Just the past week, crypto continued to show volatile traits your parents warned you about. How volatile, you might ask? Here’s Bitcoin’s year in review.

There are a few other spikes and dips, but you get what I mean. The big swings wiped out portfolios, and even those who stood the most convicted felt the jiggles in their knees.

You would think after the collapse of FTX, Silicon Valley Bank, a bear market that erased nearly $2 trillion in value, Genesis bankruptcy, and $USDC depeg, yet, the total crypto market cap just crossed back above $1 trillion.

Crypto markets are incredibly resilient, with $BTC and $ETH up 9.1% and 5.2%, with most of the market following its positive upswing.

But the mystery remains. There was every reason for crypto and equities to fail. How did we end up in these green pastures? Today, we look at four reasons why money printing is seemingly broken.

1. Banking failed, but the government saves the day

The US central bank has turned its money printer back on. Even when the rest of the world tightens and the FEDs are on the path to curbing inflation, they decided that saving the financial system > saving inflation.

How? by pumping money to ensure people can get their money out when they go to the banks and ask for withdrawals. Usually, when banks pause their withdrawals, it signals a red flag as it limits the customer’s access to their funds – leading to concerns about the bank’s financial stability or solvency, and a possible bank run may unfold.

The flow-on effect of the fall of Silvergate was another bank called Silicon Valley Bank (SVB) also running into troubles late last week. Essentially, SVB puts 56% of its assets into fixed-rate securities, was much higher than other banks. They were betting heavily on interest rates not rising.

TIMELINE OF SILICON VALLEY BANK, $SIVB, COLLAPSE:

— The Kobeissi Letter (@KobeissiLetter) March 12, 2023

1. Bank run begins with $91 billion in bonds facing interest rate risk

2. $21 billion bond portfolio sale announced, $1.8 billion lost

3. SVB announces $2.3 billion share sale to cover bond losses

4. SVB fails to raise capital… https://t.co/RE1hiynIi1

When these securities tanked, many looked to withdraw their assets on SVB, but when the fund wasn’t available, setting the stage for one of the biggest runs to happen.

But the saving grace came from the US government, by ensuring the depositors of these failed banks did not become victims of poor management and hedging.

President Obama and I put in place tough requirements on banks to make sure the 2008 crisis wouldn’t happen again.

— President Biden (@POTUS) March 13, 2023

The last Administration rolled many of them back.

Americans should have confidence that our banking system is safe, and we're taking action to make it stronger. pic.twitter.com/F3hnWl6L8K

This also means providing liquidity to the market, reassuring that any customers who want to withdraw their money in these banks can. This gave risk-on assets such as Bitcoin an optimistic price pump at the expense of the banking sector.

Crypto has grown to become increasingly correlated with other high-risk assets, especially with the price of $BTC and USD liquidity. When USD liquidity increases, so do $BTC and other risk assets. Based on the idea that the FEDs will expand its balance sheet to make failed banking customers whole, the USD liquidity will likely move north from here.

2. Binance with the biggest swap

With the changes in stablecoins and banks, the CEO of Binance, CZ, has decided to convert $1B in his relief fund from BUSD to native crypto, including $BTC, $BNB and $ETH.

The address: https://t.co/uSy1DlZCyG

— CZ 🔶 Binance (@cz_binance) March 13, 2023

According to LookOnChain, all of the $1B $BUSD industry recovery initiative funds were transferred to Binance moments after the announcement made by CZ. What would this mean for the market? This introduces a $1B buy pressure.

In a trillion-dollar market, a billion might not move a needle. However, a billion-dollar announcement by a prominent crypto figure like CZ could spark momentum for a sentiment shift. A pessimistic point of view is now CZ has $1B of material to cause a dump, and likely market sentiment will follow. Perhaps tracking their wallets would give you a better sense of how things could play out.

3. The real market movers, CPI & Interest Rates

Since May 2020, inflation has been on the uptrend, along with hawkish actions taken by the FEDs. While inflation peaked at 9.06% last year in June 2022, it seems like inflation was a bigger mountain to climb than expected.

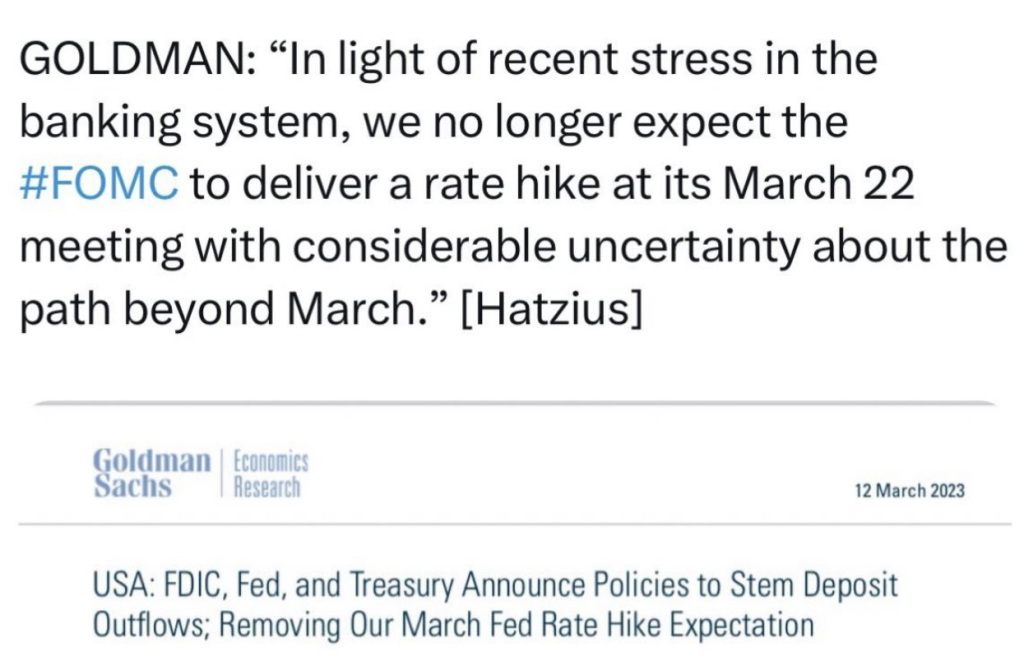

The FED’s attempt to bring inflation back to 2% (healthy levels) was put on hold after the decision to save the US financial system was a top priority. One of the biggest funds, Goldman Sachs, mentioned how they no longer expect a rate hike in the upcoming FOMC.

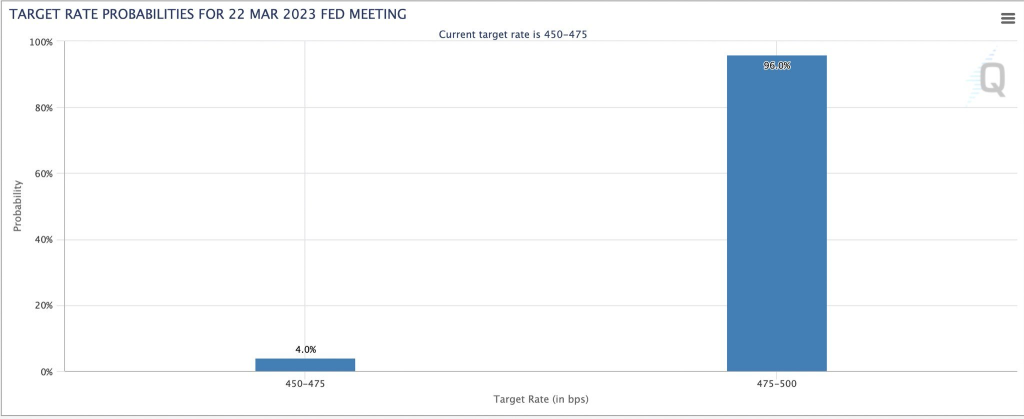

For the first time, the market is considering the possibility that there will be no rate hike next week. However, the market still favours 25bps, with a 96% probability.

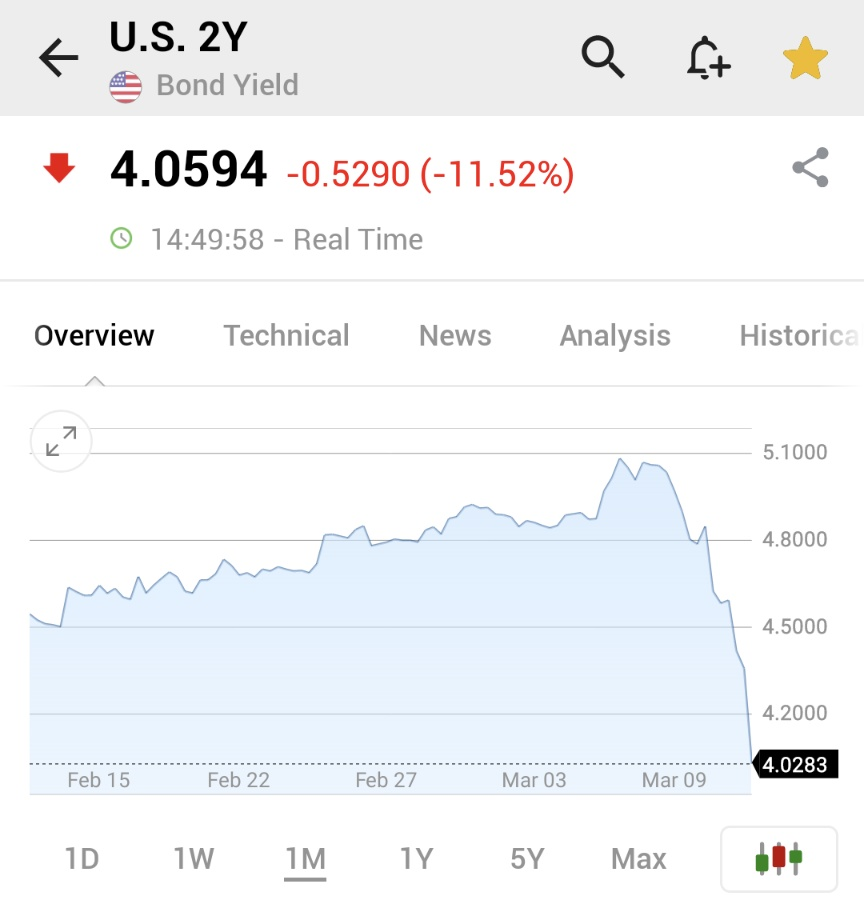

With risk on assets (like Bitcoin) not becoming a more attractive option compared to treasury yields, the two-year treasury yield was sent, plunging into deep waters. All the gains in the 1-year treasury yield were also wiped out in three days. Crypto is not the only asset class which are volatile.

The scariest question right now is, “What if they’re (Goldman Sachs) totally wrong, and Powell still hikes because of this massively inflationary bailout?” I don’t have the answer, myself. But it’s worth pondering.

4. Jim Cramer says to sell

Jim Cramer, the host of “Mad Money With Jim Cramer”, has risen over the last few months for his less-than-favourable stock market picks and market predictions. His calls gave birth to the “inverse Jim Cramer” meme, which involved taking the opposite side of trades that Cramer recommends.

Also Read: Can You Really Make Money Shorting Jim Cramer?

Two months ago, Cramer recommended Silicon Valley Bank was a buy last month at US$320. It is being closed by regulators as it faces the 2nd biggest bank run in US history.

Jim Cramer said Silicon Valley Bank was a buy last month at $320

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 10, 2023

Today it is being closed by California regulators pic.twitter.com/x1xMBTrQTS

Just recently, Jim Cramer urged investors to sell their Bitcoin. Is it time to buy?

Closing thoughts

There are two types of banks, the good and the bad. The bad banks buy bad assets with depositor’s money, while the good banks buy good assets with depositor’s money. However, banks are essential in financial systems, aiming to meet the needs of short-term and long-term lenders/borrowers.

But the red right hand comes with interest rates fluctuating. Even after the banks bought the safest assets bought, the movement of the rates will still be the trump. It seems like every good or bad bank loses, just how bad.

So does the solution from the bank solve anything at all? The contagion could continue as the smaller banks suffer unless they offer comparable interest rates above treasury bills to compensate for the higher risk.

The crypto bubble does not operate standalone anymore, these factors will have an underlying effect on prices and future forecasts, especially in whether the crypto money printer continues to go ham. Here are other key macro events this week to keep your eyes peeled on.

Key Events This Week:

— The Kobeissi Letter (@KobeissiLetter) March 12, 2023

1. FDIC deposits at SVB available on Monday

2. Feb CPI inflation on Tuesday

3. Feb PPI inflation on Wednesday

4. Retail Sales on Wednesday

5. Jobless claims on Thursday

6. Mass tech layoffs expected due to SVB

RT & LIKE if you enjoy these previews!

Also Read: Stay Ahead Of The Crypto Curve With These 5 Charts

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief