As cryptocurrency became mainstream, many began to doubt it, saying that it was fake and that its value was printed out of thin air.

While most tried to steer away from this narrative, one platform embraced these stereotypes and was even mentioned during the recent Federal Open Market Committee meeting.

“What could possibly go wrong when a government decides to print 40% of the total supply of their currency in just two years” #OccupyDeFi pic.twitter.com/DzBmv7O8KA

— Daniele 🐸✊ (@danielesesta) December 14, 2021

That platform is Abracadabra, a multi-chain lending platform that allows you to conduct spells with your interest-bearing assets, in order to conjure up Magic Internet Money ($MIM).

While its name may sound sketchy, Abracadabra’s success speaks for itself, with millions of dollars being borrowed and put up as collateral daily.

Welcome to Abracadabra

Nobody said that the ride was going to be easy to change Finance. This is a retail driven market, it makes it more volatile but also more powerful in the longer term.

— Daniele 🐸✊ (@danielesesta) December 10, 2021

The project was founded by Daniele Sesta, who is also responsible for Popsicle Finance (decentralized market maker) and Wonderland (OlympusDAO fork), both on the Avalanche chain.

Alongside him are 0xMerlin and Squirrel, co-founders of Abracadabra, who manage the platform and collectively identify themselves as members of the “frog nation”.

Where the magic happens

Abracadabra is a lending platform that lets users put up collateral in exchange for its stablecoin, $MIM (Magic Internet Money). While this concept is not new in the DeFi (Decentralized Finance) space, where Abracadabra differs from platforms like Aave is that it accepts interest-bearing tokens such as $MEMO, $xSUSHI and various Curve/Convex tokens as collateral.

This allows for investors to have liquid assets, while retaining their interest-bearing tokens and allows for either simply HODL-ing your assets and spending the borrowed $MIM or “looping” the process and performing leverage Yield Farming.

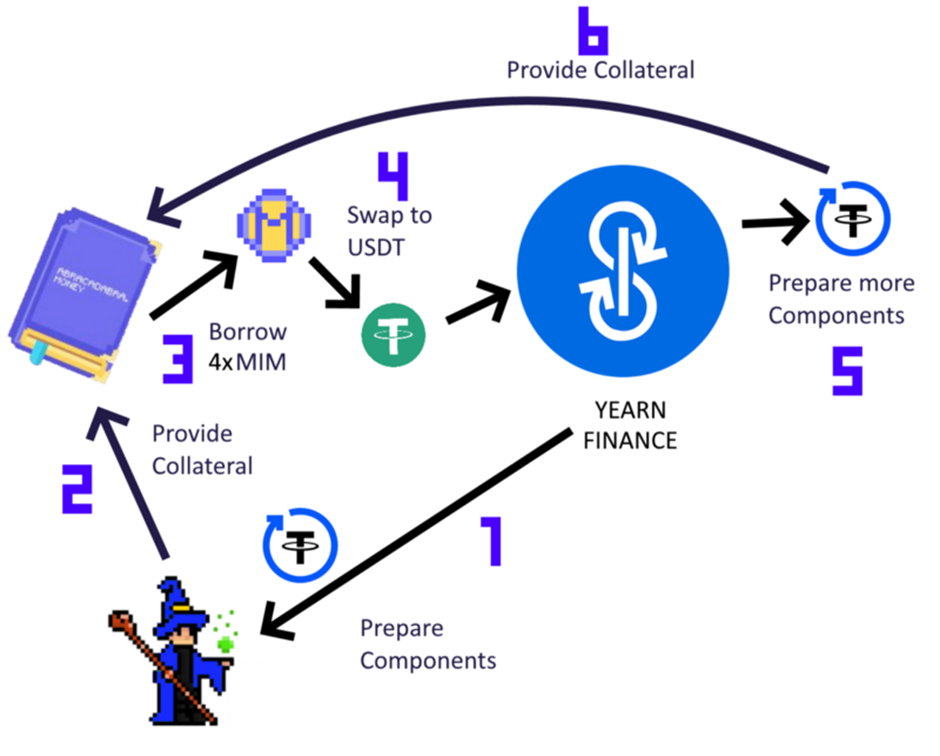

On Abracadabra, looping can be done through the following steps:

- Creating an Interest-Bearing Token (i.e. $xSUSHI, $wMEMO)

- Putting it up as Collateral

- Borrowing $MIM against that collateral

- Using it to create more Interest-Bearing Tokens

- Repeat steps 2-4

Not only does looping have the potential to increase your APYs significantly, borrowing to add to your collateral at healthy levels also helps your position in avoiding liquidations.

How to cast a spell

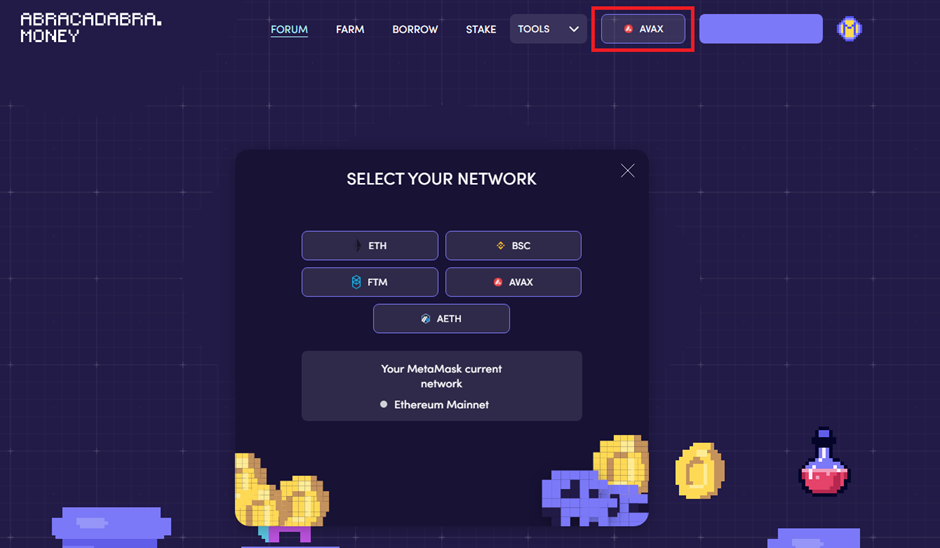

To start, head over to abracadabra.money and choose the network you want to use. Currently, five blockchains are supported by the platform with the most used ones being Ethereum and Avalanche.

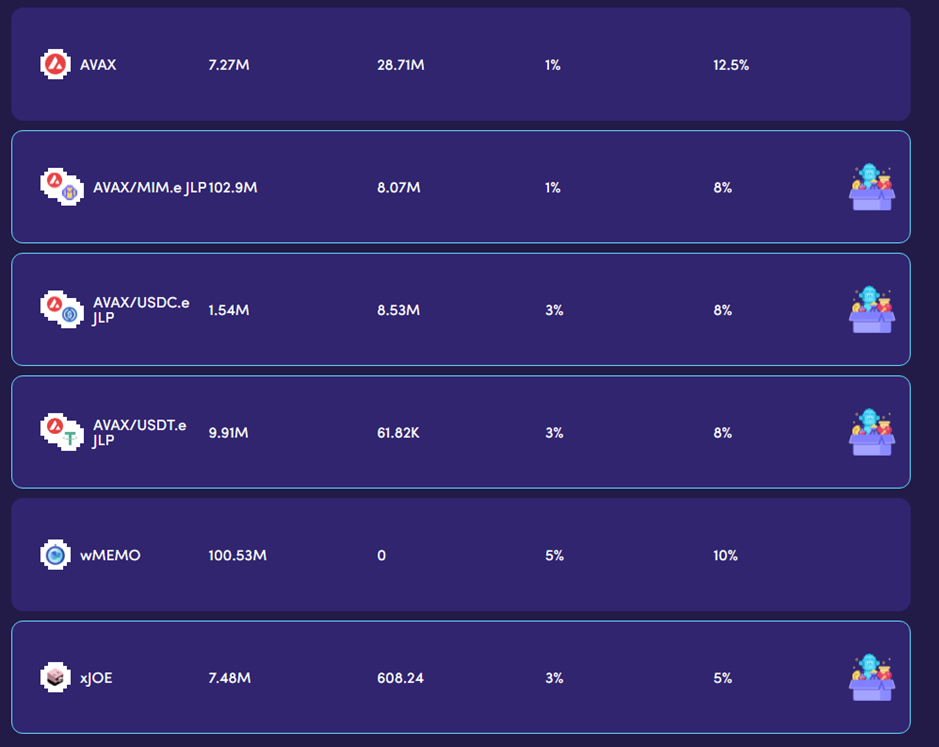

Next, click on the “Borrow” tab and choose the type of collateral you would like to deposit. Take note that as Abracadabra uses Kashi lending technology (originally from SushiSwap) to create isolated risk pools, the amount of $MIM in a pool can be empty until someone refills it by paying it back.

While this may seem inconvenient, this technology is what allows the platform to accept Interest-Bearing Tokens as collateral.

🚨 100,000,716 $MIM are available to be minted on #Ethereum using $UST as collateral! 🚨

— MIM Replenishes (@MIM_Replenishes) December 18, 2021

💸 https://t.co/HgVZ0J7ASO 💸

If the pool you would like to borrow from is constantly at zero, there are several resources that help alert you when they are refilled. Just remember to follow them and keep your notifications on!

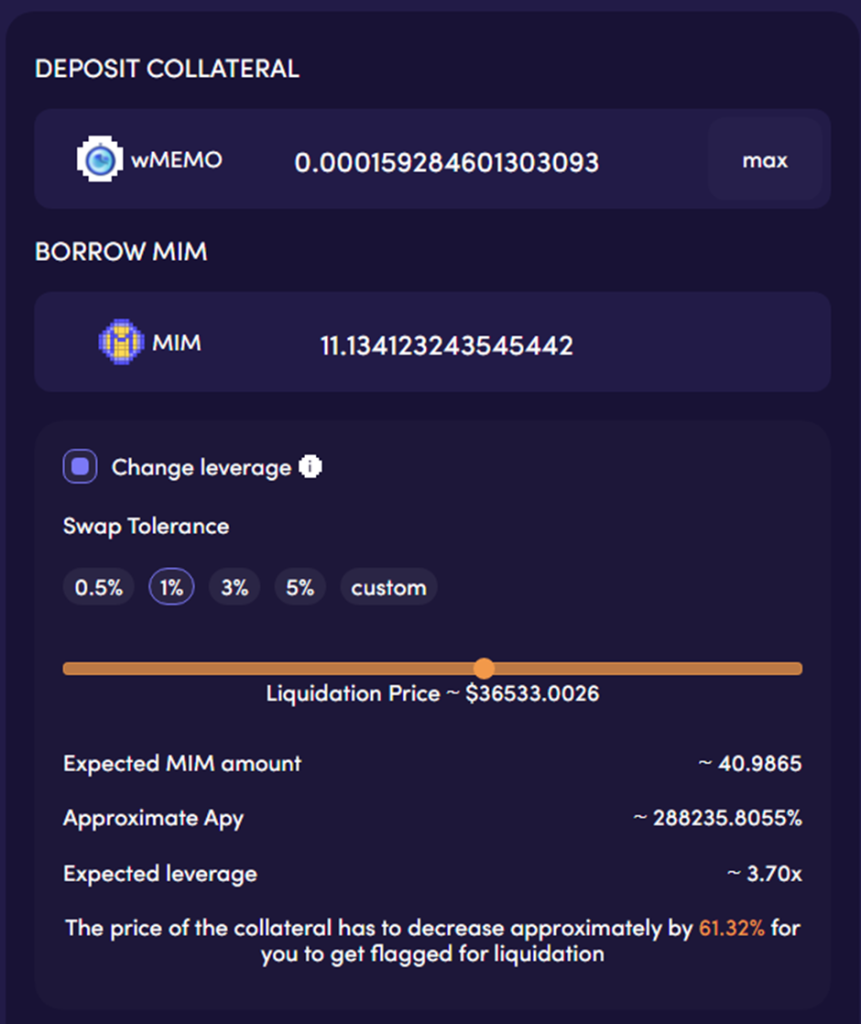

Once you have chosen your collateral, the platform will bring you to the borrow page. For this example, I’ll be borrowing $MIM against $wMEMO, the wrapped version of Wonderland’s $MEMO.

While wrapping of tokens are usually only done on their native platforms, Abracadabra allows you to wrap $MEMO to $wMEMO directly for convenience.

Enter the amount of $wMEMO you would like to deposit and choose how much you would like to borrow against it. Take note that your initial loan amount can only be a maximum of 70% of your collateral, but as your Interest-Bearing Tokens grow in value or you loop, you can borrow more against them.

Generally, I prefer borrowing in the 25-30% range, to protect myself against price volatility.

Once done, you can click add collateral and borrow. The update price is optional and simply updates the price with the oracle for a small gas fee.

The bar on the top right-hand corner also shows your position health, and you may want to think of de-leveraging or adding to your collateral should it fall.

Take note that you can further borrow on leverage from Abracadabra.

However, these positions are extremely risky and need constant monitoring. If you are a newcomer to leverage or DeFi, make sure to Do Your Own Research and experiment with small amounts before making a decision.

Congratulations, you’re done with borrowing from Abracadabra! So what else is there?

The $Spell token

While Abracadabra’s $MIM has reached a status of notoriety, there is also much to be said for the platform’s native token, $SPELL.

Currently, $SPELL can be staked as $sSPELL for about 26% APR or farmed on various pools for about 40% APY. Unlike liquidity mining protocols which usually pay out in an inflationary farm token, these $SPELL tokens are actually redistributed platforms fees.

8.7B Spell or 272M worth has been removed from supply: https://t.co/c74uU7zcjg

— 0xMerlin.eth (@0xM3rlin) November 1, 2021

Distributed 2.5 M worth of fees here to sSpell holders: https://t.co/EyQ7Q4Uakd

— 0xMerlin.eth (@0xM3rlin) October 31, 2021

When liquidations happen on Abracadabra, a fee is paid to the platform, which it then redistributes to $sSPELL holders.

Furthermore, the platform also uses those funds to buy $SPELL from the open market and burn them, reducing total supply.

While the $SPELL token has taken a beating along with the rest of the market, its managed to return a 2948% ROI in just four months thanks to token burns, high transaction volumes and a strong user growth on Abracadabra.

The future of Abracadabra

While Abracadabra has been insanely successful to date, being the 13th protocol by TVL, its founders show no signs of stopping.

One of the radical strategies that the platform has enabled, aptly titled “Degenbox”, uses the Anchor Protocol on Terra to conduct leveraged yield farming on stables, giving almost 100% APY.

100% APY on stables, paid out in stables, relatively risk-free, is one of the most promising concepts of DeFi. Just imagine your bank paying you 10% or even 5% APY.

The team has already brought a similar strategy to the Binance Smart Chain and are partnering with Terra for more projects, such as a liquidation auction system similar to Kujira’s ORCA.

Sushi jumps 10% after top Avalanche developer, Daniele Sestagalli, proposed making the platform a part of the multi-billion Abracadabra and Wonderland ecosystem.

— CoinDesk (@CoinDesk) December 13, 2021

By @shauryamalwa https://t.co/BR9jY3JH1t

The team is also working on markets for the Fantom chain, and founder Daniele’s recent proposal to restructure and partner with SushiSwap may just be another gateway for billions more in both transactions and TVL. With all the projects and such a strong roadmap, the future of DeFi may just be a spell away.

Featured Image Credit: Shrimpy Academy

Also Read: What Is Solice? Introducing The Next VR Metaverse On The Solana Blockchain To Watch Out For