THORChain was founded in 2018 with the aim of eliminating the issue of using centralized exchanges to transfer crypto assets between blockchains.

The THORChain team set out to build an independent blockchain that could bridge the external networks and at the same time, facilitating cross chain transfers.

The team has received backing from reputable investors like Delphi Digital, Multicoin Capital, X21 Capital and Zee Prime Capital.

What is THORChain?

THORChain is an independent blockchain constructed on the Cosmos SDK that also acts as a decentralized cross-chain trade (DEX).

Resembling the architecture of Uniswap, it uses an automated market maker model where the $RUNE token is used as a base swap pair.

Read more: Why I Am Investing In Cosmos In 2022, And Why An “ATOMic” Explosion Is Incoming

THORChain is a decentralized liquidity network with an interoperable blockchain that allows users to swap assets across blockchains.

What this means is that it allows investors to swap assets across blockchains with your own wallet with Rune as a somewhat “intermediary”.

THORChain does not peg or wrap any assets but simply allows users to swap tokens across various layer 1s.

Traders on THORChain can seamlessly move from Bitcoin to Ethereum, Polkadot etc without the need for them to register for an exchange or go through KYC, minimizing the counter party risk.

What is $RUNE?

Rune is built on the Cosmos SDK (Tendermint) and has a token model that increases in value as the network grows.

This means that the more liquidity deposited into THORChain’s liquidity pools, the more valuable Rune gets.

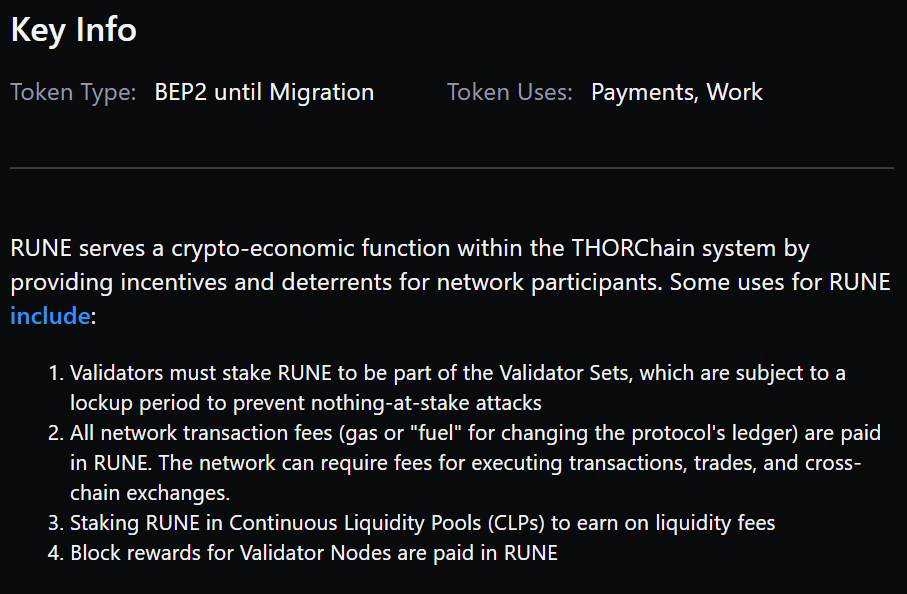

Rune also serves five purposes:

- Liquidity: As a settlement asset

- Security: Means for economic driving behaviour

- Governance: Signalling priority on chain

- Incentives: Rune is used as pay out rewards and gas fees

- Amplifier: Elevate assets on the THORchain

Find out more on THORChain’s bullish case here.

Roadmap

Spiking 34% after activating synth assets

$6m of synth volume in the first 24 hours since launch 👀

— $RUNE Ranger 🔨 (@TheRuneRanger) March 11, 2022

Bullish $RUNE pic.twitter.com/zF9CEgHJYb

Rune’s 18.4% surge back then came from the release of its synthetic assets. Crypto synthetics are a type of derivative token that is pegged to the value of the underlying collateralized asset, such as Bitcoin or Ethereum.

THORChain back its synths with 50% of the underlying asset and 50% in Rune. The activation went live earlier this week on the 10 March with synthetic BTC (sBTC) and synthetic ETH (sETH) available to be traded on the network.

Bascially, synth assets comes without any impermanent loss and it allows users to hold and trade represented token faster and at a lower cost.

This surge may have strong correlation with the full integration of Terra (LUNA) into the THORChain protocol in the beginning of march.

Currently THORSwap supports 6 wallet types for 8 blockchains as a cross chain DEX.

THORSwap supports 6 wallet types for 8 blockchains as a cross-chain DEX. pic.twitter.com/eOzoZbKR0f

— THORSwap ✌️ for $vTHOR (@THORSwap) February 25, 2022

Also Read: Market Debrief: Luna Breaking ATH, Biden’s Crypto Executive Order, Are NFTs Becoming Cold?

Planned obsolescence (31 July 2022 or earlier)

During this period, the entire THORChain team’s tokens will be fully unvested. This also means the rune tokens will entirely be 100% in circulation.

The team will also be giving up full control of the THORChain network making the platform fully decentralized without any central point of failure or team controlling the network.

Liquidity pools

THORChain is decentralized and community-owned, and therefore, all network profits are directly returned to node operators and liquidity providers. Slip-base fees are paid by traders and rewarded to THORChain network participants.

Early Participants in ChaosNet are seeing impressive returns.

- returns for LPs

- 10x higher returns than UniSwap

- Low risk of impermanent loss due to slip-based fees and network rewards

Only Multi-Chain DEX

- No other exchange allows LPs to stake native BTC, ETH, ERC20, BEP2, etc.

The black hole

💰🌀LIQUIDITY BLACK HOLE THEORY 🌀💰

— Andrew Kang (¤, ¤) (@Rewkang) June 15, 2020

There exists a token-based AMM design 🛠️

That threatens to create a liquidity blackhole 🕳️

Pulling in assets from everywhere 🌀

CEXs, DEXs, Cold Storage, etc. 🏛️

I'll break it down 👇

Tokenomics

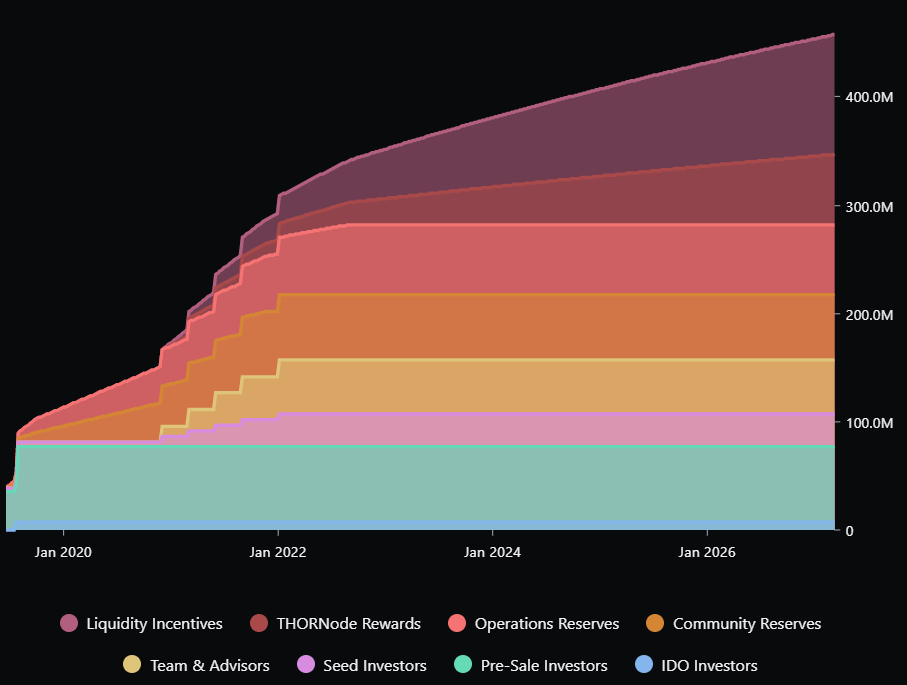

THORChain pre-minted its entire initial supply of one billion Rune tokens. The project opted to distribute assets through token sales and a reward mechanism for providing liquidity.

In October 2019, THORChain opted to burn all of the “unused” reserve RUNE, which when combined with Project Surtr, amounted to 50% of the initial max supply.

Currently, Rune has a total market cap of US$1.06 billion, sitting at rank #55 in the crypto market. Rune also has a total supply of 500 million with a circulating supply of 300 million.

The latest monthly recap on May 2022 is also made available below.

THORSwap Monthly Recap: May 2022 is now available.

— THORSwap ✌️ for $vTHOR (@THORSwap) May 30, 2022

> $vTHOR launch

> Exchange Fee Sharing

> TERRA Chain Resolution

> THORYield’s Updates & More.

Read more here: https://t.co/Zc8hBpO6P2

Key information on THORChain

Initial supply breakdown

Liquid supply curve

Price prediction

In my opinion, with a strong concept and the continual addition of projects as synthetic assets, Rune might break its all time high of US$20 in the long term. In addition, the release of its main-net and planned Obsolescence (fully un-vesting in all Rune tokens to reach max circulation) will come as catalyst to it’s positive price action.

I also believe THORChain will see an increase in adopters as users shy away from the use of centralize exchanges to fully utilize their crypto funds in a decentralize manner making THORChain’s severely undervalued.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Not Your Math Homework: dYdX Is The Protocol For Decentralized Derivatives