Key Takeaways:

- The current state of DeFi is heavily reliant on Over-collateralized loans, which have limited use cases

- Spectral Finance provides trustless credit scores on-chain, allowing under-collateralized loans

- Should Spectral succeed, the long-term implications in Web3.0 and the real world are immense

___________________________________________

In traditional finance systems, almost all lenders look at your credit score before making a decision on whether or not to loan you money, and how much money to lend you.

The Fair Isaac Company (FICO) scoring model is one of the more popular credit scoring models and it takes into consideration various factors to determine your credit score, ranging from 300 to 850.

But what about DeFi?

The thing about DeFi is that most protocols are permissionless, meaning anyone with a wallet and an Internet connection can anonymously use just about every product, from lending to yield farming.

But when it comes to lending, how can a lender be sure that a borrower is credit-worthy while maintaining the decentralized aspect of DeFi? That’s where Spectral comes in.

Before diving deep into the details, let’s take a look at the team behind Spectral.

Also Read: LABS Group – Unlocking Liquidity With Real-Estate Backed Stablecoins

The Current State of Defi Lending

In the current state of permissionless DeFi lending protocols, credit risk infrastructure is literally non-existent. The way that most, if not all lending protocols hedge against credit risk is through over-collateralization, with the exception of some unsecured lending platforms which I’ll touch on later.

Over-collateralization

Since there’s no way for a lending protocol to evaluate a borrower’s creditworthiness, they often heavily rely on over-collateralization in the event of a default to recover their funds.

To briefly explain how this works on lending protocols such as Compound or Aave:

- Borrowers would first decide which asset they intend to borrow against, as each asset would incur different Loan to Value (LTV) ratios and liquidation thresholds.

- Typically, the more stable the collateral is, the higher the LTV ratio (e.g. a 3:4 or 75% LTV means you can borrow, for example, 0.75 BTC worth of currency for 1 BTC worth of collateral). The stability/volatility of collateral also influences the borrow rates.

- In the event the value of collateral drops, borrowers are issued a margin call. If the value of collateral is not raised, the lending protocol will liquidate your collateral. This is a loan default.

One problem. Now imagine TerraUSD ($UST) was still a thing and people could use it as collateral. Back when UST was still around, it was considered widely to be a “stablecoin”, attracting stablecoin-ish interest rates. As UST collapsed, naturally lenders liquidate the UST collateral and they become the ones holding the bag.

Thus, for lending protocols to simply rely on over-collateralization as a credit risk management method may not always work in their favor, and there needs to be some way to assess the credibility of the borrower in the first place.

Unsecured lending

This is the opposite of secured lending, as it requires no collateral from the borrowers’ end to issue loans. Other than flash loans, there are few highly-utilized or successful unsecured lending protocols out there that embody the decentralized and pseudonymous aspect of DeFi. They typically have CeFi integrations requiring KYC or revealing some form of real-life identity.

Introducing Spectral Finance

Founded in mid-2020, Spectral currently has over 20 employees, led by the 2 co-founders Sishir Varghese and Srikar Varadaraj.

Sishir Varghese (CEO & Co-founder) – Experienced blockchain entrepreneur, ex-Managing Partner and Co-founder of Alphachain.

Srikar Varadarj (Co-founder) – PhD in Mathematical Science at NYU with experience in the blockchain and crypto startup scene. Partner at e^{i} Ventures.

Back in November 2021, Spectral Finance raised $6.75 million in a Series A funding round led by Polychain Capital. Just last month in August 2022, they raised another $23 million in a Series B led by General Catalyst and Social Capital, and among the list investors, Samsung.

1/7 🚀We’re thrilled to share that the @SpectralFi App V0.3.0 is available in Open Beta! https://t.co/PYsvw4jbMO

— Spectral (@SpectralFi) August 23, 2022

You can now compute your #Web3 creditworthiness or #MACROScore, a cutting-edge machine-learning-based credit-risk model.

What’s the problem we’re solving? 🧵

What exactly is the selling point of Spectral?

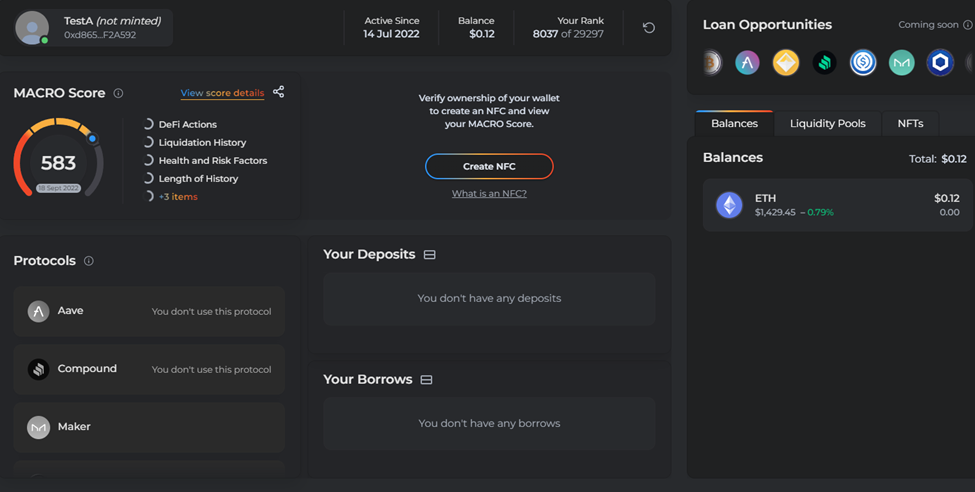

Spectral introduces a trustless and permissionless way to address credit risk analysis by building an on-chain equivalent to the traditional, ubiquitous FICO score, in what they term the Multi-Asset Credit Risk Oracle or MACRO score.

How Spectral is Changing DeFi

Spectral’s MACRO score is calculated using readily available on-chain transaction data. A borrower’s transaction history, liquidation history, amounts owed and repaid, credit mix, and length of credit history will be considered when determining the MACRO score, ranging from 300 to 850, similar to the FICO score.

With the open-source nature of the Ethereum blockchain, Spectral collects and extracts data from many of the leading DeFi protocols such as Compound, Aave and MakerDAO that is related to an address’ wallet history and transactions.

A part of Spectral’s scoring methodology also includes a “Rug Pull Analysis” which considers an address’ historical interaction with rug pull smart contracts and accounts it into the MACRO score calculation (More interaction, lower MACRO score).

Non-Fungible Credits (NFCs)

In traditional finance systems, you have to go through an intermediary to obtain information on your credit score, such as the Credit Bureau in Singapore, and it incurs a fee. With Spectral, it is a similar case in the form of an NFC which is essentially an ERC721 NFT as your credit report unique to your wallet address. When minting an NFC, it incurs an Ethereum gas fee.

Spectral also allows you to bundle different wallets together, and the platform automatically aggregates your transactions across different wallets into 1 MACRO score. To prevent people from adding random addresses they don’t own into the bundle, Spectral requires the individual to sign a nonce to prove ownership of the address (No fee incurred).

Unlocking Undercollateralized DeFi Lending

With no collateral at stake, the only risk factor for a borrower that defaults is… well, nothing (with the exception of flash loans). In DeFi, there are no chargebacks and once funds are sent out, its not yours. In TradFi, banks can still freeze your account and dig the remaining funds out, and quite possibly send debt collectors after you.

Thus, unsecured lenders can pretty much only rely on the creditworthiness of an individual to evaluate whether or not to release the funds.

Being able to evaluate an address’ on-chain credit score can possibly open up doors to more unsecured lending protocols apart from just flash loans. Additionally, existing secured lending protocols can have an added layer of risk management by being able to evaluate every borrower’s credit score, and not rely on purely collateral coughed up from the borrower which are typically more illiquid or volatile.

