On the topic of data analytics tools in identifying opportunities and threats in crypto during Metajam, a few stark platforms come to mind, namely DeFiLlama for DeFi-related resources, Dune Analytics for OpenSea data and maybe Ape Board for your portfolio tracking.

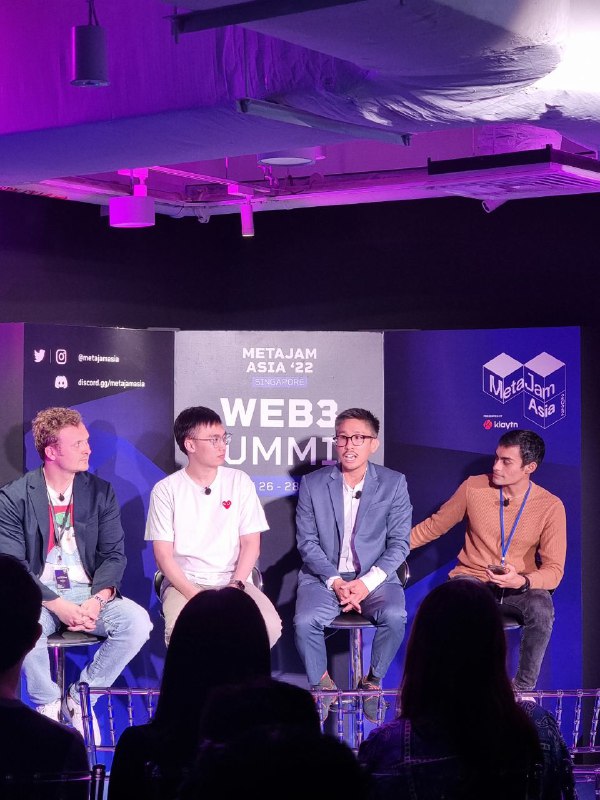

We had the opportunity to invite Alex Svanevik, CEO, Nansen, Nicholas Chen, CEO, SolanaFM and Dan Tran, Head of Business, NFTGo (Left to right), to talk about crypto data analytics tools.

The session was moderated by Liam Wells, SG NFT Creators.

Everyone wants opportunities; riding the volatility of the crypto market correctly will almost guarantee your success. Of course, opportunities come with intensive effort and commitment; it does and will not come easy.

There are three things to look out for when you are finding opportunities in the market using Nansen, (1) discovering new opportunities, (2) performing due diligence (3) defending your portfolio.

Discovering new opportunities

Discover new opportunities through trading volume and visibility on the most minted NFT collection. Similarly, look at the intelligent money inflow, and see which tokens these wallets buy. You might not know about these projects, but it may be one way you pick them up.

Also Read: Crypto Analytics For Free: How To Use Nansen’s New Lite Version Of Its Analytics Platform

Performing due diligence

Once you know about this project, you have to figure out if it is worth putting money into these projects. When you look at liquidity on exchanges, the only way to determine how much liquidity a business has is to have good data on their wallets. For NFTs, you may want to look at which influencers are buying the NFTs, which may be correlated with their price action.

Defending your portfolio

Defending your portfolio might not necessarily be metrics, but it involves much more data analytics. Intelligent alert triggers for notification on people exiting liquidity notification may enable you to react quicker from the pact in your investment decisions.

The example Alex gave is the early notification of people pulling out money from curve pools before the debugging of UST, potentially saving millions.

Also Read: “Terra Is More Than UST”: Will Do Kwon’s Revival Plan Save The Terra Chain?

Can on-chain data combat crypto’s volatility?

Data is key. In 2017, you might not know why crypto pumps/crashed because there wasn’t much visibility with on-chain data. It is important to surface the signal for all these education data and understand the market movements in crypto.

“In the case of UST, there were nine different parties triggering the de-pegging of UST” in fact; you can go much deeper in blockchain than traditional finance; this enables users to be able to start at a higher level before digging downwards to find out the root cause of the matter, something TradiFi will not give much visibility on.

Looking into the finer details with the help of data analytics may pay off too. Take, for example, Solana; when the outage of the network occurs, on-chain data will be evident in showing the plummeting of TPS to zero. Data analytics is more valuable than we know; the moment we can fully capitalise and hone the skills it offers, we will be able to make better and more sound investment decisions.

Do airdrops affect volatility? Through data analytics research, the head of business for NFTGo, Dan Tran, saw a trend of airdrops bringing massive pumps and dumps into the market. As an example, Yuga Lab’s APE coin airdrop to their NFT holders (BAYC, MAYC, etc.), he saw the price of yuga labs assets pumping before airdrops are given out. Noticeably after that, you see a dump.

“There are huge up and down spikes in everything an airdrop is announced”.

Achieving a balance between transparency and privacy

Tornado Cash is a fully decentralised protocol for private transactions on Ethereum, and its the most popular. It is the primary avenue for users to employ privacy in their dealings on Ethereum but also a route for hackers to get away with stolen ETH.

Also read: How To Improve Your Transaction Privacy On Ethereum Via Tornado Cash.

“40% of ETH inflow on tornado cash comes from hackers”. This is an issue, but what is the price for privacy? Privacy and transparency are widely debatable topics; on the one hand, many people want privacy, but transparency is a unique characteristic of the blockchain.

Instead of answering this question, I think this dilemma gives users a choice in using no, semi or complete privacy.

On-chain alphas

Do what you will with this information; this does not constitute financial advice.

In the past eight days, transactions on Solana have doubled.

There has been a lot of outflow of Ether from exchanges, from 23M Ether sitting on changes to 20M in the last five months. This coincides with the amount of ETH going to Ethereum 2.0 for staking.

Looking at OTC transactions, on-chain made by the big players might give you information to front-run with. Prices of that token pump right after news of the transaction broke out.

The rarer the NFT, in the long term, would usually trade 3x from its floor price.

6% of Blue Chip NFTs holders hold their NFTs for three months or longer. This information is crucial for you to see if holders are holding their NFTs for the long term.

Mobile-focused blockchain explorers with graphical representation might be following data analytics tools with the highest level of accessibility.

Look where the smart money is investing. There are 1.5M wallets with an NFT; only 15,000 have over 1M in value, a small percentage, but they control 26% of the market cap.

Smart money wallets are a “masterclass”. Setting intelligent alerts allow you to follow whales in real-time.

Also Read: Crypto Whales: Why They Are Important And How You Can Track Their Wallets

People tend to learn faster when they have a stake in something, putting money into something and considering them as tuition fees.

Stay away from leverage.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief