In contrast to the “Ethereum Killer” narrative perpetuated by many Alt-Layer 1 fans, the Cosmos ecosystem was heralded as a co-operative environment where projects served as building blocks toward a greater cause.

While Cosmos and it’s native token $ATOM saw steady growth in 2022, it’s potential was slowed by the fall of Terra, due to $UST’s strong ties with the Cosmos ecosystem. Despite this, $ATOM has been on a consistent upward trend in 2023, up 54% since the start of the year.

As more and more networks continue to join it’s ecosystem, what does Cosmos have in store for 2023?

Also Read: An Introduction To The Cosmos Ecosystem And Its ATOM Token

A Recap of Cosmos & Why Modular Blockchains Are The Future

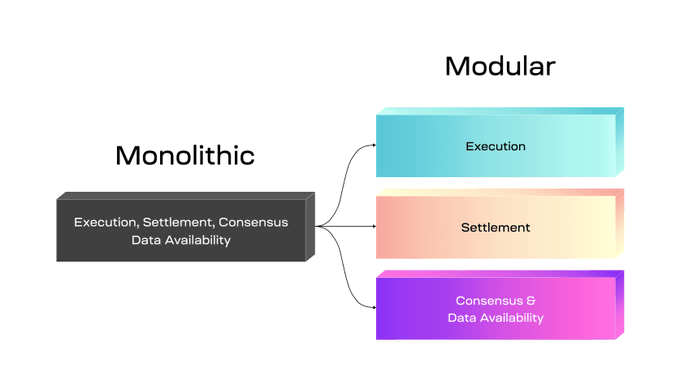

Many of the networks we are familiar with are known as “monolithic blockchains”, whereby transactions, data, and consensus all occur on the same network. This includes Bitcoin, Fantom, Solana, and more.

However, Modular blockchains separate the data and processing elements, or allows transaction processing and consensus to happen at separate layers.

By leveraging it’s SDK (software development kit) and IBC (Inter-Blockchain Communication Protocol), Cosmos is able to act as a hub for other networks to build on and connect with one another.

But are Modular blockchains really better than Monolithic blockchains?

“Let’s think of monolithic blockchains as empires that rule over many with a single governance, security & economy system. That comes at the expense of sovereignty and an ability for the smaller folks to capture the individual value they create for the empire.”

In contrast, she notes that Cosmos allows projects to retain their own sovereignty while “reaping the full rewards from running their own chain and retaining the benefits of inter-connectivity within the economic zone.”

State of The Cosmos Hub: A Comprehensive Overview

Active Users and On-Chain Statistics

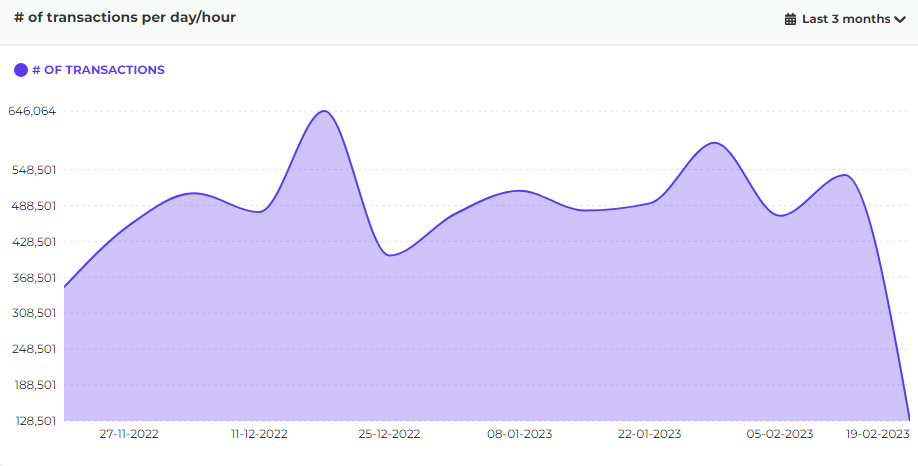

In the last 3 months, Cosmos saw an average of 500,000 transactions per day, compared to approximately 400,000 on Fantom and 100,000 on Avalanche. Furthermore, it saw an average daily trading volume of 20 million $ATOM, or roughly $220 Million in transfers daily.

