Avalanche (AVAX), has been experiencing breakout growth in the last few months, with a 600% growth in its native token price since late July.

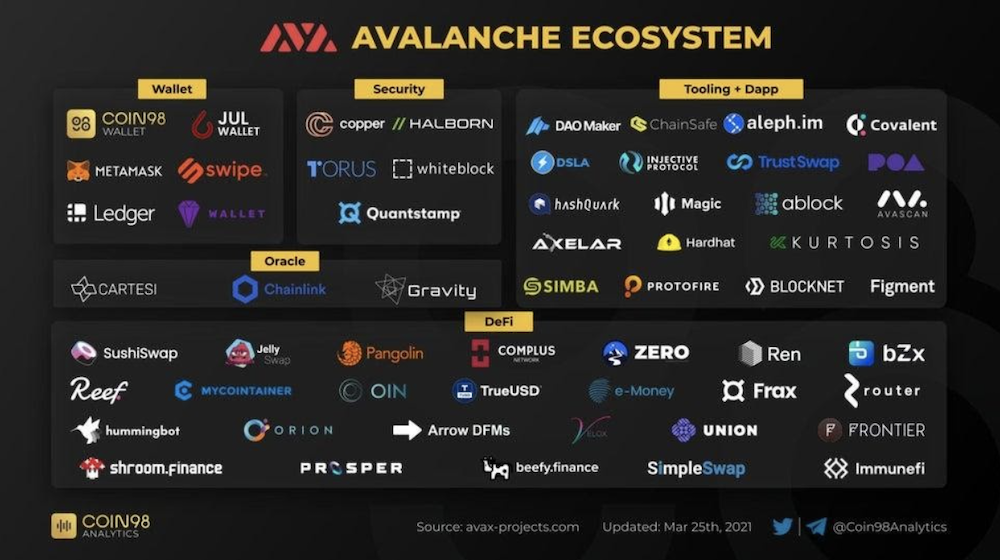

The run-up has been thanks to not only larger market moves, but also significant interest in the Avalanche ecosystem — particularly in the DeFi, NFT and smart contract spaces.

What is Avalanche (AVAX)

Avalanche was founded in 2018 by computer scientist and Cornell University professor Emin Gün Sirer and was eventually built by AVA Labs, a software development company based in 2018.

The layer 1 network consists of three integrated blockchains validated by a common set of validators: the Exchange chain (X-Chain), Platform chain (P-Chain) and Contract chain (C-Chain). Each blockchain facilitates their own use cases, while allowing all participants on the Avalanche network to be on the same page.

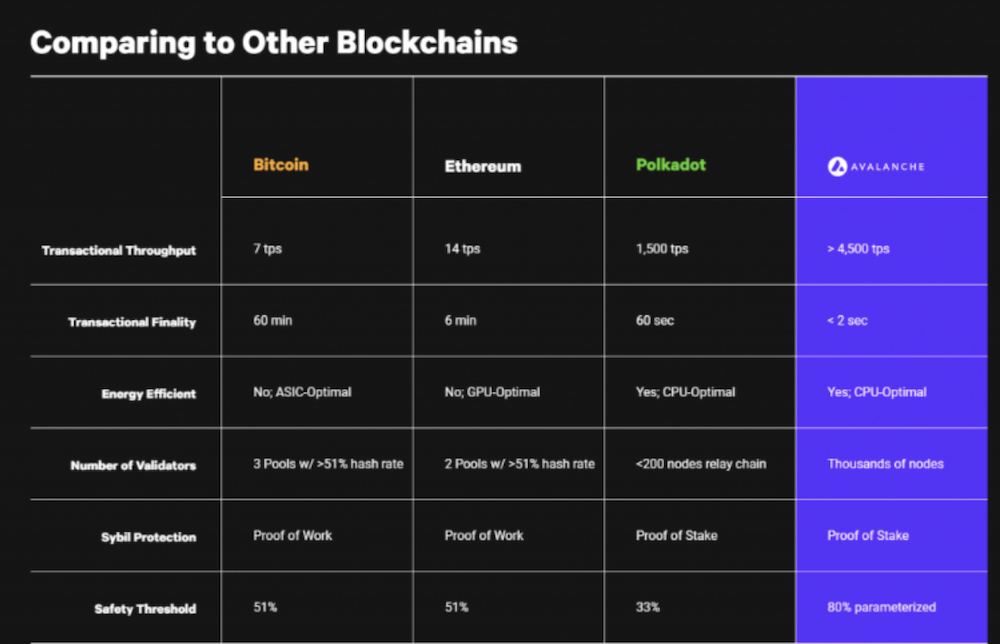

High TPS (Transactions Per Second) scores and low fees has helped the Avalanche ecosystem expand rapidly to include use further cases such as decentralized insurance and gaming.

The Avalanche foundation also helps to support such projects through grants, token purchases and more recently, their $180M liquidity mining protocol — Avalanche Rush.

The protocol encourages participants to enter the Avalanche ecosystem, rewarding them for their participation in the form of AVAX tokens.

What is Avalanche Rush?

The Avalanche foundation’s $180M liquidity mining program is finally out in its first stage, onboarding DeFi (Decentralized Finance) protocols Aave and Curve to the Avalanche public blockchain.

The program, rolled out to incentivise usage of Avalanche’s layer 1 blockchain, rewards users for lending or borrowing with DeFi with not only interest on deposited tokens, but also WAVAX (Wrapped AVAX) tokens, which can be converted back to AVAX at a 1:1 ratio.

After a slight delay, the program is currently in its first phase, with $20M and $7M AVAX allocated for Aave and Curve users respectively.

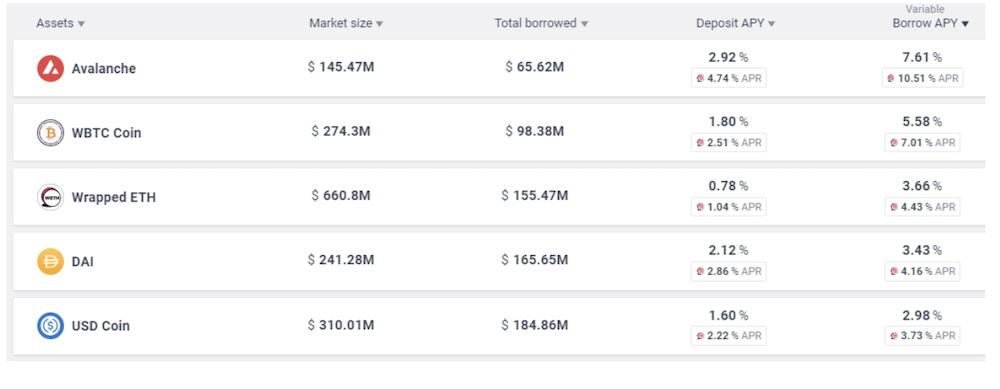

Currently, net deposit APY (Annual Percentage Yield) for AVAX yields 2.92% in the native currency and an additional 4.74% in WAVAX.

Lending Bitcoin instead yields 1.80% in WBTC (Wrapped Bitcoin) and 2.51% in WAVAX. Furthermore, these deposits can be collateralized and borrowed against to increase your deposits.

This borrowing lends itself to favourable conditions, with the rewards from AVAX outweighing almost all borrow rates currently on Aave, making borrowing essentially profitable or almost free. With rewards from the liquidity program currently outweighing borrow APY, it is a plausible strategy to compound returns.

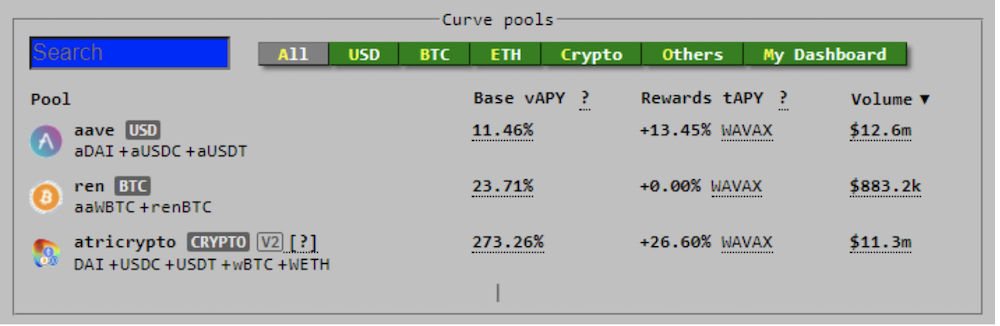

Curve also offers extremely attractive rewards, paid out by asset rewards on top of swap fees from various protocols. However, take note that the trading pairs on curve are slightly more complicated and usually come with further risk of impermanent loss, and therefore should be approached with caution by newcomers to DeFi.

Risks

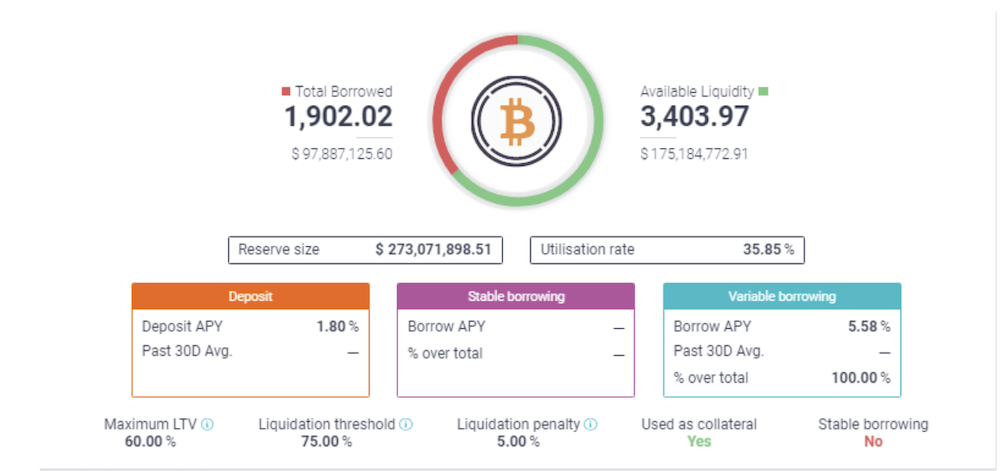

Though all yield farms carry some risk, Aave and curve are known for having measures in place to protect both sides. Borrowing against your deposits carries the most worry here, due to liquidation risk which occurs when the collateral’s value dips too much against the borrowed asset.

Using Bitcoin as collateral carries a 75% liquidation threshold and going under the threshold means either having to increase your collateral or get liquidated, forfeiting the loan and paying a 5% liquidation penalty fee.

However, thanks to overcollateralization, these situations would only occur during violent overnight price swings, which are becoming less and less common, especially for blue-chip cryptos.

How to get started with Avalanche

To get a piece of the $180m pie, you must first be able to deposit and withdraw AVAX. To do so, you need a browser extension wallet, such as MetaMask.

Also Read: How To Use MetaMask To Take The First Step Into The World Of Decentralized Finance

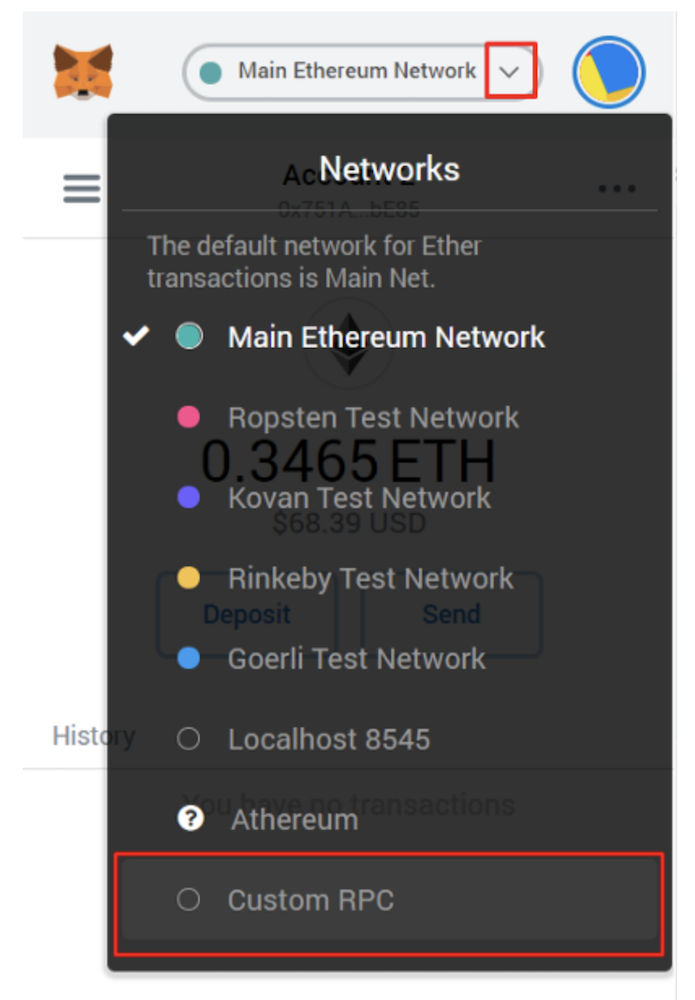

Once installed, click on the browser extension and select Ethereum Mainnet at the top. From the list of networks, select “custom RPC”. To connect to the Avalanche Network, fill in the following:

- Network Name : Avalanche Network

- New RPC URL: https://api.avax.network/ext/bc/C/rpc

- ChainID: 43114

- Symbol: AVAX

- Explorer: https://cchain.explorer.avax.network/

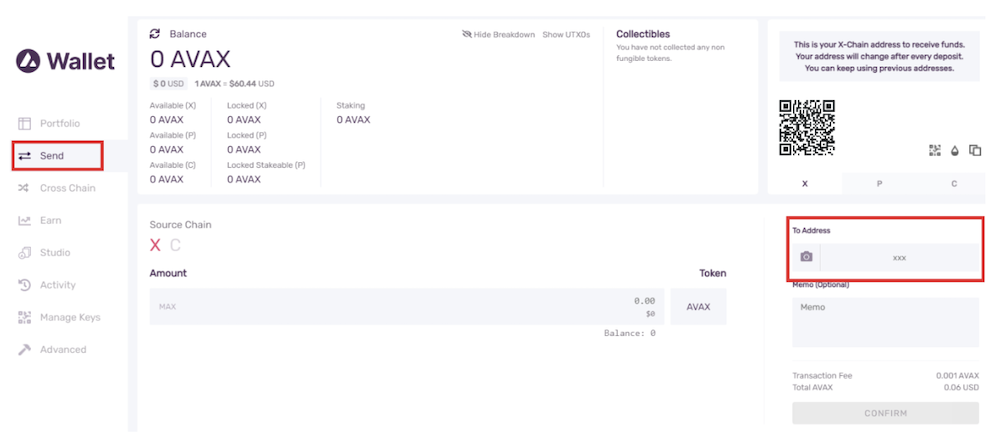

Next, head over to https://wallet.avax.network/ to create an Avalanche wallet. To transfer AVAX to your Metamask account from your, you first need to transfer it to the cross chain (C chain), one of 3 chains used by Avalanche for various purposes.

If you already have AVAX in your web wallet, click on the cross chain on the left side of the screen, and change the destination chain from P chain to C Chain. Key in the amount you would like to send and click confirm to complete the process. Take note that there is a minor transfer fee for this, usually 0.001 AVAX per transaction.

To send the AVAX to Metamask, click send and select the C chain. Copy the Metamask AVAX address, found near the top of the web wallet, and input it in the address field on the right side of the screen. Once the amount is entered, click confirm and then send transaction.

If you don’t have any AVAX, you can purchase some on exchanges such as Gate.io, Huobi and KuCoin. Take note that some exchanges have the option of sending to the cross chain directly, making it easier to transfer AVAX between accounts.

Mid-term, Avalanche Rush’s liquidity mining program is a great place to yield farm, generating extremely competitive rates in a safe environment.

Moreover, the $180million initial amount may be under reported, as it was $180million worth of tokens set aside for the program on 18 August.

Since then, the token’s price has already increased 3-fold and the actual dollar amount available for the project would probably be closer to $600M USD.

The liquidity program was also introduced to expand Avalanche’s already wide ecosystem in order to incentivise users to participate.

If you’re in the project for the long haul and already bullish AVAX, reinvesting the token into the various DeFi projects available and staking for the long haul may be the best route to pursue as the token’s price targets continues on its upwards climb.

Featured Image Credit: Avalanche

Also Read: DeFi Kingdoms: The Number 1 Project On Harmony One With A TVL Of US$140 Million

If you find this useful, do follow us on our socials to build a crypto community together!

Facebook: https://www.facebook.com/chaindebrief

Twitter: https://twitter.com/ChainDebrief

Instagram: https://instagram.com/chaindebrief

Telegram Channel: https://t.me/chaindebrief

Telegram Community: https://t.me/joinchat/Q3MVCzJrnOM1MzM1