Airdrops are a popular crypto term for the distribution of free tokens to the community with the intention to decentralise token supply and/or market its new product. How effective have these airdrops been to the native tokens we know about?

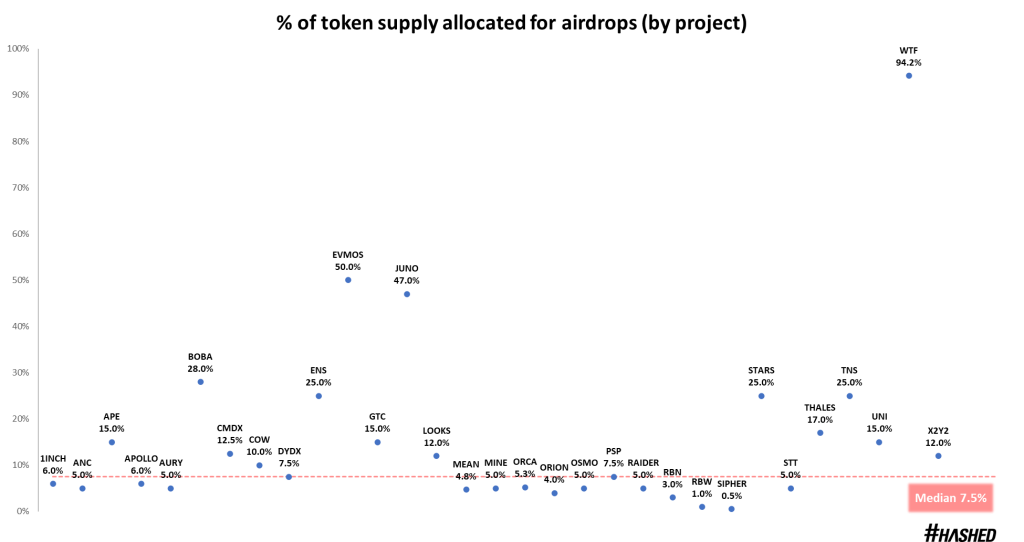

We will look at 31 different token airdrops over a span of 1.5 years, from $UNI in Sep ’20 to $EVMOS in Apr ’22, but before we do, we have to start by understanding the % of token supply allocated for airdrops in each airdrop.

The results show projects across the board with a median distribution of 7.5%, with the majority being under 10%.

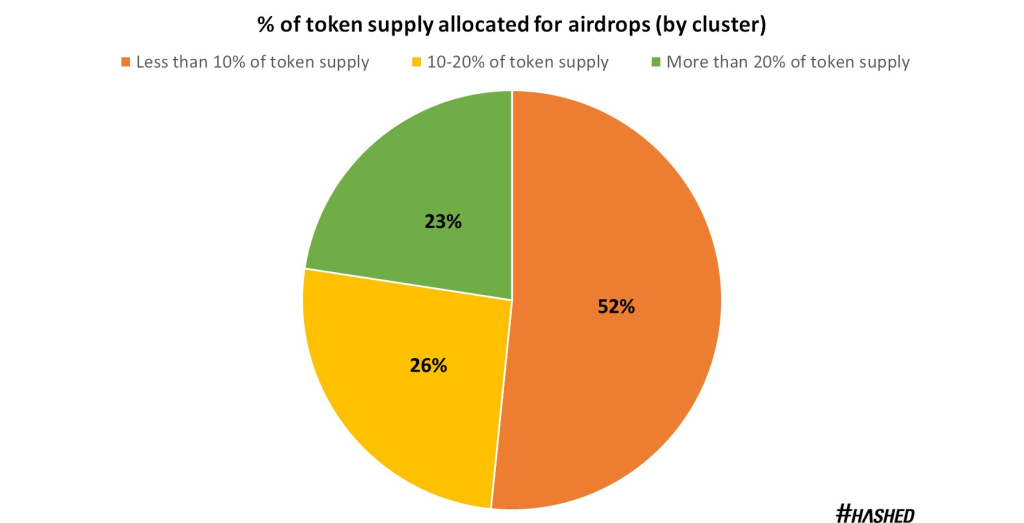

52% of the sample allocated under 10% of token supply for airdrops, followed by 26% within the 10–20% range and 23% falling below the 20% token supply bracket.

To get a rough gauge on token allocation by projects, they tend to allocate ~10% for investors and ~15% for team members as mentioned by @Robindavidji on Twitter. So setting aside 7.5% purely for airdrops is arguably a significant amount, let alone projects who has a “community-driven” tokenomics model like Evmos and Juno, with 50% and 40% of their token supply allocated to airdrops respectively.

Thinking about launching a token in this market?

— Robin | LiquiFi (Carta for crypto) (@robindavidji) June 8, 2022

Or granting future tokens to employees and investors?

We did some analysis on the latest tokenomics benchmarks and trends to help you plan your critical token decisions. pic.twitter.com/zXX35AH3wU

So why airdrops?

So, what’s the rationale for airdrops?

(1) If a product is about to go live, founders may want to scale marketing and awareness. A successful airdrop would be an efficient way to get a larger following in a short period of time, while at the same time giving users time to research the project’s legitimacy. (e.g. $APE, $EVMOS, $LOOKS)

(2) If it has been live for a while, airdrops are a good way to reward early adopters and dedicated community members while incorporating various tokenomic metrics ($COW, $DYDX, $ORCA).

Post airdrop performances

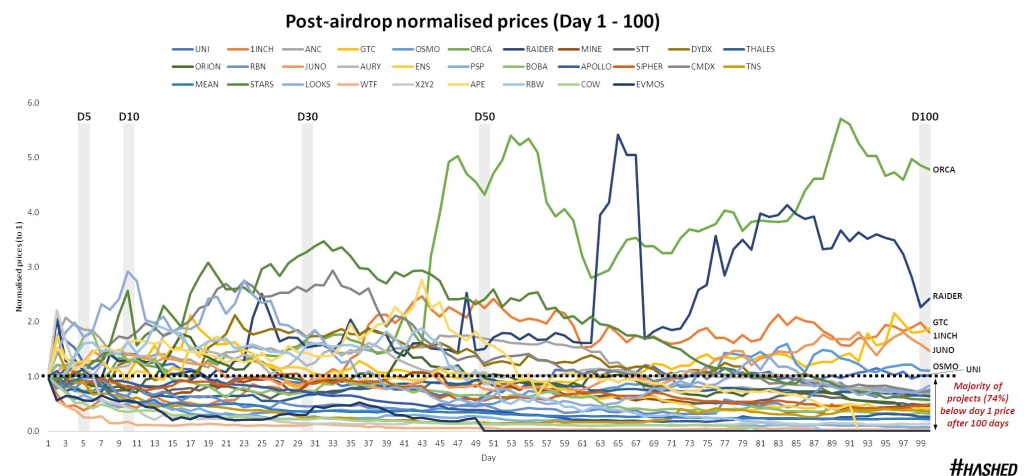

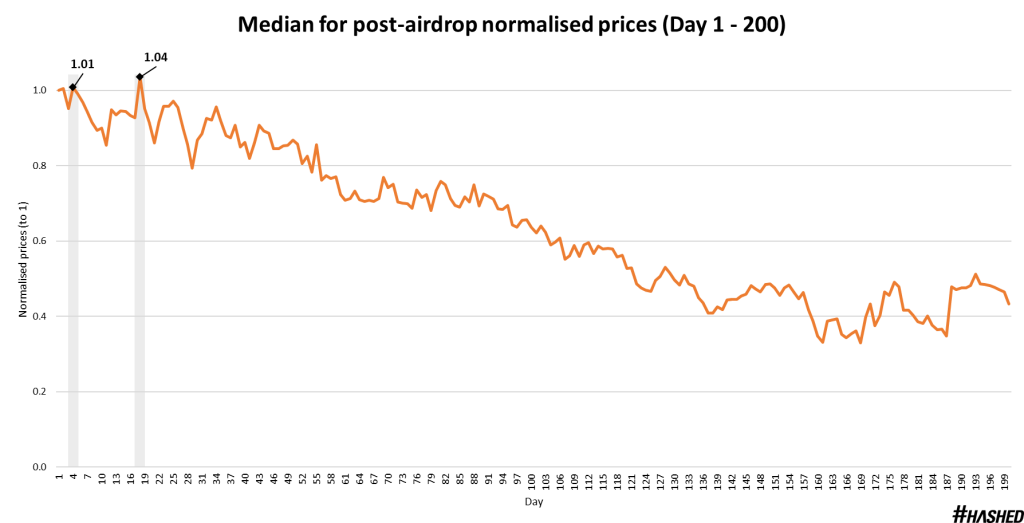

However, data indicates that airdrops are not aligned with long-term outcomes for the native token prices have been normalised to 1.0 (y-axis) and scaled to a number of days after their initial airdrops (x-axis).

Results might come as a shocking truth to some, up to 74% of projects had their tokens trading below day 1 prices.

Only 7 projects traded above their launch prices, with outperformance demonstrated by $ORCA (a Solana DEX) at 4.8x launch price and $RAIDER (a utility-based NFT RPG game) at 2.4x launch price.

The 100-day post airdrop prices chart shows 2 main results over time. Firstly, the average price performance deteriorates and secondly, increasing number of projects trades below their day 1 prices.

To go into more specifics,

- At day 5, the average airdrop has a median price of 0.99 (a -1% deviation from day 1) and 55% are already trading below the launch price

- On day 50, the average airdrop has a median price of 0.87 (a -13% deviation from day 1) and 70% are trading below launch price

- By 100 days, the average airdrop has a median price of 0.64 (a -36% depreciation in value from day 1) and 74% are trading below launch price

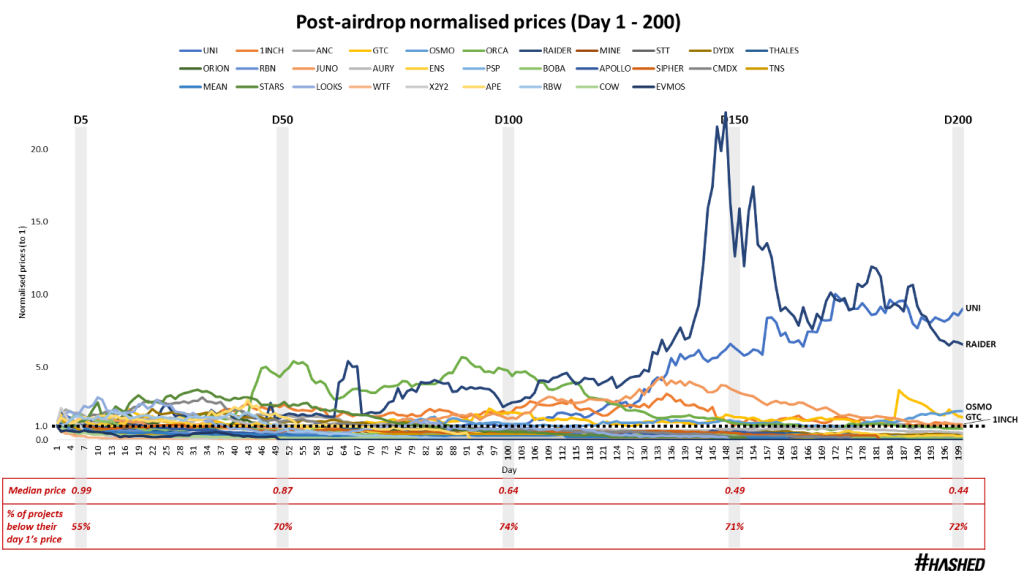

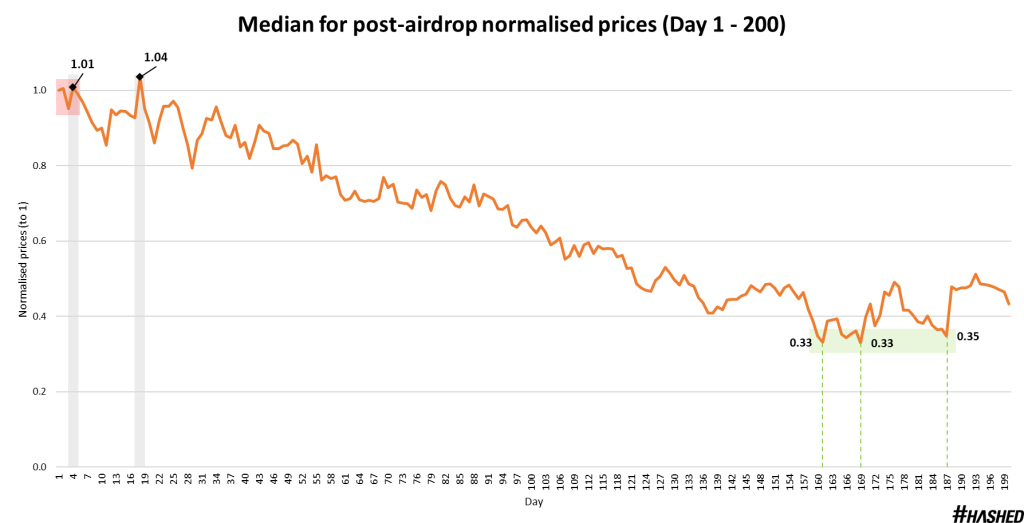

When these figures are extrapolated over a longer timeframe (200 days post-airdrop), the results are not dissimilar. There’s a trend of decreasing price performance over the longer time period, with the median airdrop price falling from 0.99 on day 5 to 0.44 by day 200.

The majority of projects (72%) continue to underperform their launch prices, though there are notable ones that did well (e.g. @Uniswap, @crypto_raiders).

Sell strategy for airdrops

Based on historical median data, there are only two days within the 200-day timeframe in which the median airdrop performs better than launch price – Day 4 (+1%) Day 18 (+4%).

This indicates that the best time for users to sell their airdrop would be as early as possible, ideally between days 1 and 5 (the first shaded area) as there is a little price fluctuation during that period.

Buy strategy for airdrops

The best time to “buy back in” would be months 5–6 (shaded green area), where median airdrop prices seem to bottom at 0.33x (-67% from launch day prices) E.g. If you bought $UNI and $OSMO at day 150 post-airdrop and sold it by day 200, you would have netted +42% and +59%.

Closing thoughts

Cpt_n3mo also talked about alternative execution methods, developers can look into decentralizing token supply/ growing product awareness in different ways other than airdrops. Basically rethinking the utility of airdrops before dropping them to the masses.

The crypto masses have a short attention span. Airdrops are a fast way of capturing their attention but it faces sustainable issues in a longer timeframe. They also have little patience for stuff that does not deliver in utility.

Even if airdrops were to be effective in those aspects of utility, are you willing to achieve that at the expense of a large majority of retail holders dumping early on?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

Also Read: Centralization Sucks, But Is Decentralization Really The Answer?