While it’s daily active users pales in comparison to many other networks, this does not take into consideration the other projects connected to it via the IBC, including Canto, Osmosis, Cronos, and more.

Network Performance and IBC Ecosystem

As transactions on the Cosmos hub continues to grow, one would expect block times – a measure of the network’s throughput, to take longer.

However, the inverse is actually occurring, with block delay timing and block counts have an inverse relationship. This means that the increase in transactions are being handled at the same level of throughput, or even faster than before.

3b/ State of Cosmos Ecosystem: IBC Chains

— Satria Pamudji (@SatriaPamudji) December 30, 2022

Of course, Cosmos isn't Cosmos if it's all about the Hub. How has IBC performed?

We see that in 2022, we are ending off 2022 with 53 chains, compared to 44 at the start of the year. pic.twitter.com/8DW4ThtQSB

Furthermore, the number of ecosystems choosing to build on Cosmos has been on an uptrend since it’s birth, with 54 chains currently connected, compared to 44 at the start of 2022. This has also assisted in returning total transfer volume to the Cosmos hub, which was significantly affected by Luna’s crash.

Prior to Terra’s downfall, total IBC volume saw a $3 Billion monthly average, which trickled down to less than $1B in the wake of $UST’s collapse. IBC transfers saw the sharpest month-on-month increase from October to November last year, rising almost 400%.

Total Value Locked

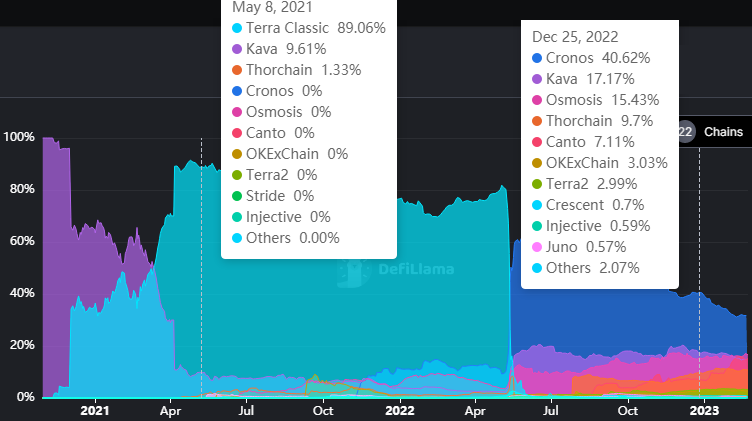

The rise in volume within the Cosmos ecosystem has been led by an uptick in activity from existing chains, as well as new, exciting projects that have begun to gain traction.

While it’s ecosystem’s TVL was largely accounted for by Terra last year, it’s downfall has given space for other protocols to shine.

Currently, the top 5 projects on the Cosmos Hub by TVL are:

- Cronos – $393M

- Osmos – $204M

- Canto – $186M

- Kava – $182M

- Thorchain – $132M

Cumulatively, the top 17 projects also have a TVL of ~$1.2 billion. For comparison, Arbitrum has a TVL of $1.86 billion, Polygon $1.18 billion, Fantom $500M, and Ethereum $50 billion.

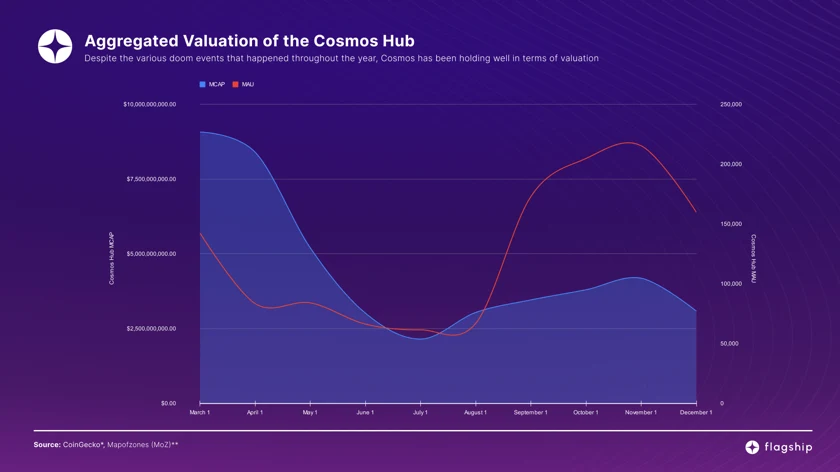

Despite having both a lower Total Value Locked and Market Capitalization since last year, Cosmos continues to gain monthly active users, a statistic that is especially important in a bear market.

An Exciting 2023 Ahead For Cosmos

2023 seems set around a key theme: development. Whether it be new, exciting use cases, or reiterating current protocols with higher standards, many are helping to bring crypto one step closer to mass adoption.

Interchain security timeline

— Thyborg (@Thyborg_) December 2, 2022

Mid Dec: Forum post

Mid Jan: On-chain prop

End Jan: ICS module launch

Mid Feb: First consumer chain prop

Cosmos is no different, making multiple major developments that will stand to benefit all within and potentially outside their ecosystem.

Their Cosmos Hub Roadmap 2.0 proposes some huge upgrades for 2023, including:

- Interchain Accounts (v8 Rho)

- Interchain Security (v9 Lambda)

- Interchain Queries

While you can dive deeper into their developmetns HERE, the possibilities of interchain modules could be a gamechanger for all. Being able to deposit collateral on Blockchain A and take a loan against in on Blockchain B, for example, is something that many wanted to see in DeFi.

Interchain Security will also set the foundations for consumer chains, similar to parachains on polkadot and subnets on Avalanche. These allow applications to build on Cosmos without running their own validator sets, instead relying on Cosmos and $ATOM to confirm transactions.

On top of better interchain communication, Jowella is especially excited for the rise of better decentralized trading experiences and uncollateralized lending within the Cosmos ecosystem.

Mars Protocol, for example, recently established themselves on Osmosis, the leading Decentralized Exchange in Cosmos. Through their “Red Bank Outpost”, they will first allow traditional money market activities, but are looking to expand into under-collateralized lending.

Mars isn't just another money market

— José Maria Macedo (@ZeMariaMacedo) February 7, 2022

It’s a generalised credit protocol enabling both peer-to-smart contract AND smart contract-to-smart contract lending 🔴

The latter is the real breakthrough and what I’m most excited about.

Thread about why 👇https://t.co/RNHJ7M7yAY

Kujira, which builds a host of decentralized protocols, has also been hard at work with the development of multiple applications such as ORCA and BOW.

However, the dAPP that manages to steal the spotlight is FIN, a decentralized exchange that manages to replicate the order-book style trading experience that many on-chain exchanges lack.

While traditional DEX use inflationary rewards to bootstrap liquidity pools, FIN uses sister protocol BOW to incentivize deposits. BOW functions as a Central Limit Order Book, which means only a limited amount of deposits are needed for a rich trading experience.

Closing Thoughts

While Cosmos isn’t off to the quickest start in 2023, major developments coming soon are bound to kick start a new paradigm for DeFi on the hub. In fact, Cosmos is quickly moving toward some of the most exciting real-world applications while creating a better user experience for all.

Cosmos is dramatic. Full of complex governance issues or ‘PvP’ – all with an underlying goal: Grow the ecosystem.

— speicherx 🕊 (@speicherx) January 20, 2023

But… the beauty of Cosmos is in the community; and I think it’s awesome to see people continually stepping up to see this vision succeed👇🏻 https://t.co/cTIyYYUVkj

Furthermore, developer count has increased by 107% on Osmosis alone, and 25% across the Cosmos ecosystem according to this report. The steady growth in their ecosystem, including the number of chains being integrated, steady user growth, and huge boosts in transfer volume also indicated that on-chain activity is returning to the hub.

Additionally, the growth of SEI, a DeFi-optimized network built on the Cosmos SDK, that received millions in funding, will also be an exciting aspect to look out for in the ecosystem.

About Coinhall:

Coinhall has built and will be improving the platform for users to execute reliable aggregated swaps at the best rate, have access to real-time charts & analytics for cosmos assets & more.

The team is also working on Seer, a data-indexing infrastructure for Cosmos, and Genie, a Web3 growth tool that tags to historical wallet behavior.

Also Read: Jowella on Building For Users, Coinhall, and Crypto’s Bright Future

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief