In a global survey released today, Bitstamp – the world’s longest-running crypto exchange, polled institutions all around the world for their thoughts on cryptocurrency.

It includes more than 28,000 participants, ranging from retail to institutional investors, from regions such as Hong Kong, Australia, Japan, and more.

Also Read: It’s Time To Zoom Out – The Bull Thesis For Web3

Institutional Demand Remains Strong

The current bear market has been brought upon by the subsequent collapses of multiple entities.

From 3 Arrows Capital to Terra Luna, many such institutions were based in, or had ties with Singapore. This would therefore imply a general aversion to cryptocurrency by those still standing.

However, the data shows otherwise.

In fact, the survey shows that more than a third of institutional investors are keen to “increase investments” in crypto, a roughly 3% increase from last quarter.

Of those polled, 33% also indicated that they plan to “expand their knowledge base” for clients.

This follows the Monetary Authority of Singapore’s (MAS) stance to continue adoption and development of blockchain technology.

In the same vein, 29% indicated that they would like to “learn more about crypto“, a good sign that institutional adoption has only just begun.

As more firms plant their roots within Singapore, we may very well see it turn into the world’s crypto hub.

Headwinds For The Island Nation

While institutional demand remains firm, the market’s effects are clearly showing.

MAS has rejected a majority of crypto firms that have tried to obtain a license to operate digital token services. This includes Binance, one of the world’s largest crypto exchanges.

“On MAS’ side, we closely scrutinise licence applicants’ business models and technologies, so that we can better understand the risks.”

Ravi Menon, MAS Chief

This has been reflected by those polled, with 10% stating that they may “reduce or remove crypto” from plans, and 7% stating that they would “decrease investments” in the space.

Many market watchers have also noticed that Singapore has taken a step back from crypto, instead pivoting to the underlying technology and infrastructure.

Regulation drives market development.

— Bitstamp (@Bitstamp) July 20, 2022

Read Bitstamp's APAC MD's piece in The Business Times about Singapore's and Hong Kong's regulatory approaches towards crypto. #cryptoregulation #singapore #HongKong https://t.co/pU1QkLNEyl

By taking a more wary approach Singapore may fall behind other crypto-friendly nations such as Dubai. In such a fast moving space, the worry of retail traders capitulating is juxtaposed by the risk of stifling innovation.

Nevertheless, it is a fine line that regulators have to thread.

With 9 in every 10 Singaporeans aiming to increase their crypto investments in 2022, the local implications of further market crashes are staggering.

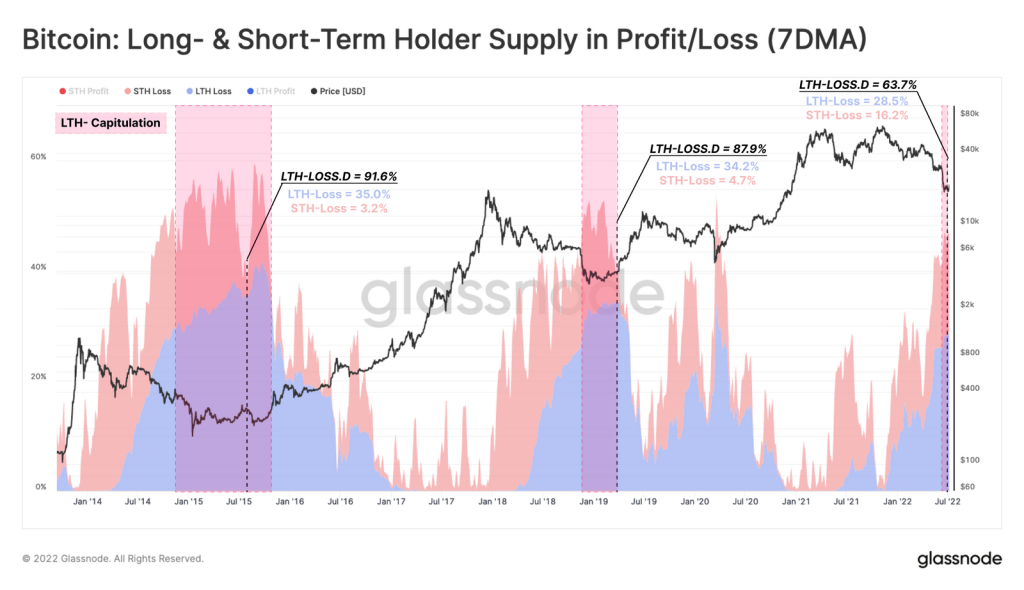

Furthermore, ~45% of Bitcoin holders are currently sitting at a loss, according to glassnode.

Factoring in the volatility of the larger crypto market, we can safely assume that the majority of crypto traders are currently underwater.

In a country with such large exposure to cryptocurrency, regulators may have no choice but to impose additional frictions for participants.

The Future Is Still Web3.0

Despite the presently negative sentiment, it still seems that crypto is here to stay.

34% of the institutions expressed that they are planning to “invest in increasing our crypto offerings“, up 9% since last quarter. 23% Also showed interest in adding “more cryptocurrency investments“.

Image: JB Graftieaux, Bitstmap Global CEO via business2community

“Although trust in crypto is still buoyant across institutions, institutional investors are right to be prudent with their market participants and advice to clients“

JB Graftieaux, Bitstmap Global CEO

And with Temasek Holdings investing millions in cryptocurrency and Web3.0, it is hard not to be bullish on the space.

Whilst the current contagion effects have shed a bad light on crypto, the events have been more operator-related than anything.

Additionally, “not enough regulation in the industry” was cited amongst the top barriers for crypto adoption. Institutions are in fact welcoming, not pushing back, on the rules being set in place.

With clearer guidelines on what can and cannot be done, they may be able to make the final push into the next stage of the crypto ecosystem.

Closing Thoughts

While retail adoption may have taken a back seat, the path for institutions has never been brighter.

Singapore is fast adopting a crypto-friendly nature for these firms, especially those focused on the infrastructure layer. In fact, the nation’s rules and regulations are still in favor of blockchain-related companies.

Certainly, Singaporean institutions are echoing this idea, with 18% still “cautiously recommending crypto”, second only to Australia in the Asia Pacific region.

Nonetheless, it is still sending mixed messages with regards to its future as a “crypto hub”, which other nations are starting to capitalized on.

As a country that prides itself on innovation, however, it may be time for Singapore to double down on the future.

Also Read: S’pore May Restrict Retail Access To Crypto – MAS Chief Ravi Menon