TrueFi is a cryptocurrency protocol dedicated to collateral-free loans, enabling lenders to earn high and stable returns on loaned cryptocurrencies, while vetted borrowers can access fixed-term, fixed-rate cryptocurrency loans.

While conventional decentralized finance loans typically require a collateral of some form before they can be issued, TrueFi seeks to emulate the system used in traditional finance, where borrowers are able to borrow money from institutions with reference to key metrics such as credit scores.

Rather than use a credit score, TrueFi operates through its native token TRU, with TRU holders collectively assessing the credit-worthiness of the borrower and individual loan applications by staking TRU, in exchange for rewards.

The protocol was launched in November 2020 by TrustToken, which developed and currently maintains five top fiat-backed stablecoins.

How does TrueFi work?

The majority of decentralized finance (DeFi) lending platforms require borrowers to provide collateral as a prerequisite for borrowing. The best example would be Compound, where borrowers need to lock up assets in the protocol to borrow against locked collaterals, which limits the ability to deploy leverage.

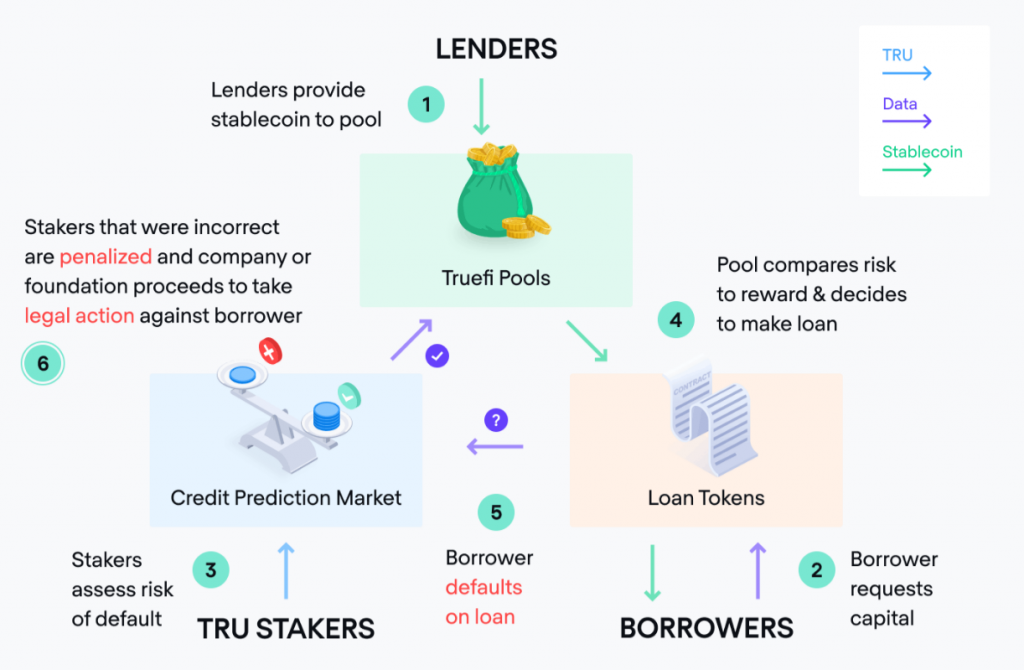

In contrast, TrueFi, enables collateral-free lending through the interaction of key stakeholders in the protocol, with a focus on transparency.

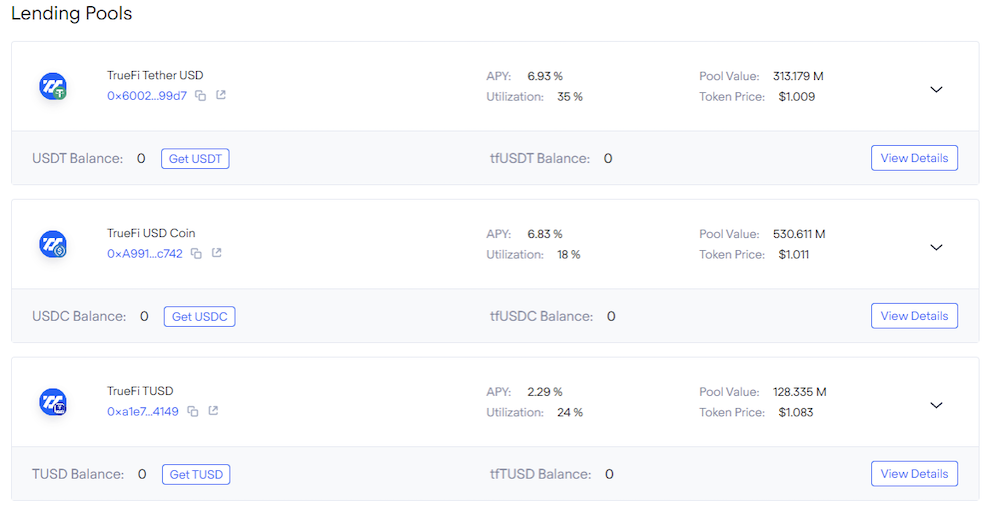

- In the TrueFi ecosystem, lenders lend stablecoins to TrueFi lending pools to earn attractive APR, with full visibility on how their funds are allocated.

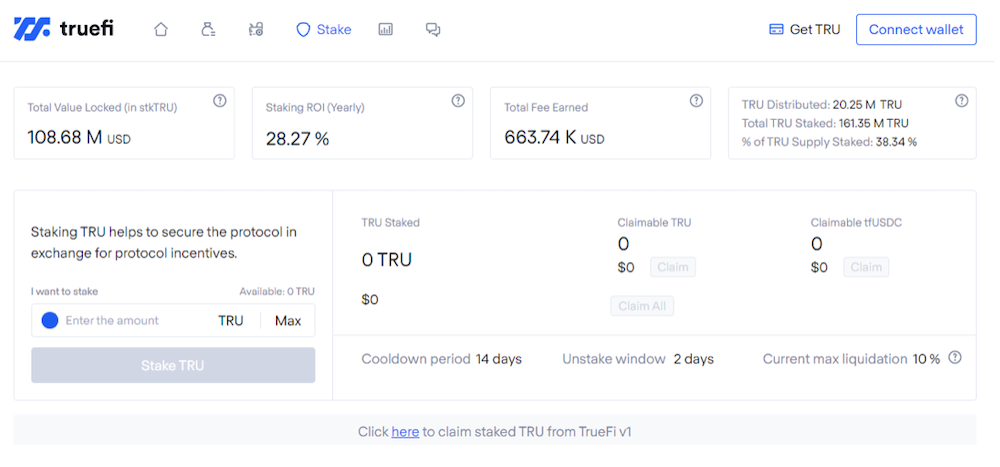

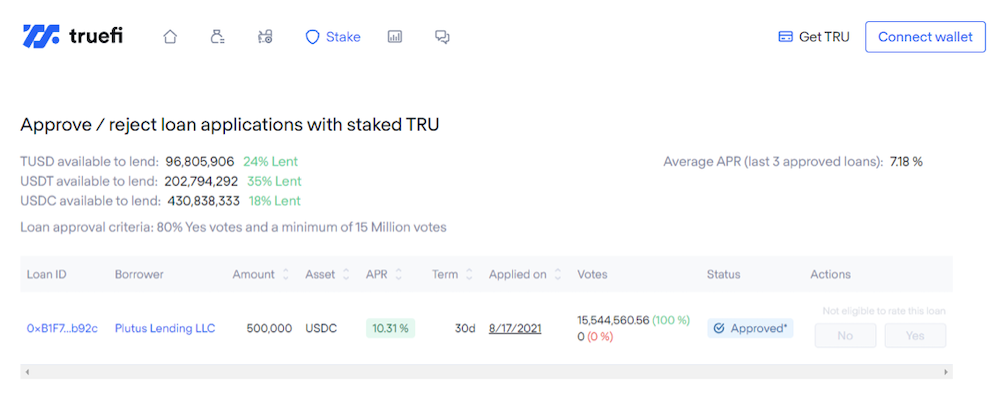

2. In the middle, TRU stakers signal the creditworthiness of all incoming loan requests through an approval mechanism, where they can vote for or against each loan application. In essence, TRU holders collectively act as a credit prediction market estimating the creditworthiness of borrowers and the desirability of the loan. At the time of writing, a total of USD108m worth of TRU is staked in the protocol, with an annual APR of 28.4%.

3. On the other end of the equation, vetted borrowers can request loans denominated in native stablecoins once they are approved by TRU stakers, by utilizing loan tokens.

Through the growth of this ecosystem, TrueFi seeks to become the leading automated, market-driven credit rating and lending system within decentralized finance.

What happens if borrowers default?

According to TrueFi, legal action can be taken against borrowers if they do not return the loan principal and interest within the term of the loan.

This is made possible by the fact that borrowers need to complete a know-your-client (KYC) and anti-money laundering (AML) review, as well as signing a legally-enforceable loan agreement with TrustToken, before they are able to borrow.

New borrowers are also only entitled to apply for smaller quantum loans initially, and can only apply for larger amounts once a record of repayment has been established.

Currently, TrueTrading, an affiliated company of TrustToken is responsible for pursuing legal recourse against defaulters.

Is TrueFi legitimate?

While collateral-free lending within the cryptocurrency space may sound novel, the protocol recently raised USD12.5m from Blocktower, Alameda Research, and A16z, which are all powerhouses in the crypto investing scene. Alameda is owned by Sam Bankman-Fried, the founder of crypto exchange FTX, while A16z is one of the most renowned venture capital technology investors globally.

Notably, Alameda is also one of the first institutional users of the TrueFi, which adds a further layer of credibility to the protocol.

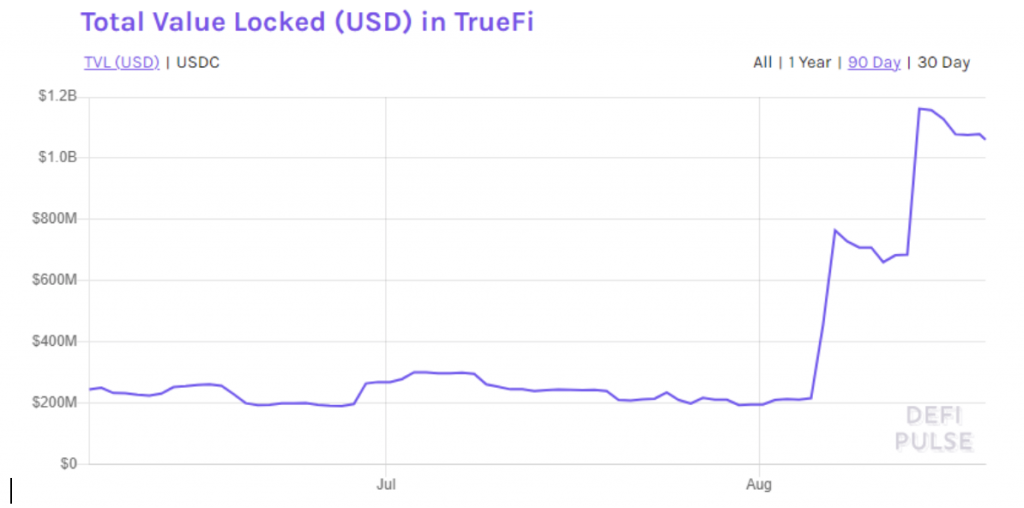

TrueFi has also grown rapidly since launch – total value locked in the protocol (TVL, or total assets under management) stood at USD1.06bn at the time of writing, with Defi Pulse ranking TrueFi at #17 on its trending protocols list.

Last week at #TrueFi:

— TrueFi.io ? (@TrustToken) August 25, 2021

??V4 upgrade — Liquidity Gauge to go live tomorrow, stay tuned for updates ?

?$1.10b TVL

?160m+ staked $TRU

?4440+ wallets holding TRU (does not include centralized exchange holdings) pic.twitter.com/80QXLdQh01

With blue-chip backing and exponential user and asset growth, TrueFi is poised to play a key role in the burgeoning lending ecosystem within decentralized finance.

Featured Image Credit: The Birb Nest

Also Read: A New Class Of Loans: How Self-Paying Loans On The Blockchain is Redefining Finance