What if I told you there is a simple way to discover alphas before everyone else? In a space where knowledge is out there in an open-sourced nature, those with the best interpretation will be the eventual winners.

Crypto data analyst Kofi recently dropped a game changer of a dashboard optimised for querying short periods (e.g. past 30min trending contracts) so you can find hot protocols long before they’d be flagged elsewhere.

Imagine spotting contracts with all the “green signs” and getting in on them early. By positioning yourself before most crypto natives take action, tracking these contracts may be the ultimate alpha for 2022.

Imagine getting into a favourable position before the wave of FOMO kicks in. 100x.

But that, of course, will not come easy; there is no free lunch, not even in a narrative and FOMO-driven crypto world.

Kofi introducted this tool first on Dune analytics, covering popular such as Ethereum, Arbitrum, Optimism, Polygon and Solana, and now, appearing on the front page of DeFiLlama’s dashboard.

Introducing "DefiLlama Trending Contracts: Polygon"

— Kofi (@0xKofi) December 9, 2022

A dashboard tracking the fastest growing contracts on @0xPolygon

Optimised for querying short time periods (eg. past 30min trending contracts) so you can find hot protocols long before they'd be flagged elsewhere pic.twitter.com/Cnmk9FZzJA

How do I even read the contracts?

Before we go on to use the tool, we have to understand what smart contracts is. They are basically digital contracts coded to take decisions based on a given input and execute any type of transaction between multiple anonymous parties without the need for manual intervention or trust.

Imagine you take a loan on a DeFi protocol, there is no receptionist or counter staff who would attend to you just like how the banks do, but instead, the codes which resides in the smart contract.

The smart contract of the protocol will issue you a loan as soon as it can verify that you have locked the required collateral.

When it’s the time for loan repayment, you can simply pay the total amount alongside the interest, and the smart contract will automatically release your collateral. Throughout this process, there will be no manual intervention or legal documentation required in this process.

There is no human element to the process, which means no ambiguity.

Ok you head over to the trending contracts page now and see a project with massive transaction growth in the past two hours, high contract activity reflecting a high gas spent, you are ready to ape.

You understand what smart contracts are now, but you still don’t quite understand what they represent. apart from those which are tagged.

Let’s look through them on by one, and see how we could capitalize on this tool.

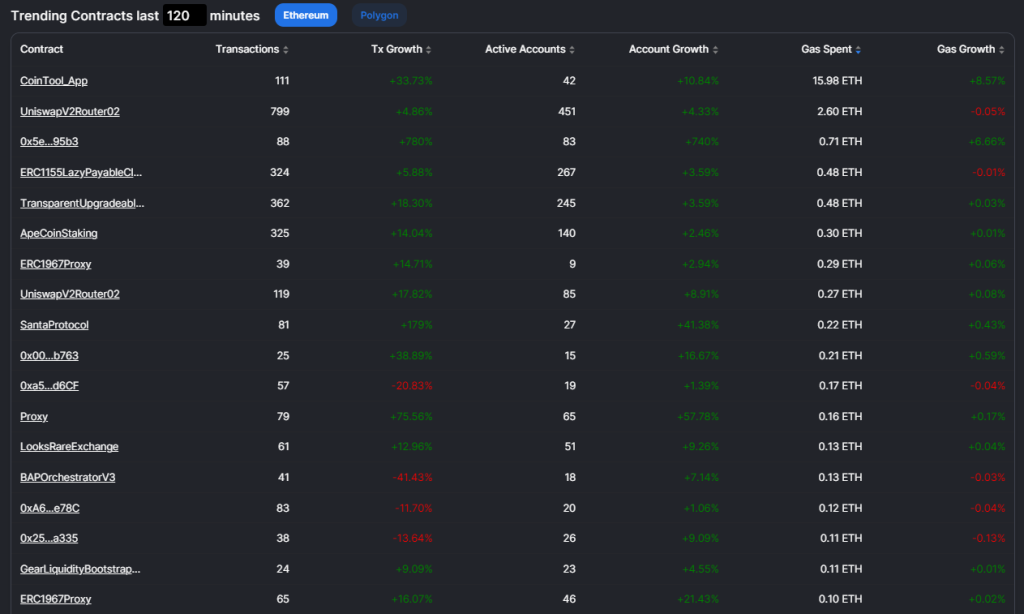

For an example, these are some Ethereum contracts trending in the past 2 hours. (22nd Dec, 3pm GMT+8)

And upon further research, you’ll find out that they are an AMM (Automated Market Maker) made by the KuCoin Community Chain who provides holders of the $KCS tokens to start trading in a decentralized manner.

SantaProtocol has 128% in transaction growth, with 22 active accounts amounting to 0.22ETH in gas fees in the past 2 hours.

A quick search on twitter you’ll find the project, probably a meme though.

But what if there are no tags on the contracts? How do we then find out what they actually do? Othere than a quick strategy guide you may employ below, a more ardous step by step process may provide you with clues.

Quick strategy I've been using to new Polygon projects using DefiLlama's trending contracts, PolygonScan, and Twitter:

— Patrick | Dynamo DeFi (@Dynamo_Patrick) December 16, 2022

1. Go to trending contracts on DefiLlama

2. Go to a contract's PolygonScan page

3. Search the contract name on Twitter

4. Confirm the contract address

Demo👇 pic.twitter.com/4sYWhFMKbl

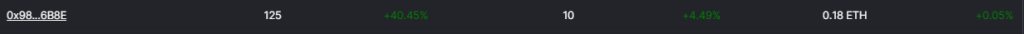

Let’s try looking at one contract without any labels. The contract sees 40% growth, 10 active accounts, with over 0.18ETH in gas spent.

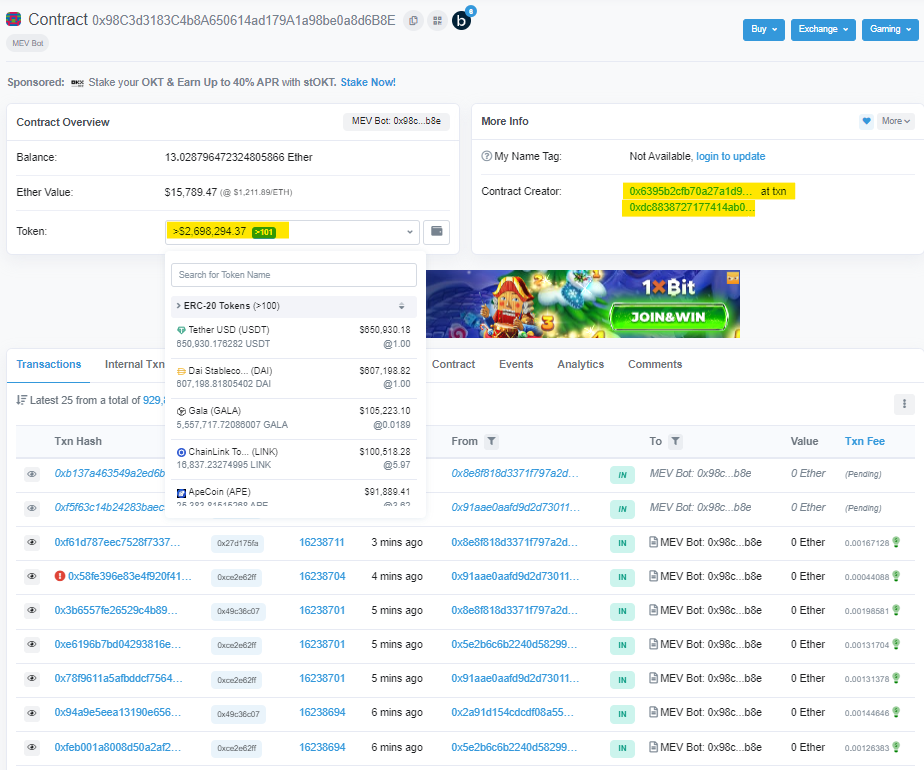

By clicking on the address, you’ll be brought to the Etherscan page. Here, the first step is to read basic details such as the creator address, token name, tokens held in the contract and so on.

Balance, Value, and Token: They will show you the total ETH held by the contract, its total value at the current price of ETH, and the total value of other assets held in the contract.

Under the creator and transaction Hash, you will see the wallet address of the creator and the transaction hash of the transaction that you can click on to see more details.

This contract does not register a native token. Otherwise you would likely see something like this.

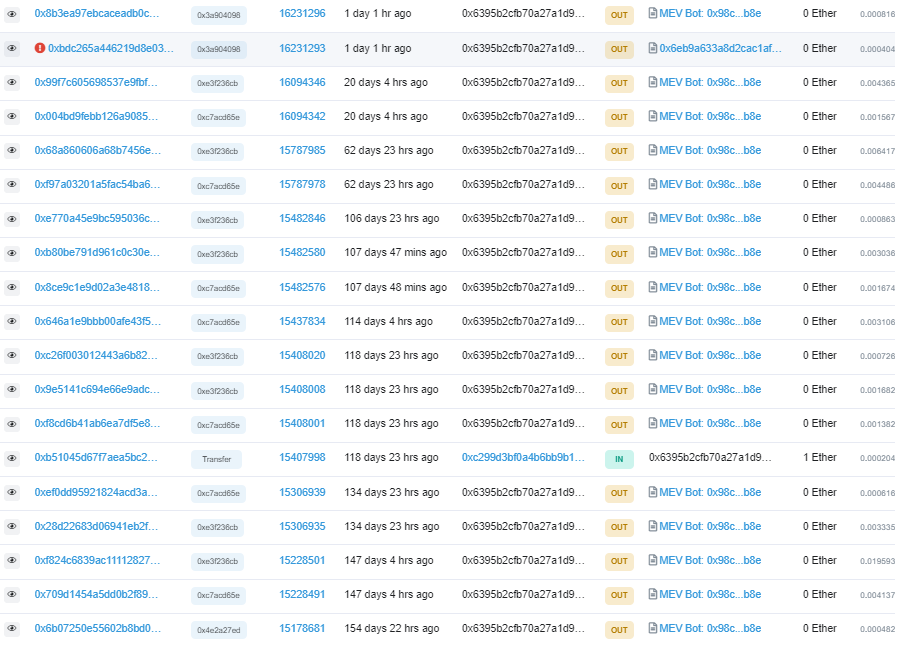

When you click on the wallet address of the contract creator, you will be directed to a page that has all the transaction and fund details of the wallet that created the smart contract.

You can check this to assess how active the wallet has been and what wallets and contracts it has previously interacted with.

With the numerous number of transactions seen below, this contract is likely to be a MEV bot.

This is a result of only one findings of what a smart contract may be, and be sure to know, there are plenty of others out there.

Closing thoughts

It is also good to note that a trending contract does not necessarily mean you should interact with it blindly. No matter how much you read about crypto, your best defense against scams is good judgment and a knowledge of the data you’re working with.

As most of those contracts are also not audited, so they pose potential risks with any interaction. With the trending contracts tool, you will be able to have datapoints on the newest contract, but that is where responsibility comes with the knowledge you receive, by of taking your own due diligence.

In my opinion, the whole point of blockchain was to put you in the driving seat. So keep on learning and stay on top of this space, because the more you know, the more you can benefit.

Also Read: Unpopular Opinion: We Should Continue To Trust Crypto Thought Leaders

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief