In a remarkable display of growth, the BRC-20 token standard has been steadily gaining momentum, with the number of tokens expanding to a staggering 14,200 and continuing to rise.

Consider this scenario: Suppose you had made a calculated investment of $1,000 to mint $ORDI tokens when they were priced at a mere $0.10 per token. Fast forward to the present, and these tokens would now command a valuation of nearly USD 70,000, illustrating the immense potential for significant returns.

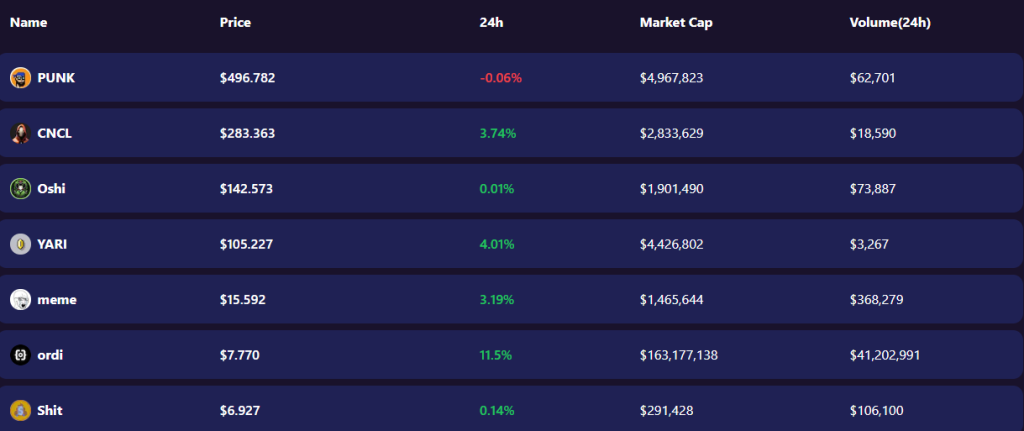

Image Courtesy: Bxdx.io

But what exactly are these $ORDI tokens, and what sets the BRC-20 token standard apart? Are they indicative of a groundbreaking technological advancement within the Bitcoin blockchain ecosystem, or do they represent a fleeting trend that will soon fade away?

The BRC-20 token standard, a protocol built upon the Bitcoin blockchain, has emerged as a means to create and manage a diverse array of digital assets. While Bitcoin itself revolutionized the concept of decentralized digital currency, the BRC-20 token standard expands upon this foundation, introducing new possibilities and use cases.

However, as with any technological advancement, it is crucial to discern between long-term innovation and short-lived hype. While the surge in BRC-20 tokens is undeniably impressive, questions arise regarding its sustainability and enduring impact.

Are these tokens heralding a new era of blockchain advancements, providing tangible benefits and transforming various industries? Or could they be a speculative bubble, bound to burst as quickly as it emerged?

What are BRC-20 tokens and How Do They Work?

The BRC-20 tokens were first introduced in an attempt to create experimental fungible tokens on the Bitcoin network and can trace its roots to a loophole in Bitcoin’s 2021 Taproot upgrade.

***BRC-20 Token Standard***

— Matty (@mattyTokenomics) May 23, 2023

"What #ETH tries that succeeds will eventually move to #BTC"

– Bitcoiners

BRC-20 tokens' marketcap skyrocketed 600%+ in just a week, overtaking standard #Bitcoin transactions!

-Wtf is BRC20 & How it started

-How it works

-Importance & Criticisms

🧵

The upgrade made attaching immutable JavaScript Object Notation (JSON) code inscriptions to satoshis, or the smallest unit of a Bitcoin, through Bitcoin ordinals possible and enabled the generation as well as transfer of fungible BRC-20 tokens on the Bitcoin base layer.

In doing so, BRC-20 tokens also benefit by inheriting the security and decentralization of the Bitcoin network.

Current Applications Of BRC-20 Tokens

While many of the use cases for BRC-20 tokens have yet to be discovered, you can already do more than just freely spending it.

P2P Transfers

In its most basic form, BRC-20 tokens can be transferred as a representation of value from one party to another. Similar to Bitcoin, BRC-20 tokens are a decentralized form of currency where value can be exchanged between peers.

Tokenization Of Real World Assets

With the JSON code, users can define the properties of the BRC-20 tokens based on the asset they would like to tokenize as well as specify limits on the supply available for minting.

Decentralized Finance (DeFi)

Unlike Bitcoin, BC-20 tokens can be integrated into many of the decentralized exchanges, DeFi lending protocols and yield farms.

Closing Thoughts

Bitcoin was invented by Satoshi Nakamoto to enable secure and trustless P2P transactions. As opposed to other Layer 1s, there is comparatively less developer activity on the Bitcoin network.

However, with BRC-20 tokens, ordinal NFTs and lightning network, it is evident that more developers have a keen interest in exploring advancements and developing further use cases for the Bitcoin network.

There is still plenty of room for growth and the future of BRC-20 tokens will be shaped by the impact of these new and innovative use cases that have yet to be uncovered.

Currently, we have preliminary investigation results, and out of all 383 transactions, 70 transactions have been identified as affected.

— UniSat Wallet – Store, Inscribe and Search. (@unisat_wallet) April 24, 2023

We will further investigate in the next few days and compensate users who are determined to be associated with the incident for their losses.

Given that BRC-20 tokens are still in the experimental stages, users also need to be aware of the inherent smart contract risks, with the recent Unisat wallet exploit being a key example.

Also Read: Bitcoin, Other Cryptocurrencies Trade at Over 10% Discount on Binance US

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

Written by: Clarence Lee