I have been investing in cryptocurrency for about a year or more but I only took it seriously a few months back, as I saw my portfolio multiply several times in just a short time frame of three to four months.

Majority of my portfolio consists of Fantom, Luna, Ethereum, and some other DeFi tokens. As my portfolio grows, it became apparent that a large percentage of my portfolio was taken up by Fantom ($FTM).

As its price volatility saw it reaching US$3.40 at its all-time high and retracing back down to the US$2 range during the recent dip, my portfolio went on a rollercoaster ride, and this made me look to other means for diversification.

Luna has been around for quite some time now, and i missed it during the early days, but after looking into it closely, I was sold.

Reasons why Luna is worth investing in

A true decentralised stable coin

A decentralized network needs decentralized money$UST ✨ https://t.co/SFOOJ74KQk

— Do Kwon 🌕 (@stablekwon) November 30, 2021

Centralised stablecoins are stablecoins that are issued by companies such as Tether, Circle, Binance, Gemini. These stablecoins are backed by real-world assets such as cash, short-term debts, bonds and even properties.

However, there are many issues regarding the assets backed as the companies rarely reveal much information on the asset, making it very ambiguous.

Thus, there is the issue of whether the stablecoin is really backed by an asset of the equivalent value.

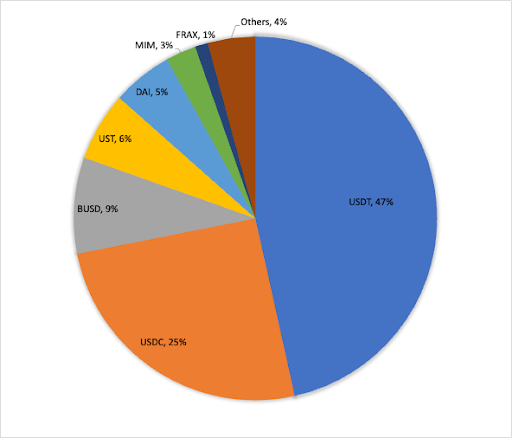

The market capitalisation of centralised stablecoins is at a worrying 81% of the total stablecoin market capitalisation which leads to the question — “Is DeFi truly really decentralised?”

Stablecoins are said to be the backbone of the DeFi ecosystem, and makes it easier for someone to hold their assets in a safe way, without being at the mercy of the volatile market.

Thus, I cannot imagine a DeFi space without stablecoins. However, the centralisation of the stablecoin makes it an easy target to be the single point of failure for the whole ecosystem, and a bank run might cause turmoil in the whole DeFi space.

Moreover, it is an entry point for governments and central entities intervention into the cryptocurrency scene, which can already be seen from the recent Tether blacklisting address rendering the USDT unusable.

JUST IN: @tether_to has blacklisted three Ethereum addresses holding a combined $160M of USDT stablecoins, public block explorer data shows.@heleneBraunn reports:https://t.co/eaCDug5Sd7

— CoinDesk (@CoinDesk) January 13, 2022

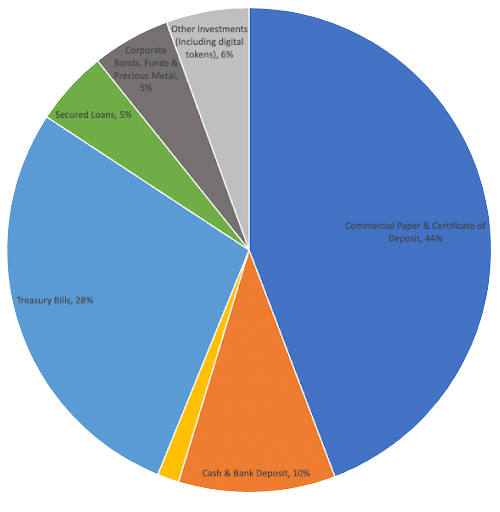

Tether recently released its asset breakdown, and the majority of the holdings are in commercial papers and certificate of deposits (44%), but it is not clear who issued them.

Even though Tether released the credit ratings of the commercial papers and certificate of deposits that it is holding, there isn’t any other information about it which makes it worrying.

There is just so much speculation regarding Tether’s backed assets that is not answered.

Terra USD (UST)

From these issues, there seems to be a need for a truly decentralised stablecoin. DAI tried to tackle the issue, but majority of its assets are collateralized by USDC which contradicts the purpose of being a decentralised stablecoin.

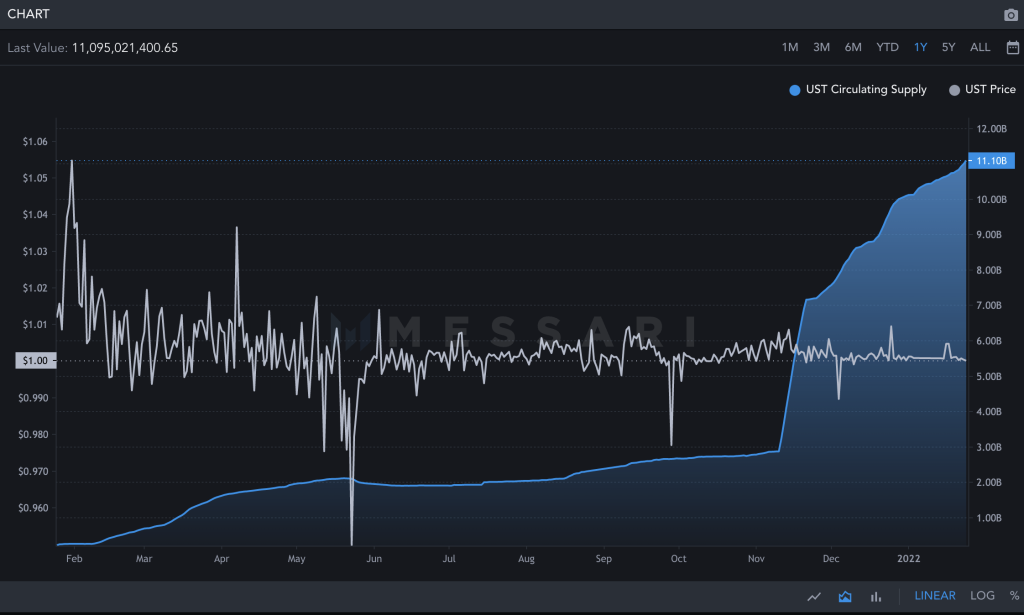

Terra USD ($UST) is an algorithmic stablecoin that solves this issue, whereby its peg is maintained by the burning and minting of the Luna token.

Also Read: An Introduction To Terra (LUNA): Is It The Next Big Crypto Ecosystem?

A higher demand for UST means a higher amount of burn for Luna which will decrease supply of Luna

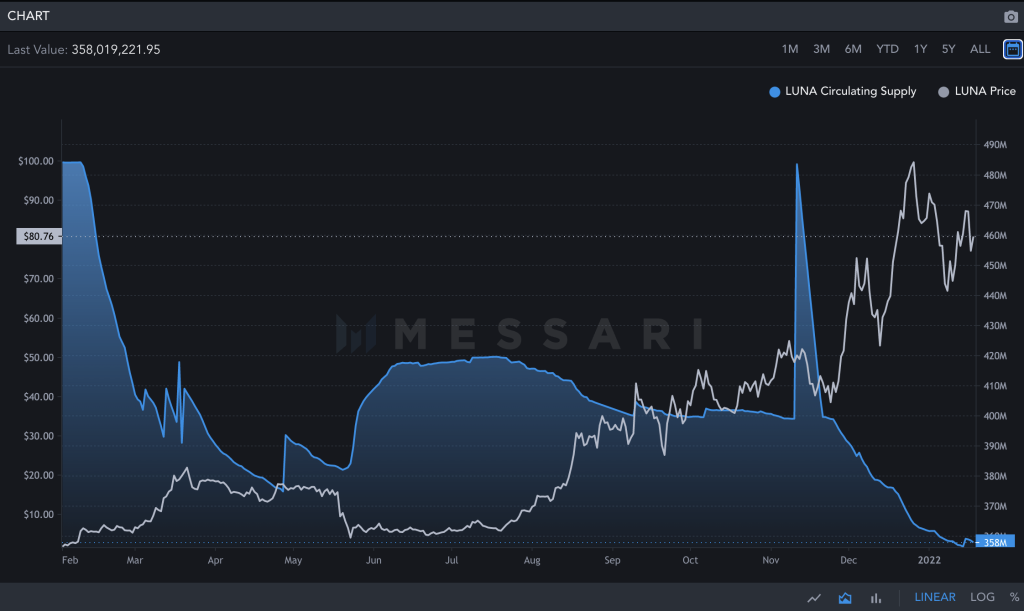

Note: The circulating supply of Luna includes staked tokens (bLuna) and exchange holdings

There was not much change in the supply of Luna following the Columbus 5 update, where the minting of $1 UST would result in the burn of $1 Luna.

The sharp spike in supply during the November period was due to the passing of Proposal 133 & 134, which burns the community pool Luna for UST. This can be observed in the increase in UST supply during that time period.

It is apparent that late November was the kick-off for the UST demand, which in turn resulted in the clear decrease in circulating supply of Luna as seen from the chart.

As the demand for UST increases, there is a possibility of a supply crisis for Luna as the circulating supply is decreasing concurrently.

Most importantly, UST is battle tested. During the May flash crash, UST depegged briefly to US$0.96 before recovering back to its peg which strengthens its reliability and efficiency.

Many algorithmic/ seigniorage stablecoins fail, as the protocol falls into a death spiral and cannot recover to its peg. But the reason why UST was able to hold its peg so well was due to the fact that the UST user base are less speculative. This is because most UST holders are depositing it into Anchor or Mirror for synthetics assets, or Chai for payments.

Strong ecosystem

The ecosystem that Terra has built is evolving and it’s not stopping any time soon.

With the few protocols currently available on the network, Terra has already cemented itself as the second largest in TVL Behind Ethereum (DeFi Llama).

Some core protocols (there are many others that are not listed) that will be the centre of Terra’s growth are:

Anchor

Anchor is a decentralized money market and saving protocol. It is positioning itself as the stablecoin bank of the blockchain, setting the benchmark interest rate of DeFi.

It is are offering a whopping 18-20% APY on UST — which is extremely high, especially compared to traditional banks that offer a mere < 1% per year.

Most importantly, Anchor takes up more than 50% of Terra’s TVL, which signifies its importance in the Terra ecosystem.

Anchor has brought countless numbers of users to the Terra ecosystem which will also invest in the other protocols available bringing the TVL and user base up in the long run.

Astroport (AMM)

Astroport is the next generation AMM DEX that combines all the good things from DEXes that are well established, mainly Uniswap, Curve, Balancer and Sushiswap.

Astroport supports different types of liquidity pools, allowing it to accommodate a variety of token markets. This will cater to the different needs of each individual token pairing which improves the slippage for the trades while at the same time increasing capital efficiency.

The Astroport launch was unconventional and seemed to be like the Vampire attack that Sushi launched on Uniswap previously.

The migration of the liquidity token from the obsolete Terraswap is key in the future success of Astroport as a deep liquidity is essential for a DEX. The lockdrop allowed Astroport to obtain a good foundation in their journey to become the top DEX in the Terra ecosystem as liquidity tokens are locked up for a certain amount of period that the liquidity provider set for.

Having an efficient DEX is a key to the success of a network as the DEX is the foundation of the ecosystem DeFi. Thus, having Astroport will greatly boost the Terra ecosystem and the building block for other future protocols that can be built on top of it.

Potential Growth

The potential of the Terra ecosystem is limitless as there are only 14 Dapps available on the Terra network, yet it has already amassed a US$18.67 billion of TVL which will continue to grow as more Dapps launch. Some exciting protocols that are launching in the near future include Mars, Prism and many others.

Mars is an upcoming money market protocol where users are able to supply or borrow assets but the interesting part about Mars is the “uncollateralized” loan where users are able to take leverage on certain yield farming strategy that is set out by Mars protocol.

The uncollateralized loan is for whitelisted smart contracts where protocols which can be applied to farming strategies on Mirror protocol.

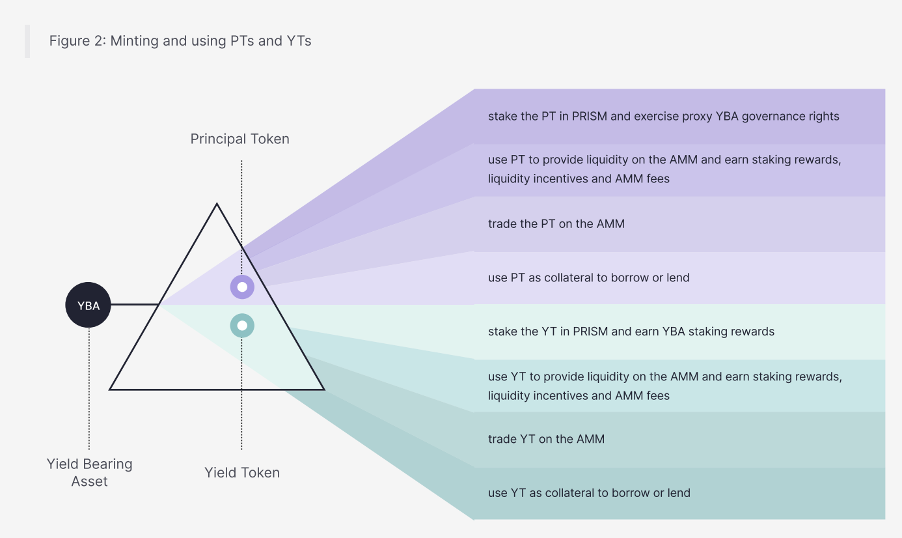

Prism is a revolutionary protocol that is launching on the Terra ecosystem, Prism allows investors to split their yield-generating asset into 2 different components: a yield token and principal token.

This allows many possibilities for investors as they are able to remain capital efficient and at the same time limit the risk that they are exposed to.

Terra also allocated war funds to increase its liquidity on Ethereum where it used its community funds to participate in the Curve/ Convex war. This is to incentivise liquidity to the UST liquidity pool. This will greatly improve liquidity on the Ethereum chain and reduce slippages.

Conclusion

With all the above being said, Luna also has its own issues that it needs to address in the near future. The small number of Dapps available on the Terra ecosystem, also presents problem of protocols such as Anchor taking up most of the TVL.

Thus, the ecosystem is very centralised, making it a possible single point of failure for Terra.

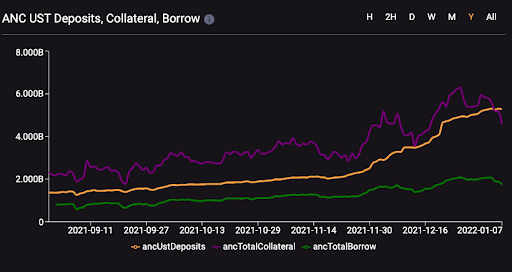

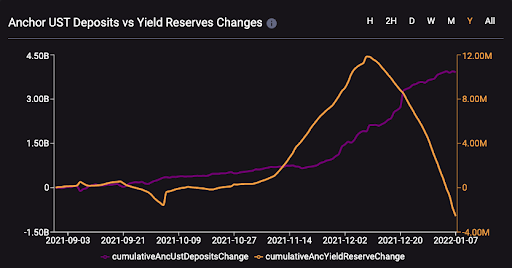

Moreover, with the increase in deposit due to the Degenbox strategy, there is a decrease in the Anchor yield reserve as the deposit increased exponentially but lenders did not increase at the same pace.

This can be seen from the chart below where the Anchor Total Borrow remains flat while Anchor UST deposits is in an uptrend from 30 November 2021.

This resulted in the sharp decrease in yield reserve as the Anchor flywheel is not sustainable at this rate of UST deposits from the Degenbox strategy.

The reason that Anchor is able to pay out such a high APR for the UST deposit is due to the yield-generating asset (BLuna) that borrowers put up for collateral and the interest paid by them.

Currently, the rate of borrowers is not increasing at the rate of UST deposits which is endangering the Anchor flywheel. As Anchor plays such a vital role in the Terra ecosystem, Terraform Labs kickstarted the Anchor yield reserve fund with US$70 million that is much required now.

For Anchor to stay sustainable, there must be ways to increase borrowing rates, interest rates or even divert the UST deposits to other protocols.

As the Terra ecosystem grows, more Dapps are launching and will share the burden of the Terra ecosystem. Mars is a protocol that will fit into the picture greatly where it can share the burden of Anchor as it is a money market. All in all, it would be great to look out for future development in the Terra ecosystem.

Portfolio reallocation is a good way of taking profits and letting your portfolio grow more and less reliant on a single bet. It is essential that you have a take profit plan for any investment that you make as you can never time the market.

[Editor’s Note: This article represents the opinions of the author, and is not financial advice. Please do your own research before investing.]

Featured Image Credit: Crypto Telegram

Also read: Growing Your Bag Of LUNA: Here’s A Guide To Yield Farming In The Terra Ecosystem