More Equitable Loans

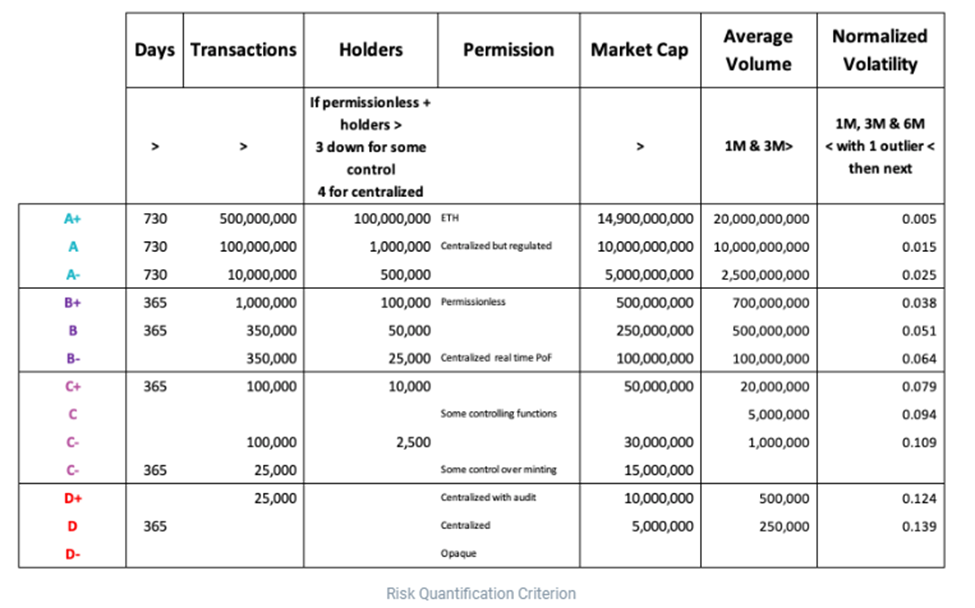

The way interest rates and borrow caps are determined on DeFi lending protocols now is dependent on properties of the asset put up as collateral. Take AAVE for example, their risk management strategy heavily, if not fully revolves around evaluating the asset put up as collateral.

The AAVE team has a risk scale to evaluate tokens to be accepted as collateral by assessing whether an asset is exposed to smart contract risk, counterparty risk and market risk. For market risk, it has some flexibility as they can vary borrowing rates based on the volatility, liquidity and market cap of the asset put up as collateral.

So what does all this have to do with more equitable loans?

Without a credit scoring system:

- Every borrower, whether you’re a good actor or bad actor, is subject to the same borrow caps or rates depending on the asset put up as collateral.

- Every lending protocol will view the borrower with an “I don’t trust you” mentality and revolve its risk management strategy around the event of a loan default.

From a borrower’s perspective, there is literally no incentive given to them for being an active borrower that has repaid every single loan they have ever taken. With credit scoring, it opens up doors to higher borrow caps and lower borrow rates for good actors.

Closing Thoughts

In a keynote address from the CEO, Spectral is currently still in a testnet, but has already landed 20,000 users in 7 days. Later in the year, Spectral is looking to expand into the mainnet and are actively building integrations with partners.

Despite the project being relatively new, Spectral is not some other DeFi project promising a “community” with “membership access or benefits. It is addressing a pretty big issue and big gap in the DeFi space – a lack of a decentralized credit risk infrastructure.

Most successful start-ups have something in common – addressing a customer/industry problem that the market ignores. In the case of Spectral, they might very well be on their way to achieve their long-term vision of making credit scoring a publicly accessible network and become the Credit Bureau of DeFi.

Also Read: What Do Bear Market Mergers & Acquisitions Really Mean For Crypto?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief