Does the gaming market in crypto still have potential today?

The bear market has spoken: Projects with massive valuations have plummeted significantly across many sectors in crypto. GameFi, one of the most hot topics in the crypto market, is no exception. But is it over for the gaming industry in crypto? Let’s take a look.

Introduction

Our story for GameFi begins naturally with the success of Axie Infinity and its P2E system. It is perhaps the most famous example of a “successful” GameFi project. Its AXS token had a launchpad sale price of $0.1 to more than $160 during its ATH and maximum hype period. That’s more than a 100 000% return!

At its peak, Axie Infinity had close to 2.5m monthly unique users. P2E is quite a novel mechanism and the results spoke for themselves.

The successes of Axie Infinity and its tokenomics have been covered in this article, but the formula for success is in my opinion here:

Additional yield from dual token system + NFTs = Money Making Opportunity

In fact, some even lauded the idea that P2E would be the new gig economy, or even act as the first sign of universal basic income (UBI), given Axie’s success in generating income for users in countries like the Philippines.

Pojects that would follow a similar model would soon launch. One example was Crabada on AVAX, a P2E game where users could use their uniquely generated NFT Crabs for battling/mining for rewards. Other notable and hyped projects included the Sandbox, Defi Kingdoms and Iluvium.

Of course, only when the tide goes down do you discover who has been swimming naked. Axie Infinity’s revenue and its reward tokens, SLP has dropped, with SLP falling over 90% from ATH.

It was unfortunate that an exploit happened on the Ronin Network, which also contributed to the “death spiral” phenomenon for Axie.

Other crypto gaming projects have had a rough impact too. DeFi Kingdoms coincidentally had an exploit, allowing for extra locked JEWEL tokens to be unlocked early and dumped on the market.

Message From @FriskyFoxDK https://t.co/DKCeC9EPpd pic.twitter.com/7hnUVZvLBb

— DeFi Kingdoms (@DefiKingdoms) April 30, 2022

Of course, while some of these exploits are unique to the projects themselves: it does raise the question: just how fast will players leave a sinking GameFi ship? What factors in the sector need to be resolved to have sustainable and organic users over time?

Issues and Barriers

Issues plaguing GameFi today can be summarized as either of the following

1. “Lack of actual product”

One example was Pixelmon, an open world Metaverse game inspired by Pokemon, whose story was covered here. NFT Pokemon where players can battle, trade and have fun in the Metaverse – sounds great, right?

Of course, the end result with their actual NFT lauch was a massive disappointment and this one picture alone says it all.

The Pixelmon project and its marketing turned out to be misleading. Many investors expected high quality NFTs and gameplay, but clearly the team did not live up to their promises. How many projects in the Metaverse and GameFi space often claim to be revolutionary, yet their roadmap does not get accomplished? Do any of these projects deserve multi-billion dollar valuations?

2. “Yield farming with extra steps”

This is another common criticism of gaming projects today. If GameFi is to be seen as yield farming with extra steps and a game attached to it, then it is no surprise that some projects are doubly hit once the bear market comes knocking and more players sell off their reward tokens to cover their costs.

Even the idea of NFTs and a breeding system ends up being a sunken fixed cost that players have to incur. In other words they are incentivized to continue dumping their in-game currency token in a P2E system to recoup their initial cost of buying/renting a character. This is also not accounting for gas costs that are required to interact in some of the games.

Triple A title video game: $60 to play a fully finished game.

— DeFi Dude (dude.eth) (@defidude) May 3, 2022

Metaverse video game: $10000 for a character, you can play in 5 years when it’s built.

Something ain’t right here.

If the core of a project is simply to earn reward tokens, then the playability and future prospects of the project becomes questionable. After all, if people are using it just to play and earn tokens for a monetary incentive, how can projects retain organic users that are in it for the long run?

GameFi projects today are still fragile to the economics and price of the Token they are introducing in their game – new designs and finetuning must happen to ensure the project survives. Yield farming itself ends up being unsustainable eventually – who is the incremental buyer and user of the in-game currency? How many players are actually staying in the game?

3. Lack of interest from the outside world

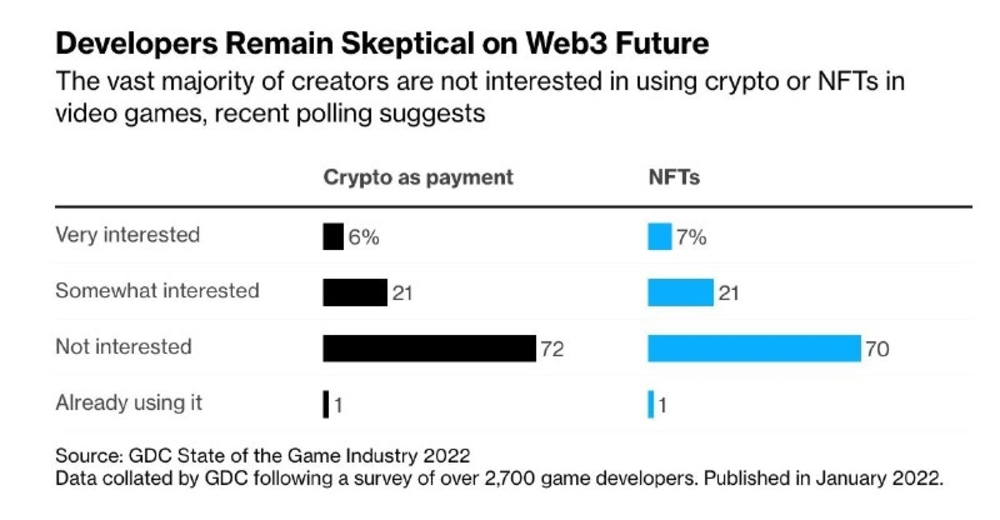

In fact, not many developers from gaming are interested on crypto as payment or even NFTs in games. The results speak for themselves.

The Way Forward

Of course, these issues are not unnoticed by teams, analysts and the retail market in general for gaming. In fact, I think everyone will agree with this statement below.

“A gaming project in crypto MUST be fun.”

How does this tie in with how a GameFi project is valued? Firstly, if players do not enjoy the gameplay, there can be no organic fanbase of the project and its fate is eventually tied to the token economics side of the project.

When the hype cycle goes away, projects must focus on ensuring players stay in the game for the long run, or they risk exodus like many have seen in older DeFi projects. But how? I believe this comes in several forms:

- Levels/Progression:

Provides a goal and journey for players to aim towards. This is obvious of course! Gamers require consistent challenges and many of them enjoy the process of “levelling” up in their ventures.

This is why online games today often have expansion packs or release frequent updates to engage their user base and provide them further goals to fulfil. It can be in the form of new quests, new maps etc. But the difficulty lies in how a GameFi project might strive to implement it.

How an RPG, FPS, TCG, racing game would adjust its progression and continue to entertain their older players will of course be different from one another.

Furthermore, the ‘endgame’ part of a GameFi project must be considered. Attracting beginners will be a different strategy compared to keeping veterans engaged in the game.

In summary, I believe continuous user gameplay and unique player counts will be a strong indicator on a GameFi project’s success.

- Importance of Sustainable In-Game Currency

The dual token system used by Axie has been replicated by many competitors, but one of the bigger issues lies in the inflation of the secondary in-game currency. Crabada, whose economic models are rather similar to Axie, has provided their own solution to tackle the inflation of their secondary token, TUS.

Crabada plans to launch an AVAX subnet, with TUS acting as the gas token being used in the subnet. In fact, their primary token, CRA, will also be used for validator staking to ensure the network remains secure. This adds further utility to their primary token as well.

Dear Crabadians! 🦀

— Crabada (🦀,🦀) 🔺 (@PlayCrabada) February 28, 2022

We are absolutely thrilled to announce news of the long-awaited arrival of our subnet, the Swimmer Network!

Swimmer Network is a dedicated blockchain for gaming that leverages on the existing infrastructure and security of @avalancheavax.

1/ 🧵🌊🏊♂️ pic.twitter.com/GHSugarW6T

This means that the demand for TUS will scale as the user model and player base for Crabada grows. By shifting away the gas usage and load from the AVAX C-Chain to TUS itself, Crabada is of course making a bet that its user base will continue to grow, thus increasing usage of the subnet, as well as demand for TUS. Will it work out eventually?

With their current track record and history of delivering, as well as their upcoming Battle Mode on the horizon, things do look promising.

Tracking inflation metrics and emissions of these tokens after the subnet launches could be some ways to observe the success of such an endeavour.

In fact, the inner economy on how the game works should be carefully considered as well. Rather than yield farmers “playing” a game and selling off secondary tokens, what about the assets that can be traded in-game for playing purposes, such as armor, weapons, skills etc?

Many of these are still under exploration and a successful robust inner game economy would be another criteria I would like to see.

My personal opinion is that older Web 2.0 games that have a successful background can act as case studies for GameFi projects. Runescape and World of Warcraft are 2 of my examples, as RPGs that have a robust in-game economy and also a dedicated user-base (due to how fun the game is!).

Ownership Of Gaming Projects

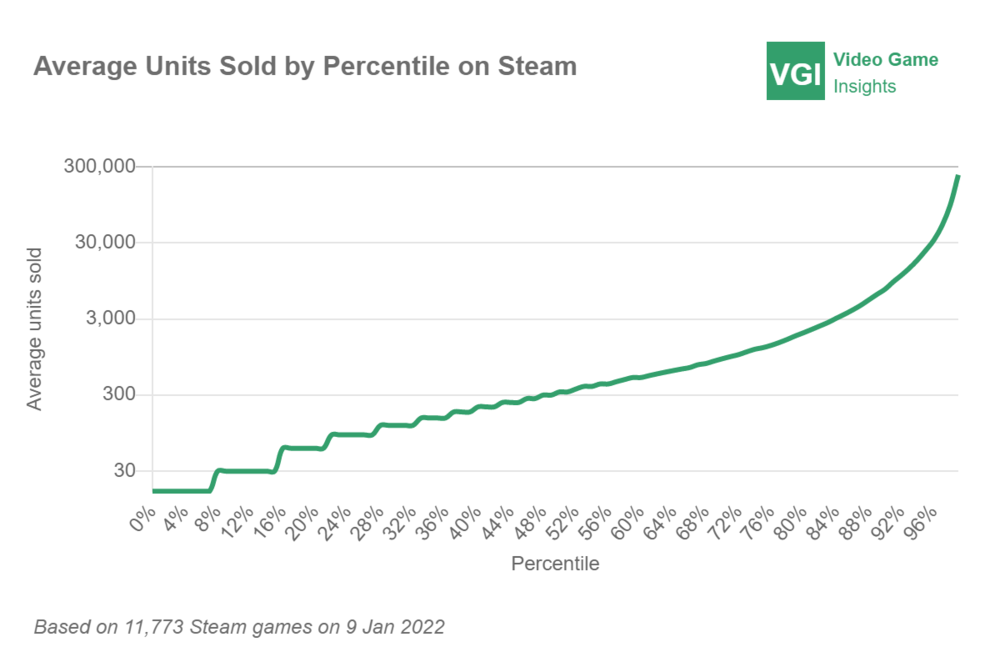

Gaming projects outside of crypto often do not gain much traction – in Steam for example, 12 000 games was released on Steam in 2021, and 27% of these games sold less than 100 units. Only 8% sold more than 10 000 units.

While statistics in Steam does not tell the full story on the video game market, my point is that most games that are released are indie games or do not generate massive amount of sales that are worth hundreds of millions.

Out of the thousands that are released every year, attention span and revenue are usually focused on a few outperformers annually (e.g Elden Ring for 2022.), or they accrue to current video games that have a strong market share and user value capture (WoW, League of Legends, gacha games).

If you were to place GameFi projects of today in the world of successful “normal” games, would they stand a chance as the exception, or will they end up as the 27%?

The only advantage that GameFi has is the idea of decentralized ownership – truly own the assets you have in game. I would see this as the premium gamers might be willing to pay, assuming that the game firstly

- Captures their attention

- Gets them to buy a token (for a purpose)

- Retains their time in the game

That is quite a tough stretch for projects and should be the golden standard to achieve today. I am hoping to see it eventually.

Closing Thoughts

Ultimately, my stance is this: User retention and the fight for the attention/mind space of apes in the space is key for any project, GameFi especially so, to survive in the future.

In an emerging market with many competitors popping up everyday, GameFi projects that wish to survive will have a long road ahead of them – but I believe that eventually the victors will still have a legendary bull run awaiting.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!