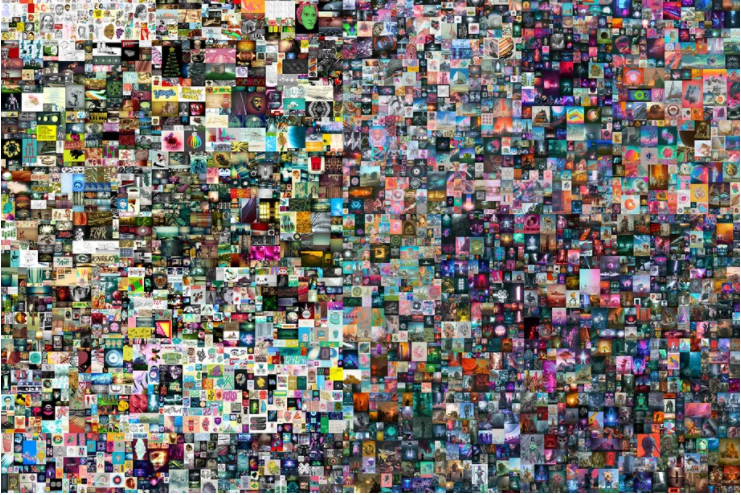

From Bored Ape Yacht Club to CryptoPunks, the NFT mania has captured the imagination of investors and collectors alike. Beeple’s Everydays: The First 5,000 Days: a collage consisting of 5,000 images was bought at Christie’s for over US$69.3 million by a Singapore-based programmer in March 2021.

This begs the question on why are people spending millions on a JPEG image which they could easily screenshot? Is the NFT craze here to stay or just a passing fad?

In this article we will discuss NFTs, its current use cases, top NFT projects such as Bored Apes and CryptoPunks and potential future use cases.

What is an NFT?

Non-fungible tokens are pieces of digital content linked to the blockchain, much like Bitcoin and Ethereum. Cryptocurrencies are fungible, meaning that they are interchangeable with an identical one of the same value much like cash.

However unlike cryptocurrencies, NFTs are unique and not mutually interchangeable. Much like Pokemon trading cards, if you trade two different cards, they would not be of the same value.

NFTs create scarcity in an otherwise infinitely available asset and there is a certificate of authenticity to prove it. NFTs can take the form of trading cards, virtual lands, gifs, jpegs, music, tweets, video game skins and much more.

What are NFTs currently used for?

One example of a NFT use case include using it as a collectable like CryptoPunks, Bored Apes Yacht Club and Jack Dorsey’s first tweet which was sold for USD 2.9 Million.

Other examples include domain name NFTs such as apple.eth, which was bought at an auction though Ethereum Name Service, Axies to generate smooth love potions for gaming-NFTs, virtual land NFTs such as land in The Sandbox and Decentraland.

Another example include NBA moments which features specific plays in recent times which was sold to fans. Lebron James’s dunk which emulated Kobe Bryant was sold for USD400k on NBA Topshots.

Bored Ape Yacht Club

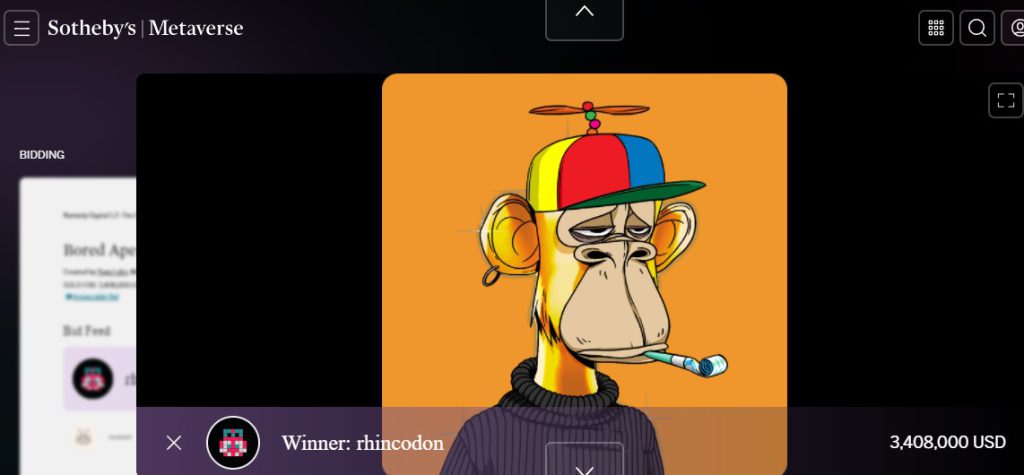

On 30th April 2021, 10,000 apes were launched on Opensea, and they were sold for 0.08 ETH or about US$200. At the time of writing, the most expensive Ape sold to date, Ape 6618 was sold on Sotheby’s at US$3.4 million.

The Bored Ape Yacht Club takes inspiration from NFT projects like CryptoPunks, where each NFT looks totally unique. Each Ape has a different rarity depending on what the Ape is wearing, doing, and its background.

The project was founded by Yuga Labs’ four pseudonymous founders: Gargamel, Gordon Goner, Emperor Tomato Ketchup, and No Sass.

The four friends were inspired to go with Apes as their characters because “aping in” is the term for those who buy new crypto or NFT without considering the risks involved.

The idea of having a club also came from their vision of a congregation place for bored billionaires, who after ‘aping in’ went on to talk numbers and make memes.

Getting special privileges such as access to an exclusive Discord server and ‘The Bathroom’, a digital area acting as a collaborative graffiti board, were also factors that gave a sense of exclusivity and club membership status for bored ape owners.

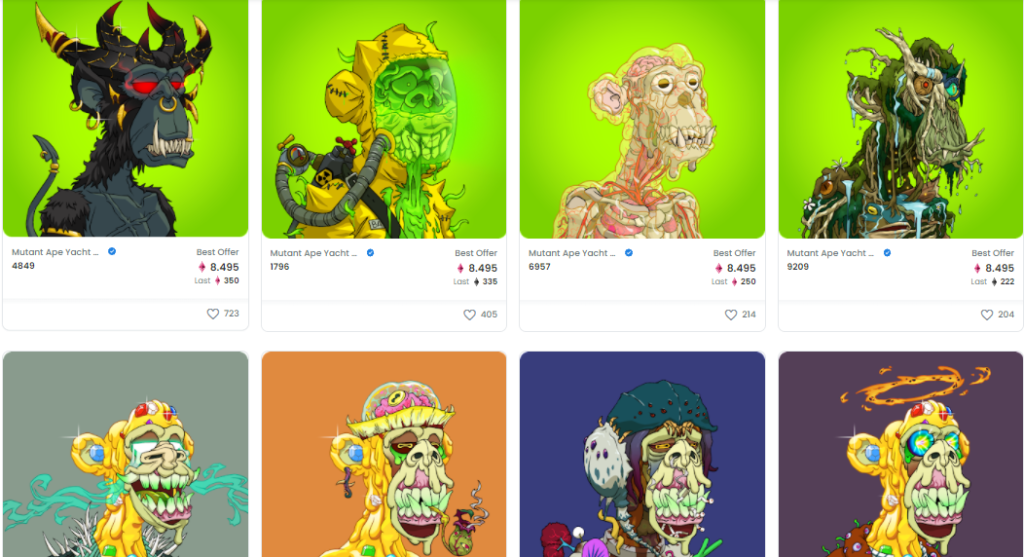

There were two follow up collections from Yuga Labs — Bored Ape Kennel Club and Mutant Ape Yacht Club.

Bored Ape members given the Kennel Dog NFT for free (apart from gas fee), as part of the membership in June. Any secondary sale of the dog NFT collection which had a 2.5% royalty fees, was given to animal shelters for the first six weeks of sale.

After six weeks, they removed the royalty fee entirely. In August, all Bored Ape owners were given a mutant serum which they could expose their Bored Ape to, to create a totally new NFT, a mutant ape.

“The purpose of introducing MAYC was to allow newcomers into the BAYC ecosystem at a lower tier of membership,” BAYC noted.

With the above aforementioned reasons, it is no wonder to why Bored Ape Yacht Club is one of the top NFT projects to date, and will continue to be so for years to come.

CryptoPunks

In 2017, Matt Hall and John Watkinson, Canadian software developers and founders of software company Larva Labs, created a software program that would generate thousands of different characters.

What initially began as an experiment that they thought could be developed into an app or game produced the groundbreaking CryptoPunks.

The CryptoPunks are a collection of 8-bit-style pixel art images of 10,000 avatars. Each has its own unique, randomly generated features that distinguish them.

Their eccentric looks were inspired by the London punk scene in the 1970s and the anti-establishment early days of the blockchain movement to which Hall and Watkinson belonged. They wanted to reflect this spirit in their CryptoPunks.

CryptoPunks were offered for free when they were first launched, though there was very little interest. They were claimed and were being sold for prices between $1 to about $30 in 2017.

Over the last 12 months, they have been sold for an average price of 22 ETH (US$54,000) with some being far more expensive than others. Some punks are worth tens of thousands of dollars while others are worth millions.

Being one of the earliest NFT projects in Ethereum, its value is tied to its time of being part of NFT’s ancient history. In addition, it has a vibrant community on discord.

It would not be surprising that CryptoPunks would be able to remain one of the top NFT projects in years to come.

What are some potential future use cases?

Music NFTs: Adoption of music NFT sales by artists forgoing big record labels. Traditional business models for music artists with record labels are typically as follows — 50-50 with 50% going to the performer and the rest shared among agents, lawyers, and distributors.

In the case of streaming, the deal gets worse for the artist. There is a growing trend amongst artists with regards to democratization of the music industry. As the consumer, being able to invest in a Kickstarter campaign for your favorite artist but, instead of merchandise or concert tickets, getting a percentage of the revenues in return.

Music NFTs would thus democratise the industry, allowing artists to be able to take the cut they deserve. We have already seen musicians in the NFT space, with Mike Shinoda, one of the founding members of Linkin Park, launching his music as a generative NFT on the Tezos blockchain.

Real world asset NFTs: Linking real-world assets with NFTs can digitize the way we prove ownership. For example, in real estate, we typically deal with physical property deeds. Creating tokenized digital assets of these deeds can move highly illiquid items (like a house or land) onto the blockchain.

Conclusion

With the digital certification of online goods allowing authenticity of ownership for digital assets, NFTs are certainly here to stay especially with popular brands such as Nike and Adidas recently coming onboard the space.

The technology would most certainly benefit artists from the creative industries while at the same time, stamp out counterfeit goods. The use cases of blockchain is most certainly at its early stages, it would most certainly be a matter of time whereby companies and people find new business models that are sustainable for both companies and consumers alike.

Featured Image Credit: Forbes / Bored Ape Yacht Club / CryptoPunks

Also Read: Here’s A Look At The Top 5 NFT Projects On Solana And How To Buy Them