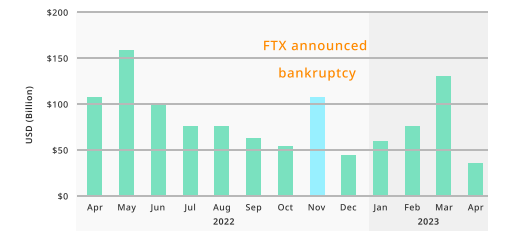

Losses in both the Terra Luna ecosystem and the centralized exchange FTX heavily impacted the cryptocurrency landscape, marking an unfortunate turning point in the history of Web3.

Furthermore, multi-million dollar hacks have continued to prevail in the scene, including last week’s USD $130 million exploit of cross-chain bridge multichain. With blockchain technology and cryptocurrency being relatively nascent products, many investors did not consider the risks associated with virtual asset operators, resulting in losses.

“These risks include decentralized exchanges being hacked and funds being drained from

liquidity pools, or centralized exchanges misusing user funds and facing liquidity issues. In

addition, the lack of regulatory norms for derivative financial products or unclear regulatory

approaches have led to excessive leverage, forcing users into liquidation” noted None Capital in their Taiwan Blockchain Industry Report 2023, released in conjunction with the 2023 Future commerce Expo.

The 71-page report, covering key themes from Web3 across a multitude of countries, dives in to the complexities of a developing cryptocurrency and blockchain scene as well as emerging trends in our current market.

Decentralized Solutions Forging a New Financial Landscape

Following the widespread collapse of centralized institutions last year, a distinct trend has emerged towards self-custody and an increase in the adoption of decentralized solutions.

The biggest benefactors were decentralized exchanges such as Uniswap, which allows users to swap their cryptocurrencies on the blockchain directly instead of having to use a centralized exchange such as Binance or Kucoin.

The report also highlighted that market share for decentralized exchanges compared to centralized exchanges has reached a YTD high of 16%, reflecting “the increasing awareness among users about controlling their own funds and a shift towards using decentralized exchanges“.

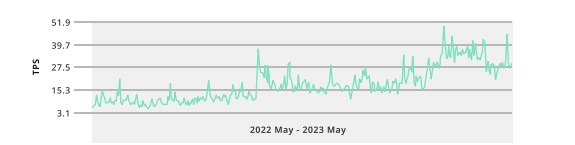

Thankfully, this shift toward self-custody has also been a key driver for innovation in the field, primarily manifesting in decentralized exchanges and Layer 2 networks.

With respect to DEXes, patents expiring from Uniswap V3 has allowed competitor exchanges to adopt their systems, with Pancakeswap providing a simpler way for general users to compose liquidity and DoDo allowing professional liquidity providers a method for creating leveraged market-making pools.

Growing demand for Layer 2 solutions has also been crucial for the growth of cryptocurrency and the DeFi sector, addressing congestion issues on the Ethereum Mainnet while providing a smoother user experience.

However, the report continues to note that while DeFi systems are fundamentally independent of traditional finance institutions, “the operational activities of some DeFi platforms may still involve compliance and legal risks.”

“As a result, regulatory actions have begun to recognize the need to enhance regulation in the DeFi space to protect user rights and maintain the stability of the financial system.”

As DeFi continues to face a trend of expanding regulatory scope in the future, the core goal of not being controlled by any singular entity remains – which still presents the challenge of finding a balance between decentralization and compliance.

International Blockchain Trends: Reducing Barriers, Facilitating Web3 Transfers

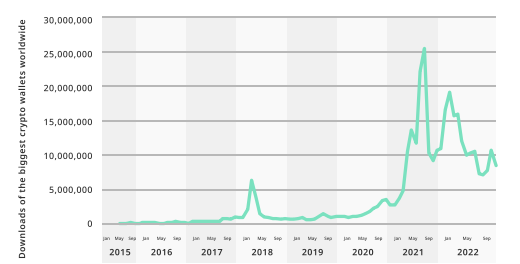

While the adoption of blockchain technology and Web3 was accelerated during the recent bull market, we saw growth taper off toward the later part of 2022. Despite it being easy to blame price action, the inability of Web3 to capture the general public’s attention is largely due to difficulties associated with onboarding onto Web3.

For example, cryptocurrency wallets still remain a large deterrent for the layman, and a large barrier to entry for most people.

Thankfully, the report highlights the strides that major blockchain wallets are making in order to reduce such barriers.

Social recovery of private keys was one advancement made this year, which would allow users to split their private keys into multiple parts and store them in a trusted circle. This could work to prevent accidental losses of crypto wallets, which have been a key concern for many in the past.

Both financial giants and Web3 native companies have also made the process of onboarding onto Web3 easier, via a slew of new solutions. In recent times, on-ramping via financial institutions and payment service providers has become a legitimate option, eliminating the “cumbersome process of transferring funds.”

At the industry level, there have been significant efforts to reduce the possibilities of exploits. While hackers stole over $3.8 billion in funds last year, cybersecurity measures have been increasingly implemented recently, both on and off-chain.

“Some crypto wallets have started adopting biometric authentication, utilizing fingerprint or facial recognition for user verification, thereby preventing malicious theft.

Furthermore, several Web2 antivirus software providers have ventured into Web3 by

developing on-chain security technologies. For example, they offer browser extensions that

collect and analyze data to detect malicious websites, phishing URLs, and fraudulent links.

When a user encounters such threats, a warning window pops up to alert them. These

measures help enhance the security of on-chain transactions and protect users from potential

risks.”

Collaboration and integration between exchanges and wallets has also been imperative in this market, as more companies engage in mergers, in-house development, or strategic investments to seize Web3 traffic.

Bitget Wallet and Bitkeep Exchange, for example, have initiated a collaboration that allows the former’s users to conveniently access Web3 products features on the latter’s platform. OKX Exchange’s wallet development and Binance’s acquisition of Trust Wallet are also allowing users to conveniently store and manage their digital assets.

How Taiwan Can Adopt International Regulatory Standards For Web3

While the Asia-Pacific region is quickly developing into a global leader for blockchain technology, Taiwan still lacks the robust and adaptable regulatory environment needed to ensure a healthy virtual asset market.

Aside from language barriers, it takes multiple months to incorporate a company in Taiwan, compared to an average of 1.5 days in Singapore, or less than 48 hours in Hong Kong.

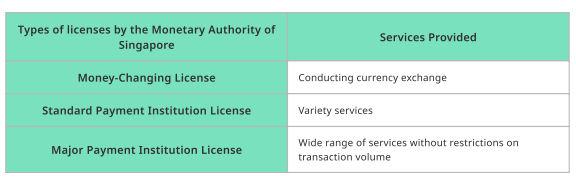

In light of this, the report proposes that Taiwan adopts standards set out by other countries and regions when it comes to the digital asset market.

Singapore’s payment service act, which establishes different levels of licenses based on the volume criteria for different types of virtual currency businesses, was a possible framework outlined in the report.

Dubai’s current model of a four-stage licensing system could also be considered, with its layered regulations providing more flexibility for virtual asset service providers in their operations.

In contrast, Taiwan’s Financial Supervisory Commission (FSC) currently adopts a self-regulatory code of conduct for industry participants and guidelines from supervisory authorities, with specific details of legislation still in the works based on international trends.

With regard to other global blockchain industry-related policies, None Capital highlights the European Union, Hong Kong, as well as Switzerland as some examples for their blockchain and growth-friendly approaches.

In 2023, the European Union introduced the European Blockchain Regulatory Sandbox, through which it seeks to “advance the adoption of distributed ledger technology (DLT) across industries and borders.”

The Hong Kong and Swiss Governments have also also actively promoted the advancement of blockchain technology locally, with the former establishing a Web3 Hub Fund to attract more Web3 enterprises and the latter enacting a blockchain law that has allowed for a thriving cryptocurrency ecosystem.

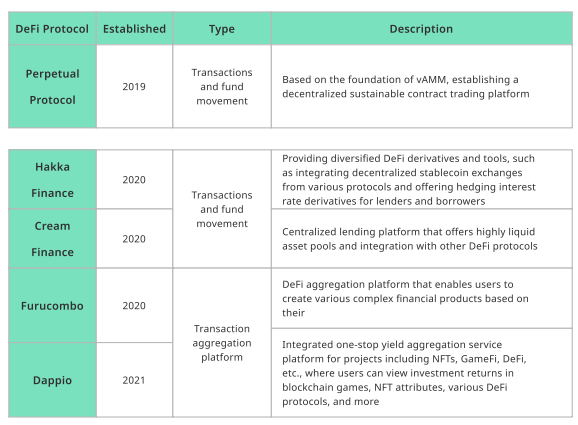

With the growing list of reputable DeFi applications in Taiwan, a forward-looking regulatory perspective alongside more purposeful local efforts could be a key catalyst for setting the region up as a hub for not just blockchain technology, but Web3 as a whole.

None Capital’s Taiwan Blockchain Industry Report 2023 is available for download HERE.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief