Avalanche is merely 23 months old and it has been witnessing tremendous growth. But they are only getting started. $CAI would give investors access to be part of the rapid growth and exposure to blue chip projects within Avalanche while maintaining deep liquidity and a robust methodology in safeguarding funds.

$CAI gives all-rounded exposure to Avalanche

We're delighted to introduce you the easiest way to invest in the #Avalanche ecosystem: $CAI – Colony Avalanche Index.

— CAI – Colony Avalanche Index (@cai_index) August 10, 2022

Brought to you by @Colonylab & @phuture_finance.https://t.co/ItlK36ZHyk

An abbreviation for “Colony Avalanche Index“, the main goal of CAI is to provide exposure to the growth of the avalanche ecosystem. If you know how an index like S&P500 works, the concept is no different with CAI.

We first have to explore what an index is. An index is a basket of assets that are put together based on a certain methodology. In the case of CAI, tokens which are included in this basket of assets are derived by looking into token characteristics (supply), liquidity, and significant usage/value accrual.

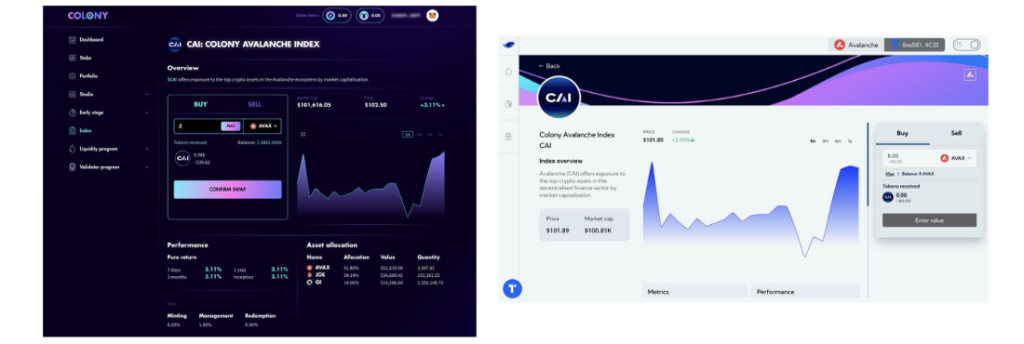

Just like the top 500 US companies that the S&P tracks, the value CAI is backed by $AVAX, $JOE and $QI.

CAI will be composed of Avalanche’s native token and some of the most prominent projects in the ecosystem:

- $AVAX (Avalanche): Avalanche’s native token.

- $JOE (Trader Joe): a one-stop-shop decentralized trading platform native to the Avalanche blockchain.

- $QI (BENQI): a decentralized liquidity market protocol on Avalanche, enabling users to lend, borrow and earn interest with their assets.

While the concept of indexing funds has seen some traction with the Bitcoin ETF, CAI is taking things into its own hands by curating one for Avalanche. You are basically investing in Avalanche’s ecosystem as a whole through the exposure of what $CAI represents.

How will tokens be chosen?

While there are only currently 3 assets that constitute $CAI, there will be more to come. The team is taking a dynamic approach in selecting assets to be included, buying the best projects and allocating them as the Avalanche ecosystem grows.

“Buying 1 $CAI is equivalent to holding 2.5 $AVAX, 170 $JOE and 1500 $BENQI.”

Elie Le Rest, CEO of Colony

The first metric the team looks out for is market capitalization. As the index is market cap weighted, any assets which would be included have to have a significant market cap.

Secondly, longevity. A project has to be live for at least 6 months.

Thirdly and probably the most important, liquidity. Atleast 2 million dollars in liquidity before being added to the index.

Additional returns from Yield Yak

As a percentage of the tokens is allocated to unlock passive yield, investors can benefit from additional returns on their investments.

One of the main reasons why people participate in DeFi is making tokens work for them. Yield take is doing this by putting them into a yield-bearing vault. By leveraging the composability of DeFi, they are building on top of existing vaults and strategies and delivering yield back to the index holders.

“We are building it slowly to maximize yield-bearing elements as much as possible.”

Dylan, Marketing Lead at Yield Yak

Another DeFi platform that joined yield farming opportunities for $CAI is Beefy Finance.

Use Beefy to earn more of the first major #Avalanche ecosystem index.@cai_index

— Beefy (@beefyfinance) September 16, 2022

✅ $CAI – $AVAX LP: 183% APY

👉 https://t.co/dAqGT6Lc0C@colonylab @phuture_finance pic.twitter.com/4DzaTxjAC7

Where to get your CAI

CAI is available through Trader Joe. (CAI-AVAX pool)

- Token address: 0x48f88A3fE843ccb0b5003e70B4192c1d7448bEf0

You can now invest in CAI through Colony’s platform and the Phuture app.

Closing thoughts

CAI’s objective is to give investors regularly managed, diversified exposure to the growth of the Avalanche ecosystem. By reducing the costs of entering and exiting the index and at the same time ensuring the index is always allocating capital with the best projects the Avalanche ecosystem has to offer.

Also Read: Slaying The Bear Market: 5 Skills You Need To Excel In a Crypto Downturn

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief