Key Takeaways:

- Treasure’s native token $MAGIC is up 202% and 193% on the 14d and 30d, respectively after major exchanges listing

- TreasureDAO Ecosystem aims to be the Nintendo of the Crypto Metaverse

- An interoperable ecosystem built on Arbitrum

___________________________________________

With some mystical movement with the $MAGIC token, it seems like a possible revival, with the token getting listed on three major global exchanges. This gave me flashbacks to the bull market last year, where “FOMO” pumps were readily happening, causing the token price to close in on the dollar mark.

#Binance will list $MAGIC @Treasure_DAO in the Innovation Zone.

— Binance (@binance) December 12, 2022

➡️ https://t.co/Ski3hO7zJL pic.twitter.com/Mc6V3Mo9WP

While some may say this pump was artificially caused by token listings on Coinbase, Gate.io and Binance, and likely see a retracement, others take to stage a possible “bigger” upwards price action that has yet to come.

But if that may be true, what would cause it?

The simple answer is games. However, there are currently only a few games on the $MAGIC ecosystem. However, the treasureDAO team has long been building the necessary tools and tokenonmics to attract more game builders in the long run.

What is $MAGIC?

After the failure of web3 games like Stepn and Crabada, people are taking a more sceptical approach by looking at its tokenomic structures.

Before we talk about $MAGIC, there is a platform governed by the $MAGIC token, TreasureDAO.

Treasure is a decentralized video game console connecting games and communities through imagination, $MAGIC, and NFTs.

They aim to become the Nintendo of the metaverse and to connect and empower builders, games and communities through the potential of web3.

Imagine them in three different layers, Cartridges; where games and metaverses are built, Community; consisting of smaller communities, guilds and resources and lastly, Infrastructure, a shared economic engine that powers the ecosystem.

And $MAGIC comes in by connecting all three layers. It serves as the natural resource of the Treasure metaverse.

Think of Treasure as an interoperable gaming ecosystem; this thought is mind-blowing.

Tokenomics

One-third of the total MAGIC supply was distributed in the initial 30-day farming period.

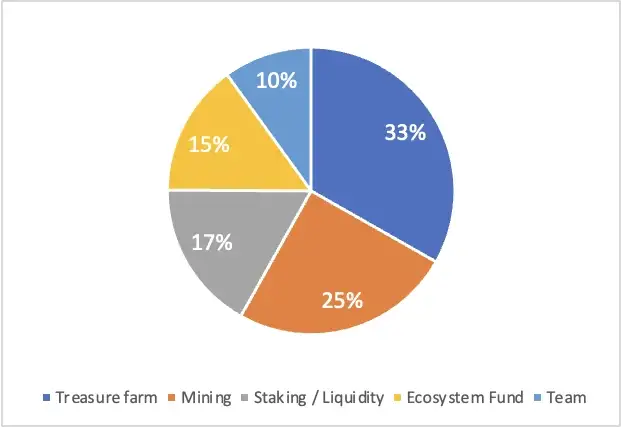

Future MAGIC emissions will be distributed at the following ratios:

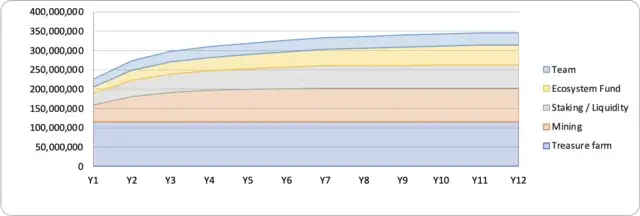

The total supply will be ~350,000,000 tokens in a 12-year-long emission schedule.

Treasure Farm: 115.5M $MAGIC (33%)

Mining Rewards: 87.5M $MAGIC (25%)

Staking / Liquidity: 59.5M $MAGIC (17%)

Ecosystem Fund: 52.5M $MAGIC (15%)

Team: 35M $MAGIC (10%)

On September 2022, Treasure announced a $3.5M token sale and partnership with Battlefly.

A total of 14,964,375 $MAGIC for the $3.5M token sale. With each token averaging at ~$0.2339.

That investment, right now, would be up 328%.

Ecosystem players

The ecosystem players within Treasure all play an essential role in smartly constructing tokenomics mechanics.

TreasureDAO is where staked $MAGIC holders will now have full control over all parts of the Treasure economy, including the MAGIC tokenomics and the Treasure marketplace.

The DAO’s treasury will be the sole recipient of proceeds from marketplace sales.

I've spent the last few months researching @TreasureDao & $MAGIC & am blown away by what is happening.

— Aylo (@alpha_pls) February 17, 2022

13 reasons why $MAGIC will be one of the best performers in 2022 🧵👇 pic.twitter.com/1yVjfiB8vj

Bridgeworld is a fun and a gamified way to incentivize the community to hold their $MAGIC supply and ecosystem NFTs locked by offering rewards, such as $MAGIC emissions or more NFTs.

Think of bridgeworld powering the shared economy for Treasure through a generalised economic framework designed to foster cross-metaverse relationships and resource sharing.

MagicSwap is like the AMM for this ecosystem and will facilitate the $MAGIC token swap among various games.

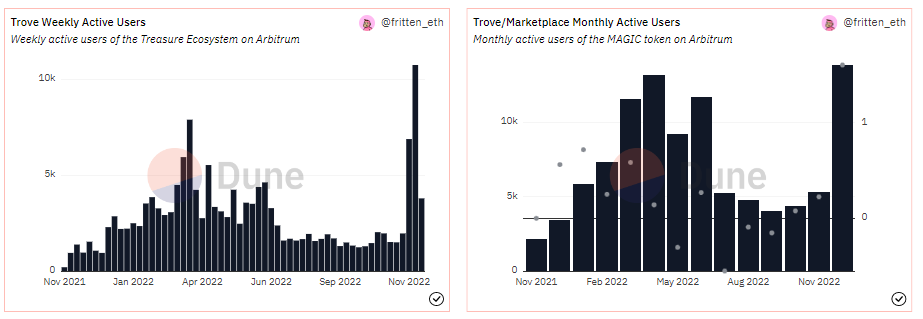

MagicSwap is currently seeing an enormous appetite from the market in terms of daily active users.

Trove, is their NFT marketplace. It is also known as the Opensea of Arbitrum, but you can play games directly on it.

The interoperable nature of this entire ecosystem allows you to access a marketplace of various NFTs in various denominated Treasure games. Which all can be bought/sold with the $MAGIC token.

1/ @Treasure_DAO's Trove – Quick Read (5 minutes) to make you insanely bullish

— Brokeboy96 (@Br0keboy96) January 27, 2022

Did a speculative post recently but team delivers so fast so this is based on the WP. @TroveByTreasure will be Treasure's generalized marketplace denominated in $Eth and built on top of @arbitrum.

But who has been buying?

Tracking smart money movements here might be a wise thing to do.

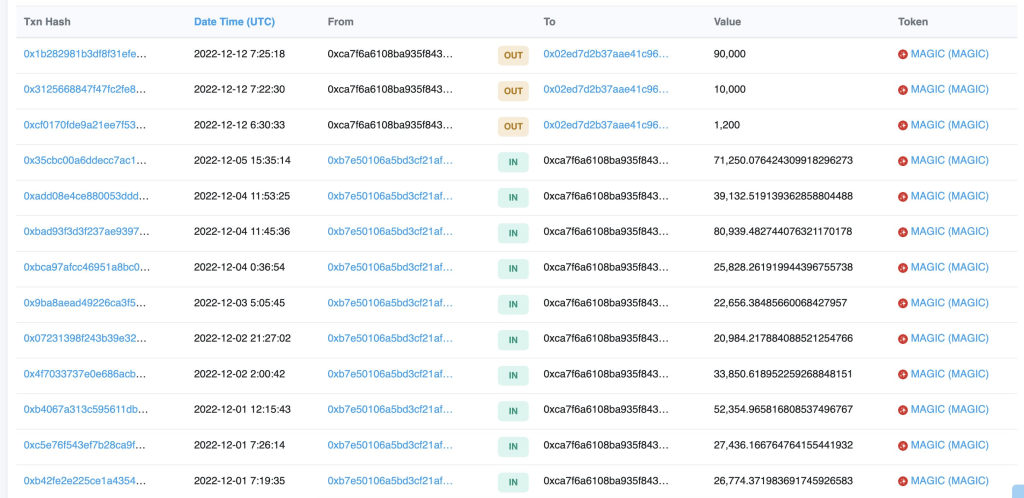

According to Nansen Intern, eth address 90416.eth has bought ~$800,000 in the past 30 days, with most of the buying in the past seven days.

There had been many other six-figure purchases as well; in particular smart money spent 149 $ETH ($185,216) on buying 401,207 $MAGIC since December 1st, with an average buying price of $0.4616.

He transferred 101,200 $MAGIC to #Binance 2 hours ago and has 300,007 $MAGIC left.

Another bought more than 100K $MAGIC tokens at ~$0.5175 25 minutes before the Binance announcement, profiting over $21K.

8.

— Lookonchain (@lookonchain) December 12, 2022

SmartMoney: https://t.co/ydlrhgSCNy

This address bought 108,665.6 $MAGIC at ~$0.5175 25 minutes before #Binance announced the listing of $MAGIC, the buying cost is 44.9 $ETH ($56,234).

Then sold at $0.7138 and got 77,568 $USDT.

Made a profit over $21K. pic.twitter.com/6UsEoAK0hY

For more smart money/whales, check out DeFi_Mochi’s findings below.

The recent runup in the price of $MAGIC was phenomenal from $0.247 to nearly $0.655 in a week! Were there any whale wallets that got in way before the @The_Beacon_GG and @coinbase announcements? Here's 3 wallets you can track which bought in massively before the pump!

— Defi_Mochi (@defi_mochi) December 10, 2022

🧵

0/8 pic.twitter.com/ELsEU9XOyW

Closing thoughts

TreasureDAO is not your average NFT project. It is a web3 gaming ecosystem with many games built on top of it. As the market starts to believe slowly in this GameFi revival, Treasure is my best bet.

As more game builders rally around the $MAGIC ecosystem, new high-quality games will undoubtedly be introduced.

Furthermore, in-game tokens that can only be bought/sold strictly on the MAGIC swap and characters/items that can only be traded using $MAGIC on the Trove marketplace will bring demand and activity for $MAGIC.

This goes beyond just purchasing a $MAGIC token on centralized exchanges for real utility.

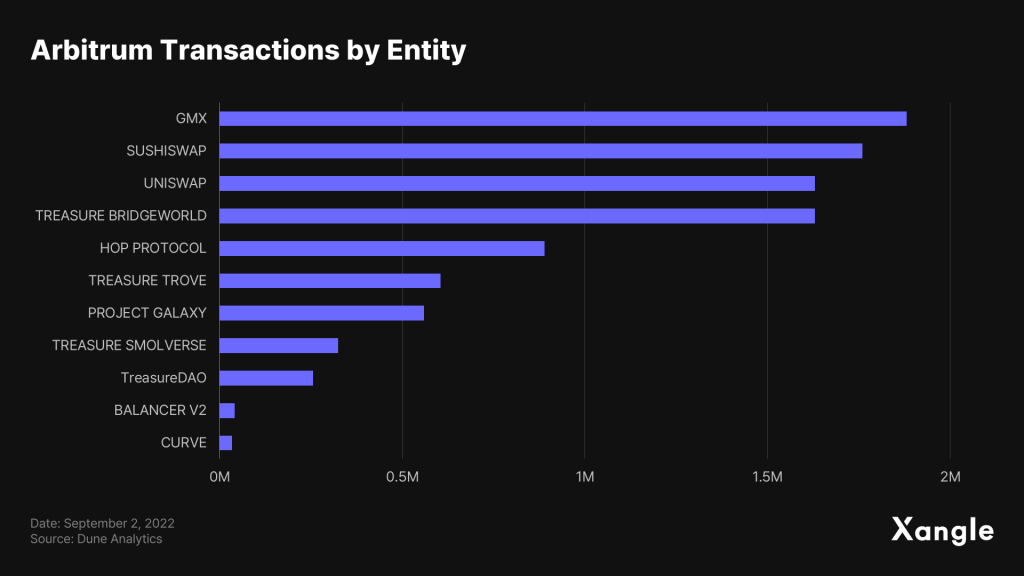

The three, Bridgeworld, Trove, and TreasureDAO, may rival GMX in terms of transactions.

High demand + high-quality games + smartly constructed tokenomics = a strong bull case, but certainly still at the expense of market conditions.

Paired with improving liquidity to $MAGIC and strong fundamentals, if you are planning to invest in gaming, Treasure may be miles ahead of others.

Also Read: Are We in Arbitrum Season?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief