March was an exciting month for crypto, with volatile markets and many new projects emerging. While there have been a wealth of opportunities, some of them stand above their peers in terms of innovation and usage.

With DeFi continuously evolving, here are three projects that could make waves in the near future.

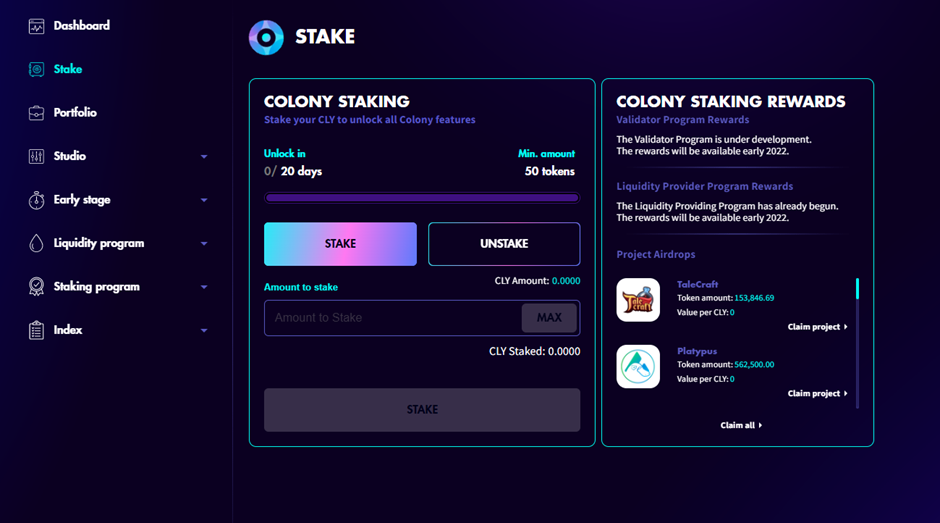

Colony Lab (Avalanche Network)

Colony Lab recently launched on Avalanche, with a future-oriented and community-driven approach. Having received support from the Avalanche Foundation, their main goals include advancing DAOs and incentivizing the next generation of dApps on Avalanche.

Functioning similarly to a Venture Capital (VC), Colony encompasses a spirit of community, open governance, and inclusion. They are also looking for opportunities to bring liquidity to Avalanche, as well as providing capital and securing the network.

While only in beta, the protocol enables a number of essential functions through smart contracts.

Some of the Key Features include:

- Powering Early-Stage Funding Projects

- Provide Liquidity to existing Avalanche Protocols

- Purchasing and staking $AVAX and upcoming subnet tokens

Having established ties with the Avalanche Foundation means that they are expected to share deal flow, creating a strong foundation for future projects. Their framework also allows investors to become more in tune with the ecosystem, promoting holistic growth.

Colony’s team will be vetting promising projects through a rigorous investment process using industry experts. If selected, Colony’s network of investment firms will help fund these selected projects so they can focus on quality instead.

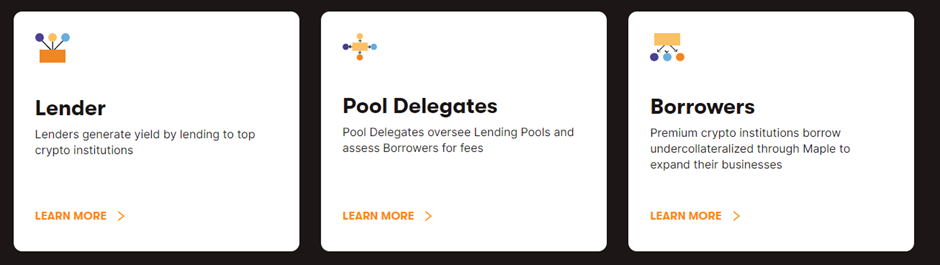

Maple Finance (Ethereum Network)

Maple Finance is a lending platform for institutions and Corporations. With more than $800 million of liquidity provided, it is no surprise that this protocol has been featured on top news platforms (Bloomberg, Messari, Coin Telegraph, etc).

There are three main functions of Maple Finance: Lending, Pool Delegation, and borrowing.

Lenders have the option of choosing between sustainable yield, capital preservation, or security.

Profitable crypto institutions are the main source of yield, alongside staked capital. In addition, all its smart contracts have been audited, and are visible on-chain.

Top VCs such as Dragonfly Capital, Flow Ventures, Spartan, and Nascent are all Maple lenders.

Pool Delegates are responsible for negotiating loan terms with borrowers, performing due diligence, and liquidating collateral in the event of a default. They also look into the profiles of corporations to evaluate relevant loan terms.

Borrowers, on the other hand, have the flexibility to discuss loan terms, unlike other decentralized protocols. Some well-known firms doing this include Alameda Research, Framework, and Amber.

Maple Finance is looking to achieve $2 Billion in liquidity by June, and more than double that by year-end. They plan to continue creating more products that generate economic value for both token holders and users.

As they liaise directly with institutions, more institutional liquidity can be onboarded into crypto. This could be a major catalyst for triggering a bull run when macroeconomic conditions are ideal.

The Graph

The graph was a notable feature in The Block’s 2022 Digital Asset Outlook Report. Their ability to group data into open APIs known as subgraphs is pivotal to DeFi applications. Making data more accessible is also crucial for DEXes to operate efficiently.

The graph enables applications to achieve high throughput with low costs, without sacrificing decentralization. Having processed over 1 billion queries since 2020, the network will be essential for the future of finance.

Centralized indexing protocols vs @graphprotocol 👨🚀

— MardΞni (🧱, 🚀) #StandWithUkraine 🇺🇦 (@Mardeni01) April 2, 2022

If your dApp is querying data from the blockchain using a centralized solution, then you should delete the d and just call it an app.

The Graph is the only protocol that solves the "single-point-of-failure" issue. pic.twitter.com/ayLRvxG2Wx

Without it, popular dApps like Aave, Uniswap, or Curve Finance would not exist. Decentraland also uses The Graph’s information to locate land, accessories, and collectibles across applications and bring them to the marketplace for users to trade.

Querying data is something that will be essential as the Metaverse, DeFi, and Web3 narratives develop. In fact, this has led to a projected 212% revenue increase by 2026.

Closing thoughts

Sometimes, it is good to look not just look for farming or money-making opportunities, but also at the exciting projects that could shape the future.

Decentralized Finance is an ecosystem that needs its parts to co-exist in order to thrive. Bringing liquidity in, providing price oracles and relevant data are some important features required for success. Looking at utility and what these protocols can contribute are important when choosing the projects your wish to back financially.

Featured Image Credit: How To Geek

Also Read: 19.63% APY? Here’s What You Should Know About Staking UST On Binance Vs. Anchor Protocol

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!