Fantom’s recent 10000% gains since the start of last year have gotten the attention of cryptocurrency investors.

Here’s what you should know before buying it.

What is Fantom?

Fantom is a distributed ledger technology stack that is building a directed acyclic graph (DAG) based platform that can be used to power smart cities and services that come along with it.

A DAG is a data modelling tool that is used in cryptocurrencies, and unlike blockchains, which consists of blocks which have vertices and edges. These transactions are recorded on top of each other. Essentially, this program allows blockchains to run advanced transactions rather than simply sending cryptocurrency to one another.

As an ultra-high speed and performance platform, Fantom is essential in decentralized finance (DeFi) and through smart contracts, developers have been able to create many decentralized apps (dApps) that can power DeFi.

With a goal of executing 300,000 transactions per second, and cross-chain communication across providers, this vision has attracted many investors.

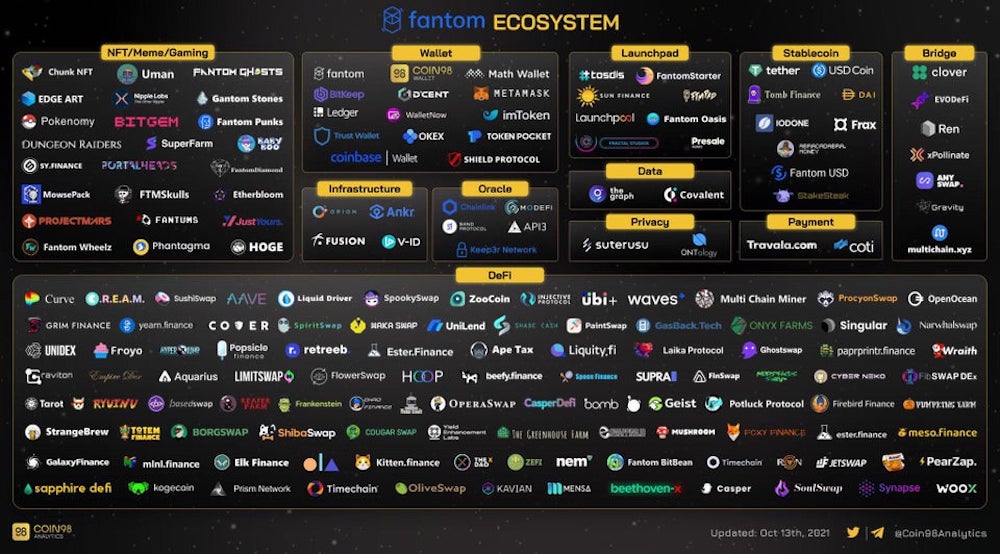

The Fantom team envisions it being used across a variety of sectors, including smart home systems, healthcare, resource management, and many others. This has resulting in the fantom ecosystem expanding like the wind.

Some very popular protocols would be Geist Finance, Curve and Aave.

Transactions on Fantom

Transactions on Fantom are inexpensive and nearly instant. It can handle thousands of transactions per second, and transactions are confirmed within one or two seconds.

In May, it was reported that Fantom had crossed three million transactions and was the fastest blockchain platform.

However, they aren’t the only platform to be doing this and Solana (SOL) has been reported to champ Fantom with 50,000 transactions a second at also a fraction.

Even so, Fantom’s performance is extraordinary, and has never been down before unlike Solana, where its system experienced a major outage that lasted for a whooping 17 hours.

Actually never mind it's been down for much longer. The timer on Solana Beach is actually just broken. Looks like down for almost 2 hours now pic.twitter.com/dIFVsIaX0Z

— Larry Cermak (@lawmaster) September 14, 2021

This is primarily due to resource exhaustion, where the transaction load touched 400,000 per second, due to a denial-of-service attack.

Fantom has yet to experience these problems and has proven to be a robust and impenetrable network currently.

Fantom DeFi

As a proof of flexibility of the Fantom ecosystem, Fantom is a state-of-the-art DeFi suite for any user. It’s EVM compatible smart contracts allow DeFi to be ideal on Fantom. Some of the main functions currently supported are:

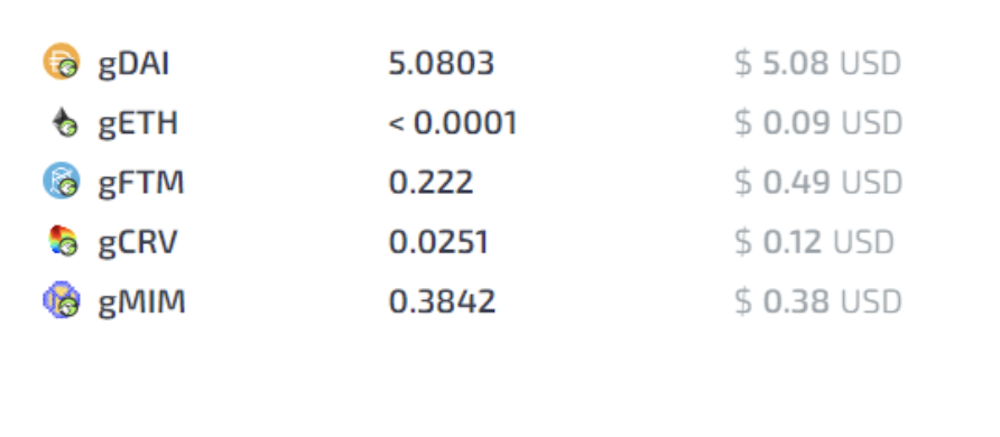

Liquid Staking: Using staked FTM tokens as collateral for DeFi applications. All assets are liquid within the ecosystem. A very popular protocol is Geist Finance.

Geist has an impressive market size, in the billions, larger than the amount stored in some small, centralized exchanges. Its no wonder this protocol has been popular with two security audits, and 50% of platform fees being given to users.

fMint: Minting dozens of synthetic assets are available on Fantom, be it cryptocurrencies, national currencies, or commodities. They can also be synthesized on other protocols and converted back to fMint by claiming from liquid staking.

fLend: Allows lending and borrowing of digital assets to trade and earn interest without losing exposure to your Fantom.

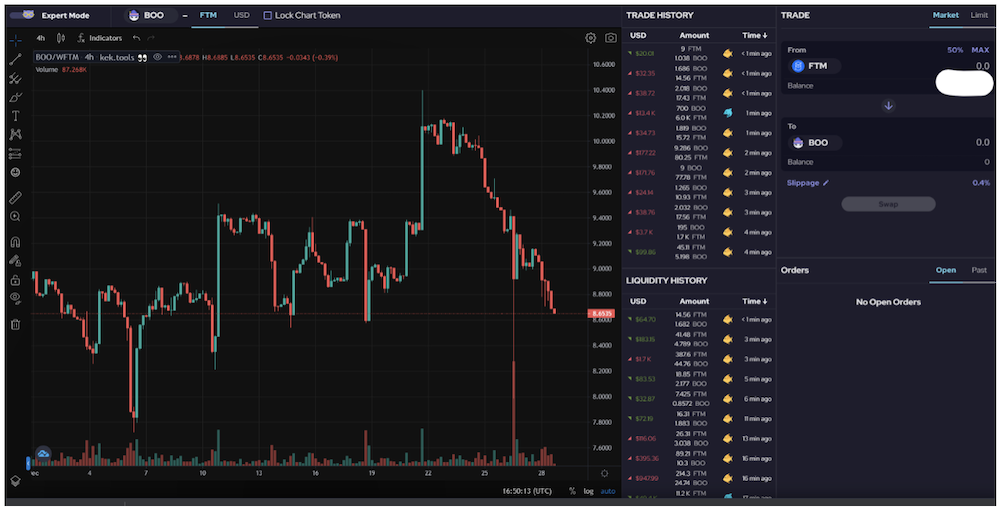

fTrade: A fully non-custodial and decentralized AMM exchange without leaving the wallet. A very popular exchange is SpookySwap, with an impressive interface.

A brief dive into Fantom Tech

Fantom architecture can be divided into 3 layers like a sandwich, the Opera Core, Opera Ware, and Application Layer.

Opera Core is the bottom bun that has the responsibility of maintaining consensus across nodes in the Lachesis Protocol. Each transaction is saved on every node, but Fantom uniquely uses a secondary type of node called a witness node to validate transactions and are reliant on a dPOS method to elect validating nodes. In addition, users must have a minimum of 1,000,000 Fantom to run a validator.

Opera Ware is the “substance” of the protocol that is designed to execute functions on the platform including things like issuing rewards and writing ‘Story Data’.

Opera Application is the sesame-seed bun that publicly holds available APIs that allows developers to allow their dApps to interact with the Opera Ware layer. In addition, an interesting application that arises from it is ‘Story Data’, which is a quintessential function for storing indefinite and massive records of data that are essential, paramount for applications like supply-chain management.

Fantom also uses Lachesis Consensus which is a DAG-based asynchronous Byzantine Fault Tolerant (aBFT) algorithm. It has effectively solved the scalability trilemma which states that only 2 of 3 conditions can be included in consensus algorithms at the same time.

Another interesting innovation is StakeDag, which leverages on participants stake for validating power. It has benefits of

- Ever node having an equal chance to create event blocks

- Fewer vulnerabilities

Closing Thoughts

Fantom is a unique protocol that has chosen DAG technology as the path to scale. It however has many competitors like IOTA as one of the first DAG project in 2015, and HBAR has similar architecture to Fantom in the use of their smart contracts.

Given its solid transaction speeds and zero-network breakdown state, as well as its advanced smart contract platform it offers, Fantom could be a solid investment. The price has dipped since its all-time high, and still has a puny market cap compared to its competitors.

Of course, enterprise adoption is the goal and essence of many blockchain projects, and the question of Fantom adoption remains largely unknown. Make sure you consider its alternatives before deciding where to put your money. That being said, the Fantom Team has the expertise, knowledge, and drive. Very notably is Andre Cronje, well know for the development of Yearn Finance (YFI), as well as Harry Yeh. Not to mention, its strong community should help to maintain its solid presence in crypto and allow further expansion.

Featured Image Credit: Chain Debrief

Also Read: What Is Abracadabra? An Introduction To The Land Of Spells And Magic Internet Money