The crypto market’s volatility is influenced by various factors, including information. Staying informed about real-time and upcoming events can greatly impact cryptocurrency investments and trading strategies.

These market-moving events, also known as catalysts, have the power to shape the market and create new narratives. Including catalysts as a part of research metrics can significantly alter investment outcomes.

As we enter Q3 2023, here are some noteworthy upcoming events that could impact the crypto market.

1. Delisting Of Tokens From Retail-Focused Exchanges

Popular trading and investing platform eToro is set to delist tokens the SEC listed as securities from their platform.

eToro which is based in Israel announced that as from July 12th, its U.S customers won’t be allowed to buy $ALGO, $MANA, $DASH and $MATIC.

Holders of the above tokens based in the U.S can sell and hold

them but can not buy via eToro after July 12th.

Another trading platform Robinhood declared that as from the 27th of June, they will delist $SOL, $MATIC and $ADA.

Robinhood which had 15.9 million users in 2022 made it known that its users who hold any of the above-named tokens in their wallet after the end of June will have their tokens sold at market value.

Retail investors using this platform won’t have access to buy these tokens after their respective deadline on Robinhood this amount to 15.9 million users.

Let’s see the effect this might have on the price of these tokens and if other investment platforms based in the USA will also delist these tokens.

Read: 4 Market-Moving Crypto News Stories You Might Have Overlooked This Week

2. The SEC’s Continued Crackdown on Crypto

The Securities and Exchange Commission (SEC) sued Binance, the world’s largest cryptocurrency exchange by volume and its CEO Changpeng Zhao for violating US derivatives rules including providing trading services for securities they listed BNB, Solana and more as securities this was reported on the 5th of June.

A day after this SEC went after, the second largest cryptocurrency exchange platform Coinbase claiming that the exchange was operating as an unregistered broker, unregistered trader and unregistered clearing agency.

In this suit, SEC listed $ADA, $MATIC, $NEAR, $DASH and more as securities.

The SEC has named these 19 tokens as securities throughout the Binance + Coinbase filings.

— Miles Deutscher (@milesdeutscher) June 8, 2023

This could have massive implications for these tokens, and the industry as a whole.

Some quick thoughts.👇 (1/9) pic.twitter.com/kYQTK8lvoe

These crackdowns on crypto by regulatory bodies and government agencies can send shock waves throughout the market hence the reason why it is important to keep tabs on the latest developments regarding regulatory agencies.

So going into Q3 2023, cryptocurrency investors should keep up with this development, especially regarding tokens claimed to be securities by the SEC to know how to position themselves.

Read: SEC Sues Binance and CEO “CZ”, Claims BNB and BUSD are Securities in Latest Filings

3. Upcoming CPI data and Upcoming FOMC Meeting

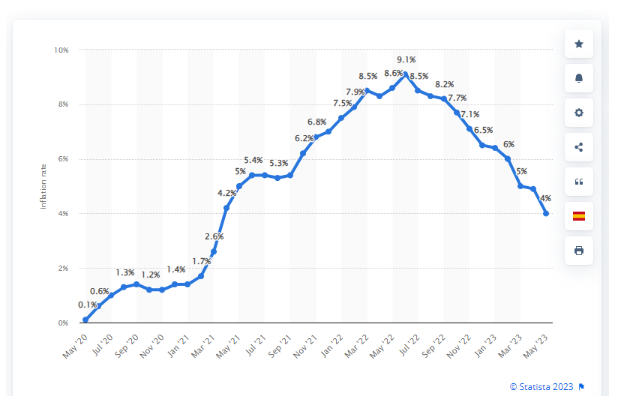

The last Consumer Price Index data for the month of May was one of the most anticipated ever, coming in at 4%, the lowest levels in about two years.

Source: Statista

This had a profound effect on the outcome of the Federal Open Market Committee (FOMC) meeting as they paused hiking interest rates for the first time since March 2022 leaving it at 5%-5.25%.

Some see this pause in interest rate hikes as hawkish i.e. temporary as the FEDs’ main aim is to bring inflation to 2% leading to speculations of the possibility of two more interest rate hike by the FEDs before the end of the year.

Increasing Interest rate affects borrowing (increases the cost of loans) and investing, especially in high-risk assets such as crypto, making relatively “safer” investments like government bonds more attractive.

The CPI data for June will be released by the Bureau of Labor Statistics on July 12th and the FOMC meeting is scheduled for July 25th-26th.

4. Institutional Interest in Bitcoin Spot ETF

Are you looking to invest in Bitcoin and take advantage of its price action without the need for private keys, wallet or even owning Bitcoin?

Then spot Bitcoin ETFs are for you, Exchange Traded Funds (ETFs) track the price of the underlying asset providing investors with exposure to the price movement of the asset without requiring investors to own or store the asset.

Blackrock, a multi-national investment company that has $10 trillion worth of assets under its management filed for spot Bitcoin ETF on Thursday 16th of June using Coinbase for custody and market pricing.

Blackrock was followed by WisdomTree a company that has $87 billion in assets under its management re-submitted an application for regulatory approval to the SEC(Securities and Exchange Commission) on the 20th of June.

JUST IN: $87 billion asset manager WisdomTree files for spot #Bitcoin ETF.

— Watcher.Guru (@WatcherGuru) June 20, 2023

WisdomTree intends to list its ETF if approved on Cboe BZX Exchange under the ticker “BTCW”.

Atlanta-based Investment company Invesco joined the spot Bitcoin ETF race. Invesco which oversees $1.49 trillion in assets teamed up with Galaxy Digital to file for the Invesco Galaxy Bitcoin ETF.

JUST IN: #Invesco reapplied for a Bitcoin ETF following BlackRock's application, advocating for more crypto investment products.

— Coingraph | News (@CoingraphNews) June 21, 2023

All of this institutional interest boosted market sentiment and the price of Bitcoin Jumped.

Source: Coingecko

BTC went from $25,080 on June 15th to a yearly high of $31,185 by June 23rd, Let’s see if BTC will be able to maintain above $30,000.

Will the SEC approve any of these ETF proposals?

Many are optimistic that they might approve especially because of Blackrock’s ETFs approval track history. Blockrock has applied for ETFs 576 times with 575 approved and 1 rejected.

After 28 #Bitcoin ETFs applications getting rejected, many have become jaded and lost hope.

— Coin Bureau (@coinbureau) June 25, 2023

However, this #BlackRock application is the most promising yet.

They have a 575-1 win ratio and I doubt they would be making this if they weren't fairly confident 🧐

The SEC in the past repeatedly rejected spot Bitcoin ETF raising concerns over cryptocurrency’s volatility and market manipulation.

Will more institutional players file for Bitcoin ETF?

Well, I guess we will have to watch and see.

Read: BlackRock Files For Bitcoin SPOT ETF: Here’s Everything You Need To Know

Closing Thoughts

Another subtle event coming up in Q3 is the Litecoin (LTC), halving set for the 2nd of August, 2023.

Also always keep up with token unlocks as these are very interesting times as the circulating supply of the token increases.

All in all, it is very important to keep up with trends, market updates and news in other to be aware of market-moving events and potential catalysts.

A good way to start is by subscribing to our free weekly newsletter to get live updates and never get left behind.

Read: 10 Huge Upcoming Crypto Unlocks and How To Trade Them.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief , Author: Godwin Okhaifo