Bullish news no longer pumps the coins you own. Majors keep bleeding. Your alt has probably gone down 90% from ATH. We are experiencing winter and the heat from the bull run only reminds me of a distant past.

Protocols and platforms have collapsed and massive systemic risk seems to get exposed in crypto every single week.

It feels scary and cold in the bear, doesn’t it?

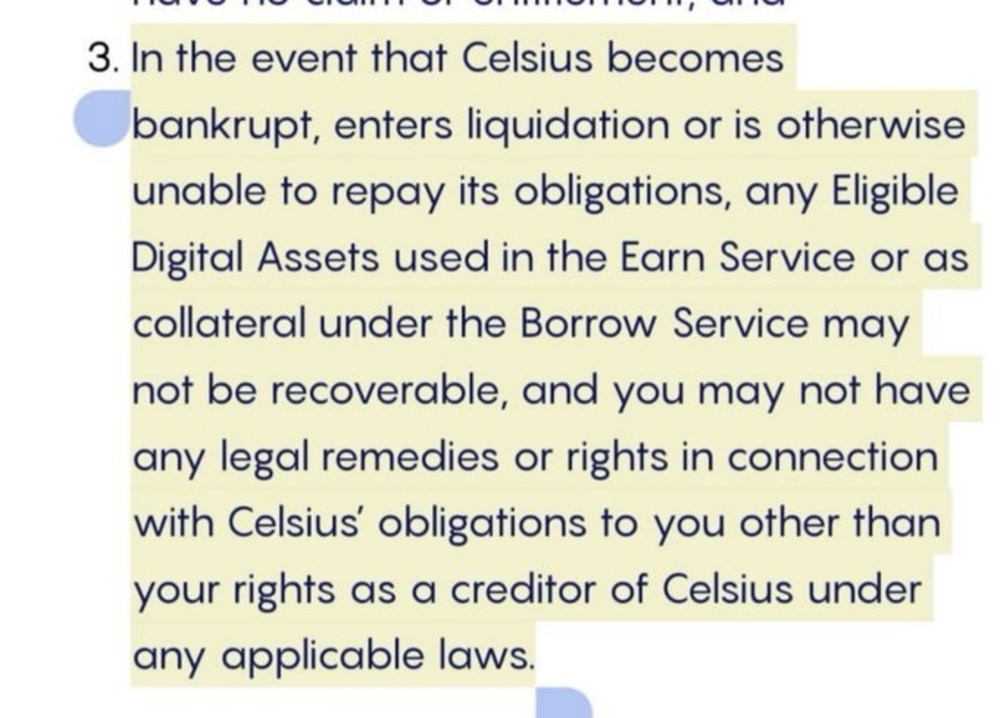

One example recently has been the inevitable bank run of Celsius, as users all flock to withdraw their assets from the lending platform… which ended up pausing withdrawals and swaps.

.@CelsiusNetwork is pausing all withdrawals, Swap, and transfers between accounts. Acting in the interest of our community is our top priority. Our operations continue and we will continue to share information with the community. More here: https://t.co/CvjORUICs2

— Celsius (@CelsiusNetwork) June 13, 2022

Narratives once shilled in the past seem to have faded away. Things do look bleak… but is that really the case?

I have written quite a number of articles related to the bear market – highlighting problems, patterns, and common mistakes people tend to make in the crypto space.

For this article, I will mainly address one question:

“What will it take for the bull run to be back?”

In my opinion, there are 2 broad themes: real world use-case, and investor psychology.

Cleansing of fragility and leverage

For the bull run to be back, there needs to be a cleansing of all the reckless behavior and overly fragile protocols in the space. Frankly, projects like Celsius and Anchor have something in common, and that is people tend to underestimate how fragile it really is.

“20% yield on Anchor and UST? Surely the algorithm of LUNA and UST will survive, right?“

“Lending out my funds on Celsius and any other centralized platforms? Surely these people will manage my funds appropriately, right?“

“Influencer X said good things about protocol X, surely this means that using it is safe and the token is worth buying, right?“

“BTC has had 9 weeks of red candles, surely it can’t go 10 or 11 weeks, right? “

Well, eventually, when the tide goes out, even the improbable situations start to look more likely. I’m sure that for many of us, we might not expect for certain coins to go down this much, but here we are.

Update: Celsius has transferred about 104,000 ETH to FTX in the past three days, including about 50,000 ETH today, 12,000 ETH yesterday, and 42,000 ETH the day before yesterday. In addition, Celsius also transferred about 9,500 WBTC to FTX today.https://t.co/RaiJTJIVm9 https://t.co/1RQaa9fT3u

— Wu Blockchain (@WuBlockchain) June 13, 2022

I think the learning point is not about price predictions, but about how far the risk is widespread all throughout crypto. An insolvency in protocol A might cause cascading liquidations which indirectly affects the rest of the market.

And in the case of Celsius, a centralized platform that has not been transparent about their sources of yield, why did investors still park their money inside?

The more we underestimate these risks, the more painful it is when these risks comes back and bite us.

Real world adoption

Beyond just shuffling tokens around to dump on others, there needs to be some form of real world generation of revenue and services people actually find USEFUL.

Real world use-cases of crypto should not just rely on leverage in the system and shuffling shitcoins around the ecosystem.

Off the top of my head, some examples may look like this:

- NFTs as representations of other significant assets (think title deeds etc)

- Enterprise usage of smart contracts

- Safer and seamless payment infrastructure across chains

- Plug-and-play DeFi that does not rely on centralized entities like Celsius/BlockFi with risk of default

- DeFi that is connected to real-world assets

- Appropriate insurance mechanisms that hedge and underwrite against massive risks in crypto

- Permissionless access to yield and income for third-world countries

- Gaming that does not just rely on buzz words with good token incentives

In short, any thing which provides Web 3.0 level of transparency, Web 2.0 ease of use, and isn’t some form of unsustainable Ponzi will encourage users to hop back into crypto.

Investor Psychology In A Bull Market

The characteristics of bull markets are psychological in nature as well. Watch for these signs:

- Investors take more risks and are open to bidding

- General sense of optimism in the markets

- A belief that what they are buying is the “future” and revolutionary

- Positive promotion of projects on media

What matters to me is not just the fundamentals of the market, but also how people behave and react to changes in the space.

There needs to be a new form of positive feedback loop or network effect that drives people to come back.

While beliefs are somewhat backed by fundamentals, observe and keep track of the amount of attention people pay to crypto, especially positive attention. The popularity of an idea and how it captures mind-share is very important in crypto, as seen from successful recent NFT projects like Goblintown.

Check your social metrics

One good thing about the bear market is that the noise and buzz starts to disappear and settle down. Most new members in community groups either stop posting, or slowly disappear.

Quality of discussions in places like Telegram, Discord, Twitter, start to become better as people get more reflective and question projects with more scrutiny.

Watch for more discussion and more inflows of parties in a project – it may be indicative of renewed interest and enthusiasm in the space.

Bull-ish macro-economic conditions

I have kept this as the last one and this is probably the most obvious. Now, I don’t profess to be an expert in the macroeconomy, and I may be the last person qualified to talk about this.

If there is one thing I am betting on, however, that would be one statement:

“Don’t fight the FED.”

Right now, the Federal Reserve is pursuing a contractionary monetary policy (quantitative tightening). Until that changes, I see no reason to overly bullish on prices of assets, especially crypto which is currently on the far-end of the risk curve.

However, as macro-economic conditions get better in the future, this certainly gives investors and builders the confidence they need to renter the market, especially for one as immature and volatile as crypto.

Closing Thoughts

If I could sum up all my thoughts into one statement, it would be this:

“Be patient, and observe.”

There is no rush in buying, or trying to time the bottom. This doesn’t mean that you should be inactive, of course. But simply doing research, trying to sharpen your edge, and taking a small break should go a long way.

Keep looking out for trends, how projects are faring, what your founders are saying, and who has disappeared/reappeared in your social channels. The best ideas and people to connect with are found deep in the bear, where survivors and true optimists remain.

Once you have crafted your own thesis and conviction, stick with it and see where it takes you. I am comfy right now, are you?

Also Read: A Double-Edged Sword? All You Need To Know About Web 3.0

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief