The latest project developments on Ve (3,3), which would be distributed to the top 20 projects on Fantom, has piqued the interest of many investors despite the market sentiments right now.

This has been positive for the Fantom Foundation, and a new phenomenon, VeDAO emerged. It looks to purpose-build DAOs with intensive capital for incredibly short periods of time.

(Also Read: What Is Fantom? Here’s All You Need To Know About $FTM Before Investing In It)

0xDAO was hence created and started a Vampire War. A vampire attack is a DeFi method that uses one protocol to provide better interest rates than another protocol to steal their customers and investors.

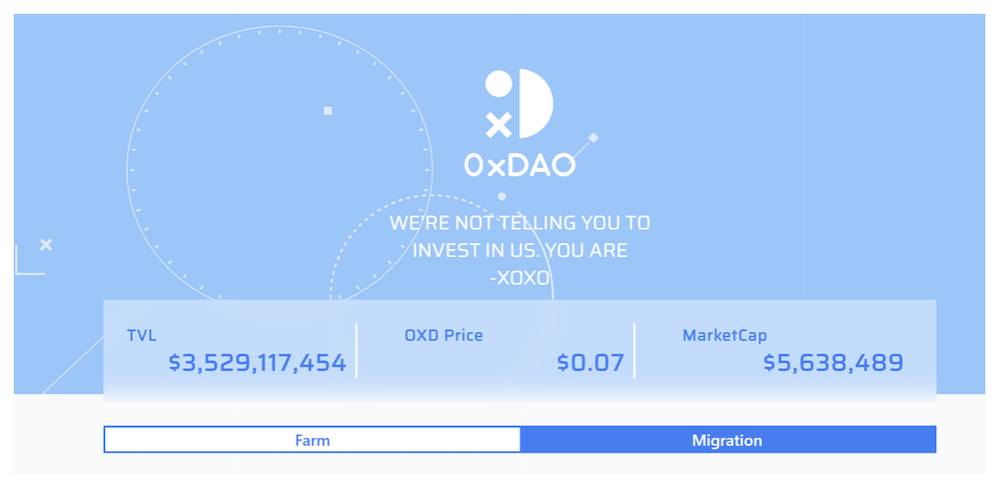

The popularity of 0xDAO is reflected by its skyrocketing TVL of US$3.5 billion in a few days.

Here’s all you need to know about 0xDAO:

Why was 0xDAO created?

One of the major problems with all DAOs is the hit and run. This means that the insane yields provided barely lasts for even a month.

0xDAO was created to combat the emergence of short term veDAOs, which steal liquidity from dedicated Fantom builders.

Essentially, 0xDAO was created as a counter measure of greedy short-term projects and would like to present a community-centered alternative with proven developers and achievable long-term goals with the help of the community.

Components of 0xDAO

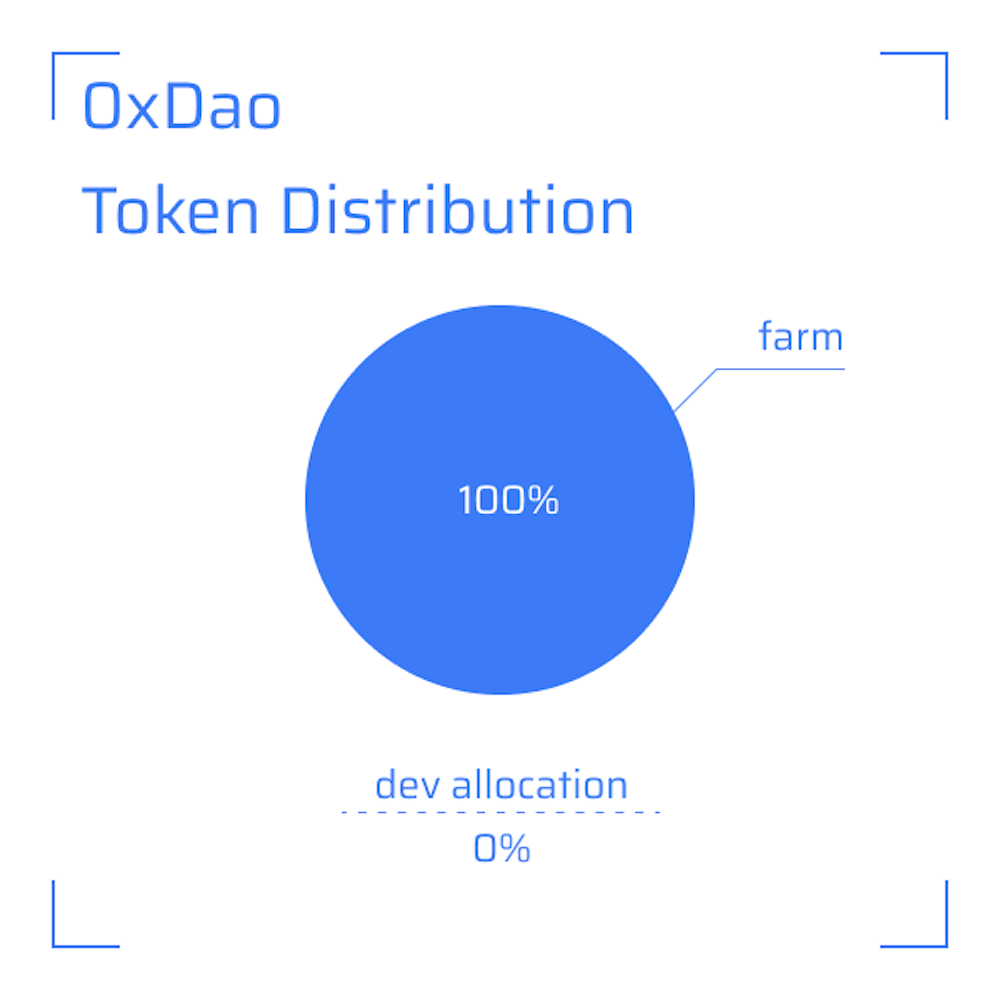

Token Distribution Model: As seen below, the developers get zero distribution, and it is a fair launch with 100% allocation via farming and no pre-mining.

Decentralized Treasury Management: The team has decided not to seed any liquidity for the native token $OXD, but publicly bootstrap liquidity from zero.

This means that when launching, there will be significant volatility especially with the high farming yields to incentivize people to provide liquidity.

In addition, yields collected from ve(3,3)’s emissions-based voting are distributed to the treasury and stakers. OXD will effectively serve as a liquid proxy vote for Andre’s SolidSwap Protocol, as 0xDAO has reached the top 20 and will hence receive a NFT with voting power.

Holders of OXD will be able to vote on how the voting power can be used.

In addition, OXD holders will be able to vote on:

- How the treasury is allocated

- The purchasing of other ecosystem tokens via a similar mechanic of OlympusDAO

- Profit capture potential through various revenue streams

This provides a fully decentralized infrastructure, maximizing profits, capital efficiency and voting power. There is no third party and thus a free market is created.

Tokenomics

Total supply: 2,000,000,000

Emission rate: 1000 OXD / second

Total supply to be emitted 23 days from launch.

Governance and security

The decision making of 0xDAO is made from the community and OXD serves as a utility token, enabling on-chain voting. Holders will also be able to participate in the decision making.

The contract for 0xDAO have been tested via SpookySwap and audited via Certik. In addition, its incredibly high TVL generally means that whales are inside the protocol which generally indicates a strong and robust security of code.

Current farming rates

0xDAO currently has very competitive farming rates.

Some examples include a single stake of wFTM with 101.16% APR currently, a very competitive rate compared to other farms, considering there is zero leverage and no impermanent loss. Other ecosystem coins are also available for single staking with almost 50% APR on BTC alone.

Closing thoughts

0xDAO is certainly very interesting, especially with the rise of the first project veDAO, triggering the creation of the second project 0xDAO.

👻 DAY : F R I D A Y 2 1 – 3 P M ( E S T )@0xDAO_fi #vampwars pic.twitter.com/i9ZBolV6iD

— 0xDAO 👻 (@0xDAO_fi) January 20, 2022

It is currently too early to determine the success of this project, given the fact that it only launched a few days ago. However, the team is robust and its decentralization concept is excellent and has been well perceived by many.

The primary catalyst would be when the snapshot is taken on 23 January, and the community will be invited to vote on set proposals in the coming days.

Once the snapshot is taken on 23 Jan, we will adjust our strategy. Community will be invited to vote on set proposals in the coming days.

— 0xDAO 👻 (@0xDAO_fi) January 22, 2022

@AndreCronjeTech https://t.co/zj9XHbb3dO

As with all protocols, to become a large money market, retail adoption is larger required alongside good hype and a strong community.

As a leading new project on Fantom, this certainly has great potential given Fantoms undervalued ecosystem.

[Editor’s note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: What Is MetisDAO ($METIS)? Its Underlying Technology And What Makes It Better Than Other L1s And L2s