As the world of cryptocurrencies continues to evolve, it is becoming increasingly apparent that we are witnessing a significant liquidity crisis within the crypto market.

This dramatic shift is having far-reaching consequences, and it is of utmost importance that we understand the factors contributing to this liquidity squeeze and consider the potential implications for the future of the crypto industry.

At the heart of this liquidity crunch lies the recent issues with the banking settlement layer of the crypto markets.

Notably, two critical platforms, Silvergate Exchange Network (SEN) and Signature Bank’s Signet, have faced significant challenges, thereby disrupting the instant settlement services they provided for the crypto market.

As these platforms provided a bridge between traditional finance and the crypto ecosystem, their struggles have sent ripples throughout the industry.

Also Read: What Bitcoin’s Evolving Supply Distribution Tells Us About Decentralization

Wait, What Liquidity Crisis?

If you aren’t (yet) informed, there is clear evidence that a liquidity crisis is currently underway in the crypto market.

Just this year, two behemoth market makers, Jane Street and Jump Trading, announced that they would be reducing their crypto trading activity in the US.

This decision to reduce their activity is likely to have a significant impact on liquidity. But why have they taken this decision in the first place?

The SEC has now directly confirmed that Jump secretly bailed out the UST project, propping up the peg and prolonging the Ponzi without any public disclosure whatsoever. Jump made over $1b in profits through their dealings with TFL and Do Kwon. https://t.co/SGQwFBppoe

— FatMan (@FatManTerra) May 16, 2023

Outside of the increasing regulatory pressure, I believe that an already present liquidity barrier is to blame.

Let’s dive a bit deeper.

One way to measure liquidity is to look at the depth of order books on exchanges. Order books are a list of buy and sell orders for a particular asset, and the depth of an order book refers to the number of orders at each price level.

A deep order book indicates that there is a lot of liquidity in the market, while a shallow order book indicates that there is less liquidity.

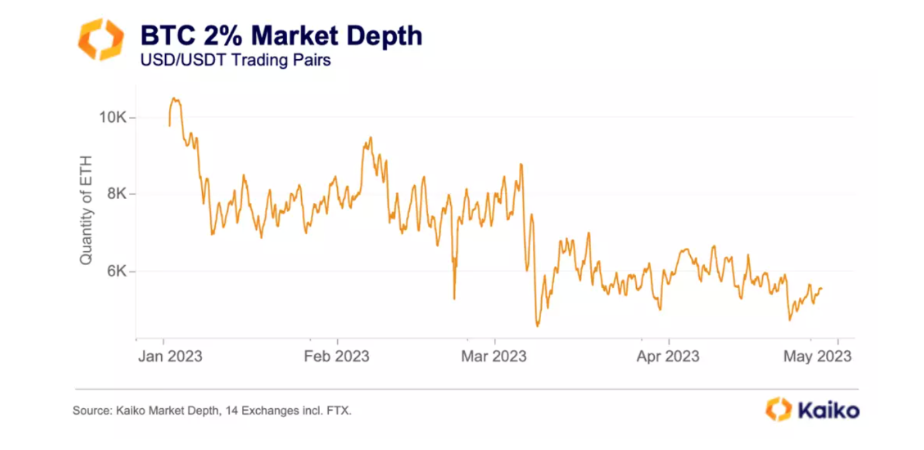

A recent study by Kaiko Data, a crypto analytics firm, found that the depth of order books on major crypto exchanges has declined significantly in recent months.

For example, the depth of the order book for Bitcoin on Binance, the world’s largest crypto exchange, has declined by more than 50% since September 2022, even prior to the recent SEC lawsuit. This decline in order book depth is a clear sign that liquidity is drying up in the crypto market.

This is having a number of negative consequences, including making it more difficult for investors to buy and sell crypto assets, increasing the risk of price volatility, and making it more difficult for businesses to accept crypto payments.

So why is this all happening?

The Power of SEN and Signet

At the heart of the issue lies the recent closure of the two major crypto banks, Silvergate and Signature Bank. These financial institutions were instrumental in facilitating the smooth functioning of the crypto market, thanks to their pioneering blockchain systems, the Silvergate Exchange Network (SEN) and Signet.

In the past several weeks, the tech banks Silicon Valley Bank (SVB), Silvergate Capital (NASDAQ: SI), and Signature have all failed, leaving many players in the digital asset market searching for new banking and financing partners. https://t.co/FDSSoSl0Jh

— veronica__ (@nicavveronica) May 16, 2023

SEN and Signet introduced a paradigm shift in how money was moved in and out of the crypto ecosystem.

Before their inception, crypto companies relied on traditional banking systems like bank wires or the U.S. Treasury’s Automated Clearing House. These methods were not only costly but also slow, operating only during banking hours, and exposed industry players to settlement risks.

The SEN and Signet networks changed all that.

They allowed for instant commercial transfers, thus eliminating the waiting period that was otherwise necessary for funds to clear.

This facilitated more efficient capital usage, as market makers did not have to tie up capital on many exchanges or wait several days for funds to clear. Major exchanges like Coinbase utilized both networks to help their institutional clients efficiently fund and settle their accounts.

A Recap of the Issues

Silvergate Bank, facing regulatory scrutiny and financial woes, discontinued its SEN platform that was used to move money to crypto exchanges.

On the other hand, Signature Bank was shuttered by New York state regulators, with its assets transferred to Signature Bridge Bank, a new interim entity run by the Federal Deposit Insurance Corporation (FDIC).

Timeline of #Crypto Crash Today:

— The Kobeissi Letter (@KobeissiLetter) March 3, 2023

1. Coinbase suspends Silvergate payments

2. SEC says crypto exchanges not "safe"

3. Crypto․com suspends Silvergate payments

4. FTX confirms $8.9 billion in missing funds

5. Crypto loses $200+ million in hours

This can't be a coincidence.

Although Signature Bank’s Signet platform continues to operate, its future remains uncertain, prompting key industry players to seek alternative service providers.

Understanding the Need

These platforms, SEN and Signet, were essential to the functioning of the crypto market. They facilitated instant settlements, allowing market makers to trade with many counterparties without taking on counterparty or settlement risk.

Market makers no longer had to tie up capital on many exchanges or wait several days for funds to clear, which improved capital efficiency. The absence of these platforms has put a strain on the market liquidity.

In traditional finance, entities like DTCC, CME, ICE act as clearinghouse firms, serving as the buyer to every seller and seller to every buyer, providing a solution to counterparty or settlement risk.

However, the crypto market does not yet have such well-established intermediaries.

Importance of A Safety Layer

While high TPS blockchains could potentially settle these transactions, the issue is more complex.

By using banking settlement layers like SEN and Signet, market makers could rely on banks for compliance with sanctions screening laws issued by OFAC (a division of the US Treasury).

Without these platforms, market makers must shoulder more risk of potentially violating these laws, which carry severe penalties.

The crux of the issue is that the crypto market, which operates 24×7, requires a similar bank instant settlement layer to unlock liquidity. The recent struggles of SEN and Signet have illustrated the consequences of losing such critical market infrastructure.

📢#Binance US to suspend USD deposits and are planning to pause FIAT withdrawal channels as early as June 13 2023

— Chain Debrief (@ChainDebrief) June 9, 2023

A recent, albeit unfortunate, example is currently unfolding due to the SEC’s lawsuit against Centralized Exchange Binance, which has prompted it’s banking partners to suspend operations with their U.S. platform.

This also follows Binance U.S. finding difficulty in establishing a banking relationship in the United States post-FTX.

And What About Centralized Systems

Unfortunately, traditional banking settlement systems like Fedwire are not equipped to handle the unique demands of the crypto market. Fedwire, although reliable and efficient, operates on a schedule that is not compatible with the 24×7 nature of the crypto market.

Fedwire’s hours of operation and inability to process transactions during weekends and federal holidays can limit the flow of funds in the crypto market, contributing to the liquidity crisis.

This liquidity crisis has far-reaching implications for the entire crypto ecosystem. Market makers are key contributors to overall market liquidity. Their ability to provide continuous buy and sell quotes is crucial for ensuring efficient market operations.

Looking Ahead

In the face of this liquidity crisis, the crypto industry is facing a tough challenge. Existing blockchain-based real-time payment networks require both the sender and the receiver to hold deposit accounts with the same bank. Thus, each bank seeking to enter the business needs to attract a critical mass of crypto participants to create a useful network.

📙 The Ultimate Guide to Liquidity 🌊

— opsec (@opsec_crypto) May 13, 2023

📜 Chapters:

I – What is Liquidity & Why Does It Matter?

II – The Core Principal Of Liquidity

III – Liquidity & Human Emotions

IV – The Technicals Of Liquidity

🔥 V – Time, Price & Liquidity (The X & The Y Axis) pic.twitter.com/pyWuapj75s

However, the closures of Silvergate and Signature have undoubtedly shaken faith in the banking industry. This crisis has made insulated networks like Bitcoin look more attractive, even as the KBW Nasdaq Bank Index fell 14% after Silvergate announced its plan to close.

As we navigate this liquidity crisis, the need for robust, efficient, and reliable systems for instant settlement in the crypto industry has never been more critical. The solution may lie in finding new banking partners or developing innovative blockchain-based systems that can replicate the features and benefits of SEN and Signet.

However, the path forward is fraught with challenges, and the industry must move cautiously but decisively to restore liquidity and ensure the continued growth and stability of the crypto market.

Also Read: TrueFi, DeFi’s Battle for Institutional Adoption, and Why You Should Care

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

This article was written by Harry Vellios and edited by Yusoff Kim