Why Is Bitcoin Pumping

There are a few reasons why Bitcoin was pumped recently, but the microenvironment mainly contributed to it. Although Bitcoin is the largest cryptocurrency by market cap, the fact is that Altcoins need Bitcoin to perform. To which direction Bitcoin moves, altcoins will likely do the same, but in varying degrees.

The pump’s primary reason was the fed hitting the gas paddle on quantitative easing, which introduced new money into the economy, along with a Bank term funding program which provides a backstop to the banks by providing them with loans to pay customer deposits.

2020 vibes.

— tedtalksmacro (@tedtalksmacro) March 19, 2023

‘Coordinated central bank action to enhance the provision of US dollar liquidity.’ pic.twitter.com/xqxZyesXn3

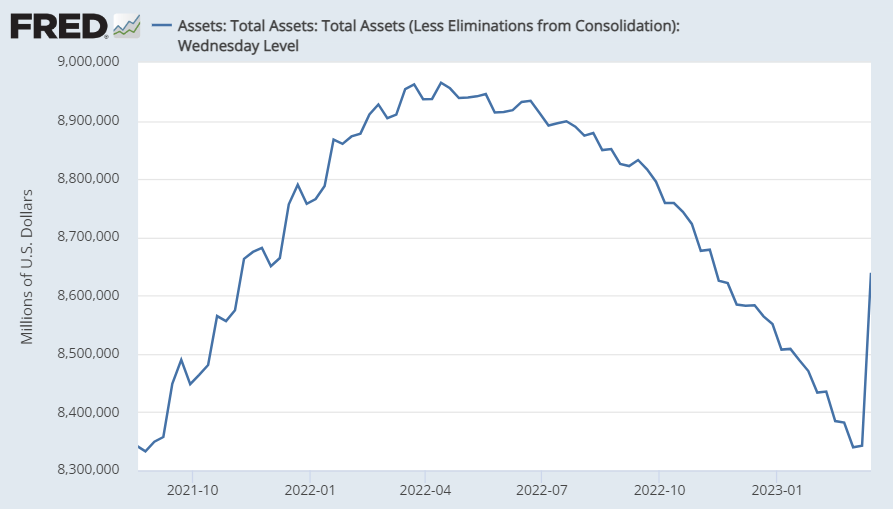

This gave a massive resurgence in the Fed’s balance sheet, something they have been tightening over the past six months. Their decision to “save the banks” removed half of the tightening efforts in the space of a week.

When people realize the incoming expansion of the money supply into the market, they look at Bitcoin and other risk assets. Furthermore, the coordinated central bank action to enhance the provision of US dollar liquidity means the Fed is opening to floodgate for fiat dollars, which the impact of tightening lessens.

According to TedTalksMacro, it “demonstrates that the Fed are concerned about market stability right now, and increases the probability that they would pause on Wednesday (FOMC Meet).”

That added more fuel to Bitcoin’s fire.

Besides Bitcoin being a “flight to safety” asset, Bitcoin’s pump was mainly due to the macro condition as investors anticipate further rate cuts.

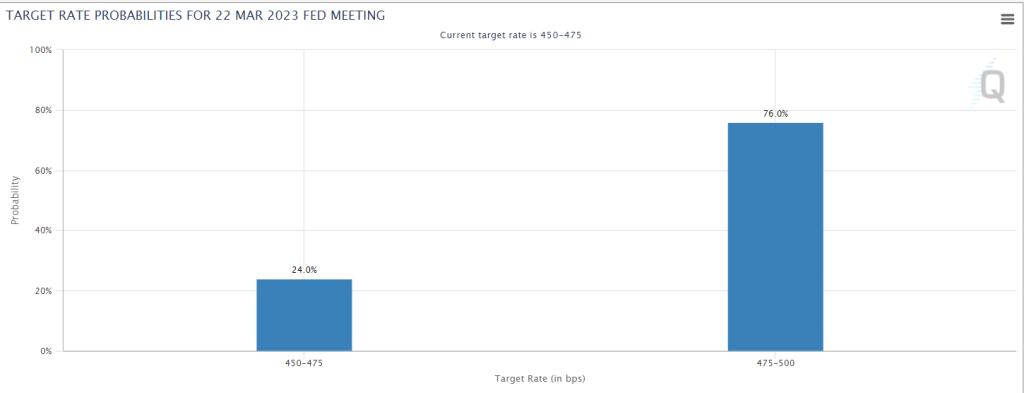

76% of the market expects a 25 basis point hike, and 24% expects a 0 basis point hike. If the 25 hikes were to come true, it would not be crazily bearish but certainly does not cause the market to explode.

However, if Goldman Sachs’s prediction of a 0% interest rate hike comes to fruition, I think parabolic days are ahead. Risk assets like Bitcoin will boom, and so will the altcoins.

ETH VS BTC

The main thing to know about altcoins vs BTC is that the alts, have been bleeding. The ETH/BTC chart continues to break downwards, reflecting the growing dominance of Bitcoin in the market.

The Bitcoin-led pump is mainly a spot-driven rally, as we can see from the open interest, which has not increased in tandem with the percentage price increase.

While many flee to Bitcoin as a haven in the face of an impending financial crisis in the US, it is clear that liquidity has not rotated into the alts.

The path to Altcoin season

The path to altcoin season outlines the phases the market follows regarding where liquidity rotates. It typically begins in phase 1, where large money flows into Bitcoin, causing prices to surge and rallying the overall market.

This is followed by profits spilling over to Ethereum as narratives of the flippening go up in the air. Liquidity then trickles down towards the larger caps. Those with solid fundamentals and product-market fit will likely perform ahead of others.

Then finally, the altcoin season begins. As we see blow-offs at the top, the mid and low caps all notice a collective upswing, outperforming coins in phases 1-3. Coins here go parabolic with no regards to solid fundamentals. Peak euphoria comes when phases 1-4 occur at the same time.

So where are we right now? The simple answer is phase 1 but when?

The FOMC rate hike could instigate it, or it could take months. Alternatively, you can look at an ETH reversal against BTC. When the charts move to the yellow box, Ethereum season is likely in full swing. That is the first indicator of phase 2.

This should be your number 1 indicator before altcoins start to pump. Bitcoin might continue sideways, but that could see the inflow of liquidity into altcoins, which could go parabolic. A pullback in the charts, however, could delay the altcoin season.

Another way to contextualize whether alt season is imminent is the BTC pairs with either coin. Across BTC pairs with larger cap coins, you want to see reversals which indicates before you consider going into any positions/ investment decisions.

Narratives I’m looking at

1. Arbitrum Ecosystem

The Arbitrum airdrop is imminent, and a massive liquidity injection will come. This airdrop is likely to act as a form of stimulus, with over 1.27B $ARB tokens entering the market via airdrops attracting liquidity or shifting from bigger tokens/stablecoins to altcoins within the Arbitrum ecosystem.

How much will $ARB be worth? A conservative estimation is a price range around its layer2 counterpart, Optimisim’s $OP, ~the $1.10. But taking a peek into their network would reveal Arbitrum being a stronger network, with more active addresses, transactions and contracts deployed.

The announcement of the airdrop has doubled the entire arbitrum ecosystem since the start of 2023, and it does not seem to stop. FYI, other than GMX, the rest of the tokens in Arbitrum has a market cap of less than $100M.

Also, keep a look out when $ARB being listing on top tier exchange, another catalyst for its upward push.

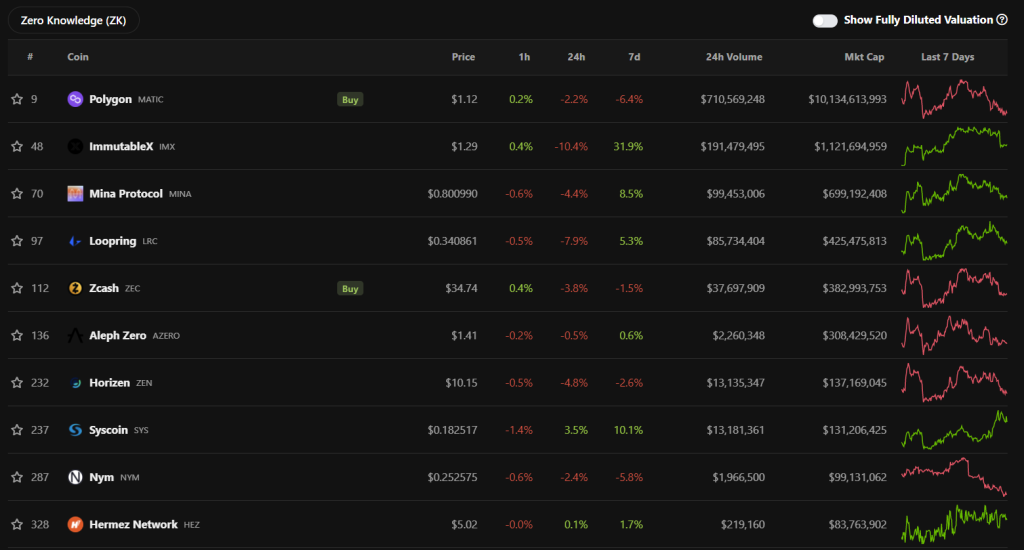

2. Zero-Knowledge coins

With Polygon’s zkEVM about to drop at the end of the month, the ZK coins are an area you might want to look at. Of course, buying into coins pre-announcement might be a bad idea, but they are a good narrative to watch out for in the long term.

For a more degen list, you can check out QuantMeta’s ZK narrative list below.

1)

— metaquant (@QuantMeta) February 11, 2023

ZK narrative list part 2 – " Degen Edition "🧵

Most of these tokens are based on pure hype (Justin Sun effect) but some are good so choose your Dark horse wisely💎$ZEN $TORN $ROSE $PIVX (Binance)$DSLA $ARRR $SUTER (Ku coin)$ARC $CULT $FRIN$ZZ $ZKS $ZKP $RAIL (Dex)👇 pic.twitter.com/sjBPZKyCjG

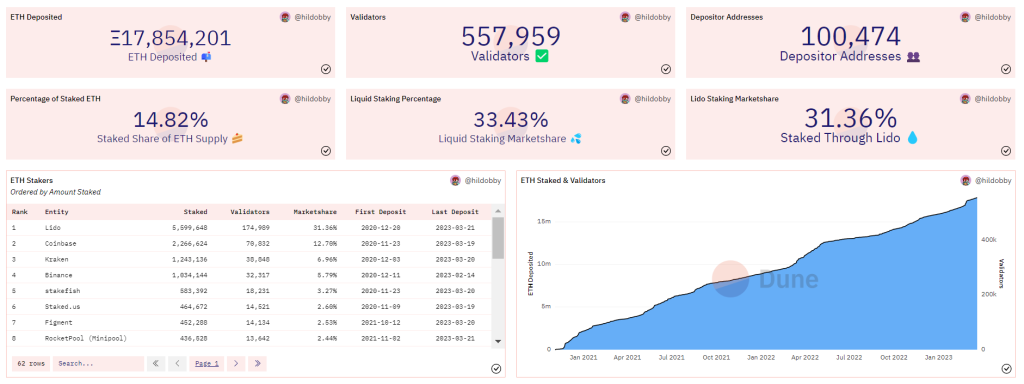

3. Ethereum Shanghai upgrade

With the Shanghai upgrade set to be out in the 2nd week of April, liquid staking derivatives could be another space to accumulate your alts. They give investors a more flexible way of earning yield.

Ethereum's upcoming Shanghai upgrade does not guarantee a pump to LSD projects.

— Louis Cooper (💙,🧡) 🍄 (@LouisCooper_) March 2, 2023

Instead, there is a multitude of potential outcomes from the $29 billion ETH unlock.

Will Lido continue to dominate? Will stakers dump their ETH? or will LSDs flourish?

Everything you must know 👇 pic.twitter.com/a4rKR3HfVt

Furthermore, the statistics show. Since the start of 2023, the number of ETH being staked and validators have been on an upward trend. Over 17.8M of ETH has been deposited, representing 14.82% with over 557K validators.

Also Read: Could Ethereum Shanghai Upgrade Cause A Major Market Dump? (WITH CALCULATIONS)

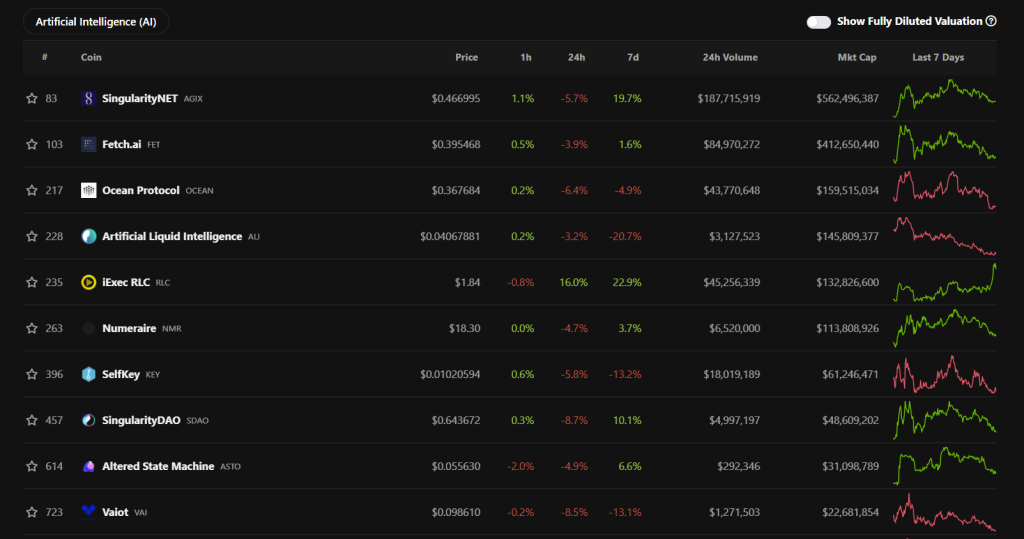

4. Artificial intelligence

In my opinion, the AI narrative had a massive run-up, and boy, it went up fast. Although it may be a premature rally, AI still stands as a very hype narrative with little reason to substantiate it with. With the dawn of ChatGPT, it is undeniable that the AI chatter in the world beyond crypto will not go away.

It is an excellent space for speculation, and looking out for active projects and showing signs of life could give you aggressive pumps on positions.

Also Read: Here Are 3 AI Crypto Projects With Massive Potential In 2023

Closing thoughts

We will never know when the altcoin season may come, but when it does, its performance will unlikely disappoint. Monitoring the flows between the different phases closely could give you the ultimate alpha in knowing where the crypto market is as we expect upcoming catalysts, which could accelerate the shifts in phases, invest time into research and load up your bags so you can ride the wave instead of chasing it.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief