If you are exploring the Cosmos ecosystem, you must have heard of the Osmosis blockchain.

Launched in June 2021, Osmosis DEX is the first decentralised exchange specifically built for the Cosmos ecosystem, with Inter-Blockchain Communication (IBC) built in. It allows for swaps and liquidity pooling of IBC-enabled, Cosmos SDK assets.

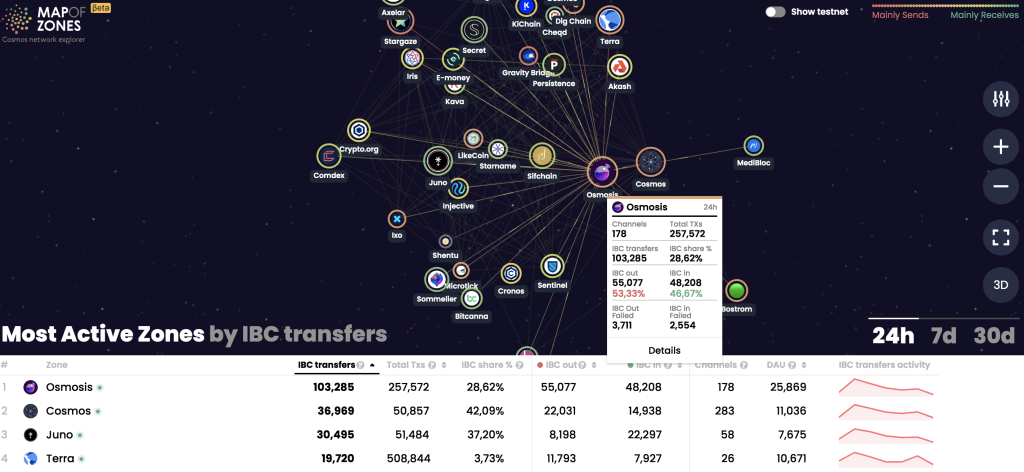

Fast forward to today, Osmosis is the top DEX in the Cosmos ecosystem by Total Value Locked (TVL), Daily IBC transfers and Daily Active Users.

Today I’m presenting my bull case for Osmosis, covering three key factors that have propelled its success.

First mover advantage

As Osmosis is the very first IBC-enabled automated market maker (AMM) decentralised exchange (DEX) launched in the Cosmos ecosystem, it has managed to secure a monopoly of a huge user base.

Let us look at a few key metrics: When we look at daily IBC transfers and daily active users, it is by far the top zone in the Cosmos ecosystem.

Why is this the case?

As Osmosis is IBC-enabled and cross-chain native, it allows for easy bridging to all the other Cosmos blockchains.

One can easily deposit/withdraw another Cosmos blockchain’s native token via the DEX. There is even a bridge directly from Terra to Osmosis.

Also Read: How To Add Terra To Your Keplr Wallet And Bridge Tokens To The Cosmos Ecosystem

When new blockchains launch in Cosmos, they often have their tokens and liquidity pools available in Osmosis as well. This incentivises more users to regularly use Osmosis to take part in swaps and attractive liquidity pools.

In all, as the first DEX that is IBC-enabled in Cosmos, Osmosis is the main chain where Cosmos ecosystem users can perform permissionless swaps between their Cosmos assets, and earn high liquidity pooling rewards.

This gives it a strong first mover advantage among other chains with similar applications. Along with its strong branding and community and intuitive UI, it is likely the top DEX of choice when new liquidity enters the Cosmos ecosystem as well.

Tokenomics and value accrual

When Osmosis was first launched, there was an initial release supply of 100 million Osmo tokens. This was split evenly between a ‘fairdrop’ (ATOM holders) as well as a Strategic Reserve.

Newly released tokens was then distributed to a combination of staking rewards, liquidity mining incentives, developer vesting, and community pool according to the following distribution:

This is encouraging to me, as it suggests a rather fair distribution of the Osmo tokens, without VCs or early investors holding a large portion of tokens.

This also mitigates threats of large unlocks and dumps that would have detrimental effects on the token’s price.

As Osmosis is a DEX chain, many may view the Osmo token simply as a farm token and deem that it has little value.

However, as Osmosis is an app-blockchain in itself, the Osmo token accrues additional value in several ways.

Staking

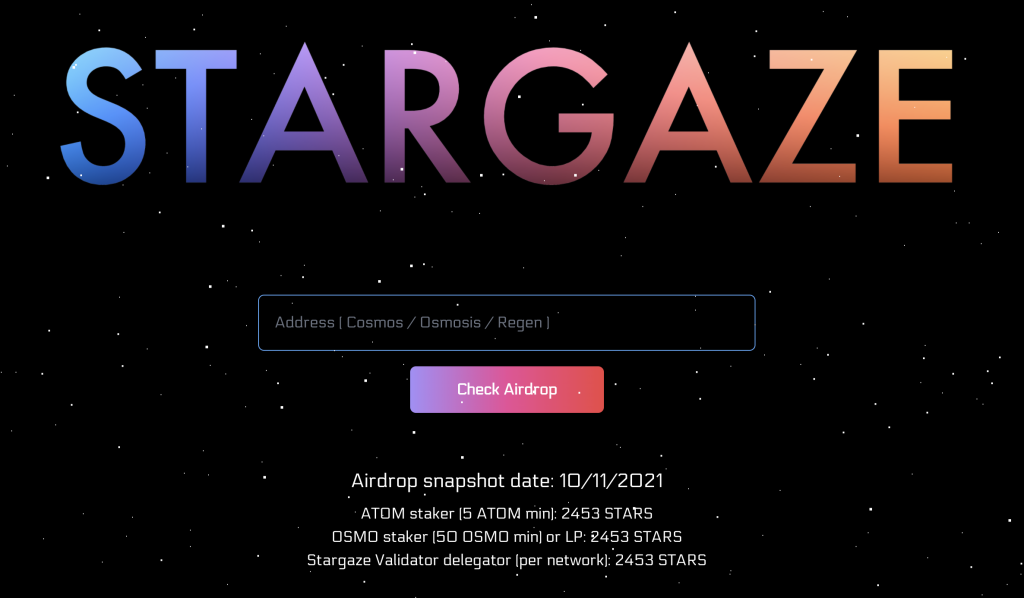

First, staking the Osmo token allows the user to earn up to 81% interest a year. Perhaps more importantly, staking the Osmo token has allowed users to be eligible for lucrative airdrops in recent months, such as Stargaze.

This anticipation of future lucrative rewards gives Osmo strong holding and staking pressure.

Liquidity pools

Next, the Osmo token is also the base pair token used in most of the liquidity pools in Osmosis. This also gives it a strong demand pressure, as users will have to buy some Osmo tokens to provide liquidity to these pools.

It is also notable that the Osmo token is not available in any centralised exchanges, so new users to the Cosmos ecosystem will have to get their hands on Osmo by trading on the DEX itself. Some new projects also reward Osmosis liquidity providers with airdrops.

Another commendable feature is in how the rewards of the liquidity pools are structured. While the minimum bonding period is 1 day, higher rewards are awarded to users who bond for a longer time period.

This incentivises more users to have liquidity bonded over a longer time, while mitigating the threat of farming and dumping.

Swap Fees

With the large number of users trading on Osmosis everyday, Osmosis also earns significant revenue from swap fees, providing more value for the chain and Osmo token itself.

Superfluid Staking

The future prospects of Osmosis are also bright.

One that I’m most excited about is Superfluid staking (currently in Beta launch).

Essentially, superfluid staking is an Osmosis feature that allows liquidity providers to use their LP tokens to stake and protect the network as well.

This allows the user to earn both yield farming rewards from the liquidity pool, as well as staking rewards and potential airdrops.

When the feature is fully launched, the user can potentially also use the other token in the LP pair for staking as well, earning staking rewards on the both pair tokens.

This clearly aligns the incentives for Osmosis stakers and LP providers, as the latter are more incentivised to stake their LP tokens as well.

As this feature is currently in Beta launch, there are some limitations.

- Only the ATOM/OSMO LP is currently eligible for Superfluid Staking.

- LP shares can only be staked to one validator per pool

- There is a built-in “superfluid discount factor” parameter, which reduces the percentage of eligible LP shares that can be staked using Superfluid Staking by 50%.

🦸♂️💦 #Cosmonauts – Superfluid Staking is now live!

— daryllabs 🧪 (@Darylloh2) March 4, 2022

Are you already doing so in @osmosiszone?

If not, find out how you can earn an extra 18% APRs with your $Atom and $Osmo in this thread!

Superfluid staking simplified: pic.twitter.com/hci4iuJ1RF

Currently, the feature offers 18% additional APR if you choose to use Superfluid Staking on the ATOM/OSMO liquidity pool.

In future, it is likely that Superfluid Staking will be available across more liquidity pools, and a higher percentage of LP shares will be able to be staked.

This feature would also likely increase the demand for Osmo tokens, as well as the total amount staked and liquidity provided in Osmosis.

Current Osmo token holders will have even more incentive to put their Osmo tokens to work, while non-holders will be incentivized to buy Osmo tokens to earn these dual rewards.

Conclusion

If you are bullish on the Cosmos ecosystem, Osmosis should be a good bet as well. It plays a key role in the ecosystem, for users to swap and bridge tokens, as well as providing liquidity.

With more future plans like Superfluid staking, as well as the launch of new IBC-compatible EVM-based chains, there is likely much more liquidity, users and transactions coming to Osmosis.

With its strong standing in the ecosystem and token’s value accrual, there are good reasons to believe that there will be a growing demand to buy, stake and hold the Osmo tokens in future.

Featured Image Credit: CryptoSlate

Also Read: Getting Started With The Keplr Wallet: The Leading Wallet For the Cosmos Ecosystem