With the recent events of Silvergate and Silicon Valley Bank, the web3 industry just keeps on getting punched in the mouth.

Web3 is of course not the only industry in shambles right now; it is uncomfortably easy to start panicking when one notices the eerie resemblances of the SVB crash to the 2008 Lehman Brothers situation. Those who survived the 2008 crisis are surely experiencing flashbacks.

Regardless, industries within web3 keep getting questioned, with DeFi being one of the key ones. Despite the attention that DeFi garnered in 2019, it faces fundamental challenges that prevent institutional investors from embracing it as a reliable and useful tool for wealth generation.

But what are these challenges, and can they be overcome?

Also Read: Why Real-World Assets Are Needed For DeFi To Succeed

The Problem with Freedom

One major issue is the tension between the philosophical values of blockchain technology and the practical needs of making money. Decentralized authority and permissionless action sound great to those with rebellious tendencies, myself included.

However, these values pose serious challenges when it comes to the business of lending and borrowing money.

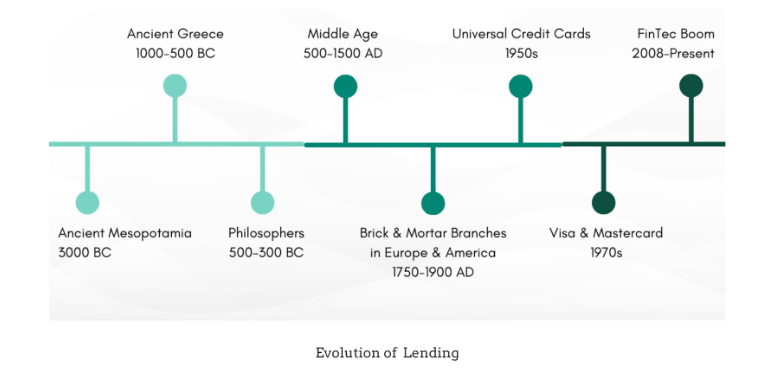

In ancient Mesopotamia, borrowing and lending was a system that relied on fear, forming trust. If you didn’t pay back on your loan on farming materials, your family would be taken as slaves.

Thankfully for the farmer, the world evolved, and with the invention of credit, such drastic measures did not need to be taken by authorities.

Credit, arguably the most transformative invention in the history of human economic evolution (see Sapiens: A Brief History of Humankind), enabled more direct mechanisms to generate trust, either through collateral (secured lending) or reputation (unsecured lending).

If you failed to pay back your loan, either your assets would be seized, or you would be exiled from the world’s financial systems.

In DeFi, where actions are anonymous, credit is impossible, and trust is difficult to establish.

To address this, DeFi has resorted to an “excess mortgage” model called overcollateralization, where borrowers need to provide collateral worth more than the borrowed amount.

Overcollateralisation effectively means that for Elon Musk to borrow $200M for a superyacht, he would need to stake $1B worth of Tesla stock to access the funds. Preposterous, right? Especially when through TradFi he would instantly be able to access the loan without any hassle, due to his credit and reputation.

In essence, DeFi finds itself at a crossroads between decentralisation and practicality.

While it has the potential to disrupt traditional finance systems (see JP Morgan’s report “Institutional DeFi-The Next Generation of Finance?”), Institutional adoption lags behind due to technical barriers such as custody, security, and UI/UX.

Until the revolution DeFi brings is greater than both the risks of getting involved in the industry and the operational hassle it requires, DeFi will be stuck in the outskirts of finance.

So, what can be done to fix this?

Revolutionizing Collateral

A series of protocols have realized this barrier, and designed systems with the vision of opening doors to mainstream adoption.

TrueFi is a DeFi protocol launched in November 2020 by crypto entrepreneur Rafel Cosman, with a clear objective:

To bring institutional investing to the web3 space, through removing the barriers of collateral.

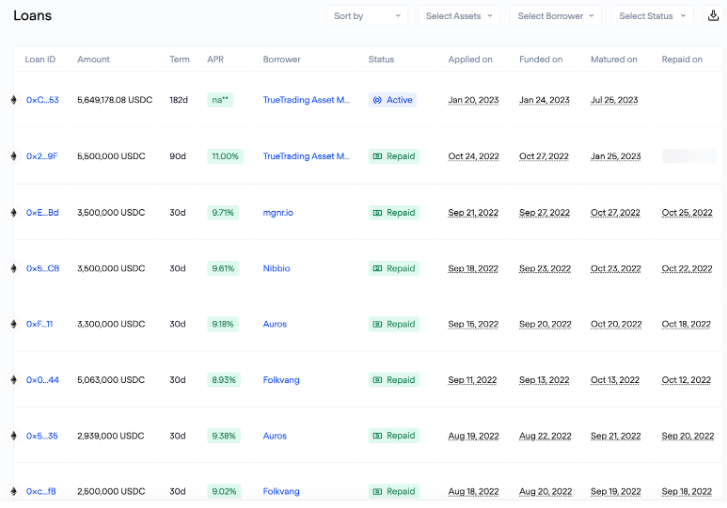

The platform operates through a two-sided system that allows lenders to deposit their stablecoin-type crypto assets into lending pools, which are then exclusively accessible to institutional investors who must undergo a series of tests to access the funds.

The team at @wallfacerlabs has published an overview of tranching solutions used by leading credit/RWA protocols.

— TrueFi (@TrueFiDAO) May 25, 2023

The analysis includes a definitive explainer of how tranching works on @TrueFiDAO.

We encourage everyone to give it a read! https://t.co/XX02Tlu2Nm https://t.co/5jsTGQgpZO

Using on-chain technology, TrueFi builds a digital credit score for prospective borrowers, and TRU token holders participate in a community-led approach where they vote on the borrower’s status and perform KYC/AML tests.

If the tests are successful, the borrower is whitelisted and can access funds.

TrueFi is specifically designed for institutional players, as borrowers must have at least $10 million in available assets to borrow funds.

Additionally, the platform incorporates “Progressive Decentralisation” technology, gradually distributing TRU tokens in the community to incentivize active engagement and promote a vetting process which promotes quality and expertise.

Specifically, the community is incentivised to retain a high quality filtering process, as the members receive returns directly proportional to how successful the projects are, due to their active staking within them.

Sounds intriguing right?

Well, the success of TrueFi was evident in 2021, gaining backing by a16z and gaining a customer base filled with massive names in the industry, like Alameda Research, Wintermute Trading, Grapefruit Trading and Invictus Capital.

The protocol successfully opened up liquidity to institutional investors without requiring collateral and provided financial investment opportunities to the public who were previously excluded due to high economic barriers.

TrueFi’s progressive decentralized approach helped incentivize community engagement, ensuring quality and expertise in the vetting process.

Although the protocol sacrificed decentralization and privacy, it was able to provide security and transparency for the lenders, resulting in a TVL of over $800 million in August 2021.

Some Major Issues

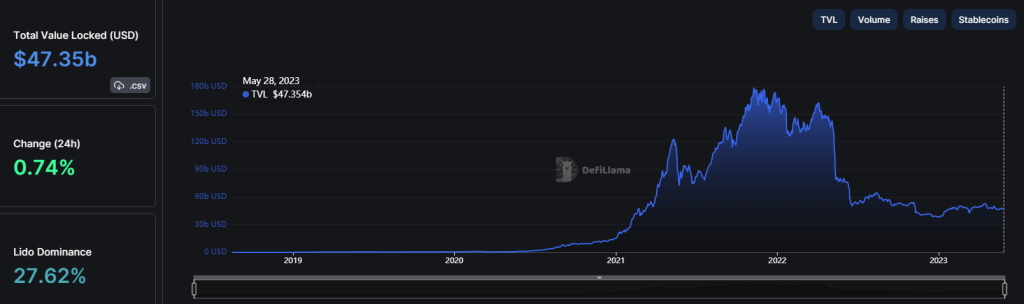

As you can see from the above graph, the story did not continue to look so positive.

Despite its early success, TrueFi’s TVL has since plummeted to less than 3% of its all-time high, with a current value of only a few million.

This is partly due to the macro trend in DeFi of course, where TVL has fallen significantly and currently stands at $47.5 billion, only 26% of its peak value of $180 billion in December 2021.

However, TrueFi has failed to bounce back up significantly like many other mainstream protocols have, and this is likely due to a few fundamental issues the protocol faces.

Firstly, there is a fundamental question raised relating to the quality of TrueFi’s KYC system.

How can an untrained community of token holders perform KYC tests through a voting system that can match the quality of the highly trained and heavily regulated professionals of the TradFi ecosystem? The idea of the two groups competing sounds preposterous.

While TrueFi has only had one project default in the protocol’s lifetime, the question of quality is fundamental.

Secondly, TrueFi’s business model is heavily dependent on community strength, which has been weakened by the bear market and negative sentiment towards the industry in the past year.

This has resulted in a much greater loss for TrueFi than for other mainstream players such as Aave and UniSwap, due to lower liquidity and a higher barrier to entry for borrowers. Whilst mainstream protocols maintain adoption due to crypto native players wanting access to crypto liquidity in order to capitalize on token price fluctuation, TrueFi’s sole customer base is institutions, a segment which is heavily deterred from interacting with the web3 space given current market conditions.

Maybe even more fundamentally, there is still a lack of strong incentives for non-crypto native institutional investors to access these funds.

There is no inherent reason, from the buyers perspective, as to why a protocol like TrueFi is advantageous to traditional finance, and if there is one, it is really not clear. Unless an investor is fundamentally passionate about the underlying principles of DeFi, TradFi is still easier, simpler and much more trusted, hence protocols like TrueFi remain untouched.

Closing Thoughts

For DeFi to become widely accepted as a viable financial tool, institutional adoption is essential.Without mainstream backing, your money is stored in a system with vulnerability to ostracization, making it unsafe.

As the DeFi industry continues to grapple with this challenge, one thing remains clear: there is no one-size-fits-all approach.

Overcollateralization remains to be the best approach for crypto native traders, and hence continues to dominate the bulk of TVL locked in the space. The challenges of accessibility, trust and incentive continue to be unsolved, even though many potential solutions are being investigated.

If no collateral through creating centralised governance pools is the answer, then the question is how far do you have to delve into centralisation?

Maple finance for example, a protocol that does a similar thing to TrueFi, has taken an ever more centralised approach to KYC testing, and doesn’t include on-chain credit scores, closely leaning in the realms of TradFi .

Other protocols are taking different approaches, notably ones which involve real-world assets. Goldfinch is a great example of this, facilitating a multitude of loans during the bull market.

6 months later this still rings true.

— Goldfinch (@goldfinch_fi) November 9, 2022

Borrowers are FinTechs + credit funds driving off-chain growth worldwide.

Pools are fully collateralized off-chain by real-world assets and income.

Built for long-term, sustainable yields, that won’t disappear with crypto market volatility. https://t.co/Wd6RhckliX

To find out more about Goldfinch and Rwa in DeFi, check out our informative articles here and here.

DeFi is brimming with potential, but its fundamental issues cannot be ignored.

In order to truly thrive, the industry must prioritize innovation and create clear and accessible pathways for institutional players, giving hope that one day the space will escape the rough outskirts of finance, and enter its bustling mainstream metropolis as an equal.

Also Read: Why Real-World Assets Are Needed For DeFi To Succeed

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

This article was written by Harry Vellios and edited by Yusoff Kim