The largest centralized exchange (CEX), Binance, recently announced a new UST (TerraUSD) staking program with up to 19.63% APY.

#Binance Staking launches $UST staking with up to 19.63% APY@terra_money

— Binance (@binance) April 6, 2022

➡️https://t.co/kCjp27H8nl pic.twitter.com/IWMRxHnrnE

The staking program will allow over 30 million Binance users to stake UST in-house and be able to get yield similar to Anchor Protocol’s levels.

This is revolutionary as stablecoins like UST are generally not able to generate such a high yield. This opens up the opportunity for risk-averse individuals to farm yield with peace of mind.

Read more about Anchor here: Earn Yield From Stablecoins: Where You Can Stake Them And How Much Interest You Can Earn

Too good to be true?

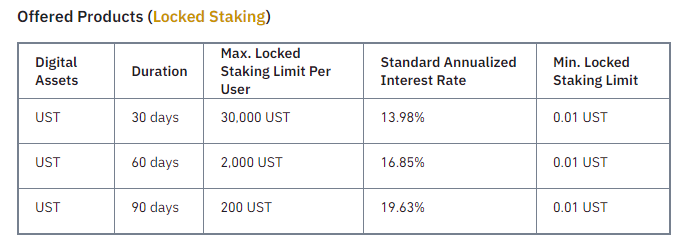

Binance users can only get the sweet 19.63% APY if they stake it for 90 days. Anything lower than 90 days would see a slide of APY to as low as 13.98% APY for 30 days.

13.98% APY is still arguably better than what traditional finance banks are offering on their fixed deposit rates.

Another important thing to note is the amount of UST you can stake on each tier. You can only stake up to 200 UST for the 19.63% APY.

Many users were unhappy that you can only stake 200 UST for 19.63% APY and would rather leave their UST in Anchor protocol.

Binance or Anchor Protocol?

Personally, I would stick to Anchor Protocol because of the following reasons:

- Liquidity — No locked staking

- No staking limit

- Similar APY

While Binance is by far less risky compared to Anchor Protocol, I do believe that Anchor Protocol is relatively safe as it is battle-tested and has gone through multiple security audits.

Always keep in mind that there might be some smart contract risks as the protocol is constantly upgraded to ensure it stays relevant in the DeFi world.

Goodbye fixed APY

1/ With the passing of Prop 20, Anchor will now implement a more sustainable semi-dynamic Earn rate!

— Anchor Protocol (@anchor_protocol) March 24, 2022

Let’s cover what this will look like 🧵

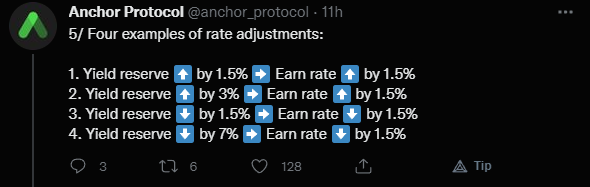

Anchor Protocol recently passed Proposal 20, which will shift from the fixed 19.5% APY to a more sustainable dynamic interest rate.

The dynamic rate would readjust every month based on the yield reserve performance for that month.

There is a hard cap on rate adjustment of 1.5% per month. The above example would show the earn rate would change based on the yield reserve.

Hopefully, this long-awaited change will help turn Anchor protocol into a self-sustainable protocol that will continue to provide attractive yields to the Terra community.

Also Read: Anchor Protocol’s Stablecoin Rates No Longer Fixed At 20% – What Does This Mean For Investors?

Can Singaporeans stake UST on Binance?

Singaporeans rejoice! We can still stake UST on Binance for the 19.63% yield.

Unfortunately, to stake on Binance you will have to transfer your UST into Binance from other sources, as spot trading on Binance is not allowed in Singapore.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Over US$100 Million: Here Are The Top 5 Marketing Plays By Crypto.com