Solana’s rise to popularity puts the spotlight on the various DeFi apps that are prevalent in it. One example is Raydium — the heart of Solana.

Raydium was the first on-chain order book automated money maker (AMM) powering Solana and is the go-to place for trading the variety of Solana DeFi tokens.

To most, it resembles the Pancake Swap of Binance Smart Chain, and evolved from its initial launch to further develop into a launchpad for new Solana DeFi token launches.

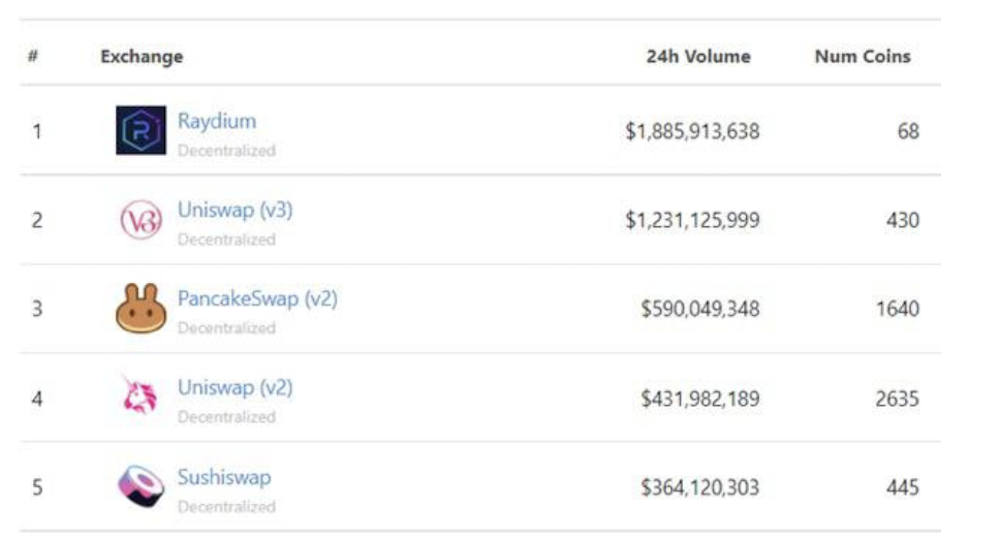

Thanks to the boom in the Solana ecosystem, Raydium was the top AMM in trading volume charts, despite having only 68 coins. This puts against strong contenders — with familiar names such as Uniswap, PancakeSwap and Sushiswap.

Let’s examine why Raydium serves as the heart of Solana and how it has evolved to be an all-star to expand the eco-system.

Great user interface for their AMM

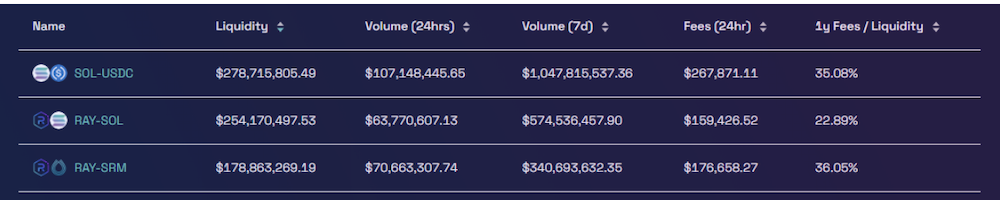

Raydium offer Solana users a sleek user interface for swaps, allowing them to purchase other Solana tokens on Raydium. Some actively traded names are shown below, such as Solana (SOL), Raydium (RAY) and Serum (SRM).

The success of Raydium was also largely due to its price execution, utilising its own liquidity pools and the Serum orderbook to get the best prices for its users.

The swap is the core of where most Solana users head to trade their Solana coins with #1 volumes and liquidity within Solana.

Raydium provides users with the opportunity to earn capital by providing liquidity to these pairs, through the form of LP tokens and farming them or by staking RAY tokens to earn a share of the entire protocol’s revenue generated.

Acceleraytor and Fusion Pools

In the early days of Solana, Raydium and Serum stood strong as the anchors of Solana.

However, in order for the eco-system to bloom, there was the need for a platform to launch new projects effectively and efficiently.

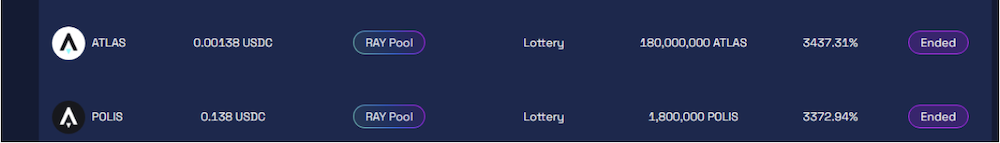

Raydium solved this by launching the Acceleraytor Launchpad, aimed at generating value for RAY stakers — having a chance to get a lottery ticket in the new project IDO.

Users who stake RAY for a 7 or 30 day period get a lottery ticket, before a transparent on-chain lottery is conducted and winners get to subscribe their allocations in advance.

The Acceleraytor launches 2-3 projects a month, and are generally highly sought after top tier projects that generates huge traction.

The recent Star Atlas IDO was heavily subscribed and delivered a 120x at the peak.

As Raydium is the AMM, they can offer the Fusion Pools for projects that list with them to kickstart liquidity. Projects can reward liquidity pool providers with their own token, instead of relying on the RAY token, for a limited period of time at the start to “kickstart” liquidity and attract huge capital.

This allows a project to launch, gain popularity across the Solana network, and have a sufficiently large liquidity pool to have stable price action and good swaps happening back and forth all in a few days of work.

Permissionless Pools

As Solana progresses, Raydium is no longer the only launchpad, and there are projects which did not get a chance to launch through its Acceleraytor and Fusion Pools. Considering the timeline where the Acceleraytor can only launch 2-3 projects a month, this sidelines potential Solana projects as well.

To tackle this, Raydium launched the ability for anyone to create a liquidity pool, so new projects can access the liquidity and security of Raydium’s platforms and capture a huge user base. This allows Raydium to maintain its position as the main automated maker of Solana, without having to dilute the brand name of Acceleraytor.

Rapid growth within Solana

As Solana has increasingly demonstrated its value proposition to developers, the number of protocols running on Solana have grown significantly which directly benefits Raydium. As of today, almost every single Solana project has a permissionless pool within Raydium.

With Raydium’s consistent and continuous development to being more than just an AMM in comparison to its more mature peers in Ethereum or BSC, it will be exciting to see future developments that would propel their growth further.

Featured Image Credit: Raydium

Also Read: From Degen Ape Academy To Solana Monkey Business: A Look At Solana’s NFT Ecosystem