Key Takeaways:

- Crypto Market Cycles are comprised of four key phases

- Understanding these cycles will help you maximize returns

- Completing all phases generally takes four years

___________________________________________

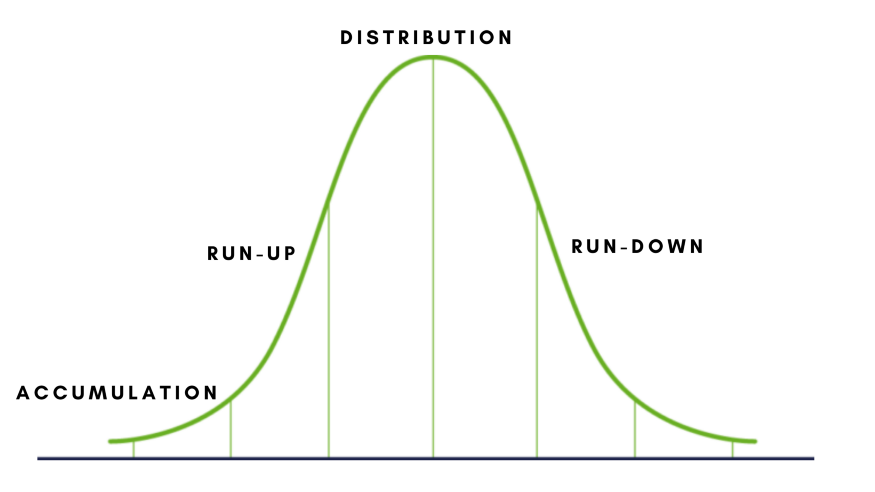

The crypto market cycle is generally defined by four phases – the slow accumulation, the quick run-up, the plateau in price and the subsequent drop in price. This is a pattern that repeats over and over again across all markets.

While it’s almost impossible to accurately pick the top or bottom of any given cycle, understanding that cycles exist and knowing which cycle the market is in will allow you to identify the best time to buy and sell, maximising your gains and minimising your losses.

Borrowing from traditional market analysis, here are the four major phases of a market cycle and how to recognize them:

Accumulation phase

The accumulation phase is either the start of a new project or the ending of a prior phase where the market has already bottomed out.

In the case of a new project, this is when early adopters or insiders buy into the project.

In the case where the market has bottomed out, the weak hands have sold and it is when smart money buys in, figuring that the worst is over. This is the beginning of a new cycle and many refer to this as “buying the dip”. This is the point in the cycle where the price is the lowest. It’s also a point marked by market sentiment moving from negative to neutral from the prior cycle.

Run-Up Phase (Bull Market)

The run-up phase is when the market begins to move to higher highs at an increasing rate. At the beginning of this phase, technical analysts pick up on these projects and it is around this point the early majority enter the market. This is the time when the market direction has become clear and overall market sentiment has changed from neutral to positive.

Towards the end of the phase, fomo investors start piling up and buy near the top in fear of missing out.

The end of this phase is marked by the fomo investors jumping in causing a large increase in market volume. At this instance, market valuations seem excessively overvalued and smart money will start to sell off their positions.

As prices begin to level off, this leads the market into the distribution phase with the final wave of investors jumping in. This is where excessive gains are seen in very short periods and media attention on the market is at its all-time high.

Distribution Phase

In the third phase of the market cycle, the price plateaus and sellers begin to dominate. This part of the cycle is identified by a period in which the bullish sentiment of the previous phase turns into a mixed sentiment. Price will normally trade in a tight range which can last for days or weeks where volatility is low and momentum is slow.

This phase concludes when the market reverses its direction. It’s at this time when classic technical analysis patterns such as head and shoulders or double/triple tops can be found and is an indication of a change in direction.

As this marks the peak of the market, it’s a period overrun by emotion. The majority of the market looks to the recent past with hopes of continued excessive gains and greed overtakes logical sense. It’s a time where smart money has already exited and where equal parts of anticipation and fear surround the market.

Run-Down Phase (Bear Market)

The last phase of a market cycle is the run-down. For the majority of investors, this is the most difficult period and a highly emotional time. Within the cryptocurrency markets, this also seems to be a time of social media pumping with the hard-held belief that the price will only keep going up.

Unfortunately, the nature of this world dictates there will always be a run-down phase and this is one of the hardest lessons not just for the cryptocurrency community, but all investors.

Psychologically, this is also the most difficult point for investors as they either are not aware of the permanence of market cycles or choose to ignore them, resulting in either selling too late or not selling at all.

Choosing to hodl and wait for the next run-up in price can significantly reduce your ROI and limit future investing opportunities. Thus, it is best to cut your losses upon realising it.

How Long do These Cycles Last?

In the traditional markets, cycles in the market tend to last 6-12 months on average. However, fiscal policy in either the United States or world markets can have a widespread effect on the length of a market cycle. If, for example, the Federal Reserve were to drastically increase (or decrease) interest rates as they are doing right now, it could prolong a market trending downward for a period of time.

The cryptocurrency market is still very young in comparison to other asset classes. There is limited historical data to indicate the duration of market cycles. The biggest market runup happened in 2017 when the price went from approximately USD $3,000 to almost USD $20,000.

Again in 2021, we had another major runup where the price went from roughly USD $10,000 to USD $69,000. While it can be said the cycle is around 4 years, there really is no specific period of how long a cycle lasts.

While the duration of market cycles can span over many years, the cycle of a specific cryptocurrency can span from a few days to a few weeks.

Conclusion

It’s important to remember cycles exist in all aspects of our lives. The sun, the moon and the markets all have their cycles. Understanding the market cycle and the phase of the market is a necessary and prudent approach when determining the best time to buy or sell — especially in this high beta asset class.

For cryptocurrency traders and investors, knowing and utilising this knowledge will help you make informed decisions to minimise your risk and maximise your returns.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: Market Cycles In Crypto: How To Identify Tops and Take Profits