Jim Cramer, the host of “Mad Money With Jim Cramer”, has risen in notoriety over the last few months for his less than favorable stock market picks and market predictions. While the show aims to “not tell you what to think, but to teach you how to think about the market like a pro”, he has ironically made several brazen calls that have gone on to be perform terribly.

Officially doubled the inverse @jimcramer account, for those who are not aware i started the account with 50k

— Algod (@AlgodTrading) August 22, 2022

honestly mind blowing how wrong one man can be pic.twitter.com/mH3DhEdJFs

This birthed the “Inverse Jim Cramer” meme, which involved taking the opposite side of trades that Cramer recommends. Twitter user Algod famously doubled a trading account simply by going short when Cramer said to buy and Vice Versa.

Also Read: Thanks For The Free Money: Here’s How I’ve Been Trading The CPI with a 100% Win Rate

Why Do People Even Listen To Jim Cramer?

While Cramer is known today for his poor timing of the market, he actually graduated magna cum laude from Harvard College with a Bachelor of Arts while being editor-in-chief for their student newspaper.

After working as an entry-level reporter, Cramer went on to study at Harvard Law School, and began dabbling into the stock market at the time, even making enough to cover his tuition fees. Post-graduation, Cramer chose to work in sales and trading at Goldman Sachs instead of pursuing a career in law.

"Everyone's decided there's going to be a recession. I don't see the recession coming. I think the Fed's being very deliberate," says @jimcramer. "I'm exhausted by the negativity." pic.twitter.com/iQlJnUfORN

— Squawk Box (@SquawkCNBC) December 6, 2022

He later went on to start his own hedge fund, named Cramer & Co. which he claimed only had one year of negative returns. Despite having a seemingly successful career in finance, Jim eventually retired from the hedge fund in 2001, returning to his first love – media.

The Inverse Cramer Index Has Been Up Only – Since the 2000s

Although Cramer only rose to mainstream media in the last decade, his public stock picks have apparently been terrible since his early days. In fact, while he claimed to have a personal return of 36% in 2000, he was recommending 10 stocks that faced major drops in value following the dot-com bubble collapse.

Articles were even published back in 2009 noting that taking the opposite side of Jim Cramer’s stock picks could lead to 25% returns in a month.

Following the Covid-19 pandemic, Cramer was increasingly vocal about several stock picks, including Netflix, Qualcomm and Disney, noting that the pandemic would assist in the growth of tech stocks that facilitated users staying at home.

Tragically, anyone who followed his Netflix buy calls would be down 38% in just a matter of days, or 65% 3 months later.

We like Coinbase to $475

— Jim Cramer (@jimcramer) April 14, 2021

Similarly, his tweet “Coinbase to $475” played out about as well as you guessed. While the stock initially jumped to $342 following an IPO reference price of $250, it quickly fell by 34% in under a week, and failed to ever significantly reclaim those highs.

Since then, Coinbase shares are down 76%.

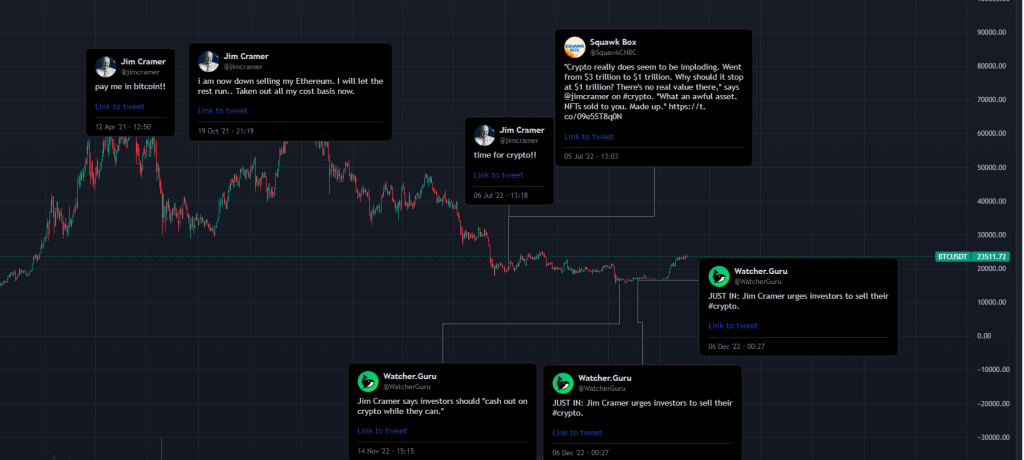

While Cramer’s poor picks in the stock market are already well known, his egregiously poor timing of the crypto markets have quickly become a popular counter-trading opportunity.

Diving deep into his public twitter account, the only call that presented a profit-making opportunity I could find was Cramer selling the 2021 bull market top on Ethereum. Even then, he stated that he only took out his cost basis, and was letting the rest ride out the remainder of the rally.

20 days later, the crypto market started its massive retrace, with Bitcoin crashing from a peak of $69,000 to $30,000 in under 2 months.

As the market continued to crash, he posted conflicting tweets, with most urging investors to sell their crypto. Ironically, even as the market crashed, his bearish tweets almost always coincided with an immediate rally, and his bullish tweets usually led to a slight dip in crypto prices.

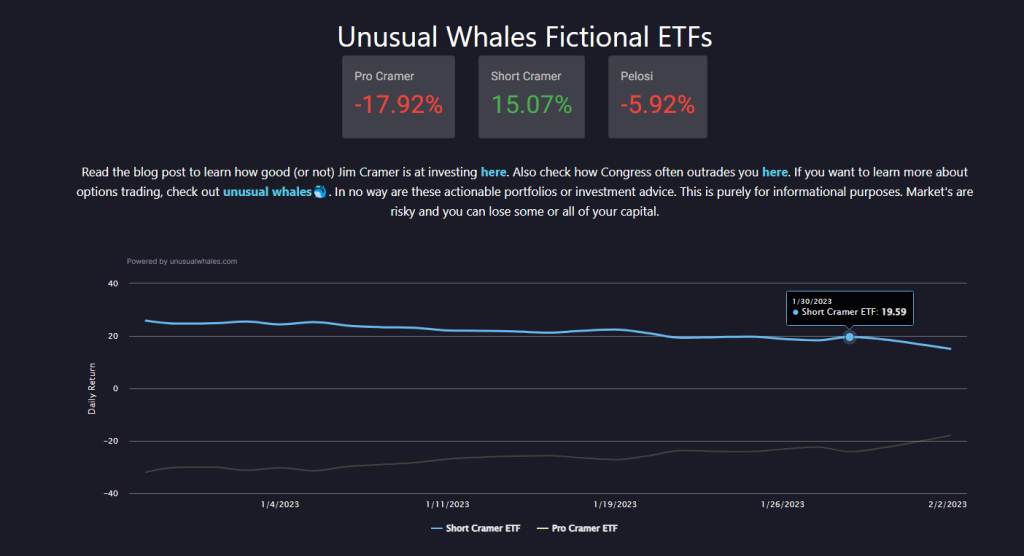

Putting it visually, Unusual Whales, a site that tracks market news for both the stock and crypto markets, has a fictional “Inverse Cramer ETF”.

The ETF shorts all of Cramer’s buys and buys anything he sells or mentions natively. Interestingly, it also holds all short positions over its lifetime, while long positions are closed after just 6 months.

Despite many of the shorted stocks currently seeing a rebound in price, the Inverse Cramer index is still up 15% in the last 6 months. The Pro Cramer index, however, is performing poorer than expected, with a 17.9% loss in the same period.

Of course, Cramer has repeatedly stated that many of his buys should be for the long-haul. However, his ability to repeatedly make poor short-term calls is painfully obvious.

Should We All Be Counter-Tradering Cramer?

Even with his years of experience trading the stock market, Jim Cramer’s public calls have been lackluster at best. Furthermore, he tends to be fickle with his view on the market, constantly flipping from bullish to bearish depending on how prices move.

Instead of trying to print PnLs, Cramer seems to be doing something else – printing headlines. By giving blatantly terrible financial advice, Cramer has been able to make it on the front page of media outlets over and over again, which manages to net him an annual salary of $5 Million from CNBC.

Any press. after all, is good press.

As for traders looking to counter-trade him, his calls have been more of a reflection of the fear and greed, often going against common logic to rile up controversy or feed echo chambers. Going short his index, therefore, makes logical sense for those looking to make a quick buck.

However, due to Cramer basically inducting himself into the Meme hall of fame, many forget that many actually view his platform as legitimate investment advice. Novice investors, especially, could easily be swayed by the charisma and confidence displayed by Cramer on both social media and television.

If major broadcasts are willing to put him on air for views, should the imperative be on us to educate the next generation of market participants on how to properly DYOR?

It has to be.

Also Read: Stay Ahead Of The Crypto Curve With These 5 Charts

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief