Decentralized finance (DeFi) has taken the cryptocurrency world by storm, backed by an exponential growth that does not seem to be slowing down.

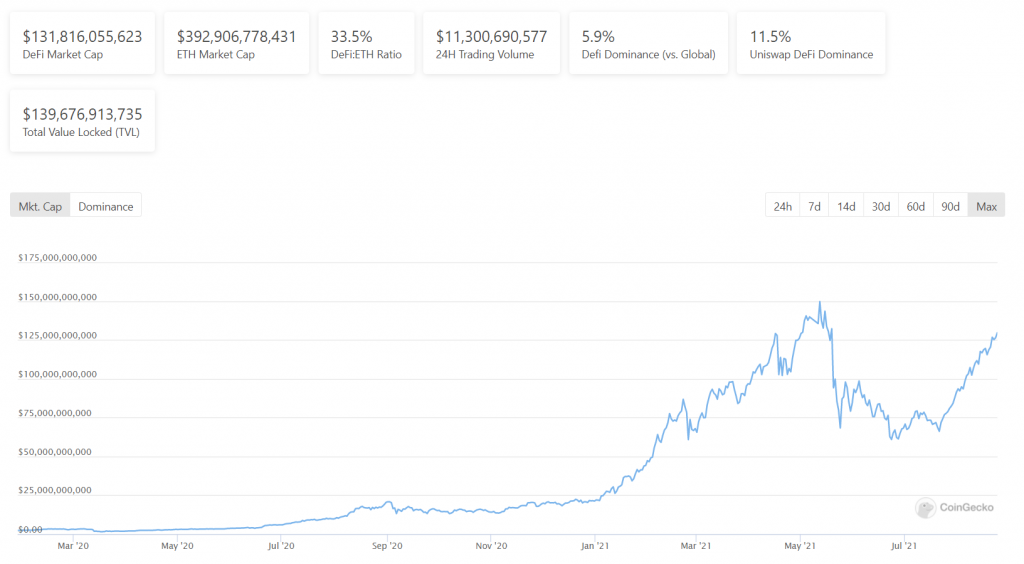

The size of the DeFi market has grown by more than six times since the start of 2021, and currently stands at a whopping $131 billion. Additionally, there is more than $139 billion worth of assets locked in various DeFi protocols.

The innovations happening in the DeFi space is exciting yet complex, with a comprehensive range of applications and products that extrapolate the offerings from traditional finance, whilst pushing the boundaries for unique services that can only happen on an onchain, decentralized setting.

From permissionless lending and borrowing protocols to juicy annual rates of returns for providing liquidity, DeFi is shaping up to be an alternative and viable monetary system that is free from the limitations of traditional finance.

Rise of DeFi

DeFi, as its name suggests, is just a decentralized form of finance that runs on blockchain technology.

Blockchain facilitates borderless peer-to-peer transactions without any need for central intermediaries. With the advent of smart contract technology, the functionality of blockchain technology is exponentially enhanced, which has in turn powered the rise of decentralized applications (dApps).

Smart contracts are at the heart of DeFi applications, allowing complex functions and applications to be conceived and executed in a trustless, transparent and non-custodial manner.

DeFI offers a range of financial services that is similar to the structure of traditional finance, which include the foundations of a lending/borrowing market, spot and derivatives market, margin trading, risk-free savings account and so on.

One of the areas at the forefront of financial and technological innovation is DeFi loans.

How do DeFi loans work?

DeFi allows financial services to operate in a decentralized manner without any central intermediary managing, administrating or supporting the operations.

Instead, a DeFi protocol that facilitates a robust lending and borrowing marketplace is entirely made up of open-source smart contracts that are backed by self-executing lines of codes.

A bank generates interest on user deposits and facilitates loans for those interested to borrow, and the exact same functions would apply to DeFi platforms.

The main difference is that lenders and borrowers in the DeFi platform would only interact with decentralized smart contracts that are programmed to algorithmically maintain the platform’s interest rates based on the current demand and supply dynamics.

More importantly, DeFi applications are by nature non-custodial, meaning anyone seeking to generate interest on their cryptocurrencies or those who are interested in borrowing cryptocurrencies would have full control of their funds at all times.

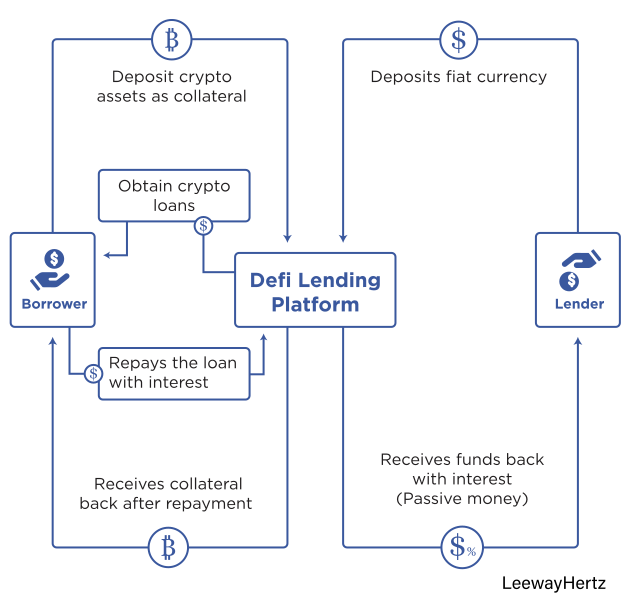

Here is a diagram that highlights how a DeFi lending platform works:

DeFi lending platforms are a great way for users who hold cryptocurrencies to make their assets ‘work for them’, instead of sitting idly in their digital wallets with total exposure to the volatility of the cryptocurrency markets.

They can earn interest by lending their cryptocurrencies on the DeFi platform where users who are interested to borrow cryptocurrencies could access these loans at a borrowing rate set algorithmically by the demand and supply forces.

In order to borrow assets on the platform, borrowers need to post collateral to ensure that the loan is fully backed.

For example, a user wanting to borrow the stablecoin DAI on AAVE – the most popular lending Defi platform – would need to deposit a certain amount of Ether (ETH). Based on the current collateral ratio of 50%, the user would need to post 10 ETH as collateral to the smart contract if he wanted to borrow 5 ETH worth of DAI.

Interestingly, a new breed of loans is making way as an innovative solution that can only happen in an onchain, decentralized setting. Enter self-paying loans.

A new class of loans

Self-paying loans represent a new class of loans where users can borrow assets on the back of the future yields of their collaterals.

This ingenious solution involves borrowers to deposit their cryptocurrency collaterals and borrow a synthetic version of the underlying collaterals that can be used to pay for anything onchain or even be liquidated in their corresponding fiat currency for usage in the real world.

The underlying locked collaterals will then be generating yields within the DeFi ecosystem, and those earned yields will be automatically used to pay off the debt. This will therefore result in the reduction of the initial loan amount with time.

This revolutionary innovation was pioneered by Alchemix, an Ethereum-based DeFi protocol that is focused on ‘rewriting the laws of finance’.

A novel approach by Alchemix is combining the aspects of a savings account with a borrowing facility, allowing users to generate interest on their deposits as well as borrow against them.

The best part about DeFi self-paying loans relative to traditional loans from a bank is that the user does not need to go through layers of verification, document processing and waiting times; just simply deposit their collaterals on the smart contracts and they can start borrowing with no paperwork or verification!

How do self-paying loans work in Alchemix

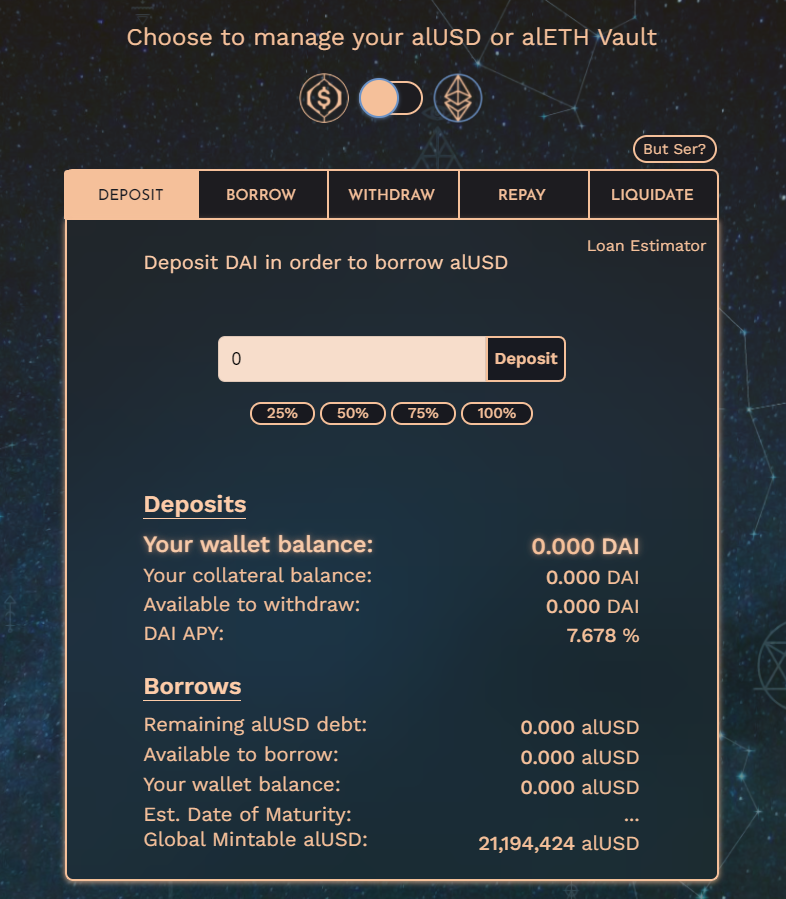

There are currently two vaults that a user can subscribe to when acquiring a crypto self-paying loan:

- Depositing DAI as collatarel and borrowing Alchemix USD (alUSD), which is the USD-backed stablecoin of Alchemix

- Depositing ETH to borrow Alchemix ETH (alETH), which is Alchemix’s tokenized ETH that can be converted into any other coins or fiat stablecoins

When a user decides to borrow from Alchemix protocol, they first need to deposit collaterals in the form of either DAI or ETH. Assuming a user wants immediate liquidity in US dollars, DAI needs to be deposited into the platform.

A user can borrow up to 50% of the deposited DAI value and receive alUSD, which is Alchemix’s stablecoin pegged to the US dollars.

So, if a user deposited $10,000 worth of DAI as collateral, he can borrow up to $5,000 of alUSD that can be used for anything; he can cash it out in fiat currency or even buy more cryptocurrency in the market.

What’s unique about Alchemix is that the value of the borrowed loans will go down with time since the interest generated from the underlying collaterals will go directly to pay down the debt. In essence, users are getting an interest-free loan from the protocol.

Extending the example of a user borrowing $5,000 from an underlying collateral of $10,000 (in DAI) with a fixed interest rate of 10%, the user will earn $1,000 at the end of the year.

This generated interest will be used to pay back the original loan, and this will result in the reduction of the loan from an original $5,000 loan amount to $4,000.

In this case, the user still maintains the $10,000 in underlying assets as collaterals: $4,000 of outstanding loans and $6,000 of equity. Historically, Alchemix offers a return rate of between 10%-20%.

The simplicity of Alchemix in accessing self-paying loans without the prohibitive requirements of traditional loans is testament to the ongoing pace of innovation that DeFi is bringing to the table. This is just a start of the ongoing evolution of redefining finance.

Featured Image Credit: Forbes

Read also: How To Get Started With Decentralised Finance (DeFi) For Beginners