With the spotlight fixed on The SEC, Binance, and Coinbase this week and dominating social media platforms, it’s no surprise that some noteworthy happenings in the Web3 space have slipped under the radar.

Despite not capturing the same level of attention within the crypto community as the recent lawsuits, these developments undoubtedly hold the capacity to sway markets and affect investors and traders.

Also Read: We Are in A Crypto Liquidity Crisis – But The Reason is Not What You Think

1. The CFTC’s “Precedent Setting” Court Battle With Ooki DAO

Late last week, the Commodity Futures Trading Commission (CFTC) won a default judgement in the United States against Ooki DAO, an DeFi margin trading and lending platform.

The CFTC had initially filed the lawsuit against Ooki DAO in September 2022, with the judge ruling that Ooki DAO was to permanently shut down and pay a penalty of approximately USD$640,000.

Although no representative for Ooki DAO showed up to debate the lawsuit (hence the default judgement), the larger implication is the judgement that a decentralized autonomous organization could be held liable for legal violations as a “person” under the Commodity Exchange Act.

Recall, that lacking a legal entity to wrap membership or BORG-like opCo to be proxy, DAO members in this case ("Ooki") may have joint & several liability to pay reg fines as an unincorporated association.

— ross (@z0r0zzz) June 9, 2023

This can mean one person can be on the hook for full court damages. pic.twitter.com/VnE6GU4eCj

“A DAO and its members can be summoned to court by just posting its forum… and another federal court has determined DAO tokens suggest general partnership” noted one Twitter user.

Despite the perception of DAOs as intangible entities, the reality is that their creators must remain actively involved in the decision-making process due to the limitations of pure automation.

Moreover, if token holders or forum participants can be linked to the DAO, it could have far-reaching consequences in the realm of legal proceedings.

This raises the possibility that DAO members might bear some degree of responsibility for the future actions and outcomes of the DAO.

Such implications highlight the evolving legal landscape surrounding DAOs and the potential accountability that may befall their participants.

Also Read: UNICEF’s Crypto Experiment: How DAOs Will Revolutionize Humanitarian Aid

2. North Korea’s Booming Bear Market

While user activity in the crypto world remains sluggish, there is one distinctive group that persists in extracting the maximum possible value from our still-nascent industry.

Unfortunately, hackers and scammers have continued to target DeFi protocols, and even wallets – a cause of concern for anyone in crypto.

Abandoned Atlantis Loans project exploited for $1.1 million

— web3 is going just great (@web3isgreat) June 13, 2023

June 12, 2023https://t.co/eq9DnT9QU4 pic.twitter.com/z62PTSghbl

This week alone, two protocols, Atlantis Loans and Sturdy Finance, were exploited for USD$1.1 million and USD$775,000 in funds respectively.

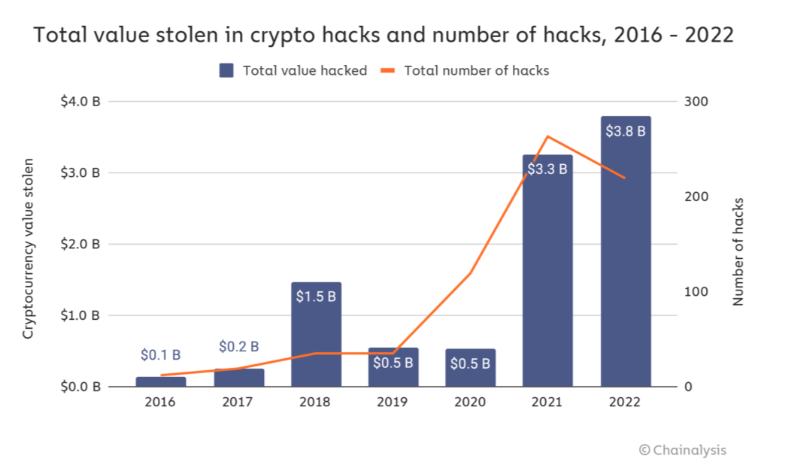

Despite Web3’s overall progression in_ recent years, it seems that the increased activity in crypto has also presented a strong correlation with hacks, with $3.8bn in exploits happening in 2023 alone.

The recent Atomic Wallet exploit, which was responsible for more than $35 million in lost funds, has also been potentially linked to the North Korean Lazarus group.

Update:

— ZachXBT (@zachxbt) June 6, 2023

Atomic Wallet Hack appears to potentially have been done by Lazarus Group/DPRK

(seeing lots of similarities in the laundering patterns to Ronin + Harmony)

The collection of crypto hackers were previously responsible for exploits such as the Harmony and Ronin Bridge hack. According to one report by CNBC, the group cumulatively stole $775.7 million stolen in just one month last year.

As we navigate deeper into the bear market, the interest in cryptocurrency will likely diminish even more if hacking incidents persist, leading to an already low risk appetite plunging further.

Not only will these events continue to affect regular adoption, but the adverse headlines such exploits bring about will only stifle regulatory outlook for crypto, especially from an outside-in perspective.

Also Read: 30 Crypto Hacks Over $30M, Broken Down

3. Almost a Million BNB Set For Liquidation

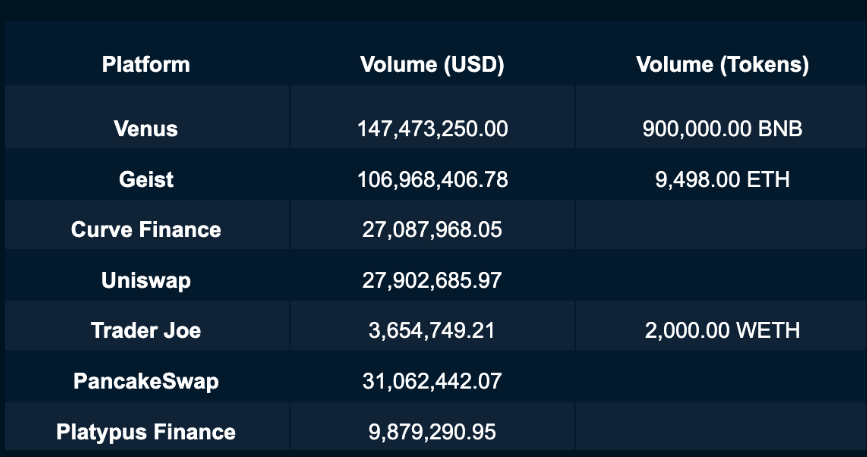

Last year, the Binance Smart Chain Bridge halted under the direction of Binance CEO Changpeng “CZ” Zhao, after an attacked managed to unlawfully issue themself 2 million $BNB tokens, valued at approximately US$566m at the time.

Although this managed to stop the attacker in their tracks, there was no unilateral decision amongst validators to rollback the network, and therefore the extra supply would remain on-chain.

The attacker then bridged their ill-gotten gains to multiple other chains, and deployed them in lending protocols to borrow stablecoins and other crypto assets against their collateral.

They also deposited 900,000 $BNB onto Venus Protocol on the Binance Smart Chain, and took out a $150m loan against it.

With the $BNB token plummeting 21% in light of the SEC’s recent actions, the attacker’s position in Venus Protocol has been put dangerously close to it’s liquidation threshold of $220.

According to the governance proposal below, the BNB Chain core will take over the $BNB position on Venus if the BNB price hits the liquidation threshold. https://t.co/MSUHLUTwTS

— BNB Chain (@BNBCHAIN) June 12, 2023

While the team behind the BNB chain has prepared to undertake the arduous task of liquidating 900,000 $BNB, it still represents approximately 0.6% of the entire supply.

At current prices, this represents ~USD$200m in tokens which could potentially be offloaded into the market, albeit in stages, during bearish conditions.

Also Read: SEC Sues Binance and CEO “CZ”, Claims BNB and BUSD are Securities in Latest Filings

4. U.S. Regulatory Landscape Prompts Pre-emptive Moves From Crypto Companies

As the SEC continues to remain opaque regarding crypto regulations, companies located in the United States have begun taking precautionary actions to avoid potential legal concerns in the region.

Crypto.com, a leading centralized exchange platform, recently announced that they would be shutting down institutional trading in the US.

Citing limited demand from institutions and the current market landscape as the main reasons for doing so, some have suggested that their sudden announcement comes in light of the SEC’s recent actions against Binance and Coinbase.

BREAKING:

— whalechart (@WhaleChart) June 7, 2023

Robinhood to delist tokens named in the SEC lawsuit against Binance and Coinbase. This includes Solana, Polygon and Cardano.

Companies that offer crypto services to retail clients have also taken to delisting any tokens that the SEC has labelled as “securities”.

1. SEC alleges that Coinbase was operating as an unregistered exchange, broker, and clearing agency

— Chain Debrief (@ChainDebrief) June 6, 2023

It also notes several cryptocurrencies as "securities", including #MATIC, #ICP, #NEAR, #DASH, and more.

Full non-exhaustive list attached pic.twitter.com/GLvUKZCgKS

Robinhood, a popular commission-free application for customers to trade cryptocurrency and stocks, for example, has made public their intentions to delist Cardano (ADA), Polygon (MATIC), and Solana (SOL) following a recent review.

eToro, a similar trading platform, has announced that they will be removing Polygon (Matic), Algorand (Algo), Decentraland (MANA), and Dash (DASH) for U.S. Customers.

Over the weekend, renown venture capital firm Andreessen Horowitz, better known as a16z, also announced the establishment of their first international office in London.

The country that properly incentivizes decentralization is going to win web3 and reap the benefits.

— miles jennings | milesjennings.eth (@milesjennings) May 3, 2023

Recognizing this, many in Congress want to foster decentralization. The SEC’s only plan is to attack it. pic.twitter.com/CNCCporbRJ

With companies seemingly shifting away from the United States as a crypto hub, it seems that Web3, unironically, is starting to get more decentralized.

Also Read: Bitstamp’s CEO on Regulation, Bear Market Building & Seeing Bitcoin at $200

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief