With the end of 2021 approaching, I thought it would be apt to reflect on my crypto portfolio for the year.

In this article, I will introduce my portfolio and elaborate on the strategies that I’ve adopted.

Subsequently, I will reflect on the right and wrong decisions I’ve made throughout the year. Lastly, I’ll touch on my crypto investing plan for 2022.

Background: My 2020 crypto strategy

I’ll start by introducing myself and my initial thoughts on crypto. I started diving into blockchain research towards the end of 2019.

After gaining conviction in blockchain, I started investing in crypto in early 2020 during the crash that was precipitated by the Covid-19 pandemic. It was an opportune time and I invested in ETH at an average cost of ~US$200.

As there was not much to do in the crypto space at that time, I treated my investment in ETH just like my investment in stocks; I simply bought and HODLed ETH.

ETH ended 2020 trading at ~US$750, and this represented a 3.75x gain in my crypto portfolio within one year.

2021 crypto strategy

As my 2020 crypto returns were pretty decent, I continued HODLing ETH throughout the first half of 2021. Eventually, I liquidated my ETH in end April / early May at an average price of US$3,000.

I guess I was rather lucky as my portfolio was barely affected during the May crash. But the more important event that happened in May was the shift in my mindset from a TradFi perspective to a DeFi perspective.

And so began my new strategy and the commencement of my foray into yield farming on Polygon, which went on from May to June.

In July, I transferred my funds from Polygon to Terra and started yield farming LUNA.

I also had some funds left in Polygon to participate in Polygon’s Play-to-Earn game (Aavegotchi).

This was also what got me started with NFTs, and I subsequently shifted these funds over to Solana in August to trade Solana NFTs.

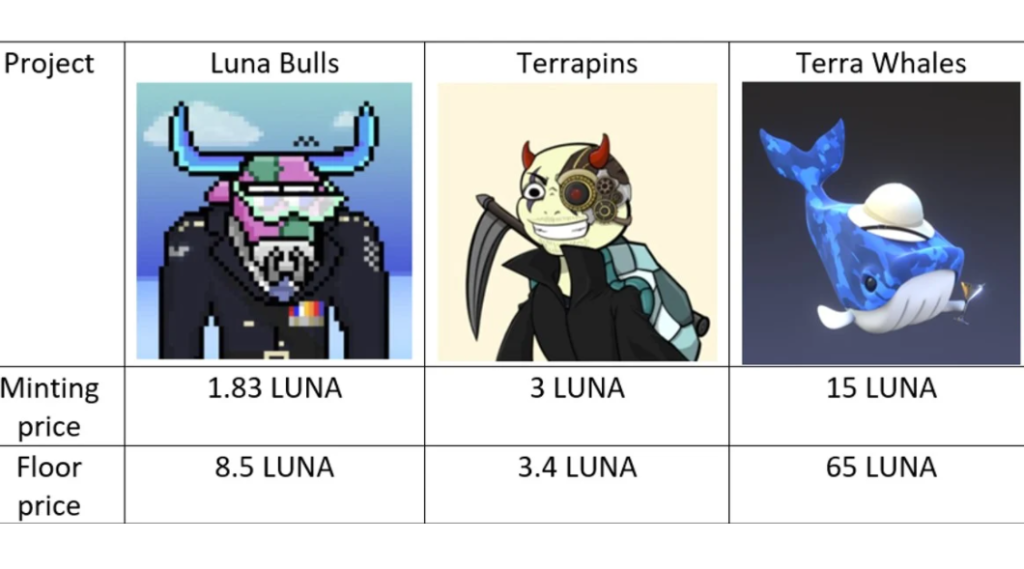

In October, Terra NFT season commenced and my LUNA was instead used to trade NFTs.

I was also introduced to Harmony and DeFi Kingdoms in October and started staking and yield farming JEWEL together with Harmony ONE token.

By November, NFTs started getting oversaturated on the Terra blockchain and I took most of my LUNA and started yield farming together with JEWEL on DeFi Kingdoms.

In mid-December, I started cashing out my crypto position to build a warchest of stablecoins. As of now (end December), the only crypto I have is my locked JEWEL rewards and a tiny bit of Immutable X (IMX).

All in, my YTD gain amounted to 1540%, which is 16.4x. Coupling this with my 2020 gains of 3.75x, I managed to achieve a 2-year gain of 6000%!

Now, let’s take a look at the good and bad decisions I’ve made this year.

Good decision: mindset

Firstly, the best decision I made was to pivot my thinking, from viewing crypto with a stocks mindset to viewing crypto with a blockchain mindset.

If I continued HODLing my ETH instead of using my crypto to interact with on-chain protocols, my YTD gains would be 435%. Ostensibly, treating crypto as a DeFi asset instead of a TradFi asset was a clear alpha-generator for my portfolio.

Good decision: MATIC

Selling my ETH and rotating my funds into MATIC was also a rather good decision because it coincided with Polygon’s liquidity mining programme.

The incentives boosted MATIC’s price from US$0.38 to US$2.45 (+545%) from late April to early May, and it was the only coin among the top 100 cryptocurrencies that was in the green during the crypto crash on 19th May.

Good decision: Terra and LUNA

The next best decision I made was to rotate my funds from Polygon to Terra. I started buying LUNA at the start of July at an average price of US$7.

While yield farms on Terra weren’t very attractive, Anchor’s borrowing rate made up for it and I was enjoying a yield of 100+% while borrowing UST, which I used to recursively leverage LUNA.

Terra’s NFT season in October was also rather decent and it gave me a 1-month return of 421%.

I eventually sold my LUNA in mid-December at an average price of $75 (+971%).

Good decision: Solana

As LUNA farms in Terra weren’t attractive, I looked for alternatives on other chains. One such alternative was farming wLUNA-renLUNA on Solana’s SaberSwap with no impermanent loss.

I started farming right after it launched and the initial yield started off rather high (300%) and it was issued in the form of Saber tokens (SBR), which traded around US$0.02 at that time

Periodically, I also harvested my SBR yield to swap it for SOL, which was trading around 30 USD. When Solana’s TVL started skyrocketing, both SBR and SOL started mooning and I sold all my SBR at US$0.55 (+2650%) and SOL at US$160 (+433%).

I also took my funds in the Solana ecosystem to flip Solana NFTs like Bold Badgers and Aurory to further multiply my gains.

Good decision: DeFi Kingdoms

The last good decision I made was to enter DeFi Kingdoms. I bought JEWEL at US$3 and started staking it in the bank (35-40%) and yield farming JEWEL-ONE for 2500% APR.

When the APR started dropping under 1000%, I withdrew my JEWEL-ONE LP and instead started farming JEWEL-LUNA for 1000+% APR.

I eventually cashed out and sold my JEWEL in mid-December at an average price of $11.50 (+283%)

Bad decision – Polygon

While buying MATIC was a good decision, the yield farming strategies I executed on Polygon were questionable at best.

As this was my first yield farming experience, I was rather conservative. As such, I only LPed pools with no impermanent loss, which resulted in significantly lower yields.

There was only one stablecoin pool that I invested in that had a relatively high yield, and that was Iron Finance’s IRON-USDC pool, which eventually got rugged.

Bad decision: Play-To-Earn

When the P2E hype started in July, I thought I missed out on AXS when it rose to $10.

Instead, I tried finding “the next Axie” and chanced upon Polygon’s P2E game: Aavegotchi (GHST), which rose by 200%. While the returns were decent, it pales in comparison to AXS’ subsequent 1550% gain to hit its ATH of $165.

Bad decision: Missed opportunities and bad timing

Besides missing out on AXS, I also missed the L1 rotation to AVAX. Additionally, while I bought FTM at $0.22, my FTM bag was miserably small during the L1 rotation to Fantom. To make matters worse, I sold my FTM at $1.20 while it kept rising to $3.50.

On this note of bad timing, here are some other instances:

LUNA: Sold at US$75, which ended up hitting US$100

SOL: Sold at US$160, which ended up hitting US$260

SBR: Sold at US$0.55, which ended up hitting US$1

JEWEL: Sold at US$11.50, which ended up hitting US$15

DFK-wise, another mistake I made was not making the effort to understand the game mechanics and my refusal to buy DFK Heroes, a decision that I regret now.

Evaluation

To summarise, both my DeFi and NFT strategies went well this year.

After learning from my yield farming mistakes on Polygon, my subsequent endeavours on Terra, Solana, and Harmony went well.

Throughout the year, I bought/minted a total of 39 NFTs on Polygon, Solana, Terra, Celo, and Near. From my collection, I sold 27 at a profit and six at a loss, while I’m HODLing my remaining six NFTs.

Looking ahead

Firstly, I believe that the NFT PFP narrative will be much less hyped going into 2022. In contrast, NFTs with utility are more likely to shine, particularly P2E NFTs.

To gain exposure to this sector, I stand by my investment in JEWEL. And when DFK: Crystalvale launches on Avalanche, I plan to buy some CRYSTAL and mint Heroes to participate in quests.

⚔ Really exciting news, Heroes! We're introducing the upcoming launch of a new realm in the kingdoms…

— DeFi Kingdoms (@DefiKingdoms) December 2, 2021

❄🏰 DeFi Kingdoms: Crystalvale is coming to the #Avalanche blockchain!@avalancheavax #defikingdoms $JEWEL $CRYSTAL $AVAX pic.twitter.com/rwCOsymKwJ

Additionally, I’ve spent my winter break researching new platforms, and one that caught my attention is Immutable X, which I’ve initiated a small position in recently. It is an Ethereum L2 specifically designed for P2E games and their NFT assets.

Moving on to DeFi, there has been a recent narrative shift towards DeFi2.0 projects such as OlympusDAO and Wonderland that catalysed the rise of Protocol-Owned Liquidity. However, after hours of research, I still fail to understand POL’s value-add.

As such, LUNA and its superior tokenomics will still be my alpha play for 2022 as I believe Terra can better facilitate the adoption of DeFi. Additionally, UST is an algorithmic stablecoin with actual utility starting with the Terra Alliance, and I believe this utility will prevent it from suffering the death spiral like other algo stablecoins. In contrast, MIM has not much utility besides earning yield. (Not hating on Wonderland, perhaps it’s just my PTSD from IRON Finance speaking)

Conclusion

TLDR: my 2022 plan, for now, is to hold IMX and LP JEWEL-LUNA for passive income.

But who knows, narratives are always changing. To survive in this fast-paced crypto world, adaptability is salient. E.g. If the narrative shifts to Web3.0, I will rotate capital to Arweave instead. Elrond is also a potential L1 to look out for due to its unrivaled technical features and forward-looking business model.

For those who aren’t invested in crypto, I hope this article can encourage you to step out of your comfort zone and give crypto a chance in 2022.

For those who are already invested in crypto but view them with a stocks mindset, I hope this article incentivises you to treat crypto as a blockchain asset instead.

Before ending off, I would just like to interject with a disclaimer that this article is not meant to be constituted as financial advice. Crypto is inherently risky and interacting with DeFi/NFT/P2E protocols will only compound the risk further. Ultimately, your investment activity should depend on your risk appetite, so just invest in what you’re comfortable with.

Thanks for reading till the end and I wish you the best in your investments!

Featured Image Credit: Chain Debrief

Also Read: The Chain Debrief Community Shares Their 2021 Biggest Lessons And Top Crypto Picks For 2022