Trader Joe may be a rather familiar name for some DeFi enthusiasts, and especially so for those involved in the Avalanche ecosystem.

For unfamiliar readers however, TraderJoe is a decentralized exchange (DEX) that allows for swaps (just like Uniswap). It also offers features such as a lending aspect (Banker Joe) where one can deposit capital for yield or use it as collateral to take out loans from.

Exposure to this project was via $JOE, its governance token. The project was launched in July 2021.

Since the Avalanche Rush and period of growth for the ecosystem, $JOE has easily gained the reputation for being a “blue chip” in the ecosystem and had a remarkable run from late August 2021, growing to as fast as 1 billion TVL locked by the end of September.

The rise of $JOE was partly due to the rising popularity of AVAX’s chain and the inflow of money coming in due to last year’s Avalanche Rush.

Buying and farming a DEX during the initial DeFi blowup was proven to be a popular strategy for degens. However, Pangolin, the first decentralized exchange built by Ava Labs did not have the success $JOE did.

Despite launching much later, $JOE differentiated itself by offering a sleek and unique user interface for users: one interesting design choice was the inclusion of charts and candlesticks right beside the swapping features, compared to the older Uniswap/Sushiswap design.

Trader Joe was also quick in launching new farms for LPs during this period, allowing it to aggressively capture massive TVL and trading volume. In fact, they even had a simple guide for liquidity providers (LPs) to migrate liquidity from Pangolin to JOE.

This strategy allowed for Trader Joe to flip Pangolin in both TVL and trading volume. In fact, a virtuous cycle happened: as the TVL of the DEX increases, the greater the pool depth and the lesser the slippage for users.

This attracts more users to trade on the DEX and generates more trading volume and revenue for liquidity providers. This attracts liquidity providers to stay or for more liquidity providers to join in, increasing the TVL and kickstarting the cycle again.

Their successes were not unnoticed by investors. By September, Trader Joe had already raised $5 million in a strategic sale led by Defiance Capital, GBV and Mechanism Capital.

Notable investors also included Stani Kulechov (AAVE), 3 Arrows Capital, Delphi Digital and even the Avalanche Foundation.

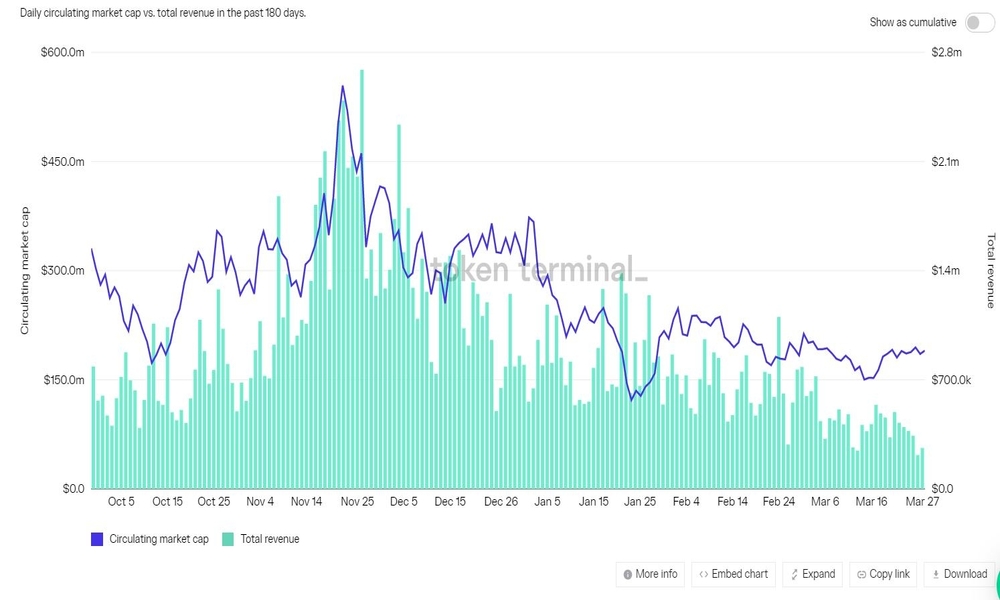

All of these success snowballed and Trader Joe would boast an ATH in TVL of US$2.5 billion and a market capitalization of US$554 million.

Trader Joe’s fall

The hype phase for JOE would fade away however and JOE would eventually revert back to the mean.

As the narratives shifted to a variety of new EVM compatible chains popping out and taking some market share, JOE’s revenue and market cap would plummet after it peaked in November.

Why was this the case? Simply put, there was a general lack of demand for the JOE token, as well as inflationary tokenomics kicking in from DeFi.

While JOE was using a similar model from Sushi, where you could stake your JOE into xJOE for a portion of protocol revenue, the reward token given out was simply more JOE tokens, allowing for farmers to use the classic farm and dump strategy.

It was the classic case of what happened when people and early users started taking profit on their high APY farms.

Furthermore, it was also possible to initiate the classic “Pool 1” strategy with JOE: using stables or non-JOE tokens to farm and dump rewards. In other words, it was possible to earn yield on JOE while retaining almost zero exposure to the token.

While Trader Joe continued to pull in consistent revenue from trading volume and lending fees from Banker JOE, the DeFi farming meta favored a strategy that was unfriendly to JOE holders.

Resurgence?

The JOE team is of course aware of this — in fact they have revamped their tokenomics to provide more utility for their token and prevent farm and dump strategies. — namely rJOE, sJOE and veJOE. Users would be able to stake their JOE into either of the 3 methods.

Solution 1: rJOE

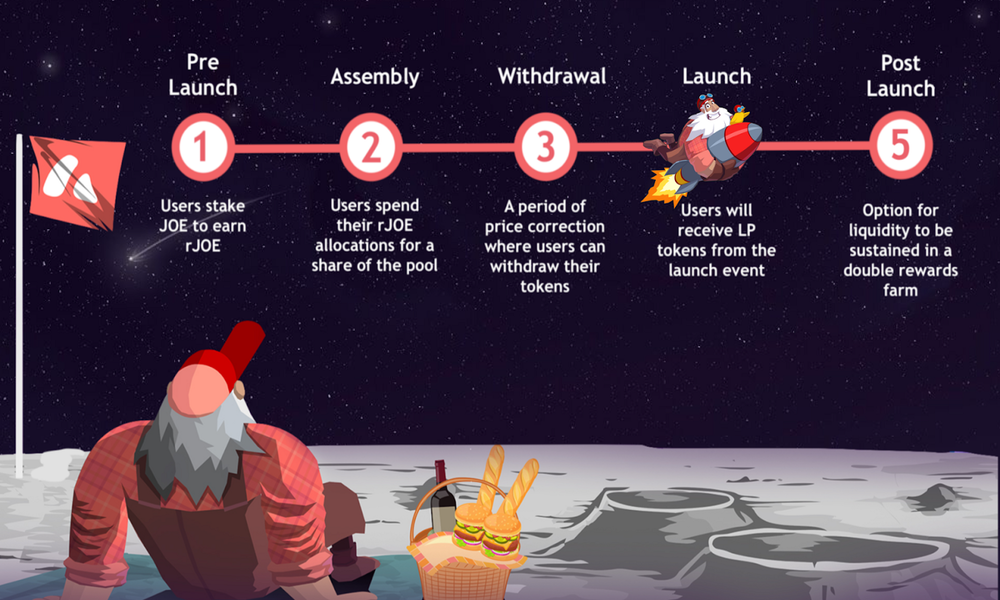

TraderJoe has in fact launched RocketJoe in February, which acts as a launchpad for users to invest in new upcoming projects on Avalanche. Users stake their JOE token into rJOE to gain access to Rocket Joe launches of new projects. Notable projects included Vector Finance, Echidna Finance, Fief Guild and Heroes of NFT.

Some other benefits are that liquidity pools are already established prior to the launch, and these liquidity pools discourages frontrunning and sniping that are prevalent in launches. This allows for users to get tokens at better and fairer prices. Projects that launch on Rocket Joe will also have protocol owned liquidity.

Therefore, as the ecosystem grows and there is continued demand for new AVAX projects, expect to see more launches using Rocket Joe. rJOE holders can benefit from fairer launches and have better upside.

This eventually creates the network effect for Rocket Joe to be a dominant player in the Avalanche launchpad niche and also raises demand for the JOE token.

Solution 2: sJOE

The second solution would be to stake JOE into the sJOE token. sJOE earns revenue generated by the platform from trading and lending. 0.05% of trades are paid to the sJOE staking pool. Some fees from liquidations in Banker Joe would also go to sJOE as well.

Rewards would be paid in the stablecoin USDC and can be harvested any time. There are also zero unstaking fees. Only a small flexible deposit fee is taken when you stake JOE into sJOE. This fee is dependent on the level of JOE already staked into the pool and caps at maximum 3%.

Yields being paid in stablecoins also tackle the problem of JOE selling pressure when they are emitted as rewards from farming it in DEX liquidity pools or borrowing/lending rewards on Banker JOE.

Solution 3: veJOE

Their final solution, veJOE is a vote escrowed tokenomics system. In short, lock your token for a longer period of time for governance and a higher boosted yield.

veJOE holders can earn boosts on their farms up to 2.5x. Users stake their JOE for extended periods of time to earn veJOE.

The more JOE staked into veJOE, the more veJOE you earn over time. The more veJOE you have, the higher the farm yields as well.

There is also a boost function where one If one unstakes JOE they lose all their accrued veJOE. More details on this thread below:

The recent launch of veJOE could be the missing piece needed for $JOE tokenomics to be complete and manage the sell pressure that’s been happening on $JOE for some time now.

— Omar 🔺️👁🔺️ 187 🧹 (@OmarOnChain) March 27, 2022

Let’s see how this works and how veJOE can help @traderjoe_xyz can reach it full potential.

The veToken system is similar to how CRV utilizes their veCRV model and I believe this feature may be the most interesting out of their new solutions. The veJOE system has potential for aggregators and an extra “layer” to be built on top of JOE.

For example, Convex Finance was a product that was built on top of Curve’s tokenomics, allowing for users to earn increased CRV rewards without the need to lock their own CRV tokens.

In fact, one such project called SteakHut Finance already exists as of the time of writing – the Curve Wars and Platypus Wars may just be a glimpse on what future “JOE Wars” may look like.

Closing thoughts

Firstly I believe that Avalanche is here to stay, especially after the various developments and buzz around the recent Barcelona conference. A summary of what the team has delivered may put their hard work into perspective. The team has created a

- Decentralized exchange with consistent good trading volume on Avalanche

- A lending protocol that allows for users to deposit for yield and take loans for collateral

- A launchpad to boost fair launches for new tokens and projects on Avalanche

- A variety of methods to lock up and stake the token (alleviating the problems associated with DeFi “ponzinomics”)

Is there more down the road? Absolutely. In fact, TraderJoe has even teased its upcoming NFT marketplace, titled as JOEPEG. A sneak peek at what projects and NFTs that are already collaborating with them can be found in their Twitter.

Trader Joe may have a lot of ambition, yet it seems to hit the mark for their product launches. It is in my opinion a silent builder and a key DeFi building block in the Avalanche ecosystem — a sign of a project that deserves close attention.

Featured Image Credit:

Also Read: A Look At The Game Changing Trends And Key Innovations In DeFi Today