The U.S. Securities and Exchange Commission’s 136-page lawsuit against Binance, filed today (6/6), has put forth 13 charges again the largest cryptocurrency exchange in the world, as well as it’s CEO, Changpeng “CZ” Zhao.

Already triggering the largest liquidation event since the start of 2023, the complaint built on an earlier investigation from the Commodity Futures Trading Commission. While the previously published 70-odd page report had already alluded to possible insider trading from Binance, the SEC’s suit has managed to gather an entirely new plethora of internal messages, likely from former senior Binance executives.

Also Read: SEC Sues Binance and CEO “CZ”, Claims BNB and BUSD are Securities in Latest Filings

SEC Alleges CZ-Controlled Entities of Market Manipulation, Co-Mingling of Funds

The collapse of Centralize Exchange FTX and sister company Alameda Research brought to light what many in Web3 were already speculating – the possible co-mingling of customer and company assets.

Binance now faces comparable accusations, with the report noting that CZ and Binance had an undisclosed relationship with their two main market making firms, Sigma Chain and Merit Peak.

4. Binance internally used Market makers that CZ "owned and controlled", and enabled "manipulative trading on the Binance US platform pic.twitter.com/ywfmeMy7XE

— Chain Debrief (@ChainDebrief) June 5, 2023

More notably, Merit Peak’s U.S. bank account was used as a “pass through” account, receiving over $20bn in customer funds from Binance.

“Merit Peak then transferred the vast majority of those funds to Trust Company A, in transfers that appear to relate to the purchase of BUSD. As Merit Peak was a purportedly independent entity, sending Binance customer funds to Merit Peak placed those funds at risk, including of loss or theft, and was done without notice to customers”, the report stated.

In another instance, Binance’s U.S. entity transferred more than $200m in funds to the Sigma Chain account, of which $11 million was used to purchased a yacht.

More notably, the SEC has expressly stated that “Zhao’s control over both BAM Trading and Sigma Chain has enabled Sigma Chain to conduct the manipulative trading on the Binance”, calling painful memories from Crypto Traders regarding Alameda’s predatory strategies on FTX.

A former Binance senior executive also testified that the company was heavily dependent on CZ “not just as a control person but also as an economic counterparty” and that efforts to attain trading independence from CZ had been rejected.

Furthermore, the SEC alleges that Binance’s Shanghai-based finance team was able to execute “money transfers between bank accounts and depositing cash injections from Merit Peak when BAM Trading operating funds were low.”

Binance has since denied any allegations that user assets were never at risk, further noting that “all user all user assets on Binance and Binance affiliate platforms, including Binance.US, are safe and secure, and we will vigorously defend against any allegations to the contrary.”

SEC Continues To Press on Binance’s alleged illegal operations in the U.S.

In the same vein as their previous suits against other cryptocurrency entities, the SEC has accused Binance of not only dealing with unregistered securities, but also marketing their product despite being unregistered in the U.S.

Within the document, Binance’s former COO was quoted blatantly admitting that “we are operating as a fking unlicensed securities exchange in the USA bro.” While the context surrounding the statement still remains enigmatic, the complaint also notes that a Binance consultant had developed a strategy dubbed the “Tai Chi Plan”, to “reveal, retard, and resolve built-up enforcement issues”.

While the actual plan was never fully effected, the SEC alleges that CZ had implemented much of it, by creating a separate “Binance U.S.” franchise.

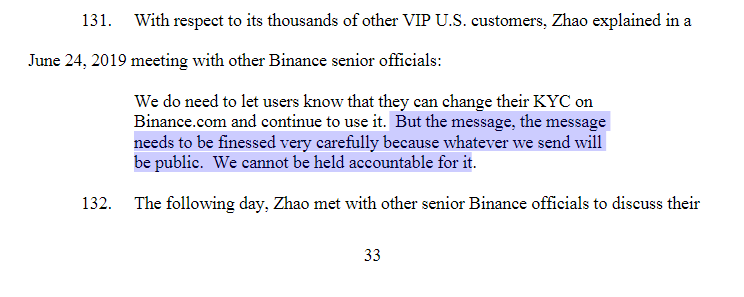

Both the CFTC and SEC filings also quoted internal messages from CZ, directing officials to subtly hint “VIP U.S. Customers” to either change their KYC or IP in order to maintain volume on their exchange.

At the time, a Binance presentation reported that approximately 159 U.S. VIP customers represented almost 70% of all global VIP trading volume.

Additionally, the complaint states that Binance had publicly solicited users for, and marketed it’s Binance.US platform.

“BAM Trading’s solicitation of customers has occurred at Zhao’s direction. In addition, Zhao has regularly marketed the Binance.US Platform services and the crypto asset securities available for trading on the Binance.US Platform. For example, through his Twitter account, Zhao has promoted the launch of new products offered on the Binance.US Platform or when the platform begins offering services to investors in a new U.S. state or territory.”

These “crypto asset securities” not only constituted Binance’s native tokens $BUSD and $BNB, but also other cryptocurrencies such as $SAND, $SOL, $MATIC, $FIL, $ATOM, $MANA, $ALGO, $AXS, and $COTI.

Is This Binance’s FTX Moment?

The SEC’s new trough of sworn testimony and evidence against Binance has likely shaken the faith of even the strongest believers in both the largest centralized exchange, as well as their CEO. Unfortunately, many of these allegations, including co-mingling of user funds, and predatory market manipulation, draw strong parallels with the collapse of Sam Bankman Fried’s FTX and Alameda Research.

However, it seems that only time will tell, given Binance’s strong statement to the SEC that they are “prepared to fight it to the full extent of the law”. They have also gone to turn the tables on the commission, stating that “The SEC’s real intent here, instead, appears to be to make headlines.”

Regardless, while the market has dropped across the board in reaction to the news, it seems that only time will tell whether the SEC has truly overblown the entire situation.

Also Read: Binance Statement To SEC: We are prepared to fight it to the full extent of the law

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief