tokens can be pooled together and farmed.

aUST pools

While these are the two main use cases of Loop, we will be focusing on their AMM DEX to see if there is a hidden farming opportunity on the Terra ecosystem.

With the introduction out of the way, let’s take a look at a new addition to the farms’ section on the DEX and this is none other than the 4 aUST pools which were launched recently.

Why this is exciting is obvious — instead of using UST which is non-yield bearing, you can use your deposited UST (aUST) in anchor to provide liquidity. Talk about capital efficiency! Let’s take the aUST-LUNA farm for example.

aUST-LUNA pool

The pool on Loop is currently yielding an APR of 47.08%. But this is not the entire yield. Because 50% of the LP is provided using aUST, we can then view the yield as roughly 56.83% (47.08% + 19.5%/2).

This is in comparison to the LUNA-UST pool on Loop which yields an APR of 44.22%. In this scenario, based on APR alone, you would be better off farming the aUST-LUNA pool instead.

Even if we were to include fees from the pool (as seen from coinhall), the aUST-LUNA pool would still provide a higher APR.

aUST-UST pool

If the above pool is too volatile for you, you can take a look at the aUST-UST pool. It currently has an APR of 15.82%. But again, 50% of the LP is made up of aUST and thus, the effective APR should be around 25.5% (15.82% + 19.5%/2) instead.

What about impermanent loss?Sure, this is not a stable pair as aUST is expected to appreciate against UST at a rate of around 20% p.a. Even in this case, the impermanent loss will only be around 0.5% at max. The incentives you earned will more than cover your impermanent loss.

However, some things worth considering include the utility of this pool. While this pool provides a great yield farming opportunity the utility has been questioned by some. The co-founder shared his thoughts in this article which could be a good read.

Another point to note is that staking rewards are only claimable after two weeks. Withdrawing your funds before two weeks will eliminate the incentivised rate you would have otherwise earned.

Anytime you reinvest or add on to your initial position, the two-week period resets. Separately, it is interesting to note that the TVL of this farm is sitting at around US$20 million despite a smaller APY (after converting the APR). This is compared to the bPsi pool on Spectrum with a TVL of US$12 million and an average of 30% APY.

Conclusion

While Loop might have been overlooked at the start, I believe it has many features that are worth exploring. This is especially so for yield farming opportunities as the price of LOOP seems to have found a bottom. Hence, yield farmers can now farm with better peace of mind.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Loop Finance

Also Read: How To Earn More Than 19.5% With Your UST On Terra