BTC dominance has been on a historic downtrend, going from a high of 73% in December 2020 to the current 39% dominance.

BTC dominance refers to the measure of BTC market cap as a ratio over the total cryptocurrency market cap.

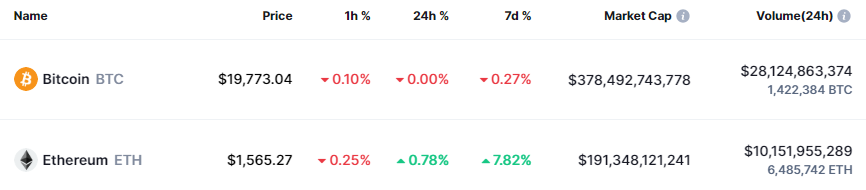

It can be calculated with the following formula: BTC dominance = BTC market cap / Total cryptocurrency market cap.

Investors and traders typically use BTC dominance as a guide for the current general market trend.

In the bear market, we would typically see a lower BTC dominance as investors move funds into stablecoins and vice versa for the bull market.

Ultrasound Money

Since the start of 2020, Ethereum has been slowly increasing its dominance against other cryptocurrencies.

The increase in dominance could be due to a range of factors from a robust ecosystem to the famous EIP-1559 proposal.

EIP-1559 was a proposal that would increase the amount of Ethereum burnt, while reducing the volatility of gas fees.

This is really impressive as Ethereum held its own when the solunavax (Solana, Luna and Avax) narrative was trending and a lot of money was pouring into those layer 1s alternatives.

However, don’t be too quick to rush for “flippening narratives”.

While Ethereum has indeed gained market share within Web3.0, it is still far away from touching crypto gold.

Currently, it’s market capitalization stands at approximately half of Bitcoin’s, despite the bullishness surrounding the upcoming merge.

The Merge

We might see Ethereum dominance increase further after The Merge. We are currently at the last leg of The Merge and the countdown has begun. You can use this tracker here to see when the merge is happening.

If you don’t know what is The Merge, it is also known as Ethereum 2.0 upgrade. Ethereum will shift from the energy-intensive Proof-of-work (PoW) system to a more energy-efficient Proof-of-stake (PoS) system.

The Merge will also reduce the current selling pressure produced by miners as stakers will not need to sell Ethereum tokens to cover things like utility and maintenance.

Also Read: Will Ethereum Finally Dethrone Bitcoin? Everything You Need To Know About The Merge

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief